Chapter_2

advertisement

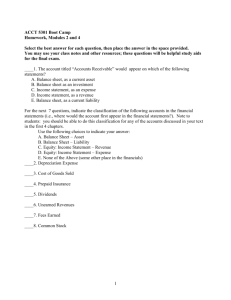

BSAD 221 Introductory Financial Accounting Donna Gunn, CA International Exchange • Argentina • France • Turkey • Australia • Germany • United Kingdom • Barbados • Isreal • United States • Czech Republic • Mexico • Denmark • Peru • Finland http://sites.stfx.ca/international_exchange/ • Poland Contact Brenda Riley: briley@stfx.ca Trial Balance Account Listing of all accounts and their balances at a given point in time Debit Cash 80,000 Accounts Receivable 72,000 Advertising Supplies 25,000 Prepaid Insurance 6,000 Office Equipment 50,000 Notes Payable Accounts Payable Unearned Service Revenue Common Shares Retained Earnings Service Revenue Salaries Expense 45,000 Rent Expense 9,000 TOTALS 287,000 Credit 50,000 25,000 12,000 80,000 20,000 100,000 287,000 Transaction A transaction is any event that has financial impact on the business • Can be measured • Provides objective information • Must be able to assign $ amount to transaction Recording Transactions Every transaction affects at least two accounts (duality of effects). The accounting equation must remain in balance after each transaction. A = L + SE What the company owns What the company owes What the owners have invested The Account Assets are economic resources that benefit the business now and in the future Cash Accounts receivable Inventory Notes receivable Prepaid expenses Land Buildings Equipment, furniture, and fixtures 2- The Account Liabilities are the debts of the company. Bank loan Notes payable Accounts payable Accrued liabilities (for expenses incurred but not paid) Long-term liabilities (bonds and mortgages) 2- The Account Shareholders’ (owners’) equity is the owners’ investment in a corporation. •Contributed Capital •Retained Earnings •- impacted by Revenues and Expenses •Dividends 2- Recording Transactions Accounts and effects • Identify the accounts affected and classify them by type of account (A, L, SE). • Determine the direction of the effect (increase or decrease) on each account. Balancing • Verify that the accounting equation (A=L+SE) remains in balance. The Debit-Credit Framework Debits and credits affect the Balance Sheet Model as follows: A = L + SE ASSETS LIABILITIES EQUITIES Debit Credit for for Increase Decrease Debit Credit for for Decrease Increase Debit Credit for for Decrease Increase Trial Balance Account Listing of all accounts and their balances at a given point in time Debit Cash 80,000 Accounts Receivable 72,000 Advertising Supplies 25,000 Prepaid Insurance 6,000 Office Equipment 50,000 Notes Payable Accounts Payable Unearned Service Revenue Common Shares Retained Earnings Service Revenue Salaries Expense 45,000 Rent Expense 9,000 TOTALS 287,000 Credit 50,000 25,000 12,000 80,000 20,000 100,000 287,000 How Do Companies Keep Track of Account Balances? A T-account is a tool used to represent an account. Account Name Left Right How Do Companies Keep Track of Account Balances? Journal entries T-accounts How Do Companies Keep Track of Account Balances? The left side of the T-account is always the debit side. The rightside sideofof The right thethe T-account thethe credit T-accountis is als always credit side. side. Account Name Left Right Debit Credit T-Accounts and the Trial Balance Account Cash 80,000 Notes Payable 50,000 Dividends 5,000 Revenue 100,000 Debit Cash 80,000 Accounts Receivable 72,000 Advertising Supplies 25,000 Prepaid Insurance 6,000 Office Equipment 50,000 Notes Payable Accounts Payable Unearned Service Revenue Common Shares Dividends 5,000 Service Revenue Salaries Expense 40,000 Rent Expense 9,000 TOTALS 287,000 15 Credit 50,000 25,000 12,000 100,000 100,000 287,000 Journal Entry Company X provides $1,000 of services and is paid in cash. Cash is received so cash will be increased. As cash is an asset the increase is shown as a debit. Revenue is earned, so revenue will be increased. Revenues are an increase to equity, therefore the increase is shown as a credit. Dr. Cash Cr. Revenue $1,000 $1,000 To record service revenue of $1,000 T-Accounts and the Trial Balance Account Cash 80,000 1,000 81,000 Revenue 100,000 1,000 101,000 Debit Cash 81,000 Accounts Receivable 72,000 Advertising Supplies 25,000 Prepaid Insurance 6,000 Office Equipment 50,000 Notes Payable Accounts Payable Unearned Service Revenue Common Shares Dividends 5,000 Service Revenue Salaries Expense 40,000 Rent Expense 9,000 TOTALS 288,000 17 Credit 50,000 25,000 12,000 100,000 101,000 288,000