CVP - 1 COST-VOLUME-PROFIT ANALYSIS A Managerial Planning

advertisement

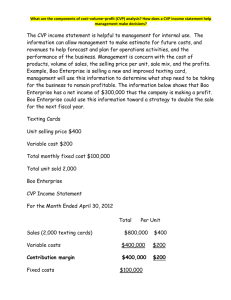

CVP - 1 COST-VOLUME-PROFIT ANALYSIS A Managerial Planning Tool CVP - 2 CVP ANALYSIS Advantages Assists in establishing prices of products. Assists in analyzing the impact that volume has on short-term profits. Assists in focusing on the impact that changes in costs (variable and fixed) have on profits. Assists in analyzing how the mix of products affects profits. CVP - 3 CVP ANALYSIS Additional Items Breakeven considerations Target income goals CVP - 4 LIMITATIONS OF CVP ANALYSIS Requires accurate knowledge of revenue and cost amounts and behavior patterns • Identification of fixed and variable components Linear revenue and cost functions • Integration of concept of “relevant range” No change in inventories Constant sales mix CVP - 5 Three Methods of Using the CVP Model Operating Income Approach Contribution Approach Graphical Approach CVP - 6 A CVP Example Assume the following: Sales (400 Microwaves) Less: Variable Expenses Contribution Margin Total Per unit %of Sales $200,000 $500 100% 120,000 300 60 $ 80,000 $200 40% Less Fixed Expenses Net Income 70,000 $10,000 1. What is the break-even point? 2. How much sales-revenue must be generated to earn a before-tax profit $30,000? 3. How much sales-revenue must be generated to earn an after-tax profit of $30,000 and a 40% marginal tax rate? CVP - 7 The Operating Income Approach for Breakeven Point Sales - Variable costs - Fixed Costs = Net Income Sales-Revenue Method: 100%(Sales)- 60%(Sales) - $70,000 =0 (at BEP) .4 (Sales) = $70,000 Sales = $175,000 Units-Sold Method: Let x = Number of microwaves at the break-even point $500(x) - $300(x) - $70,000 = 0 (at BEP) $200 (x) = $70,000 x = 350 microwaves CVP - 8 The Contribution Approach for Breakeven Point Sales-Revenue Method: BEP (Revenue $) = (Fixed Costs + Net Income)/Contribution Ratio = $70,000 + 0/.40 = $175,000 Units-Sold Method: BEP (Revenue Units) = (Fixed Costs + Net Income)/Contribution per microwave = $70,000 + 0/$200 per microwave = 350 units CVP - 9 The Operating Income Approach for Targeted Revenue Sales - Variable costs - Fixed Costs = Net Income Sales-Revenue Method: 100%(Sales)- 60%(Sales) - $70,000 = $30,000 .4 (Sales) = $100,000 Sales = $250,000 Units-Sold Method: Let x = Number of microwaves at the break-even point $500(x) - $300(x) - $70,000 = $30,000 $200 (x) = $100,000 x = 500 microwaves CVP - 10 C-V-P and After-Tax Target Profits Sales - Variable costs - Fixed Costs = Net Income/ (1-tax rate) Sales-Revenue Method: 100%(Sales)- 60%(Sales) - $70,000 = $30,000/(1-.4) .4 (Sales) = $120,000 Sales = $300,000 Units-Sold Method: Let x = Number of microwaves at the break-even point $500(x) - $300(x) - $70,000 = $30,000/(1-.4) $200 (x) = $120,000 x = 600 microwaves CVP - 11 The Contribution Approach for Targeted Revenue Sales-Revenue Method for Targeted Revenue: Targeted(Revenue $) = (Fixed Costs + Net Income)/Contribution Ratio = ($70,000 + $30,000)/.40 = $250,000 Units-Sold Method for Targeted Units Sold: BEP (Revenue Units) = Fixed Costs + Net Income/Contribution per microwave = ($70,000 + $30,000)/$200 per microwave = 500 units CVP - 12 COST-VOLUME-PROFIT Traditional Format Total Revenue Total Costs Total $ Breakeven Point Total Variable Costs Total Fixed Costs Level of Activity CVP - 13 COST-PROFIT-VOLUME Contribution Margin Format Total Revenue Total Costs Total $ Breakeven Point Total Fixed Costs Total Variable Costs Contribution Margin Level of Activity CVP - 14 A Multiple-Product Example Assume the following: Regular Unit of Sales Sales Price per Unit Sales Revenue Less: Variable Expenses Contribution Margin Less Fixed Expenses Net Income 400 $500 $200,000 120,000 $ 80,000 Deluxe Total Percent 200 $750 $150,000 60,000 $ 90,000 600 ---------$350,000 100.0% 180,000 51.4 $170,000 48.6% 130,000 $ 40,000 1. What is the break-even point? 2. How much sales-revenue of each product must be generated to earn a before-tax profit $50,000?