Financial Accounting

A Decision-Making Approach, 2nd Edition

King, Lembke, and Smith

*

Prepared by

Dr. Denise English,

Boise State University

John Wiley & Sons, Inc.

CHAPTER

FIFTEEN

USING FINANCIAL

STATEMENT

INFORMATION

After reading Chapter 15, you should be able to:

1. Describe the importance of the Securities and Exchange

Commission for users of financial information and

provide a general overview of SEC reporting

requirements.

2. Explain what is meant by consolidated financial

statements, their advantages and limitations for

decision makers, and the basic approach to preparing

them.

3. Describe current requirements with respect to segment

reporting and how such information can be useful for

decision making.

4. Describe how interim financial reporting may help

decision makers.

CHAPTER

FIFTEEN

USING FINANCIAL

STATEMENT INFORMATION

After reading Chapter 15, you should be able to:

5. Identify the types of notes and supplemental information

expected to be found in financial reports and link this

information to decisions about enterprise activities.

6. Identify, describe, and use financial ratios to evaluate

financial statements and identify specific characteristics

of an enterprise.

7. Explain why understanding personal financial reporting is

important, and how it differs from corporate financial

reporting.

The Securities and

Exchange Commission

The Securities and Exchange Commission (SEC) is a

government agency having primary responsibility for

regulating the financial reporting of companies with publicly

traded securities.

The SEC was established in 1934 to oversee the issuance

and trading of securities by publicly held companies and to

assure full and fair disclosure by those companies.

The SEC was given authority over reporting and disclosure

requirements, but does not regulate a company’s activities.

Nor does it guarantee the results of decisions made by

information users.

Authority and

Impact of the SEC

The SEC has generally taken the position that it would

prefer to see accounting standards established by the

private sector bodies, such as the FASB.

If the private-sector body issues a standard with which the

SEC disagrees, the SEC typically accepts the standard but

requires companies to disclose in notes to the financial

statements what the effects of using the SEC’s preferred

method would be.

A company that files misleading financial statements may

face civil, or criminal penalties levied by the SEC. The SEC

can also stop all trading in a company’s securities, denying

the company access to the capital markets.

SEC Filing and

Reporting Requirements

Public companies are required to file a number of reports with the

SEC, the most common of which are:

Registration statement--must be filed before securities can be issued

and must include audited financial statements from the registrant.

Form 10-K--must be filed annually, cover the last annual accounting

period, and include audited financial statements.

Form 10-Q--must be filed quarterly and covers the most recent threemonth period; it is less detailed than the 10-K, but must include

financial statements which can be unaudited.

Form 8-K--must be filed within fifteen days of the occurrence of an

unscheduled material event, such as bankruptcy, change of auditor, or

the disposal of a major segment of business.

Management’s Discussion

and Analysis

The Management’s Discussion and Analysis (MD&A)

section of the annual report presents management’s

detailed analysis of the company’s position and

operations, along with a line-by-line discussion of

changes in the financial statements.

In addition, it focuses on the company’s liquidity, capital

resources, matters expected to have a significant effect

on the company, and the effects of inflation.

It helps decision makers understand the “why” behind

the numbers.

Level of Financial

Statement Disclosure

A primary issue relating to the usefulness of information

reported in financial statements relates to the type of

reporting that best presents the overall picture of a

company’s activities and position, while at the same time

permits decision makers to grasp the details of the

different aspects of the business enterprise.

The general approach to resolving this issue has been for

the authoritative bodies to require companies to present

consolidated financial statements along with additional

disclosures relating to different business-line and

geographic areas of the business.

+

Consolidated Financial Statements

Financial statements that report on the combined financial position

and activities of a parent company and other companies that it

controls (subsidiaries) are called consolidated financial

statements.

The parent and its subsidiaries are legal entities, but the

consolidated entity is not. The consolidated entity has economic

reality, though, and provides a basis for defining the reporting entity.

A parent company has control if it can direct subsidiary policies

and, in effect, use the subsidiary’s assets as its own. A controlling

interest in the subsidiary may occur when a majority, or even a

significant amount (larger than other shareholders) is owned.

The portion of stock owned by others (than the parent company) are

referred to as minority or noncontrolling interests.

+

Consolidated Statements

and Decision Making

Consolidated statements are prepared primarily for

those who have a long-run interest in the parent

company, such as owners and long-term creditors.

It would be difficult for a decision maker to analyze each

subsidiary in addition to the parent and make an overall

evaluation without consolidated financial statements.

If only interest in a subsidiary exists, however,

consolidated financial statements will not be as useful.

+

Consolidated Statements

and Decision Making

When examining consolidated financial statements, if

the parent and subsidiary entities are dissimilar,

some difficulty in interpreting financial statements

may occur.

Another limitation of consolidated financial statements

is that not all of the assets reported in the balance

sheet are directly available for the parent’s use.

Under GAAP, consolidated financial statements

must be presented whenever general-purpose

statements are issued to the public.

+

Principles of Consolidated

Financial Statements

Consolidated financial statements for a combined

entity are presented as if the related companies

were actually a single company.

An additional step is taken to remove the effects of

transactions or relationships between the affiliated

companies. The main items that are eliminated are as

follows:

–

–

–

–

Parent’s investment in subsidiary;

Stockholders’ equity of the subsidiary(ies);

Intercompany receivables/payables;

Intercompany sales and profits.

Segment Disclosures

By analyzing a company’s different activities, a

decision maker is in a better position to assess a

company’s future and judge the economic impact of

possible future events.

The FASB has mandated that certain disaggregated

information be included with corporate financial

statements. These additional disclosures provide

information about the following:

–

–

–

a company’s different operating segments;

the different geographic areas in which it operates;

the company’s major customers.

Interim Financial Reporting

Interim financial reports, issued between annual

reports, help meet the need for timely information. All

publicly traded companies are required to file interim

reports quarterly with the SEC.

At a minimum, interim reports must include:

–

–

–

–

–

–

Sales revenue, income tax expense, and net income;

Earnings per share for each period presented;

Disposal of a segment of the business, extraordinary items,

unusual or infrequently occurring items, and accounting changes;

Significant changes in income taxes;

Contingent items;

Significant changes in financial position.

Notes and Other

Financial Statement Information

The notes to the financial statements are provided

by management to supplement the numbers in the

financial statements.

Some forms of disclosure are mandated by GAAP, but

management frequently has some discretion in

deciding whether to include certain details in the body

of the financial statements, or in the notes.

Because notes are designed to explain and expand on

the information included in the body of the financial

statements, they do not replace the information on the

statements.

Summary of Required

Note Disclosures

Exhibit 15-3

(partial)

Accounts Receivable •allowance for doubtful accounts

•accounts pledged or assigned

Inventories

•valuation methods (e.g., lower of cost or market)

•costing methods (e.g., FIFO, LIFO)

•major categories of inventories

•special inventory financing arrangements

Investments

•valuation methods

•alternate valuations (e.g. market value)

Property, Plant,

•depreciation methods

and Equipment

•interest included in cost

•accumulated depreciation

•collateral arrangements for borrowings

Summary of Required

Note Disclosures

Financial Instruments

Long-term Debt

Pensions

Other Postretirement

Benefits (e.g., medical

insurance)

Exhibit 15-3

(partial)

•description, nature, and purpose

•principal amounts and fair values

•gains and losses from changes in fair values

•description of each type or issue of debt

•maturities of debt by year

•special terms or provisions

•description of plans

•amounts of all components used in

computation of employers’ cost and obligation

•description of plans

•amounts of all components used in

computation of employers’ cost and obligation

•estimated effect of change in health care cost

Summary of Required

Note Disclosures

Income Taxes

Stockholders’

Equity

Contingencies

Exhibit 15-3

(partial)

•amounts and classification of deferred taxes

•reconciliation of reported income tax expense with

taxes computed at the statutory rate

•par or stated value of stock

•number of shares authorized, issued, outstanding

•details of employee stock incentive plans

•value of stock options granted

•description of unresolved events that could have a

significant effect on the company in the future

Summary of Significant

Accounting Policies

All companies are required to provide a

summary of significant accounting policies

used to prepare the financial statements.

Other supplemental information often

includes quarterly financial information and

five-year or ten-year financial summaries.

Content of Summary of

Significant Accounting Policies

Exhibit 15-4

(partial)

Consolidation policy--a brief statement of which subsidiaries are

consolidated and, if not all are consolidated, what the basis for exclusion

is. Also, the treatment of intercompany transactions is described.

Cash and Cash Equivalents--a description of what securities are

considered cash equivalents, as well as any policies that might affect the

availability of cash.

Accounts Receivable--an explanation of any receivables that are

special or that have nonroutine collection patterns.

Inventories--a description of inventory valuation methods used (e.g.,

cost, lower of cost or market) and inventory costing methods used

(e.g. LIFO, FIFO). Special inventory valuation practices, such as for

inventory being constructed under long-term contract, are described.

Other Current Assets--a description of content, if significant.

Content of Summary of

Significant Accounting Policies

Exhibit 15-4

(partial)

Investments--a description of investments and how they are valued.

Property, Plant, and Equipment--a brief statement about how fixed

assets are valued and depreciated. Sometimes, the depreciation

periods are disclosed. More detail is usually given in a subsequent note.

Liabilities--valuation and classification descriptions. This item may be

omitted because liabilities are always discussed in detail in a separate

note.

Owner’s Equity--often omitted because policies relating to owners’

equity are fairly standard. Computations for earnings per share may be

described, as might the method of accounting for treasury stock, if any.

Subsequent notes may describe stock options or special owners’ equity

transactions.

Content of Summary of

Significant Accounting Policies

Exhibit 15-4

(partial)

Revenue Recognition--a description of when revenues and other

types of income are recognized.

Specialized Industry Practices--a description of recognition and

measurement policies unique to the industry.

Other Items--an explanation of special accounting treatment accorded

particular transactions or events, such as the adoption of a new

accounting method.

Foreign Currency Translation--a description of the currencies used in

the company’s business and how they are restated to dollars.

Use of Estimates--a caveat explaining that accounting employs

estimates that affect reported amounts and that estimates could differ

from actual amounts.

Content of Summary of

Significant Accounting Policies

Exhibit 15-4

(partial)

Concentrations--when applicable, a description of the company’s

limited number of suppliers, customers, transportation channels, or

similar factors that could adversely affect the company under certain

conditions.

Reclassifications--a description of any amounts that have been

reclassified from prior year financial statements to conform with

current classification.

Financial Analysis

Financial statement analysis often involves

comparing reported information about a

company over different time periods and

between different companies during the same

period of time. Three financial analysis

approaches are:

–

–

–

horizontal analysis

vertical analysis

ratio analysis.

Horizontal Analysis

An analysis of financial statement data over a period of

years is horizontal or trend analysis.

Typically the amounts for the current and one or two

earlier periods are compared to determine both the

dollar amount and percentage change from period to

period.

Net Sales

2001

2000

$25,350 $23,120

Change

Dollar Percent

$2,230

9.65%

Vertical Analysis

An analysis of the individual components of the financial

statements is referred to as vertical analysis.

In vertical analysis, the dollar amounts in the financial

statement are restated as percentages to show their

proportion of the totals.

Statements presented in percentages are referred to as

common-size financial statements.

2001

Net sales

$25,350

Operating expenses 20,070

Net income

5,280

Common

Size

100.0

79.2

20.8

2000

$23,120

17,280

5,840

Common

Size

100.0

74.7

25.3

Ratio Analysis

Liquidity

Solvency

Profitability

Return to investors

Comparisons within financial statements

and across time often are made with the

help of summary measures and ratios as

discussed in previous chapters.

Financial ratios can be analyzed with

respect to liquidity, solvency, profitability,

and return to investors.

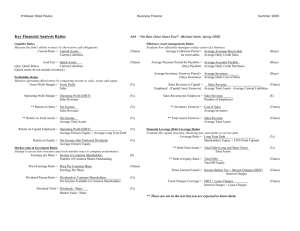

Summary of Key Ratios

Exhibit 15-5

(partial)

Net sales revenue

1. Accounts receivable turnover:

Accounts receivable

Net sales revenue

2. Asset turnover:

Total assets

3. Cash flow

per share:

Cash provided by operations - preferred dividends

Number of common shares outstanding

Cash provided by operations

Current maturities of debt

5. Cash flow to total debt: Cash provided by operations

Total debt

Current assets

6. Current ratio:

Current liabilities

4. Cash flow to current maturities of debt:

Summary of Key Ratios

Exhibit 15-5

(partial)

Accounts Receivable

7. Days sales in receivables:

Credit sales / 365 days

Inventory

8. Days sales in inventory:

Cost of goods sold / 365 days

9. Debt to equity:

10. Diluted earnings

per share:

11. Dividend payout:

Long-term debt excluding deferred taxes

Stockholders’ Equity

Net income- preferred dividends

+ adjustment for conversion of securities

Common shares outstanding +

additional shares from potential conversion

Dividends paid

Net income

Summary of Key Ratios

Exhibit 15-5

(partial)

Cash dividend per share

Market price per share

12. Dividend yield:

13. Dividends to operating

cash flow:

Dividends paid

Cash provided by operations

14. Earnings per share:

Net income- preferred dividends

Common shares outstanding

15. Gross margin percentage:

16. Inventory turnover:

Net sales - cost of goods sold

Net sales

Cost of goods sold

Inventory

Summary of Key Ratios

17. Long-term debt to

total assets:

18. Net income margin:

19. Operating cycle:

Long-term debt

Total assets

Net income

Net sales revenue

Accounts receivable +

Inventory

Credit sales/365 days Cost of goods sold/365 days

20. Price-earnings ratio:

21. Quick ratio:

Exhibit 15-5

(partial)

Market price per share of common stock

Earnings per share

Quick assets

Current liabilities

Summary of Key Ratios

Net income

Total assets

22. Return on assets:

23. Return on common

equity:

Net income - preferred dividends

Stockholders’ equity - preferred stock claims

24. Return on total equity:

25. Times interest earned:

26. Times preferred

dividends earned:

Exhibit 15-5

(partial)

Net income

Stockholders’ equity

Operating income

Interest on long-term debt

Net income

Preferred dividends

Liquidity

Liquidity measures provide an indication of an entity’s

position with respect to cash and assets that may be

converted into cash in the relatively near future.

Some liquidity measures are:

–

–

–

–

–

–

–

–

current ratio

quick ratio

accounts receivable turnover

days sales in receivables

inventory turnover

days sales in inventory

operating cycle

cash flow to current maturities of debt

Solvency

Solvency measures help decision makers

evaluate an entity’s ability to meet its

obligations in a timely manner.

Some solvency measures are:

–

–

–

–

Long-term debt to total assets

Debt to equity

Times interest earned

Cash flow to total debt.

Profitability

Profitability measures provide indications of a

company’s operating success.

Some profitability measures are:

–

–

–

–

–

Gross profit (margin) percentage

Net income margin (return on sales)

Return on common equity

Asset turnover

Return on assets.

Return to investors

Return measures focus on more direct

measures of returns to investors.

Some return measures are:

–

–

–

–

–

Earnings per share

Diluted earnings per share

Dividend payout

Dividends to operating cash flow

Cash flow per share.

Personal Financial Reporting

Individuals are often asked to provide personal financial

information when seeking a large loan, or entering a

business venture. Personal financial statements are also

used for purposes such as reviewing the adequacy of

resources accumulated for retirement, analysis of asset

holdings, and estate planning.

Two personal financial statements are generally prepared:

– Statement of financial condition (personal balance

sheet);

– Statement of changes in net worth (personal income

statement).

Personal Financial Reporting

Assets should be reported at their fair values, and liabilities at

the lower of the discounted future cash payments or the current

cash settlement amount on a personal balance sheet. In

addition, an estimated income tax liability must be reported for

the difference between the current fair values of the assets and

liabilities and their tax bases.

Changes in the values of the assets and liabilities are reported

in the personal income statement, as is the change in the

estimated income tax that would have to be paid on the

changes; distinction between realized and unrealized changes

in net worth should also be drawn.

Copyright

Copyright © 2001 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work beyond

that permitted in Section 117 of the 1976 United States

Copyright Act without the express written permission of the

copyright owner is unlawful. Request for further information

should be addressed to the Permissions Department, John

Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale.

The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.