File

advertisement

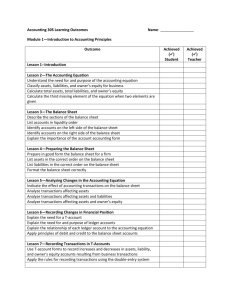

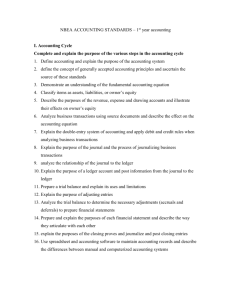

Page |1 Accounting Principles 30S Course Outline 2014-2015 Business & Technology Department Mission Statement: Students need consumer, communication, economic, financial and advanced technology skills for them to succeed in a constantly evolving society. Business and Technology Education will allow students to acquire academic and technological skills they will need to achieve their goals. Business and Technology Education incorporates advanced technology, ethical standards, recognition of our school’s position in an increasingly global economy, cooperative learning, teamwork, and a commitment to life long learning. Business and Technology Education emphasizes creative and critical thinking, and encourages acceptance of change. Skills Portfolio: Academic – Effective communication, critical thinking and engaged learning. Advanced Technology – Apply guidelines for ethical and responsible use of Information and Communication Technology (ICT) and analyze advantages and disadvantages of the use of technology in society. (Examples: lack of access, ease of manipulating data…etc.) Personal Management – Maintain a positive attitude; act responsibly and respectfully while displaying willingness for adaptability and creativity. Self Assessment – Reflect on learning tasks and set personal goals to go beyond established criteria ‘for’, ‘as’ and ‘of’ learning. Teamwork – Collaborate with peers and staff to become active participants and to excel in the learning process. Common Essential Outcomes: Organizational skills and categorize information by: -Accessing, storing and managing files on a variety of drives. (Examples: network, USB…etc.) Page |2 -Accessing school resources online. (Examples: Website, wiki’s, blog’s…etc.) -Accessing, managing and creating file directories (Example: a structure of electronic file folders.) All students will be assessed on the non achievement factors listed on the report card. General Goal for ACC30S: Accounting is the language of business. Accounting education prepares individuals to meet personal needs, to provide them with an awareness of a wide variety of accounting and technology careers and to lay the foundation for continued study and lifelong learning. Specific Outcomes for ACC30S: Students will be introduced to manual accounting procedures to provide an understanding of the accounting concepts, principles and processes. These manual accounting procedures are used in a computerized accounting environment on an ongoing basis using Microsoft Excel. Simply Accounting may be introduced in a progressive way towards the end of the course. Module 1 2 3 4 5 6 7 8 TITLE Introduction to Accounting Principles The Income Statement Journals and Ledgers The Worksheet Cash Control Merchandising Business Payroll Income Tax Module 1—Introduction to Accounting Principles Outcome Lesson 1--Introduction Lesson 2—The Accounting Equation Understand the need for and purpose of the accounting equation Why study accounting Characteristics of business The nature of accounting Becoming a professional accountant Role of accounting Classify assets, liabilities, and owner’s equity for business Calculate total assets, total liabilities, and owner’s equity Calculate the third missing element of the equation when two Hours 18 12 12 13 15 6 16 12 % of Course Page |3 elements are given Lesson 3—The Balance Sheet Describe the sections of the balance sheet List accounts in liquidity order Identify accounts on the left side of the balance sheet Identify accounts on the right side of the balance sheet Explain the importance of the account accounting form Lesson 4—Preparing the Balance Sheet Prepare in good form the balance sheet for a firm List assets in the correct order on the balance sheet List liabilities in the correct order on the balance sheet Format the balance sheet correctly Lesson 5—Analyzing Changes in the Accounting Equation Indicate the effect of accounting transactions on the balance sheet Analyze transactions affecting assets Analyze transactions affecting assets and liabilities Analyze transactions affecting assets and owner’s equity Lesson 6—Recording Changes in Financial Position Explain the need for a T-account Explain the need for and purpose of ledger accounts Explain the relationship of each ledger account to the accounting equation Apply principles of debit and credit to the balance sheet accounts Lesson 7—Recording Transactions in T-Accounts Use T-account forms to record increases and decreases in assets, liability, and owner’s equity accounts resulting from business transactions Apply the rules for recording transactions using the double-entry system Lesson 8—Calculating New Balances in the Ledger Calculate the new balance for each account after transactions have been recorded Record the account balance on the correct side of the account Page |4 Lesson 9—Preparing a Trial Balance Prepare a formal trial balance of a given General ledger Identify the sections of the trial balance sheet Lesson 10—Preparing An Update Balance Sheet After Changes In Financial Position Summarize the results of changes to the fundamental elements of the accounting equation by preparing an updated balance sheet Module 2—The Income Statement—In the Red or Black? Outcomes Lesson 1—Profit and Loss Understand and explain the meaning of revenue and expense Calculate net income or net loss Lesson 2—Preparing an Income Statement Explain the need for and purpose of an income statement Prepare an income statement Explain the Matching Principle (GAAP) List the procedures used n the accrual basis of accounting Lesson 3—Debit and Credit Rules for Income Statement Accounts Identify increases and decreases in the accounting equation Identify increases and decreases in income statement accounts Apply debits and credits to income statement accounts Lesson 4—Recording Revenue and Expense Changes in the Accounts Use T-accounts to show increases and decreases in revenue and expense accounts Explain the Revenue Recognition GAAP Explain Expense Recognition GAAP Define Drawings Lesson 5—Preparing an Updated Trial Balance and Income Statement Classify the types of accounts in the trial balance Identify the normal side of each account in the trial balance Prepare trial balances and income statements to reflect changes caused by transactions Lesson 6—Preparing Balance Sheets in Report Form Prepare an updated balance sheet including the net income (or loss) and the withdrawals by the owner Prepare balance sheets in both report and account formats Page |5 Module 3—Journals and Ledgers—Keeping Track of It All Outcomes Lesson 1—The General Journal Explain the need for and importance of a journal Record journal entries resulting from business transactions Record the opening journal entry for the start-up of a business Lesson 2—The Ledger and Posting Procedures Explain the need for and purpose of the ledger Post journal entries into appropriate ledger accounts with a cross-reference for each entry Prepare a chart of accounts Post an opening entry to appropriate ledger accounts Prepare a forwarding entry to begin a new ledger page Lesson 3—Subsidiary Ledgers Explain the need for and importance of source documents Analyze the debit and credit parts of business transactions from given source documents Identify the need for and the purpose of the three-ledger system Record transactions in an accounts receivable ledger Record transactions in an accounts payable ledger Check the accuracy of the final balance in any given account Identify the final balance in any General Ledger account as a debit, credit, or zero balance Prepare an updated trial balance Find and correct errors in journal and/or ledger Define accounting cycle Prepare balance sheets in both report and account formats Module 4—The Worksheet—Sharpen Your Pencil! Outcomes Lesson 1—The Six-Column Worksheet Explain the need for and purposes of a worksheet Prepare a six-column worksheet Lesson 2—Preparing Financial Statements from a Worksheet Review the need for and purpose of an income statement and a balance sheet Review the preparation of balance sheets in account and report form Prepare income statements and balance sheets from information in a six-column worksheet Page |6 Prepare a classified balance sheet Review the GAAP—Cost Principle Lesson 3—Analyzing Financial Statements Analyze the performance and financial position of a business from the income statement and the balance sheet Lesson 4—Closing the Ledger Explain the need for and the purpose of closing the ledger Prepare journal entries to close revenue and expense accounts Prepare journal entries to transfer net income or net loss to the capital account Prepare a journal entry to transfer the drawings account to the capital account Lesson 5—Posting the Closing Entries to the Ledger Post closing entries to the ledger Lesson 6—Preparing a Post-Closing Trial Balance Prepare a post-closing trial balance from a given General Ledger Module 5—Cash Control—Who’s Got the Money? Outcomes Lesson 1—Control of Cash Receipts Explain the different forms of cash Discuss the principles of cash control Differentiate between ethical and unethical practices of cash control Define cash float Prepare a daily cash proof Differentiate between cash shortages and cash overages Explain the need for a cash short/over account Analyze and record cash over and short transactions in a General Journal Prepare a bank deposit Apply the appropriate accounting principle Lesson 2—Sales and Goods and Service Tax Define Federal Goods and Services Tax (GST) Describe the purposes and concepts of GST Calculate GST Define Provincial Sales Tax (PST) Calculate PST Differentiate between GST Payable and PST Payable Analyze and record GST and PST collected on sales in a Page |7 General Journal Analyze and record GST Refundable Analyze GST Payable and GST Refundable account balances to determine the refund/remittance amount Record remittance of GST Payable to the federal government Analyze PST Payable account balance to determine the amount to be remitted to the provincial government (without Sales Tax Commission) Calculate the Sales Tax Commission for Manitoba Calculate and record remittance of Provincial Sales Tax owing to the Manitoba government Lesson 3—Multicolumn Journal Describe the multicolumn journal Differentiate between the advantages and disadvantages of using a multicolumn journal Analyze and record transactions in the multicolumn journal Prove and rule the multicolumn journal Lesson 4—Petty Cash Explain a petty cash system Explain the need for a petty cash voucher Establish a petty cash fund Prepare a petty cash summary Replenish the petty cash fund Apply the appropriate accounting principle Lesson 5—Banking at Financial Institutions Distinguish between a NSF (not sufficient funds) cheque and a dishonoured cheque Distinguish between outstanding and cancelled cheques Differentiate between a certified cheque and a line of credit Define endorsement Explain the difference between current account and savings account Distinguish between chequebook record and bank/credit union statement Distinguish between debit card and credit card Differentiate between debit memo (DM) and credit memo (CM) Define service charges Discuss the concept of virtual Page |8 Lesson 6—Bank Reconciliation Explain the need for a bank/credit union reconciliation statement Prepare a bank/credit union reconciliation statement Analyze and record the journal entries to adjust the cash records Write a cheque Prepare a bank/credit union deposit Module 6—Merchandising Business Outcomes Lesson 1—Merchandising Business Income Statement Define merchandising business Identify and explain how a merchandising business differs from a service business Define Cost of Goods Sold Prepare an Income Statement including the Cost of Goods Sold section Lesson 2—Cost of Goods Sold Identify the special accounts for a merchandising business Calculate the cost of goods sold Record transactions for a merchandising business Prepare a Cost of Goods Sold statement Module 7—A Dollar Earned Outcomes Lesson 1—Introduction to Payroll Define the Employment Standards Act Explain the importance of a social insurance number (SIN) Distinguish between employee’s and employer’s roles Define income tax Compare exemptions and net claim codes Complete the Personal Tax Credits return (TD1) form Lesson 2—Paying Employees Define pay period Compare/contrast salaries, commissions, and wages Differentiate between hourly rate and piece rate Distinguish between regular hours and overtime hours Compute gross earnings Lesson 3—Payroll Deductions Compare deductions required by law, deductions that may be required by collective agreement, and voluntary deductions Compare/contrast Income Tax, Canada Pension Plan (CPP), and Employment Insurance (EI) Distinguish between company Registered Pension Plan (RPP) and Registered Retirement Savings Plan (RRSP) Page |9 Differentiate between Manitoba Health Insurance and extended insurance Determine Canada Pension Plan deductions Determine Employment Insurance deductions Define taxable earnings Computer taxable earnings Determine income tax deductions Distinguish between gross pay and net pay Computer net pay Lesson 4—Payroll Register Explain the purpose of an employee’s earnings record and statement of earnings Describe the payroll register Prepare a payroll register Prove the accuracy of the payroll register Computer, balance, and print a payroll register using spreadsheet software Lesson 5—Payroll Liabilities and Expenses Differentiate between Salaries Expense and Salaries Payable Record the totals from the payroll register into the General Journal Record the payment of salaries to the employees in the General Journal Analyze and record the employer’s payroll expenses in the General Journal Analyze and record the remittance of payroll liabilities in the General Journal Describe the different methods of transferring pay to the employees Discuss the necessity of updating employees’ earnings records after each pay period Specify the importance of the basic payroll records Apply the appropriate accounting principle Module 8—Income Tax—Your Fair Share Outcomes Lesson 1—Personal Income Tax Have had a brief overview of the history of income tax in Canada Be aware of the document necessary to file an income tax return Have been introduced to terminology associated with filing an income tax return P a g e | 10 Lesson 2—Federal and Provincial Territorial Tax Rates Compare provincial/territorial tax rates Calculate federal and provincial/territorial taxes due Lesson 3—Preparing a Personal Income Tax Return— Profile 1 Complete an Income Tax return for a high school student Lesson 4—Preparing a Personal Income Tax Return— Profile 2 complete an Income Tax return for a high school student Assessment Strategy: An important component of learning is the assessment and evaluation of student progress and achievement. Therefore a variety of strategies will be used to assess students and these will include some or all of the following: Practice assignments – These will be assessed as part of the “for” and “as” learning. Teacher observation checklists - These will be assessed as part of the “for” and “as” learning. Projects – These will be assessed as part of the “of” learning. A best of series is offered for students. Quizzes and tests - These will be assessed as part of the “of” learning. Students will be allowed to write make-up tests under the following circumstances: If you miss a test, you will receive a zero grade for that test unless you have emailed me to make me aware of your absence and your parent/guardian has called the attendance line to inform the school of your absence. Tests will include both written and computer components. Tests will not be cumulative except to the extent that the material in each chapter builds on the previous chapters. Grade Breakdown: Projects, quizzes and tests make up 80% of the final grade. A final exam is held prior to exam week and is worth 20% of the final grade. Important Sites: http://melansonaccounting.weebly.com/ Contact me: emelanson@pembinatrails.ca Supplies for class: 1. Binder with loose-leaf or notebook 2. Pen/Pencil 3. USB (2GB or higher) to be left in the classroom P a g e | 11 PROFESSIONAL BEHAVIOUR (excerpt from) http://umanitoba.ca/faculties/management/academic_depts_centres/dept/accounting_fina nce/media/2012T01_ACC_1100_SCarney.pdf You are expected to treat your classmates and your instructor professionally at all times, both inside the classroom and outside it. Your instructor is expected to do the same. A student who demonstrates a high level of professional in-class behaviour does the following: Arrives on time for class (does not leave during class for water/snacks, pack up and/or leave early) Listens – alert, eyes on the speaker, nonverbal signs of attention demonstrated (does not watch the clock, use cell phones and laptop computers, read non-class material, chat with neighbours, etc.) Volunteers – contributes to discussions without being asked Speaks to the issue being discussed Participates in classroom activities with energy and evident enthusiasm Extras: If you are finished all of your work, please remain seated and quietly keep yourself busy. (NO GAMING) Please remain seated until the bell goes