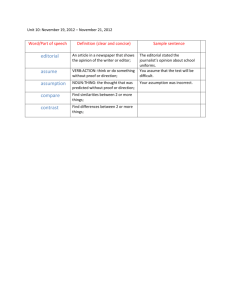

Cost Impact of Adopted Assumption Changes

advertisement

South Dakota Retirement System Board Consideration of Assumption Changes September 5, 2012 Adopted Assumptions • At the July Board of Trustees meeting, the following recommended assumption changes were adopted: – Mortality: 1995 Buck Table with a 1-year setback for males – Salary Increases: Reduce salary increase assumption and base on service – Retirement: Separate reduced/unreduced rates, separate by class (Teacher/Non-Teacher) and gender, extend 100% assumed retirement age – Termination: Use rates based on service for 5 years and age thereafter, increase termination rates in early years, eliminate Judicial termination rates – Disability: Reduce Class A rates, eliminate Judicial disability rates – Inflation: Reduce long-term inflation assumption to 3.25% – Improvement Factor (COLA): Reduce long-term COLA assumption to 2.75% – Interest on Accumulated Contributions: Reduce long-term assumption to 3.50% 1 Adopted Assumptions • In a separate motion, the Board adopted the following investment return assumption: – 7.25% for 5 years – 7.50% after 5 years 2 Cost Impact of Adopted Assumption Changes Current Assumptions Adopted Assumptions Normal Cost Rate 11.249% 10.362% Expenses 0.250% 0.250% 30-Year Amortization 0.978% 2.012% Total Required Contribution Rate 12.477% 13.624% As of June 30, 2011 -Change from Current Assumptions 1.147% Expected Contribution Rate 12.477% 12.477% Market Value Funded Ratio 102.9% 99.0% -Change in MVFR Statutory contributions less than required contributions by 1.147% of pay MVFR decreased 3.9% (3.9%) Note: Cost Impact has been estimated based on 2011 valuation results. The exact impact on future valuations will vary to some degree. To meet the required contributions, the Present Value of Benefits (PVB) would need to be reduced by about $141M (1.5% of PVB). 3 Improvement Factor (COLA) Assumption Recommendation • Because the adopted investment return assumption reduces the Market Value Funded Ratio (MVFR) more than the recommended assumption and reflects a lower future investment return expectation, we believe the probability of the future Funded Ratio exceeding 100% will decrease and the probability of the Funded Ratio being between 90% and 99.9% will increase, resulting in a reduction of the average expected COLA to 2.7% as follows: MV Funded Ratio Range Probability of Being in Range COLA Limits Expected Average Improvement Factor Less than 80% 5% 2.1% 0.105% 80%-90% 15% 2.1%-2.4% 0.349% 90%-100% 40% 50% 2.1%-2.8% 1.056% 1.320% Over 100% 40% 30% 3.1% 1.240% 0.930% 2.750% 2.704% Total • The above calculation is not a method change, but recognizes the reduced MVFR and reduced investment return assumption result in a reduced average annual COLA • Buck recommends the adoption of this additional assumption change NOTE: The COLA assumption does not affect the actual benefit increases paid pursuant to statute. 4 Cost Impact of Adopted Assumption Changes with Additional Recommended Change in COLA Assumption Current Assumptions Adopted Assumptions and Long-Term COLA Assumption = 2.70% Normal Cost Rate 11.249% 11.291% Expenses 0.250% 0.250% 30-Year Amortization 0.978% 1.874% Total Required Contribution Rate 12.477% 13.415% As of June 30, 2011 -Change from Current Assumptions 0.938% Expected Contribution Rate 12.477% 12.477% Market Value Funded Ratio 102.9% 99.5% -Change in MVFR Statutory contributions less than required contributions by 0.938% of pay MVFR decreased 3.4% (3.4%) Note: Cost Impact has been estimated based on 2011 valuation results. The exact impact on future valuations will vary to some degree. To meet the required contributions, the PVB would need to be reduced by about $115M (1.2% of the PVB). This situation meets the first condition of SDCL 3-12-122 and can also be referred to as the System being out of actuarial balance 5 Potential Actions to Maintain Actuarial Balance • To restore actuarial balance, a retirement system can consider: – Increasing member or employer contributions – Decreasing benefits (Corrective Action) – Changing actuarial assumptions or methods • Increasing member or employer contributions: there has been a long-standing understanding with Legislature and Executive Branch to manage SDRS within fixed statutory contributions • Decreasing benefits (Corrective Action): Certain SDRS design features that include subsidies, inefficiencies, higher costs than anticipated, or above competitive features will be discussed later today • Changing actuarial assumptions or methods: – Board has adopted assumptions after comprehensive review – Buck recommends one additional change (assumed average annual COLA) resulting directly from the application of the adopted assumptions – Re-initialization of SDRS Funding Method and use of Cushion may be appropriate 6 Potential Actions to Maintain Actuarial Balance – Re-initializing Funding Method • The SDRS Funding Method, the Frozen Entry Age Actuarial Cost Method, originally set the Normal Cost (NC) and Actuarial Accrued Liability (AAL) based on the Entry Age Cost Method AAL • Over time, the Frozen Entry Age Method has allocated a higher percentage of the future costs of the System to the NC and less to the AAL • Re-setting the NC and AAL based on the Entry Age Normal Cost Method provides a more accurate measure of the expected long-term NC and the AAL currently based on the present plan terms and adopted assumptions. It has no impact on the expected future costs of the System; it only reallocates the future costs between NC and AAL • If applied to the June 30, 2011 results, re-initializing would have lowered the NC rate by 12% and increased the AAL by 2%, which would have reduced the MVFR by 2%. This could potentially impact the amount of future COLAs 7 Cost Impact of Adopted Assumption Changes, Additional Recommended Change in COLA Assumption and ReInitialization of Funding Method Current Assumptions Adopted Assumptions, COLA Assumption = 2.70% and Re-initialization Normal Cost Rate 11.249% 9.928% Expenses 0.250% 0.250% 30-Year Amortization 0.978% 2.453% Total Required Contribution Rate 12.477% 12.631% As of June 30, 2011 -Change from Current Assumptions (0.154%) Expected Contribution Rate 12.477% 12.477% Market Value Funded Ratio 102.9% 97.5% -Change in MVFR Statutory contributions less than required contributions by 0.154% of pay MVFR decreased 5.4% (5.4%) Note: Cost Impact has been estimated based on 2011 valuation results. The exact impact on future valuations will vary to some degree. To meet the required contributions, the PVB would need to be reduced by about $45M (0.5% of the PVB). 8 Potential Actions to Maintain Actuarial Balance • The adopted assumptions plus the recommended assumed average annual COLA change result in SDRS being out of actuarial balance by approximately $115M (page 5) • Potential actions to maintain actuarial balance are: • – Increase member or employer contribution – ruled out based on long term understanding – Decrease benefits – eliminate subsidies, etc. and/or take more significant action – Change actuarial assumptions/methods. Possibilities include: • re-initializing funding method -- results in SDRS being out of actuarial balance by approximately $45M (page 8) • use of some or all of Cushion More than one option can be taken 9