SIS Community Capital: EOI guidelines

advertisement

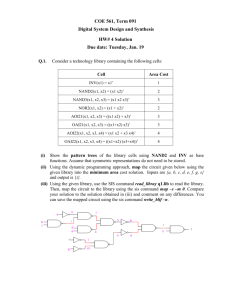

SIS COMMUNITY CAPITAL: EOI GUIDELINES What is the SIS Community Capital Fund? SIS Community Capital provides affordable unsecured finance over a six year term. It enables organisations to develop their business and focus on delivering social impacts before repayments of the loan capital begin. It provides the time and space to generate income and use cash flow to build revenues, paying interest only in the first 3 years at an affordable rate of just 6% p.a. Eligible charities, community organisations and social enterprises who are successful in securing a SIS Community Capital investment could also lever in further investment in time using their approved status and the tax reliefs available. Applications are sought from enterprises looking for investments of between £25,000 and £100,000 The funding is ideally suited to established social enterprises which are looking to expand or replicate their business or capital projects as well as a range of other purposes. How do I know if I’m eligible? The guidelines included in the table below will provide you with the information to help determine whether you can apply and understand the criteria applied to the Fund. Loans will be made only to ‘investment-ready’ organisations. A range of factors will be considered, including financial viability, social outcome measure, management and governance and risk assessment. Information to determine this will be requested following on from your EOI submission. How can I apply? By completing and sending an EOI to communitycapital@socialinvestmentscotland.com. The guidelines should help you to complete your EOI. Anything not covered below should be directed to one of our team at the email address above or 0131 558 7706. The fund is limited and will be offered on a first come, first served basis to eligible enterprises. The fund opens to expression of interest on the 12th of August and will close on the 14th of October. Organisation Any application should be submitted by the Parent/Top Company, rather than a trading subsidiary. This should also include the date the organisation was formed. Registered Address The registered address of the applicant organisation, including the full postcode. Legal Status The social enterprise must be one of the following: (i) A charity registered with the Office of the Scottish Charity Regulator (including a SCIO); (ii) A community interest company; or (iii) A community benefit society, that is not a charity, Based, operating and having social impact in Scotland. This should also include the date the noted status was granted. Charity/Company Number The company, charity or FCA registration number. Loan Amount required Minimum: £25,000 Maximum: £100,000* Loan Term The term you wish to take the loan over. Up to a maximum of six years, and no shorter than three years. Only interest will be payable for the first three years. *Investments may be structure using coinvestment with other products offered by SIS to enable the offer of funding packages in excess of £100,000. Those Note early repayments cannot be made in the first three years. requesting over £100,000 should contact SIS in advance of submitting an EOI to discuss further. Use of Funds Provide brief details of the planned use for the funds i.e. what you intend to purchase with the funds. Loan Drawdown Preference Please provide details of when you would like to drawdown the funds applied for. All funds must be drawn by 31 March 2016, at the very latest. HMRC Advance Assurance. Social Enterprises should apply to HMRC for advance assurance for comfort that they and the proposed investment will qualify for SITR. If you have received these assurances please indicate so her. If not please let us know and SIS will support you throughout the process. Social Impact Outcomes Loans will be made only to social enterprises with a definable and measurable social impact in line with Big Society Capital’s Outcomes Matrix methodology, and which support one or more of the following beneficiary groups: Homeless people; People experiencing long term unemployment; People living in poverty or financial exclusion; People with addictions issues; People with long-term health conditions/life-threatening or terminal illness; People with learning disabilities; People with mental health needs; People with physical disabilities or sensory impairments; Voluntary carers; Vulnerable parents; Vulnerable children’s (inch, looked after children); Vulnerable young people and NEETS (more commonly referred to in Scotland and More Choices, More Chances); Older people (including people with dementia); Ex-offenders; and People who have experienced crime or abuse. Contact Details Please enter the contact details, for the person we should speak to about this application. State Aid Investment which attract SITR are subject to the restrictions on the giving of state aid. Please detail how much, if any, State Aid you have already received in the last 3 years and whether any exemptions can be applied. If an organisation has already reached or exceeded de minimis or the funding from us would result in de minimis being exceeded then we will not be able to provide any further funding as this would result in aid being given . We will not knowingly fund proposals that exceed State Aid limits. Broadly speaking, most organisations will be able to receive a maximum of around £275,000 over three years. Excluded Activities Dealing in land, commodities, futures, shares, securities or other financial instruments; Banking, insurance, money-lending, debt factoring, hire-purchase financing or other financial activities; Property development with a view of realising a profit on sale; Fishery and aquaculture activities; The subsidised generation or export of electricity Road freight transport for hire or reward; and Providing services or facilities to another business whose business consists substantially of one of the above excluded activities. SIS COMMUNITY CAPITAL: EOI GUIDELINES