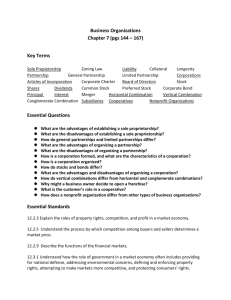

Types of Business Ownership PPT

advertisement

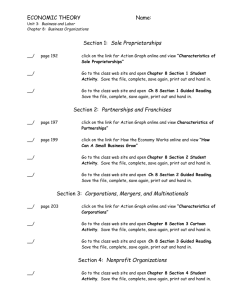

3.00 Acquire knowledge of business ownership to establish & continue business operations 3.06B Select form of business ownership Objectives Summarize the advantages and disadvantages of the most common types of business ownership. Three basic forms of business ownership Your choice depends on your needs & goals •Sole proprietorship •Partnership •Corporation Sole proprietorship •A business owned and operated by one person. Advantages of sole proprietorships •Easy and inexpensive to create. • Unless you need certification or local permits, government intervention is minimal •Owner makes all business decisions & has control over all aspects of the business. •Flexibility in scheduling to meet owner’s needs Advantages of sole proprietorships cont. •Owner receives all profits. •Privacy – owner is the only one who knows details of the business • Secret ideas, formulas, or recipes •Ability to act quickly in making decisions – no checking with others Advantages of sole proprietorships cont. •Tax advantages • Business itself pays no taxes • Taxes are paid as personal income of owner which is usually lower than corporate taxes • Many business expenses are deductible •Easy to close/dissolve • Pay employees and creditors • Sell your equipment • Notify customers if possible Disadvantages of sole proprietorships •Owner has unlimited liability for all debts and actions of the business. •Unlimited liability: The debts of the business may be paid from the personal assets of the owner. •If you cannot pay business debt with business income, bill collectors can take your personal assets (home, car) •Difficult to raise capital. •Banks/lenders consider sole proprietorships to be a highrisk investment •Needs include paying employees, purchasing equipment & inventory, & running the business •Expansions can be delayed or halted causing you to lose business to your competition Disadvantages of sole proprietorships •Sole proprietorship is limited by his/her skills and abilities. •Uncertain life •You are “it” – illness or injury that prevents you from working may cause you to close •Bankruptcy or incarceration will dissolve your business •The death of the owner automatically dissolves the business. Partnership A form of business ownership in which two or more people share the assets, liabilities, and profits. Advantages of partnerships •Fairly easy & inexpensive to start • May pay attorney if you develop a partnership agreement •Combined resources • Team with partners with different skills, experience, contacts, & capital • Sharing responsibilities makes business run more efficiently & smoothly • Increase the amount of capital to run the business. Lenders may be more willing to lend or extend credit •Decreased Competition • Combining like businesses will decrease or eliminate competition Advantages of partnerships cont. •Reduced expenses • When two or more businesses combine expenses are no longer being duplicated • Ex. promotion, office space, supplies, utilities •Business losses are shared by all partners. •The partnership does not pay income tax on profits. • Each partner pays income tax on her/his individual share of the profit Disadvantages of partnerships •Unlimited liability • Each owner in a general partnership has unlimited liability. • Each partner can lose personal assets to pay business debt • In a limited partnership, the liability is limited to the amount invested in the business •Limited Capital • Although partners may bring more capital to the business than sole proprietors, it is still limited to what each can contribute • Some lenders may still be reluctant to lend large amounts •Difficulty in ending • Withdrawing can be complicated if there is no written partnership agreement • By law profits must be divided equally if no agreement Disadvantages of partnerships cont. •Partnerships may lead to disagreements. • May disagree on business goals, finances, responsibilities, & division of profits • Can affect the efficiency of the business, morale of employees, & success or failure of the venture •Developing a detailed partnership agreement often helps resolve the conflict because it addresses many issues that cause potential disagreements • In 1916, the U.S. government developed the Uniform Partnership Act (updated in 1997) which serves as a guide for legally formulating a general partnership agreement • A limited partnership is more formal & specific in nature & is governed by the Uniform Limited Partnership Act (ULPA) Disadvantages of partnerships cont. •Uncertain life/Transferability • Unless specified in a detailed partnership agreement, bankruptcy, death & the withdrawal or admittance of a new partner dissolves the partnership • Remaining partners may start a new partnership if they have the money to buy the former partner’s share Corporation A business that is chartered by a state and legally operates apart from its owners. Owned by stockholders who have purchased units or shares of the company Types of corporations •C-corporation: The most common form of corporation. It protects the entrepreneur from being personally sued for the actions and debts of the corporation •Subchapter S corporation: A corporation that is taxed like a sole proprietorship or partnership. •Nonprofit corporation: Legal entities that make money for reasons other than the owner’s profit. Limited Liability Company (LLC): A form of business ownership that provides limited liability and tax advantages. Advantages of corporations •Financial Power •Can raise money quickly by issuing shares of stock. •Because it is closely regulated by the government, financial institutions are more willing to lend larger amounts of capital •Limited Liability •Owners are liable only up to the amount of their investments. Personal assets cannot be used to pay business debt •Unlimited life •May exist indefinitely •The death or withdrawal of an owner/stockholder does not affect the life span of the corporation Advantages of corporations cont. •Easy-to-transfer ownership •Ownership simply transferred by selling stock to someone else •New stock certificate is issued in the name of new stockholder. No permission is required by others •The business can hire experts to professionally manage each aspect of the business. •Can result in a more efficiently run organization Disadvantages of corporations •Difficulty in forming & operating • Legal assistance is needed to start a corporation • Lawyer fees can be very expensive • Must request approval from the State & register the Articles of Incorporation • Decisions about value & class of stock & shareholder voting rights •Corporations are subject to more government regulations than partnerships or sole proprietorships. • Reporting & taxation requirements vary from state to state • Required to keep detailed reports for stockholders & to keep them informed of certain corporate transactions, meetings, & voting rights • New charter must be approved if corporate activities change Disadvantages of corporations •Dual taxation •Corporation is taxed on profits from the company •Shareholders are taxed on the dividends they earn on their investments •Separate owners & managers • Stockholders are not generally involved in the day-to-day operation of the corporation • Stockholders form a board of directors to make decisions about the business & managers carry out these decisions • Separation of ownership & management provides more opportunity for irregularities or misunderstandings Hybrid forms of Business Ownership •Limited Liability Company (LLC) •Limited Liability Partnership (LLP) •Both combine various elements of sole proprietorships, partnerships, & corporations into one package Advantages of Hybrid Businesses •Cost to start & operate •Generally less expensive than corporations •No dual taxation - requires less paperwork & regulation •LLPs are designed for business professionals such as lawyers & doctors • Partners might need to carry a required amount of liability insurance •Limited Liability •Personal assets cannot be used to pay business debt •Owners (members) lose only what they have invested in the business if it fails Advantages of Hybrid Businesses cont. •Taxation •LLCs & LLPs pay taxes on personal income-tax returns •Since they are not considered separate entities (like corporations) they are not subject to dual taxation •Combined resources •Often have more owners & tend to have a wider pool of financial resources, skills, talents, & contacts •Life span •Hybrids are required to dissolve after a specific time period • Depending on the state registered in, usually between 30 & 40 years •Owners can decide if they want to reorganize or let it dissolve Advantages of Hybrid Businesses cont. •Flexibility •Number of members permitted in LLCs are unlimited • Sub S corporations must have 100 or fewer shareholders •Most states require only one member to establish a business as a hybrid •Members are permitted to run the company or to allow others to manage it •Membership changes do not automatically dissolve the company Disadvantages of hybrids •Requirements & laws to establish & operate hybrids vary from state to state •Problematic for businesses that operate in more than one state •No universal guidelines from state to state •Verification of each state’s statutes can be costly