Bequests

advertisement

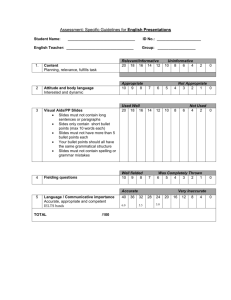

Trends in Planned Giving and Five Easy Ways to Get Started Presented by Christy Eckoff, JD, LL.M. Director of Gift Planning The Community Foundation for Greater Atlanta •• Bullet Mission information here To be the most trusted resource for growing philanthropy to improve communities throughout the Atlanta region. • Goals • Engage our Community • Strengthen the Region’s Nonprofits • Advance Public Will • Practice Organizational Excellence The Community Foundation for Greater Atlanta •• Bullet History/background information here • Founded in 1951 • Among top 12 community foundations in country - Assets $755 million • Raised $104 million in 2012; $95 million in grants • Over 900 funds, 700 of which are donor advised Charitable transfers of assets– cash, real estate, stock Complex gifts • Serve metro Atlanta region and 23 counties surrounding city. 2010 Tax Act and 2013 Fiscal Cliff Agreement Income Tax information here • Bullet 2010 -12 –Temporary 2 year extension of 2010 ordinary income tax rates – maximum tax rate of 35% 2013 – Maximum tax rate of 39.6% for individuals making $400k or more or households making $450k or more Payroll Tax 2010-12 - Temporary 2% reduction in withholding 2013 Gone IRA Charitable Rollover Extended to cover 2010 and 2011 2012 – in effect 2013 – in effect 4 • Bullet information here Capital Gains Tax 2010-12 - Temporary 2 year extension of 15% maximum long-term capital gains tax rate 2013 – 23.8% maximum long-tern capital gains tax rate (includes 3.8% Healthcare Act surtax) Dividends 2010-12 - Temporary 2 year extension of 15% maximum long-term capital gains tax rate 2013 – 23.8% maximum long-tern capital gains tax rate (includes 3.8% Healthcare Act surtax) Transfer Tax Law Bullet information here • •Applicable Exclusion Amount: $5 million • Gift Tax Exemption: $5 million • Generation Skipping Tax Exemption: $5 million • Estate, GST & Gift Tax Rates: – 2012 - 35% maximum rate – 2013 – 40% maximum rate • Basis Step-Up OR Step-down • Deduction for state death taxes • Annual Exclusion: $13,000 6 Summary of Impact • Bullet information here • Most married couples need to review estate plan • Any person with an estate over $5 million should be actively updating their estate plans and taking action to leverage these changes in by the end of 2013 • Certainty??? • NOW IS THE TIME to talk to high net worth prospects about including your charity in their plans 7 Charitable Deduction for Current Gifts • Bullet by Limited information Adjusted gross here Income and type of asset Deduction by artist may be very limited Deductions may be carried over for 5 years What is Gift Planning? • Bullet information here Helping donors make substantial gifts through an examination of their assets, obligations, and charitable intent It’s an opportunity for charitable giving in circumstances that may not otherwise allow a donor to make a large gift 9 Why is gift planning important? • Bullet information here Average major gift is 20 times an annual fund contribution Average planned gift is 200-400 times an annual fund contribution 10 Top Donors 2008 Top Donors in the U.S., 2008 • Bullet information here 1 Leona M. Helmsley Family wealth, Hotels Years on List: 1 Total Amount Committed: $5.2 billion 2 James LeVoy Sorenson Invention, Investments Years on List: 1 Total Amount Committed: $4.5-billion 3 Peter G. Peterson and Joan Ganz Cooney Finance Years on List: 1 Total Amount Committed: $1 billion 4 Harold Alfond Manufacturing, Retail Years on List: 1 Total Amount Committed: $360 million 5 Donald B. and Dorothy L. Stabler Construction, Real Estate Years on List: 1 Total Amount Committed: $334.2 million 6 David G. and Suzanne D. Booth Finance Years on List: 1 Total Amount Committed: $300 million 7 Frank C. Doble Energy Years on List: 1 Total Amount Committed: $272 million 8 Robert L. and Catherine H. McDevitt Investments Years on List: 1 Total Amount Committed: $250 million 9 Michael R. Bloomberg Media and Entertainment Years on List: 6 Total Amount Committed: $235 million 10 Dorothy Clarke Patterson Family Wealth Years on List: 1 Total Amount Committed: $225 million 11 Richard W. Weiland Technology Years on List: 1 Total Amount Committed: $174.3 million 11 Top Donors 2008 • Bullet information here 1 Leona M. Helmsley Family wealth, Hotels Years on List: 1 Total Amount Committed: $5.2 billion 2 James LeVoy Sorenson Invention, Investments Years on List: 1 Total Amount Committed: $4.5-billion 3 Peter G. Peterson and Joan Ganz Cooney Finance Years on List: 1 Total Amount Committed: $1 billion 4 Harold Alfond Manufacturing, Retail Years on List: 1 Total Amount Committed: $360 million 5 Donald B. and Dorothy L. Stabler Construction, Real Estate Years on List: 1 Total Amount Committed: $334.2 million 6 David G. and Suzanne D. Booth Finance Years on List: 1 Total Amount Committed: $300 million 7 Frank C. Doble Energy Years on List: 1 Total Amount Committed: $272 million 8 Robert L. and Catherine H. McDevitt Investments Years on List: 1 Total Amount Committed: $250 million 9 Michael R. Bloomberg Media and Entertainment Years on List: 6 Total Amount Committed: $235 million 10 Dorothy Clarke Patterson Family Wealth Years on List: 1 Total Amount Committed: $225 million 11 Richard W. Weiland Technology Years on List: 1 Total Amount Committed: $174.3 million 12 • Bullet information here • Bullet information here Medical College of Georgia Foundation (Augusta) has received a bequest of $66-million from J. Harold Harrison to establish a fellows fund named after him to endow faculty chairs and student scholarships. Dr. Harrison was a cardiovascular surgeon who retired as chief of surgery at St. Joseph's Hospital of Atlanta. He was also a cattle farmer. Dr. Harrison graduated from the college in 1948 and was a former chairman of the foundation's board. He died in June 2012. $66-million Bequest •Medical Bullet information College of Georgia here Foundation (Augusta) has received a bequest of $66-million from J. Harold Harrison to establish a fellows fund named after him to endow faculty chairs and student scholarships. Dr. Harrison was a cardiovascular surgeon who retired as chief of surgery at St. Joseph's Hospital of Atlanta. He was also a cattle farmer. Dr. Harrison graduated from the college in 1948 and was a former chairman of the foundation's board. He died in June 2012. Share of Donors Who Made Bequests – 2011 – Top 50 donors • Bullet information here Total Value of Bequests Total Value of Gifts from Living Donors 16 2011 • Bullet information here Margaret A. Cargill Family wealth 1 $6-billion (bequest) Beneficiaries: Margaret A. Cargill Foundation (Eden Prairie, Minn.); Anne Ray Charitable Trust (Eden Prairie, Minn.) 2 William S. Dietrich IIManufacturing $500-million (bequest) Beneficiary: Dietrich Foundation (Pittsburgh) 3 Paul G. Allen Technology $372.6-million Beneficiaries: Paul G. Allen Family Foundation (Seattle); Allen Institute for Brain Science (Seattle) and other groups 17 When to think “planned gift” • Bullet information here Between ages of 40-59 Within 10 years of retirement Life altering event • • • • Divorce or remarriage Death of spouse or child Inheritance from parents Need for parents or special needs children for specialized, on-going care 18 When to think “planned gift” • Bullet information here Cash poor Wants to leverage gift Assets have depreciated greatly Want to do something, but are afraid to give up cash 19 Yes, but….. • Bullet information here When to think about a planned gift? – I wish I could give, but ……. • • • • • • • I have young kids or grandkids to think of I have kids in college I take care of my parents I don’t have the liquidity I can make more than your endowment makes I need money for retirement Other reasons 20 How do you find Planned Givers? Prospect Research • Bullet information hereand Cultivation • Board members • Large donors • Consecutive year givers (10+) – even at small amounts • Never married • DINKs 21 How do you find Planned Givers? •Self-Identification Bullet information here – Check the box on pledge cards – Marketing • Newsletters • Postcards • Emails 22 Cheapest and Simplest Way to Get Started • Bullet information here “Remember The Community Foundation in your estate plans.” Place on every piece of donor interaction • • • • • Email signature lines Letterhead Solicitation letters Stewardship reports Donor newsletters 23 How to be a success • Bullet information here • Have a way to say NO! • Create and update your gift acceptance policy! 24 How to be a success • Bullet information here • Concentrate on bequests and beneficiary designations! • Have a designation mechanism. 25 Most have not been approached to • Bullet information make here a planned gift Ever been approached about making a planned gift to charity 12 Just general suggestions without method mentioned Bequest through will 9 No, have not been approached 78% Yes, have been approached 22% 3 2 Ways suggested* Name as beneficiary of life insurance policy Name as beneficiary of retirement account *Based on all. Multiple responses accepted, so total will exceed the 22% represented in pie chart. How to be a success • Bullet information here • OUTSOURCE Marketing! • Have a website and do monthly emails! • Put your bequest language online 27 How to be a success • Bullet information here • Don’t forget younger donors!!! • 43% of bequests and 35% of charitable remainder trusts are created by individuals age 55 and younger 28 Percentage of Planned Givers • Bullet information here Age 31% Percentage of Planned Givers 18-24 6% 25-29 3% 30-39 8% 40-49 20% 50-64 32% 65+ 31% Study by Donorpulse between 8/5/08 and 8/14/08 29 Bequest donors are not Elderly! • Bullet information here * Bequest pledge makers are generally between 45 and 54 years of age. …. Most first set up gifts to a charity in their wills at age 49 *The 45- to 54-year-old group accounted for 26 percent of total charitable bequest pledgers in the survey, followed by the 55- to 64-year-old group (22 percent) and the 65- to 74year-old group (20 percent) *Individuals aged 45 to 54 years were more likely to have made provisions for a charity in their will than those aged 65 or older 30 How to be a success • Bullet information here • Leverage what you have! • Drip, drip, drip….. 31 Concentrate on • Bullet information here • Major gift donors and prospects – triple asks, blended gifts • Consistent donors • Members of Alumni Association or volunteer arm • Board Members • Faculty and staff 32 Current Gifts •Bullet Stock –information appreciatedhere and depreciated 1035 Insurance Exchange Virtual Endowments Real Estate IRA Charitable Rollover – Up to $100,000 • Way to get those funds out of the estate (subject to double taxation) Other assets and privately-held assets 33 Estate Giving Basics • Bullet information here Donor enjoys benefit of asset during lifetime Donor retains control of asset till death Donor receives estate tax deduction but no income tax relief Removes asset from taxable estate and may avoid probate Donor’s good works often go unnoticed during lifetime. 34 Estate Gifts • Bullet information here Bequests from a Will Life Estates IRA/Retirement Plan Gifts Pay (transfer) on Death Accounts – beware of Mauer case in GA 35 Basic types of planned gifts • Bullet information here Bequests 36 Who makes charitable bequests? • Bullet information here People Younger Than You May Think • • • • Average age: 58 Younger ages: 43% < 55 Age of first will/living trust: 44 Age of first charitable bequest: 49 37 Younger Donors Bullet information here • •Younger donors are the least resistant to the idea of bequest gifts; older donors are the most resistant. • Older Americans (aged 70 and over) with wills in place are the least likely of any age group to say they will consider adding a nonprofit at some point in the future. • 64% have wills before reaching age 50. That is even truer of the most affluent, with 84% having wills before they are 50. 38 Who makes charitable bequests? People of all wealth/income strata • Bullet information here • Average Income: $75K/year • Lower Income Level: 36% < $50K/year • High Net Worth Persons (Estates of $10 million+) give 3X more at death than last 10 years living • Individuals with wealth concentrated in closely held businesses • Religious persons (all forms of giving) 39 Bequests • Bullet information here 68% of bequest donors do not notify the Charity of their charitable bequest At The Community Foundation, bequest donors are eligible to join the Legacy Society and are assigned a Philanthropic Advisor – over $1 million – Center for Family Philanthropy 40 Life Estates • Bullet information here Charity receives the property and donor gets the use of that property for their life. 41 Retirement Plans • Bullet information here 42 IRA/Retirement Plan Gifts • Bullet information here Charity is the beneficiary of the IRA/Retirement Plan IRA/Retirement Plan passes directly to the charity free of federal income tax and/or federal estate tax. Estate receives a charitable deduction 43 Split Interest Gifts • Bullet information here Give the asset now – but keep the benefits! 44 Charitable Gift Annuity • Bullet information here A contract between the donor and charity where the donor transfers property (or cash) in exchange for a fixed dollar payment for life. 45 Why attractive? • Bullet information here Interest Rates are extremely low – 1-2% on a CD Interest Rate on a charitable gift annuity can go as high as 8.5% Simple 2 page contract Current tax deduction based on age and amount of annuity 46 How can I … • Bullet information here Support my elderly parents and charity at the same time? 47 Illustration • Bullet information here 48 Who gives Charitable Gift Annuities? • Bullet information here Typical Annuitant/Donor: 77 year old female (60/40 split) 92% are “plain vanilla” CGA’s (immediate payment) 62% of CGA donors first heard about it through non-profit’s materials Average contribution: $30,000 TCF minimum: $25,000 and at least 60 years of age and half to unrestricted fund 49 Charitable Trusts • Bullet information here Charitable Remainder Trusts • Irrevocable transfer of property by the donor • Donor (and/or other beneficiary) retains a right to receive income from the trust • Donor received income tax deduction in year of trust creation • No immediate capital gain tax on transfer to trust and any subsequent sale of the assets by the trust • At the of trust term, trust principal distributes to charity 50 Who creates CRTs? • Bullet information here CRT donors are: • Profile: Married, avg. age 62, mean income $86K/year • More likely to be male • Similar to high income/net worth bequest donors • More concerned about taxes and planning • 68% first heard about CRT’s from legal and financial advisors. 51 How Can I … • Bullet information here Provide a college education or income to my children and still support charity? 52 Illustration • Bullet information here 53 Charitable Lead Trust • Bullet information here Charitable Lead Trust Basically opposite of a charitable remainder trust • Income from trust goes directly to charity • Remainder goes to the donor or to their beneficiaries 54 Lead Trust • Bullet information here How can I put $1,000,000 in trust, give $1,000,000 to charity, and get back $1,000,000 (or more) ten years later? 55 Illustration • Bullet information here 56 Life Insurance • Bullet information here If a cash value policy, can be an outright gift. • Donor receives immediate charitable tax deduction • Charity can either: • Cash it in • Keep policy in force until death of insured 57 Life Insurance • Bullet information here Can also be used as wealth replacement • Fund a life insurance policy with a gift annuity or charitable lead trust 58 References • Bullet information here Christy Eckoff – ceckoff@cfgreateratlanta.org (404)588-3183 Marketing firms • • • • Stelter Crescendo Virtual Giving RR Newkirk 59 References • Bullet information here The Complete Guide to Planned Giving, Deborah Ashton American Council on Gift Annuities Georgia Planned Giving Council Planned Giving Design Center Planned Giving Today Partnership for Philanthropic Planning 60