file

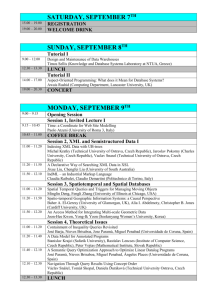

advertisement

Risk Management as Practiced by International Real Estate Investors ERES conference June 2009 Author: Sascha Donner EuroFH – University of Applied Sciences, Hamburg Faculty: European Business Administration Supervisor: Prof. Dr. Ottmar Schneck With support from: Real Estate Advisory Group Germany “The Independent Real Estate Advisors“ OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMARY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMARY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY PURPOSE Survey of risk management practices as employed by real estate investors at the international level PREVIOUS STUDIES Gibson, V.A./ Louargand, M. (2002) “Risk Management and the Corporate Real Estate Portfolio” Hyss, S. (2006) „Risikomanagementprozesse der Immobilienwirtschaft“ Dr. Peter & Company (2007) „Interne Studie über Risikomanagement“ Schwenzer, J. (2008) „Bedeutung und Ausprägung des Risikomanagements von Immobilien in Deutschland“ REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMARY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY STUDY DESIGN Hypotheses: • Risks which are present in larger real estate portfolios can be effectively reduced by means of diversification or the use of derivatives. • Systematic and comprehensive risk management tailored to the real estate industry is lacking to a great extent. REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY STUDY DESIGN Points of inquiry: • In what forms is risk management to be found among the various types of real estate investments? • What risks garner the greatest share of investor attention? • What methods and resources are employed in the risk management process? REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY STUDY DESIGN Survey conducted via web-based questionnaire in English and German languages The questionnaire comprised 51 questions in 7 areas: A) General questions concerning participant’s firm B) Integration of risk management in the firm structure C) Risk identification at property level D) Risk analysis and risk assessment E) Risk management and risk controlling F) Communication and information flow G) Risk management methods Questions posed were predominately of a closed form. Isolated half-closed questions were used. In order to ascertain the distinct characteristics of the various aspects of risk management, scales (range 1 min. – 7 max.) were used, and rankings were performed by the participants. REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey STRUCTURE AND METHODOLOGY STUDY DESIGN 613 international real estate investors (representing 49 nations) were randomly selected from a database of 1,836 investors. The database had been compiled from publicly accessible information sources and with the support of REAG GmbH Frankfurt. Invitations to participate were sent out (83% of investors were written to by name), and reminder e-mails were dispatched after 1 and 2 weeks respectively. Duration of the survey: 3 weeks (12/01/09 – 31/01/09) Response rate: 8.2 % (50 Investors) REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMARY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY SURVEY PARTICIPANTS - Distribution according to investor type Detailed overview Corporate 7% Other 4% Project developers 7% Real estate corp. 13% Real estate investment trust 6% Pension fund 4% Closed fund 15% Insurance 3% Bank 7% Privat equity investors 15% Fund of funds 3% Investment fund / open real estate special fund 8% Investment fund / open real estate - public fund 8% REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY SURVEY PARTICIPANTS – Distribution according to investor type Summarized 19 % 16 % 15 % 15 % 14 % Real estate corporations and REITs Investment Funds Private Equity Investors Closed Funds Banks, Insurance companies, Pension funds 7% 7% 4% 3% Corporate Project developers Other (advisory, management and leasing companies) Fund of funds REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY SURVEY PARTICIPANTS – Geographical distribution 16 different nations Germany UK USA Other countries 28% Austria Italy France Bermuda Denmark Ireland Georgia UK 10% Germany 62% Japan Netherlands Norway Luxembourg Australia Canada REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey DESIGN AND METHODOLOGY SURVEY PARTICIPANTS Year of establishment Number of associates 25 30 20 10 7 5 2 1901-1925 1926-1950 20 15 13 10 8 5 5 2 Number of entries [n] Number of entries[n] 14 15 24 25 20 5 0 0 before 1901 1951-1975 Founding year of company 1976-2000 after 2000 few er als 11 11-50 51-250 Number of associates REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey greater than 250 OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMARY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS A: General Questions Concerning Participant’s Firm - PORTFOLIO 4,0 4,0 3,6 3,5 3,5 3,5 3,0 2,5 Mean (arithm. mean) Mean (arithm. meanl) 2,8 3,0 2,2 2,0 1,5 1,5 2,5 2,2 2,1 2,0 2,0 1,5 1,0 1,0 0,5 0,5 0,0 0,0 Portfolio properties Project development Element Portfolio property Project development Holding Other Holding Other Rank σ σ² Range 3,5 2,8 2,2 1,5 0,92 1,05 1,16 1,08 0,85 1,09 1,34 1,17 1-4 1-4 1-4 1-4 Commercial property Element Office property Residential property Special property Industrial property Residential property Special property Industrial property Rank σ σ² Range 3,6 2,2 2,1 2,0 0,90 1,28 1,14 1,15 0,81 1,60 1,31 1,32 1-4 1-4 1-4 1-4 REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS B: Integration of Risk Management in Company Structure Integration in company hierarchy 25 22 Number of entries [n] 20 20 15 14 15 Hierarchy level Level of risk management 10 6 6 6 5 2 2 3 2 1 0 1 3 5 1 7 9 Hierarchy Level / Level of Risk Management REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS B: Integration of Risk Management in Company Structure Assignment to company function 25 30 25 20 25 20 Number of entires [n] Number of entries [n] 17 15 12 10 8 6 19 20 15 10 6 5 5 0 0 0 Company controlling Real estate controlling Other Compliance Internal audit department None Line function (w ith discretionary authority) Staff function (w ithout discretionary authority) *other: asset / portfolio management, investment committee, business management, purchasing, all areas REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey Don't know RESULTS B: Integration of Risk Management in Company Structure CRO vs. CCO In 32 % of firms there exists the position of Chief Risk Officers (CRO) In 44 % of firms there exists the position of Chief Compliance Officers (CCO) REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS B: Integration in Company Structure Duties of Chief Risk Officers (CRO) Duties of Chief Compliance Officers (CCO) 16 14 14 14 12 12 12 13 Number of entries [n] Number of entries [n] 12 10 8 6 4 2 1 10 11 9 8 6 5 6 4 2 0 0 Monitoring Coordinating Linked to top management Other Monitoring Coordinating Linked to top management REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey Provides information Other RESULTS C: Risk Identification at Property Level 92 % of investors carry out regular inspections of property premises. Thereof: 84 % annually 13 % at least every 2 years 3 % less frequently 70 % have predominately direct contact to tenants. 34 % of investors survey tenant satisfaction. Thereof: 88 % annually 12 % at least every 2 years REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS C: Risk Identification at Property Level Who identifies risks at the property level? 40 • Risk identification takes place predominantly in-house. 37 35 38 35 Number of entries [n] 35 30 25 20 15 8 10 5 8 9 6 3 1 3 4 3 4 6 0 0 EXTERNAL property manager EXTERNAL asset manager INTERNAL asset / portfolio management Other INTERNAL department Rental and vacancy risk Maintenance and operating risk Risk of changing market rents and prices Macro and micro-location risk • Property managers carry practically no significance although they generally stand in the closest position to the property and tenants. • Problematic interface configurations. • 90 % of investors work with external property managers. 34 % have a compatible IT System. REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS D: Risk Analysis and Risk Assessment Property risks according to significance Element Rental and vacancy risk Risk of changing market rents and prices Maintenance and operating risks Valuation risk Economic activity risks Risks arising from changing micro-location Interest and currency exchange rate risks Rank σ σ² Range 5,3 4,9 3,9 3,8 3,8 3,3 3,0 1,72 1,89 1,86 1,98 2,01 1,80 1,66 2,95 3,55 3,45 3,93 4,05 3,23 2,74 1-7 1-7 1-7 1-7 1-7 1-7 1-7 REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS D: Risk Analysis and Risk Assessment Who assesses risks? 45 41 3536 36 35 30 27 26 23 25 20 14 5 11 9 9 6 7 4 3 1 2 3 2 5 4 Controlling department 4 5 4 1 1 1 1 0 Internal asset / portfolio management 9 7 Risiko management department 10 11 • Risk assessment takes place predominately within the scope of duties of the internal asset / portfolio management. • Interest and exchange rate risks are predominantly assessed by the finance department. 1 0 01 Finance department 15 External service provider Number of entries [n] 40 Maintenance and operating risk Rental and vacancy risk Risk of changing micro-location Risks of changing market rents and prices Valuation risk Economic activity risks • Other internal departments are rarely involved (assessment / risk management). • Risk management department? Interest and currency exchange rate risks REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS D: Risk Analysis and Risk Assessment Methods of risk assessment 45 • There are three clearly dominant methods. 39 36 35 35 • Methods involving probabilities are little used. 30 25 21 13 11 10 9 5 4 3 Other 15 Monte Carlo Simulation 16 Time series analysis 20 Correction method (risk premium) Scoring model Value at Risk Ratings Gut feeling Scenario analysis 0 Sensitivity analysis 5 DCF Model Number of entries [n] 40 • Gut feeling is given an important place after the “Big 3”. REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS E: Risk Management and Risk Controlling 37 • 64 % of investors indicated that risk management guidelines in their firms are established. 36 30 24 22 • At 36 % of firms there are risk managers for individual business areas. None Risks of changing microlocataion Economic activity risk Interest and currency exchange rate risks 1 Valuation risk 40 35 30 25 20 15 10 5 0 Maintenance and operating risks Number of entries [n] Regularly and systematically monitored risks REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS F: Communication and Information Flow Direct recipient of information gathered at property level 45 Type of information conveyance 45 41 42 40 40 Number of entries [n] 30 25 19 20 34 35 32 13 15 10 30 23 25 20 15 10 3 5 7 5 Other Risk management department Controlling department Top management 1 0 Asset / property management Number of entries [n] 35 0 Fixed reports Written reports as needed Oral REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey Special purpose softw are Other RESULTS G: Methods of Risk Management sorted according to significance 45 40 36 35 33 • Early warning systems are little employed in risk management. 30 25 20 20 • “Gut feeling” is given an important place. 8 6 5 4 1 Delphi methode 9 Flow chart analyse 9 10 Brainstorming 13 15 5 Technical literature Special software Early warning system Workshops and training Survey of associates Gut feeling Market research Check lists 0 Risk reporting Number of entries [n] • Three methods are dominant. 41 REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Risk reduction • Diversification is the most important method, followed by derivatives. 45 41 40 32 Number of entries [n] 35 30 25 20 15 8 10 5 0 Diversification Use of derivatives • Other: “high EK-Quote” “reaction to abnormalities” “insurance” “supervision” “limit system” “recognition and rectification” Other REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Diversification and modern portfolio theory 40 37 Across: 34 • Geographical regions 29 30 24 25 22 20 19 • Use types • Tenant types 15 10 5 Location: mix of A and B Locations Property: various sizes Tenant: multitenant / single-tenant Tenant: mix of types Property: various uses 0 Location: geographical Number of entries [n] 35 REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Diversification and Modern Portfolio Theory ACQUISITION OF PROPERTIES • 56 % take into consideration the influence of newly acquired properties on the risks of the entire portfolio. • 26 % calculate the influence. • 18 % do not consider such influence at all. PROPERTY ASSETS • 60 % take into consider the influence of changes in the risk profiles of individual property assets on the entire portfolio. • 18 % calculate the influence. • 22 % do not consider such influence at all. REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Diversification and Modern Portfolio Theory • For and against - 50 : 50 Very difficult 8% Rather difficult 42% Excellent 6% • Naive portfolio selection Rather good 44% REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Derivatives 35 • Almost exclusively classical hedging against interest and currency risks. 32 Number of entires [n] 30 25 21 • Real estate derivatives are “still” hardly used. 20 15 10 4 3 Property risks Inflation risks 5 0 Interest risks Currency risks REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Excel vs. special purpose software • Excel is dominant. 45 41 40 • 44% of investors use special purpose software. Number of entries [n] 35 30 25 • Other: MS Access 22 20 15 10 5 2 0 Excel Special purpose software Other REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Ratings – use of ratings in the risk management process 30 28 25 Number of entries [n] 25 19 20 • External ratings: - high effort - high costs 14 10 8 6 5 5 0 External ratings For portfolio properties • Ratings are predominately not applied; if such are in fact used, then internal ratings. • Scoring vs. rating 17 15 28 Internal ratings For project developments None • Internal ratings: - better data records - fewer costs - better control For holdings REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey RESULTS G: Methods of Risk Management Ratings – quality of rating agencies Rating agencies Don't know 24% Real estate rating agencies Excellent 2% Rather good 26% Don't know 32% Excellent 0% Very poor 10% Rather poor 38% „Very poor“ and „rather poor“ = 48 % Very poor 16% „Very poor“ and „rather poor“ = 44 % REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey ´Rather good 24% Rather poor 28% OBJECTIVE OF THE STUDY STUDY DESIGN SURVEY PARTICIPANTS RESULTS SUMMERY REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey SUMMARY Actual state of risik management Possible future developments Aim - Fulfilment of legal obligations - Protection of company existence - Reduction of risk premiums - Risk management as a component of company steering - Render risks more transparent (internal / external) - Gain of competitve advantage Realisation - Deficiencies in risk identification, risk assessment and steering - Interfacing between departments and external providers not clearly defined - Lack of committment to risk reporting - Fixation on the short term period - Adaption of risk management methods to real estate industry - Strengthened application of special software in risk mangement - Application of findings from behavioral finance research - Future oriented REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey SUMMARY Adaptation of Risk Management due to the Credit / Real Estate Crisis? 22 % no answer 48 % no adjustment 30 % wish to adapt their risk management Following adjustments were named: • Focusing on finance and credit risks • Focusing on strategic risks • Increasing real estate know-how • Increasing reporting requirements • Standardization • IT-supported analysis • Persistence REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey Thank you for your attention! REAG EUROPE: Germany, Greece, France, UK, Italy, Czech Republic, Poland, Portugal, Romania, Russia, Spain, Turkey