Keynes and Hayek

advertisement

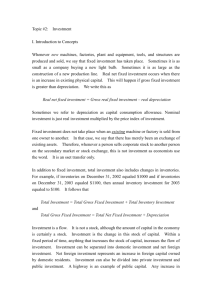

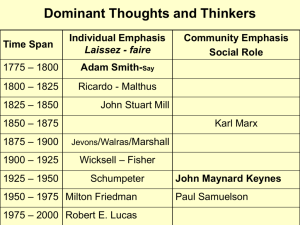

Capital-Based Macroeconomics Adapted from Time and Money: The Macroeconomics of Capital Structure by Roger W. Garrison London: Routledge, 2001 Keynes and Hayek: Head to Head 2009 Keynes and Hayek: Head to Head John Maynard Keynes 1883 — 1946 Friedrich A. Hayek 1899 — 1992 Visions and Frameworks Keynes’s vision of the economy suggests a circular-flow framework—in which earning and spending are brought into balance by changes in the level of employment. Graphically, the circular flow appears as the Keynesian cross, the cross’s intersection identifying the particular state of the economy in which income and expenditures are in balance. Hayek’s vision of the economy suggests a means-ends framework—in which the means of production are transformed over time into consumable output. Graphically, the means and ends appear as the Hayekian triangle, the triangle’s shape depicting the intertemporal pattern of investment. In equilibrium, the pattern of investment corresponds to the intertemporal preferences of consumers. A BRIEF REVIEW of the KEYNESIAN CIRCULAR-FLOW FRAMEWORK SKIP BUSINESS ORGANIZATIONS LABOR AND OTHER FACTOR SERVICES THE CIRCULAR-FLOW FRAMEWORK WORKERS INCOME CONSUMERS INVESTORS BUSINESS ORGANIZATIONS EXPENDITURES consumption plus Investment LABOR AND OTHER FACTOR SERVICES GOODS AND SERVICES WORKERS INCOME CONSUMERS INVESTORS BUSINESS ORGANIZATIONS EXPENDITURES consumption plus Investment SLOW 6% FAST 2% WORKERS INCOME CONSUMERS INVESTORS CONSUMPTION EXPENDITURES consumption plus Investment BUSINESS ORGANIZATIONS STAGES OF PRODUCTION WORKERS INCOME CONSUMERS INVESTORS CONSUMPTION EXPENDITURES consumption plus Investment BUSINESS ORGANIZATIONS STAGES OF PRODUCTION WORKERS INCOME CONSUMERS INVESTORS SKIP EXPENDITURES consumption plus Investment BUSINESS ORGANIZATIONS In Keynesian equilibrium, INCOME equals EXPENDITURES. Y=E For a wholly private economy: Y=C+I WORKERS INCOME CONSUMERS INVESTORS EXPENDITURES C+I 1 a 45o Investment The As taught economy atdepends allislevels, in a INVESTMENT Keynesian the neither consumption on (current) equilibrium C = a + bY income somewhere function nor is an on along the the rate o line—the 45interest. essential of component It depends line itself b identifying of only theonKeynesian profit all possible income-expenditure framework. expectations, The which CONSUMPTION equilibriumstability presumed themselves points. are notof this function underlies well-anchored in Keynesianreality. economic thinking. INCOME INCOME Consumption and Investment (as well as Government Spending) are portrayed as additive components of total spending. The three components are distinguished largely in terms of their stability characteristics: stable (C ), unstable (I), and stabilizing (G). A wholly private macroeconomy achieves an income-expenditure equilibrium when Y = C + I. Note that income itself (rather than prices, wages, or the interest rate) is the equilibrating variable. EXPENDITURES C = a + bY CONSUMPTION C+I According to Keynes, it is only by “accident or design” that the economy is actually performing at its fullemployment potential. Yfe INCOME INVESTMENT We assume here that, Labor income In (Y capital-based = WN) macroeconomics, In full Keynesian employment macroeconomics, implies that initially, full employment is fully representative the economy of is operating on its production full employment possibility implies frontier, that conditions prevail—if only total income,the such PPF that itself being defined in terms the labor of sustainable market clears output at the by accident. changes in labor levels of consumption and investment going goods. wage rate, the going W income stand in direct wage itself having emerged S proportion to changes during a period in which the LABOR D INCOME in total income. economy was experiencing no N macroeconomic problems. EXPENDITURES C ΔI+ I EXCESS INVENTORIES C = a + bY ΔC 1 ΔY = (1 – b) ΔI E= <Y ΔY Yfe INCOME According to Keynes, a collapse of investment activity (the collapse being attributed to a waning of “animal spirits”) is the primary cause economic downturns. In response to reduced SKIP investment and hence reduced employment opportunities, the economyWspirals downward into recession and possibly into Note that the going wage keeps S deep depression. going—even after the market D conditions that gave rise to it are The simple investment-spending multiplier, 1/(1-b), quantifies N gone. the extend of the downward spiraling. EXPENDITURES C+I C = a + bY Yfe INCOME A further loss of confidence In theon Keynesian the part of construction, the business prices and the community will send the wage economy rate are even sticky further downward. from its fullemployment potential. But note that they’re not stuck too high. W They’re stuck just right. The going wage rate S will clear the labor market once again—as D soon as spending and hence labor demand recover to their full-employment levels. N EXPENDITURES C+I C = a + bY Yfe INCOME Recovery may be self-initiating. Waning animal spirits may become waxing animal spirits. In due time, a pressing need to maintain or replace depreciating capital may account for the lower turning W point of a bust-and-recovery sequence. S (Keynes, of course, preferred not to wait it out. He advocated D make-work projects, deficit spending, and monetary stimulation N to get the economy turned around.) EXPENDITURES C+I C = a + bY INCOME Yfe Recovery may continue as further investment activity drives labor-demand back to its full-employment level... W S D N EXPENDITURES C+I C = a + bY INCOME From full-employment onward, there is upward Recovery may in continue as further investment activity drives The equilibrium points pressure on both prices level... but thereAnd is since the laborlabor-demand market tracedback out to its full-employmentand wage rates. nothing about the and recovery during the recovery and“animal spirits” that will bring prices wage rates are process an end at full W employment. inflationary spiraltoconstitute not sticky upwards, the S the so-called L-shaped economy experiences a Over-optimism may push the economy beyond its inflation. fullsupply curve. spiraling D employment level. Yfe N MORPHING FROM CIRCULAR FLOW TO MEANS AND ENDS EXPENDITURES C = a + bY INCOME Yfe CONSUMPTION C+I INVESTMENT The nature of the Keynesian-styled spiraling associated with recession, depression and inflation becomes more transparent with the production possibility frontier in play. W Also, the PPF helps buildSa bridge from Keynes to Hayek. D N EXPENDITURES C = a + bY Yfe INCOME CONSUMPTION C+I INVESTMENT A waning of animal spirits causes investment to decrease and with it income and consumption. The economy falls inside its PPF. W S D N C = a + bY Yfe INCOME CONSUMPTION EXPENDITURES C+I INVESTMENT Note that if investment A further were towaning fall to zero, sendsthe theeconomy economywould settle into an income-expenditure deeper into the equilibrium PPF’s interior. with Y = C. Movements inside the frontier (and beyond Thus, the vertical intercept of the Keynesian demand constraint W it) trace out a linear relationship, showing is aligned withS the intersection of the consumption function and how consumption varies with investment. the 45o line. D The straight line that passes through these N points is the Keynesian demand constraint. EXPENDITURES C+I C = a + bY CONSUMPTION a b C = (1 – b) + (1 – b) I b 1–b a (1 – b) Yfe INCOME INVESTMENT For simplicity, let a = 0 and b = 0.90. Then C = a + bY becomes C = 0.90Y. And C = a/(1-b) + b/(1-b) I becomes C = 9(I), which led Keynes to write: “If, forformula example, the public are in the so habit of spending of their “The is not, of course, quite simple as in thisnine-tenths illustration…. But income consumption goods, entrepreneurs to of there is on always a formula, more itorfollows less ofthat this ifkind, relating thewere output produce consumption goods at a cost more than nine timesofthe cost of consumption goods which it pays to produce to the output investment the investment goods theyappears are producing, partbeyond of their dispute. output could goods…. This conclusion to me tosome be quite Yet the not be sold at awhich price which itsat cost production.” consequences follow covered from it are theofsame time unfamiliar and of the greatest possible importance.” EXPENDITURES C = a + bY INCOME To keep track of possible interest-rate movements, the loanable-funds market can be brought into view. Though Keynes argued that neither saving nor investment depend to any significant extent on the interest rate, he also argued that both curves (as conventionally drawn) shift together, leaving the interest rate unchanged. INVESTMENT RATE OF INTEREST Yfe CONSUMPTION C+I S D SAVIING (S) INVESTMENT (D) EXPENDITURES C = a + bY INCOME With the loanable-funds market in play, we see that decreased investment is accompanied by a leftward shift in the demand for loanable funds, Appearing putting downward in Keynes’s pressure General on the Theory interest is this rate. specific applicationWof the loanable-funds S But the spiraling downward of income implies framework. The implications, according to that the is supply of loanable funds (a.k.a. saving) D Keynes, that the loanable-funds reckoning is, also shifts leftward, relievingNthe downward at best, superfluous. pressure on the interest rate. INVESTMENT RATE OF INTEREST Yfe CONSUMPTION C+I S D SAVIING (S) INVESTMENT (D) As shown on page 180 of his General Theory, Keynes presented the loanable funds market with the interest rate [ r ] on the horizontal axis. i Although he failed to label the vertical axis, the accompanying text indicates that “saving” and “investment” are measured vertically. Keynes’s diagram can be flipped over and rotated 90 degrees to make it conform to modern renditions of the market for loanable funds. S, I S, I Some of the saving curves are intended only to demonstrate that income is a shift parameter and are not otherwise relevant to Keynes’s argument. So, let’s omit them i ieq S’ = I’ S=I S, I Some ofbelieved Keynes the saving thatcurves a shiftare in investment intended to demand would demonstrate that beincome accompanied is a shift byparameter a matching shift are and in the notsaving otherwise schedule. relevant to Keynes’s argument. So, let’s omit them. Yfe CONSUMPTION C INCOME Appearing in Keynes’s General Theory is this specific application of the loanable-funds framework. The implications, according to Keynes, is that the loanable-funds reckoning is, at best, superfluous. INVESTMENT RATE OF INTEREST EXPENDITURES C+I S D SAVIING (S) INVESTMENT (D) EXPENDITURES C INCOME Hence Keynes The To resolve rightward the also Keynes’s Paradox: denied shift inthat “Paradox supply an increase ofofloanable Thrift” in saving requires funds would puts only that downward have wethe replace pressure effectthe imagined Keynesian on the by interest the cross, loanablerate. which Try to save more and you’ll instead earn less! funds theorists. reflects the economy’s Keynes’s circular “Paradox flow,of with Thrift,” the as But before there is any movement along the articulatedtriangle, Hayekian in his General which depicts Theory means is to theand point: demand for loanableW funds, the pressure is ends in their temporal sequence. S “Every ...as relieved attempt reduced to save consumption more bycauses reducing income D consumption and hence saving will so toaffect fall. incomes that the attempt necessarily defeats itself.” N INVESTMENT RATE OF INTEREST Yfe CONSUMPTION C+I S S D SAVIING (S) INVESTMENT (D) EXPENDITURES C CONSUMPTION C+I CONSUMPTION INCOME The level of consumption that appears as a part of the Keynesian circular flow also appears in the capital-based framework as the consumable output of a temporal sequence of production activities. INVESTMENT RATE OF INTEREST Yfe S D SAVIING (S) INVESTMENT (D) CONSUMPTION CONSUMPTION CONSUMPTION Note thathowever, the sole effect the structure We begin, Keynes, The market level ofasmechanisms consumption before, assumed withon in that the play a economy appears “fixed herestructure are asofstill a part of production comes from the initial in those functioning industry,” of the envisioned Keynesian which at itsinfull circular by the employment Keynes. current flow context alsoreduction level. appears implies in athe consumption. The derived-demand effect works a Hayekian triangle capital-based framework of fixed as shape, the consumable the only live W W In accordance The labor market with is the representative paradox, anofincrease each of in undiminished ontriangle’s all the stages. issue being output of a temporal the sequence size, which of production represents S earlier S saving the stages causes of production the economy thatto make spiral updown the to a the level of employment and the extent of activities. The interestcapital rate isstructure. effectively less-than-full-employment economy’s level. D out of play. The D capital utilization. leftward shift of savingN tookNthe downward pressure off of interest rates. And, in any case, the capital structure is assumed to be fixed. INVESTMENT RATE OF INTEREST STAGES OF PRODUCTION S S D SAVIING (S) INVESTMENT (D) CONSUMPTION CONSUMPTION Three modifications are needed transforma the And now, the “Paradox of Thrift”tobecomes “Gateway to Growth.” Keynesian vision into the Hayekian vision: With wage rates and the interest rate both 1.adjusting 2. 3. Allow Divide Get ridfor the ofto stage-specific the structure Keynesian of production labor Demand markets---in into Constraint. stages. changing market conditions, thewhich wage rates can adjust to changed conditions. economy move along its market PPF and the structure of production can adjust to an increase in saving. INVESTMENT RATE OF INTEREST STAGES OF PRODUCTION W W W S S S S D D D D N N N SAVIING (S) INVESTMENT (D) CONSUMPTION EXPENDITURES BUSINESS ORGANIZATIONS “Mr. Keynes’s aggregates conceal the most fundamental mechanisms of change.” STAGES OF PRODUCTION WORKERS INCOME FACTOR OWNERS CONSUMERS Keynes and Hayek: Head to Head John Maynard Keynes Friedrich A. Hayek Capital-Based Macroeconomics Adapted from Time and Money: The Macroeconomics of Capital Structure by Roger W. Garrison London: Routledge, 2001 Sustainable and Unsustainable Growth The Macroeconomics of Boom and Bust 2009 Capital-Based Macroeconomics Adapted from Time and Money: The Macroeconomics of Capital Structure by Roger W. Garrison London: Routledge, 2001 Keynes and Hayek: Head to Head 2006