Types of Strategies

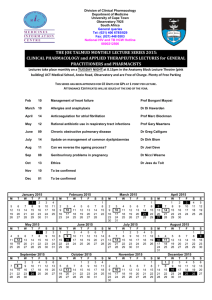

advertisement

Types of Strategies Level of strategies 1 Prof. Dr. Majed El-Farra 2009 Strategy hierarchy 1. Corporate strategy: 1) growth strategy, 2) stability strategy, 3) retrenchment strategy. 2. Business unit strategy: 1) cost leadership, 2) differentiation, 3) focus, 4) mixed. 3. Functional strategy. 2 Prof. Dr. Majed El-Farra 2009 Types of Strategies A Large Company Corp Level Division Level Functional Level Operational Level 3Ch 5 - Types of Strategies company A small Company Functional Level Operational Level 4Ch 5 - Corporate strategies • Top level management formulate for overall organization • The question at the corporate level we should answer when design strategies: In what industry should we be operating? • It depends on the outcome of SWOT analysis. 5 Prof. Dr. Majed El-Farra 2009 Growth strategies Growth strategies: They result increase in sales, market share and profit: the types: • Internal growth: Increase internal capacity of organization without acquiring other firms. • Conglomerate Diversification: Acquiring unrelated business. • Merger: Two roughly similar size firms combine into one. To benefit of synergy. • Strategic alliance: Temporary partnerships 6 Prof. Dr. Majed El-Farra 2009 Corporate Restructuring The change in a broad set of actions and decisions, e.g., changing relationships and organization of work. • The aim of restructuring is to improve effectiveness. • Restructuring could be growth, stability or retrenchment. This depends on why we use it. 7 Prof. Dr. Majed El-Farra 2009 Retrenchment strategies • Types: 1- Turnaround: Eliminating unprofitable outputs, pruning/cutting assets, reducing size of work force, rethinking firm’s products lines and customer groups. 2- Divestment: sell one of business units 3- Liquidation: last resort strategy 8 Prof. Dr. Majed El-Farra 2009 Strategies in Action Vertical Integration Strategies • • • 9 Forward integration Backward integration Horizontal integration Prof. Dr. Majed El-Farra 2009 Strategies in Action Forward Integration Defined • Gaining ownership or increased control over distributors or retailers 10 Example • General Motors is acquiring 10% of its dealers. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Forward Integration 11 Present distributors are expensive, unreliable, or incapable of meeting firm’s needs Availability of quality distributors is limited When firm competes in an industry that is expected to grow markedly Advantages of stable production are high Present distributor have high profit margins Prof. Dr. Majed El-Farra 2009 Strategies in Action Backward Integration Defined • Example • Seeking ownership or increased control of a firm’s suppliers 12 Prof. Dr. Majed El-Farra 2009 Motel 8 acquired a furniture manufacturer. Strategies in Action Guidelines for Backward Integration 13 When present suppliers are expensive, unreliable, or incapable of meeting needs Number of suppliers is small and number of competitors large High growth in industry sector Firm has both capital and human resources to manage new business Advantages of stable prices are important Present supplies have high profit margins Prof. Dr. Majed El-Farra 2009 Strategies in Action Horizontal Integration Defined • Example • Seeking ownership or increased control over competitors 14 Prof. Dr. Majed El-Farra 2009 Palestinian Islamic Bank acquired CairoAmman Bank Islamic transaction branch. Strategies in Action Guidelines for Horizontal Integration Firm can gain monopolistic characteristics without being challenged by federal government Competes in growing industry Increased economies of scale provide major competitive advantages Faltering/losing due to lack of managerial expertise or need for particular resources 15 Prof. Dr. Majed El-Farra 2009 Strategies in Action Intensive Strategies • • • 16 Market penetration Market development Product development Prof. Dr. Majed El-Farra 2009 Strategies in Action Market Penetration Defined • Seeking increased market share for present products or services in present markets through greater marketing efforts 17 Example • Ameritrade, the online broker, tripled its annual advertising expenditures to $200 million to convince people they can make their own investment decisions. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Market Penetration Current markets not saturated Usage rate of present customers can be increased significantly Market shares of competitors declining while total industry sales increasing Increased economies of scale provide major competitive advantages 18 Prof. Dr. Majed El-Farra 2009 Strategies in Action Market Development Defined Example • • 19 Introducing present products or services into new geographic area Khuzendar Tiles maker introduce his product to Gulf markets. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Market Development 20 New channels of distribution that are reliable, inexpensive, and good quality Firm is very successful at what it does Untapped or unsaturated markets Capital and human resources necessary to manage expanded operations Excess production capacity Basic industry rapidly becoming global Prof. Dr. Majed El-Farra 2009 Strategies in Action Product Development Example Defined • Seeking increased sales by improving present products or services or developing new ones 21 • • Apple developed the G4 chip that runs at 500 megahertz. Khuzendar Tiles maker introduce Ceramic as a new product. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Product Development 22 Products in maturity stage of life cycle Competes in industry characterized by rapid technological developments Major competitors offer better-quality products at comparable prices Compete in high-growth industry Strong research and development capabilities Prof. Dr. Majed El-Farra 2009 Strategies in Action Diversification Strategies • • • 23 Concentric diversification Conglomerate diversification Horizontal diversification Prof. Dr. Majed El-Farra 2009 Strategies in Action Concentric Diversification Example Defined • Adding new, but related, products or services 24 • National Westminister Bank PLC in Britain bought the leading British insurance company, Legal & General Group PLC. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Concentric Diversification 25 Competes in no- or slow-growth industry Adding new & related products increases sales of current products New & related products offered at competitive prices Current products are in decline stage of the product life cycle Strong management team Prof. Dr. Majed El-Farra 2009 Strategies in Action Conglomerate Diversification Example Defined • Adding new, unrelated products or services 26 • Consultant Construction Engineering acquired Bisects factory. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Conglomerate Diversification Declining annual sales and profits Capital and managerial talent to compete successfully in a new industry Financial synergy between the acquired and acquiring firms Exiting markets for present products are saturated 27 Prof. Dr. Majed El-Farra 2009 Strategies in Action Horizontal Diversification Defined • Adding new, unrelated products or services for present customers 28 Example • Prof. Dr. Majed El-Farra 2009 The El-Awda Co. provide ice-cream product to present customer Strategies in Action Guidelines for Horizontal Diversification Revenues from current products/services would increase significantly by adding the new unrelated products Highly competitive and/or no-growth industry w/low margins and returns Present distribution channels can be used to market new products to current customers New products have counter cyclical sales patterns compared to existing products 29 Prof. Dr. Majed El-Farra 2009 Strategies in Action Defensive Strategies • • • • 30 Joint venture Retrenchment Divestiture Liquidation Prof. Dr. Majed El-Farra 2009 Strategies in Action Joint Venture Defined Example • • Two or more sponsoring firms forming a separate organization for cooperative purposes 31 Lucent Technologies and Philips Electronic NV formed Philips Consumer Communications to make and sell telephones. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Joint Venture 32 Combination of privately held and publicly held can be synergistically combined Domestic forms joint venture with foreign firm, can obtain local management to reduce certain risks Distinctive competencies of two or more firms are complementary Overwhelming resources and risks where project is potentially very profitable (e.g., Alaska pipeline) Two or more smaller firms have trouble competing with larger firm A need exists to introduce a new technology quickly Prof. Dr. Majed El-Farra 2009 Strategies in Action Retrenchment (turnaround) Defined • Regrouping through cost and asset reduction to reverse declining sales and profit. Sometimes it is called turnaround or reorganizational strategy. 33 Example • A company sold off a land and 4 apartments to raise cash needed. It introduce expense effective control system. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Retrenchment 34 Firm has failed to meet its objectives and goals consistently over time but has distinctive competencies Firm is one of the weaker competitors Inefficiency, low profitability, poor employee morale, and pressure from stockholders to improve performance. When an organization’s strategic managers have failed Very quick growth to large organization where a major internal reorganization is needed. Prof. Dr. Majed El-Farra 2009 Strategies in Action Divestiture Defined Example • • Selling a division or part of an organization 35 Harcourt General, the large US publisher, is selling its Neiman Marcus division. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Divestiture 36 When firm has pursued retrenchment but failed to attain needed improvements When a division needs more resources than the firm can provide When a division is responsible for the firm’s overall poor performance When a division is a misfit with the organization When a large amount of cash is needed and cannot be obtained from other sources. Prof. Dr. Majed El-Farra 2009 Strategies in Action Liquidation Defined • Selling all of a company’s assets, in parts, for their tangible worth 37 Example • El-Ameer Block factory sold all its assets and ceased business. Prof. Dr. Majed El-Farra 2009 Strategies in Action Guidelines for Liquidation When both retrenchment and divestiture have been pursued unsuccessfully If the only alternative is bankruptcy, liquidation is an orderly alternative When stockholders can minimize their losses by selling the firm’s assets 38 Prof. Dr. Majed El-Farra 2009 Michael Porter’s Generic Strategies Cost Leadership Strategies (Low-Cost & Best-Value) Differentiation Strategies Focus Strategies (Low-Cost Focus & Best-Value Focus) 39Ch 5 - Prof. Dr. Majed El-Farra 2009 Business Unit Strategies • Here we answer the question: How should we compete in the chosen industry? Cost leadership Differentiation (real or perceived). Mixed Focus 40 Prof. Dr. Majed El-Farra 2009 Business Strategy Focuses on improving competitive position of company’s products or services within the specific industry or market segment 416- Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Generic Competitive Strategies -–Lower Cost strategy •Greater efficiencies than competitors –Differentiation strategy •Unique/superior value, quality, features, service 426- Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Competitive Advantage -–Determined by Competitive Scope •Breadth of the target market 436- Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies 446- Prof. Dr. Majed El-Farra 2009 Prof. Dr. Majed El-Farra 2009 45Ch 5 - Porter’s Competitive Strategies Cost Leadership -–Low-cost competitive strategy –Broad mass market –Efficient-scale facilities –Cost reductions –Cost minimization 466- Prof. Dr. Majed El-Farra 2009 Michael Porter’s Generic Strategies • Cost leadership emphasizes producing standardized products at a very low per-unit cost for consumers who are pricesensitive. • There are two types of cost leadership strategies. • a. A low-cost strategy offers products to a wide range of customers at the lowest price available on the market. • b. A best-value strategy offers products to a wide range of customers at the best price-value available on the market. 47Ch 5 - Prof. Dr. Majed El-Farra 2009 Cost leadership • Striving to be the low-cost producer in an industry can be especially effective when the market is composed of many price-sensitive buyers, when there are few ways to achieve product differentiation, when buyers do not care much about differences from brand to brand, or when there are a large number of buyers with significant bargaining power. 48Ch 5 - Prof. Dr. Majed El-Farra 2009 Cost leadership • The basic idea behind a cost leadership strategy is to underprice competitors or offer a better value and thereby gain market share and sales, driving some competitors out of the market entirely. • 5. To successfully employ a cost leadership strategy, firms must ensure that total costs across the value chain are lower than that of the competition. This can be accomplished by: • a. performing value chain activities more efficiently than competition, and • b. eliminating some cost-producing activities in the value chain. 49Ch 5 - Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Differentiation – –Broad mass market –Unique product/service –Premiums charged –Less price sensitivity 506- Prof. Dr. Majed El-Farra 2009 Differentiation • Differentiation is aimed at producing products that are considered unique. This strategy is most powerful with the source of differentiation is especially relevant to the target market 51Ch 5 - Prof. Dr. Majed El-Farra 2009 Differentiation • A successful differentiation strategy allows a firm to charge higher prices for its products to gain customer loyalty because consumers may become strongly attached to the differentiation features. • 3. A risk of pursuing a differentiation strategy is that the unique product may not be valued highly enough by customers to justify the higher price. 52Ch 5 - Prof. Dr. Majed El-Farra 2009 Differentiation • Common organizational requirements for a successful differentiation strategy include strong coordination among the R&D and marketing functions and substantial amenities to attract scientists and creative people. 53Ch 5 - Prof. Dr. Majed El-Farra 2009 Focus • 1. Focus means producing products and services that fulfill the needs of small groups of consumers. • 2. There are two types of focus strategies. • a. A low-cost focus strategy offers products or services to a small range (niche) of customers at the lowest price available on the market. • b. A best-value focus strategy offers products to a small range of customers at the best price-value available on the market. This is sometimes called focused differentiation. 54Ch 5 - Prof. Dr. Majed El-Farra 2009 Focus • Focus strategies are most effective when the niche is profitable and growing, when industry leaders are uninterested in the niche, when industry leaders feel pursuing the niche is too costly or difficult, when the industry offers several niches, and when there is little competition in the niche segment. 55Ch 5 - Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Cost-Focus – –Low-cost competitive strategy –Focus on market segment –Niche focused –Cost advantage in market segment 566- Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Differentiation Focus – –Specific group or geographic market focus –Differentiation in target market –Special needs of narrow target market 576- Prof. Dr. Majed El-Farra 2009 Porter’s Competitive Strategies Stuck in the middle – –No competitive advantage –Below-average performance 586- Prof. Dr. Majed El-Farra 2009 Risks of Generic Strategies Risks of Cost Risks of Cost Leadership Leadership Cost leadership is not Cost leadership is not sustained: sustained: •• Competitors Competitorsimitate. imitate. •• Technology Technologychanges. changes. •• Other bases Other bases for for cost cost leadership erode. leadership erode. Proximity in Proximity in differentiation is lost. differentiation is lost. Cost focusers achieve Cost focusers achieve even lower cost incost in even lower segments. segments. 596- Risks ofof Differentiation Risks Differentiation Differentiation is not Differentiation is not sustained: sustained: Competitorsimitate. imitate. • • Competitors • Bases for • Bases for differentiation becomedifferentiation less important become less important to to buyers. Cost proximity isbuyers. lost. Cost proximity is lost. Differentiation focusers Differentiation focusers achieve even greater achieve even differentiation in greater differentiation in segments. segments. Prof. Dr. Majed El-Farra 2009 Risks of Focus Risks Focus The of focus strategy is The focus strategy is imitated: imitated: The target segment Thebecomes target segment structurally becomes structurally unattractive: unattractive: • Structure erodes. •• Structure erodes. Demand disappears. • Demand disappears. Broadly targeted Broadly targeted competitors overwhelm competitors overwhelm the segment: the segment: • The segment’s • differences The segment’s from other differences from other segments narrow. narrow. • segments The advantages of a • The advantages of a broad line increase. broad line increase. New focusers subsegment New focusers thesubsegment industry. the industry. Level of Strategy • Functional/operational Strategies: Concern with org. internal resources and processes which effectively deliver the corporate and business strategic direction. Functional strategies are interrelated. Functional strategies e.g.: purchasing & materials management, production, finance, R&D, HR, IT, and marketing. 60 Prof. Dr. Majed El-Farra 2009 purchasing & materials management (as example) Buying materials in quantity, quality and cost which correspond with the corp. generic strategies (Business Unit strategies). 61 Prof. Dr. Majed El-Farra 2009 What kind of internal factors help managers determine whether a firm should emphasize the production and sales of a large number of low-priced products or a small number of highpriced products? • • • • • 62 The most important factors can be brought out by going through each functional area. For example, under marketing, a strong market research group may be able to identify the kinds of niches available to the products or services under consideration. In terms of finance, the production of a large number of low-priced products suggests a large capital intensive manufacturing facility. To produce a few high quality goods with a small amount of capital because the needed manufacturing facilities may be small, utilizing craft labor. R&D may be an important consideration also. In order to produce high-quality products, a fairly sophisticated applied R&D effort may be needed. An expensive engineering staff may be needed, In terms of human resource management, a fairly unskilled and low paid workforce cannot normally be expected to produce a high quality product on old assembly line machinery. Either the workforce would need to be replaced or an extensive job training and job enrichment program would need to be established. Either approach costs both time and money. Prof. Dr. Majed El-Farra 2009 Is it possible for a company or business unit to follow a cost leadership strategy and a differentiation strategy simultaneously? Why or why not? • Michael Porter argues that a business unit which is unable to achieve one of the competitive strategies is likely to be "stuck in the middle" of the competitive marketplace with no competitive advantage. That unit, according to Porter, is doomed to belowaverage performance. • Research by Greg Dess and Peter Davis as well as by Rod White, suggests however, that this may not be the case. Examples can be found of businesses which have been able to jointly follow overall low cost and high quality differentiation strategy. Japanese companies such as Toyota in automobiles and Matsushita (Panasonic and National) in consumer electronics are good examples. Their offer of low price and high quality created serious problems for those companies following only cost leadership in the U.S. 63 Prof. Dr. Majed El-Farra 2009 How can a company overcome the limitations of being in a fragmented industry? • Businesses tend to be local and oriented to market segments. This may occur because the industry is relatively new - based upon a product in the early stage of its product life cycle. • Entry barriers are probably low and new entrants are constantly moving into the industry as others leave or go bankrupt. Often, the trick to be a successful firm in this kind of industry is to find the key to standardization which allows economies. • Domino's Pizza achieved success in fast food by providing standardized pizza throughout North America and by guaranteeing delivery time faster than competition. Before Pizza Hut and Domino's settled upon standardized pizza appealing to a wide variety of tastes across North American, the pizza business was a fragmented industry characterized by many small pizza "parlors" serving small market segments in cities throughout America . 64 Prof. Dr. Majed El-Farra 2009