ADDITIONAL ISSUES IN LIABILITY REPORTING

advertisement

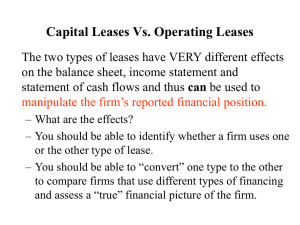

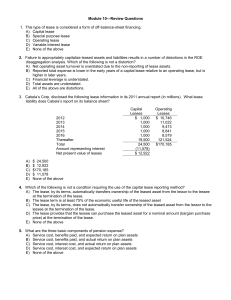

Additional Issues in Liability Reporting Chapter 12 Lease Obligations • A business firm may obtain assets either by purchase or lease. Lease Obligations • A lease is an agreement between the lessor (owner) and lessee (renter) which conveys the right to use the leased property for a designated future period. Lease Obligations • Leases are limited in their terms only by the creativity of the contracting parties and by, of course, legal concerns. The benefits of leasing include the following: • They offer financial flexibility to the lessee because lessors generally do not have the power to impose severe restrictions on the lessee. • The lessee may have reduced risk of equipment obsolescence. • The lessor may be able to resell or re-lease the asset if there is a well-developed secondary market. • Because payments are a set amount, the lessee usually has reduced financial risk. A company purchases an asset: • The company must use compound interest tables to compute the present value of the payment or payments and record an asset and a liability for the present value. A company purchases an asset: • The company must record annual interest expense until the loan is paid off and must record depreciation expense for each year that it owns the asset. A company purchases an asset: • It must also make periodic payments on the principal of the loan. A company purchases an asset: • On the balance sheet, noncurrent assets and liabilities are both increased. A company purchases an asset: • On the income statement, both interest and depreciation expenses are recorded. A company leases an asset: • The first thing to determine is whether the lease is a capital or an operating lease. A company leases an asset: • A capital lease is interpreted as if it is essentially a purchase of an asset, whereas an operating lease is interpreted as an ordinary rental. A company leases an asset: • A lease is considered to be a capital lease if it meets any one or more of the following four criteria: A company leases an asset: • The lease transfers ownership of the property to the lessee by the end of the lease. A company leases an asset: • The lease gives the lessee an option to purchase the leased asset at a bargain price (called a bargain purchase option). A company leases an asset: • The lease gives the lessee an option to purchase the leased asset at a bargain price (called a bargain purchase option). A company leases an asset: • If a company leases a 700 series BMW for three years and is given the option to buy the car for $3,000 at the end of the lease, then that would probably be considered a bargain purchase option. A company leases an asset: • The lease term is equal to 75% or more of the estimated economic life of the leased property. A company leases an asset: • If the economic life of the asset is 8 years and the lease term is 7 years, then that lease meets this criterion. A company leases an asset: • The present value of the lease property (the lease payments) is 90% or more of the fair value of the property at the inception of the lease. A company leases an asset: • If a lease meets none of these criteria, then it is treated as an operating lease. A company leases an asset: • An operating lease is interpreted as an ordinary rental. Capital Leases • If the lease is a capital lease, then the lessee records an asset and a liability at the lower of the fair market value of the property or the present value of the minimum lease payments. Capital Leases • The present value of the minimum lease payments must be computed using the compound interest tables. Capital Leases • The cost of the asset is systematically expensed, or amortized, and the company must also record interest expense on the liability. Capital Leases • Annual payments on the principal must also be made. Capital Leases • On the balance sheet, noncurrent assets and liabilities are both increased. Capital Leases • On the income statement, both interest and amortization expenses are recorded. Capital Leases ASSETS = LIABILITIES + OWNERS’ EQUITY Leased Lease assets obligations +$8,222,000 +$8,222,000 Capital Leases ASSETS = LIABILITIES + OWNERS’ EQUITY Leased Retained earnings assets –$1,370,333 –$1,370,333 (amortization expense) Capital Leases ASSETS = LIABILITIES + OWNERS’ EQUITY Cash Lease Retained earnings obligations –$2,000,000 –$986,640 +$986,640 (interest expense) –$2,000,000 Operating Leases • If the lease is an operating lease, then the lessee will simply record rent expense for each of the payment periods. • No asset or liability is recorded. Operating Leases • Thus, the asset cost will not be amortized because the lessee has not capitalized the cost of the asset. Operating Leases ASSETS = LIABILITIES + OWNERS’ EQUITY Cash Retained earnings –$2,000,000 –$2,000,000 (rent expense) Accounting for Leases • Whether the lease is an operating or a capital lease can have a dramatic effect on financial ratios. Accounting for Leases • Ratios using net income, total assets, or debt in their calculations will be affected. Accounting for Leases • Return on assets, the debt-to-assets ratio, and earnings per share will all appear less favorable in the earlier years of a capital lease. Accounting for Leases • Operating leases are often called "offbalance-sheet" financing because neither an asset nor a liability is recorded. Accounting for Leases • A company with any type of lease is required to disclose substantial details of the lease in the notes to the financial statements. Postretirement Benefit Obligations • Most medium- and larger-sized firms provide retired employees with pensions and other postretirement benefits. Postretirement Benefit Obligations • These costs are incurred the service lives of the retirees — the working years prior to retirement. Pension Expenses and Obligations • Pension plans are either defined contribution plans or defined benefit plans. Defined Contribution Pension Plans • A defined contribution pension plan specifies the periodic amount that the firm must contribute to a pension fund. Defined Contribution Pension Plans • The employer's only obligation is to make the agreed-upon contributions to the plan. Defined Contribution Pension Plans • The employee bears all the risks and rewards. Accounting for these plans is straightforward and noncontroversial. Defined Benefit Pension Plans • A defined benefit pension plan specifies the benefits that employees will receive at retirement. Defined Benefit Pension Plans • The employer assumes all the risks and rewards associated with pension fund investments. Defined Benefit Pension Plans • These types of plans are popular in U.S. industries having strong labor union representation. Defined Benefit Pension Plans • The employer knows how much he must pay to an employee in the future and must estimate and make assumptions about investments and actuarial concerns so that he can invest enough to have that required future amount available. Defined Benefit Pension Plans Employer Firm Cash Contribution Pension Fund Benefit Payments Obligation to Pay Benefits Retirees Basic Accounting for Pensions • It is important to differentiate between the employer and the pension fund. Basic Accounting for Pensions • The employer makes contributions to the pension fund, and the fund makes payments to retirees. Basic Accounting for Pensions • Some analysts do not regard the fund as a separate entity and would like to see the employer firm and the fund consolidated for reporting purposes. Basic Accounting for Pensions • An employer must estimate future payments to retirees and discount the payments to present values using an appropriate rate of interest. Basic Accounting for Pensions • The choice of a discount rate is critical. Basic Accounting for Pensions • Many companies use overly optimistic discount rates, and surveys show that these companies are severely underfunded in their pension plans. Basic Accounting for Pensions • Note the following rule of thumb: Basic Accounting for Pensions • A 1% variation in the assumed discount rate will cause about a 20% variation in the valuation of pension obligations. Measurement of Benefit Obligations • There are three possible present value measurements. Measurement of Benefit Obligations • The vested benefit obligation indicates amounts to which employees have irrevocable rights. Measurement of Benefit Obligations • The accumulated benefit obligation shows the amount of benefits that employees have earned to date, based on current salary levels. Measurement of Benefit Obligations • The projected benefit obligation shows the amount of benefits that employees have earned to date, based on expected future salary levels. Measurement of Benefit Obligations • Managers and analysts often disagree about which of these best represents a firm's pension obligation. Measurement of Benefit Obligations • Present accounting standards are a compromise, disclosing two types of pension costs along with extensive supplementary disclosures in the notes to the financial statements. Measurement of Pension Expense • The following are components of pension expense. Measurement of Pension Expense • Service cost is the value of future pension benefits that employees have earned during the current year. Measurement of Pension Expense • Interest cost on the projected benefit obligation. Measurement of Pension Expense • Return on plan assets, based on anticipated, not actual, return. Measurement of Pension Expense • Return on plan assets, based on anticipated, not actual, return. – The return can be either a positive or a negative number, depending on how the investments have done. Measurement of Pension Expense • Other items (net), such as amortization of prior pension cost, obligations resulting from changes in pension benefits, and revision in assumptions underlying the pension valuation, among others. Pension reporting involves two types of assumptions: • Actuarial—employee turnover, services lives, longevity, etc.—which are fairly standardized and noncontroversial Pension reporting involves two types of assumptions: • Economic—discount rate and return on plan assets—which stir up much controversy. Reporting Nonpension Postretirement Benefits • Firms are required to report their obligations to provide future nonpension post-retirement benefits and accrue the expenses during the years that employees provide service. Reporting Nonpension Postretirement Benefits • Adoption of this new standard in 1993 reduced profits at the 100 largest U.S. corporations by about 33%. Difference Between Pension and Nonpension Benefits • The accumulated postretirement benefit obligation measures the present value of the future benefits that employees and retirees have earned to date. Difference Between Pension and Nonpension Benefits • The fair market values of the plan assets are minor, relative to the accumulated benefit obligation. Nonpension Postretirement Benefit Expense • Cost components for nonpension expenses follow the same format as those for pension costs. Nonpension Postretirement Benefit Expense • The service cost represents the amount of the accumulated benefit obligation earned by employees over the current year. Nonpension Postretirement Benefit Expense • The interest cost is the beginning-ofthe-year obligation multiplied by the discount rate. Nonpension Postretirement Benefit Expense • The return on plan assets is only a minor offset to the other components because the benefits are not substantially funded. Nonpension Postretirement Benefit Expense • As is true for pension benefits, the FASB requires significant disclosures for nonpension postretirement benefits in the notes to the financial statements. Additional Issues in Liability Reporting End of Chapter 12