Briefing on Accreditation of Cooperatives

advertisement

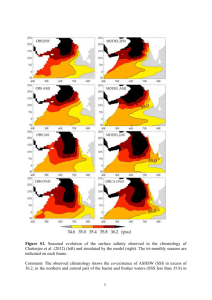

Accreditation of Cooperatives as Collecting Agents A presentation by Ms. Nora M. Mercado Department Head Cooperative and Informal Sector Account Management Group Outline I. Introduction II. SSS Circular 2011-001 • Objectives • Coverage • Service Fee and Billing III. Procedural Highlights IV. Profile of the Target Market I. Introduction Sept 2005 Feb 2010 Jul 2010 Dec 2010 Feb 2011 ExManCom approved the revised proposal on the accreditation of coops and people organization Consultation meeting with the head of coops, attended by the EVP & Chief Actuary Templo, SVP See and VP Argabioso and branch operations sector officials Briefing on accreditation of coops as SSS collecting agents was held at Tuguegarao City SSC approved the collection agnecy agreement (for coops) under Res. No. 972s.2010 on 08 Dec 2010 Issuance of Circular 2011001 signed by PCEO De Quiros, Jr II. SSS Circular 2011-001 The Social Security Commission in its Resolution No. 972-s.2010 dated 08 December 2010 approved the Collection Agency Agreement (Cooperatives), as well as the Guidelines on Accreditation of Cooperatives as Collecting Agents of the Social Security System. 4 II. SSS Circular 2011-001 • Objectives 1. To provide convenient facility to members of Cooperatives, who are at the same time selfemployed or voluntary members of the SSS, to pay their contributions and other obligations to SSS 2. To ensure faster crediting of payment made by the payor; and 3. To give incentives to cooperatives in encouraging their members to pay their contributions and other obligations to SSS 5 II. SSS Circular 2011-001 • Coverage 1) Who may be accredited? A.The cooperative must be a Primary Cooperative B. Must be duly registered with the CDA. C.Must be in existence for at least three (3) years. D.Must be registered with the SSS as an employer and regularly paying as such. E. Its operations must pass the financial evaluation criteria. 6 II. SSS Circular 2011-001 • Coverage 2) How to apply for accreditation? Submit an accomplished Application for Accreditation with the necessary documentary requirements to SSS Branch Office. 3) Authority to collect. Limited to its members who are Selfemployed or Voluntary Members of the SSS and who have agreed in writing to avail of its services. 4) SSS payments to be collected. (1) Social Security Contributions; (2) Educational, Salary, Calamity, and Stock Investment loan amortization; (3) Housing loan amortization; and (4) Miscellaneous payments. 7 II. SSS Circular 2011-001 • Service Fee and Billing Service Fee of Six Pesos (P 6.00) for every transaction within fifteen (15) days Not due on Miscellaneous Payments LESS than the Minimum Monthly Contribution No demand shall be valid except upon submission of the required Collection List SSS to pay Penalty equivalent to 3% per annum for any delay in the payment of the Service Fee. 8 III. Procedural Highlights A. Submission and Approval of Application Cooperative The Application for Accreditation as Collecting Agent (AACA) Form shall be made available in all SSS branches, in the intranet and the SSS website. The applicant shall fillout and submit two (2) copies of the AACA Form to the nearest SSS Branch together with the documentary requirements 9 III. Procedural Highlights B. SSS Payments Acceptance The collecting agent shall: 1. Start collection only upon posting of the Performance Security. Collecting Agent 2. Collect SSS payment only from its members. 3. Acknowledge receipt of SSS payments by issuing the Official Receipt (OR) that the Collecting Agent uses in its regular business transactions. All payments received (amount and date of payment) should be in accordance with Circular 33-P on the Schedule of Contributions effective January 1, 2007 and Office Order 2011-101 on the Revised Payment Deadlines for Contributions and Member Loans, unless amended. 10 III. Procedural Highlights C. Remittance, Submission of Collection List and Collection of Service Fee Remittance of SSS Payments The collecting agent shall: 1. Remit all SSS payments on such dates/schedules as the SSC may specify to any SSS Depository Bank or SSS Branch Teller. Collecting Agent 2. Pay penalty for late remittance equivalent to One Tenth of One Percent (1/10 of 1%) of the total amount due 11 III. Procedural Highlights C. Remittance, Submission of Collection List and Collection of Service Fee Preparation and Submission of Collection List The collecting agent shall: 1. Prepare a Monthly Collection List for Collecting Agents (MCL-CA), which contains the following data: Collecting Agent • • • • CAAN Name Address Summary of Remittances (amount paid, SBR/Transaction Date and Number) Member’s Details such as: • SS number & Name • Amount Paid & Applicable Month/Period • OR number & Date of payment, with corresponding totals where applicable. 2. Submit the MCL-CA to the nearest SSS Branch on or before the tenth day of the month following the Collection month. 12 III. Procedural Highlights C. Remittance, Submission of Collection List and Collection of Service Fee Collection of Service Fee The collecting agent shall: 1. Submit the Billing to the nearest SSS Branch. Collecting Agent 2. Not collect Service Fees for the following: • SSS payments without the assistance of the Cooperative • SSS payment receipts not bearing the name of the Cooperative even • SSS payments made but member is not reported thru CAML or his membership has been terminated by the Cooperative thru a notification letter; and • Miscellaneous payment in the amount less than the existing minimum monthly SSS contribution. 13 IV. Profile of the Target Markets 15 Cooperatives in the Philippines Total Membership of Cooperatives Registered Under Art. 144 of RA 9520 by Region As of December 2010 Region I II CAR III NCR IV V VI VII VII IX X XI XII CARAGA ARMM TOTAL Total Number of Registered Cooperatives 1,133 628 628 1,696 1,749 2,175 718 1,247 1,431 634 685 1,333 1,505 879 952 812 18,205 Total Membership of Registered Cooperatives 400,365 368,818 247,487 616,267 1,305,364 568,293 239,330 416,080 585,996 276,554 297,587 389,183 1,098,545 186,897 153,982 45,349 7,196,097 Number of Cooperative Federation Per Asset Size Micro 152 55% Small 52 19% Medium 38 14% Large 33 12% 16 Cooperatives in the Philippines Distribution of Cooperative Membership V, 3% NCR, 18% IV, 8% Average Member Per Coop VI, 6% 800 III, 9% VII, 8% CAR, 3% II, 5% I, 6% VII, 4% 600 IX, 4% 500 X, 5% XI, 15% 700 Average No. of Members = 395 400 300 200 ARMM CARAGA XII XI X IX VII VII VI V IV NCR III CAR 0 II 100 I ARMM, 1% CARAGA, XII, 3% 2% 17 Top 20 Cooperatives in the Philippines Rank REGION 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 NCR CO NCR Region 10 Region 07 NCR CO NCR CO Region 04 CO NCR CAR NCR CO NCR NCR Region 07 Region 08 Region 07 NAME OF COOPERATIVE PAFCPIC Cooperative Rural Bank of Bulacan ACDI Savings and Credit Coop First Community Coop Cebu CFI Community Coop PLDT Employee's Credit Coop Inc. PANELCO III NOVADECI FICOBANK SIDC Negros Occidental Electric Coop PLDT Employees Multi-Purpose Coop Baguio-Benguet Community Credit Coop DSE (BSP) Credit Cooperative Metro South Cooperative Bank Amkor Tech. Phils. Employees Coop National Confederation of Coop Perpetual Help Community Coop Metro Ormoc Community Coop Dumaguete Cathedral Credit Coop NO. OF TOTAL ASSETS MEMBERS (In Millions) 75,598 5,105.63 Multi-Purpose 134 3,228.71 Coop Bank-Secondary 34,404 3,187.62 Credit 116,171 2,931.31 Multi-Purpose 39,528 1,996.76 Credit 11,038 1,501.36 Credit 117,389 1,219.10 Service 20,038 1,172.48 Multi-Purpose 227 1,130.69 Coop Bank-Secondary 13,213 1,091.52 Multi-Purpose 119,426 1,026.68 Service 8,383 1,004.56 Multi-Purpose 15,500 952.10 Credit 3,061 939.97 Credit 859 896.22 Coop Bank-Secondary 8,078 856.23 Credit 340 844.28 Federation-Tertiary 16,000 824.72 Credit 35,884 821.02 Credit 4,900 792.26 Credit TYPE Where Are We Today SSS Registered Associations and Cooperatives as of November 2011 ER Business Code Prefix 0611 0641 0652 0653 0827 0828 1 2 3 4 5 6 7 8 9 10 662 63 17 488 17 342 1,576 508 235 478 66 49 213 14 14 589 44 20 480 33 27 500 69 12 777 81 16 156 9 2 TOTAL 5,919 904 734 260 252 888 1,323 179 314 578 297 230 83 0712 0713 TOTAL 60 19 35 62 530 199 88 79 23 90 81 92 128 113 49 114 44 61 18 22 1,167 455 418 102 111 212 244 180 316 161 8,108 10,356 4,540 6,191 6,250 10,604 3,789 5,974 2,186 2,830 3,000 4,352 3,779 5,382 5,972 7,193 9,055 10,580 2,041 2,492 4,404 1,056 851 3,366 48,720 65,954 Where: 0611- cooperatives 0641 - associations (property owners) 0652 - associations (building and loan associations) 0653 - credit associations 0827 - trade associations 0828 - labor associations 0712 – Omnibus Operator 0713 – Taxi/PUJ Transport Source: ADM-1 Other Registered Associations: Federations of various industries (both formal and informal) - 80 Associations (excluded from above stats) also of formal and informal groups - 128 Association of direct selling industry - 1 19 End of Presentation 20