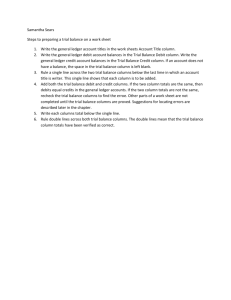

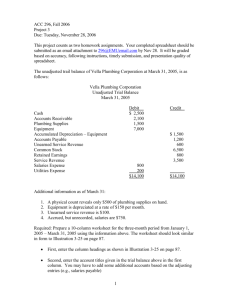

Balance Sheet Columns

advertisement

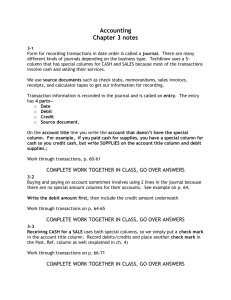

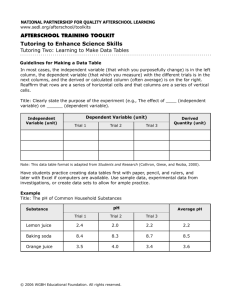

Chapter 4 1 College Accounting 10th Edition McQuaig McQuaig Bille Bille Nobles PowerPoint presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University 4–1 © 2011 Cengage Learning Fiscal Period A fiscal period is any period of time covering a complete accounting cycle. A fiscal year is a fiscal period consisting of twelve consecutive months. A fiscal year does not have to coincide with the calendar year. For income tax purposes, any period of 12 consecutive months may be selected. However, you must be consistent from year to year. 4–2 The Accounting Cycle Sequence of steps in the accounting process completed during the fiscal period. 4–3 The Work Sheet The work sheet is a tool (working paper) used by accountants to record necessary adjustments and provide up-to-date account balances needed to help in preparing financial statements. The heading consists of three lines: (1) the name of the company, (2) the title of the working paper, and (3) the period of time covered. 4–4 Work Sheet for Conner’s Whitewater Adventure 4–5 The Columns of the Work Sheet Trial Balance Columns Assuming normal balances, the account classifications are listed in the Trial Balance Debit and Credit columns of the work sheet as follows: 4–6 The Columns of the Work Sheet Adjusted Trial Balance Columns The adjusted trial balance columns are merely extensions of the Trial Balance Columns, plus or minus any adjustment amounts. 4–7 The Columns of the Work Sheet Income Statement Columns An income statement contains the revenues minus the expenses. Revenue accounts have credit balances, so they are recorded in the Income Statement Credit column. Expense accounts have debit balances, so they are recorded in the Income Statement Debit column. Assets The Columns of the Work Sheet Balance Sheet Columns Asset accounts have debit balances, so they are recorded in the Balance Sheet Debit column. Liability accounts have credit balances, so they are recorded in the Balance Sheet Credit column. The Capital account has a credit balance, so it is recorded in the Balance Sheet Credit column. Drawing is a deduction from Capital, thus it has a debit balance and is recorded in the Balance Sheet Debit column. 4–9 Adjustments Adjustments are a way of updating the ledger accounts. Adjustments may be considered internal transactions. They are determined after the trial balance has been prepared. Adjustments are first recorded on the work sheet when using a manual accounting system. 4–10 Prepaid Insurance (a) The $1,875 balance in Prepaid Insurance represents the premium paid in advance for a three-month liability insurance policy. $1,875 per year ÷ 3 months = $625 per month Prepaid Insurance Cost of insurance that remains paid in advance 4–11 Recording the Adjustment on the Work Sheet Label the debit and credit amounts of the adjustment with (a) in the Adjustment columns. Extend the new amount in the Prepaid Insurance account to the Balance Sheet Debit column. Extend the new amount for the Insurance Expense account to the Income Statement Debit column. 4–12 Depreciation of Equipment Durable items, such as appliances and fixtures, are recorded as Equipment because they will last longer than one year. The cost of these assets should be systematically spread out over their useful lives. This process is called depreciation. Depreciation Expense, Equipment Accumulated Depreciation, Equipment, is contrary to, or a deduction from, Equipment, so we call it a contra account. 4–13 Example of Depreciation of Equipment (b) The Equipment account has a balance of $51,300. Conner estimates that the equipment will have a useful life of seven years, with a trade-in (salvage) value of $8,292 at the end of that time. Using straight-line depreciation, Conner determines the depreciation for one month is $512. STEP 1. STEP 2. STEP 3. Subtract the trade-in (salvage) value from the cost to get the full depreciation. $51,300 – $8,292 = $43,008 Divide the full depreciation by the number of years in the asset’s useful life to get the depreciation for one year. $43,008 ÷ 7 = $6,144 Divide the depreciation for one year by 12 to get the depreciation for one month. 4–14 $6,144 ÷ 12 = $512 Depreciation of Equipment On the balance sheet, the balance of Accumulated Depreciation is deducted from the balance of the related asset account. 4–15 Wages Expense This adjustment necessary because the end of the pay period rarely falls on the same day as the end of the fiscal period. 4–16 Wages Expense (c) The amount of wages for the month of June for Conner Whitewater Adventures is $2,360 (or $78.67 per day based on 30 days). The last payday was June 24. Using Wages Expense and Wages Payable accounts, update the ledger accounts for unpaid (or accrued) wages owed to employees for the time between the end of the last pay period and the end of the fiscal period. 4–17 Net Income Net income (or net loss) is the difference between revenue and expenses. When revenue is larger than expenses, net income is placed in the Income Statement Debit column. It is also placed in the Balance Sheet Credit column. 4–18 Net Loss When revenue is smaller than expenses, the net loss is placed in the Income Statement Credit column. It is also placed in the Balance Sheet Debit column. 4–19 Mixed Accounts Each adjusting entry contains an income statement account (revenue or expense) and a balance sheet account (asset, contra asset, or liability). Accountants refer to these accounts as mixed accounts, which are accounts with balances that are partly income statement and partly balance sheet amounts. 4–20 Steps in Completion of the Work Sheet 1. 2. 3. 4. Complete the Trial Balance columns, total, and rule. Complete the Adjustments columns, total, and rule. Complete the Adjusted Trial Balance columns, total, and rule. Record balances in the Income Statement and Balance Sheet columns and total each column. 5. Record net income or net loss in the Income Statement columns by subtracting the smaller side from the larger side and adding the differences to the smaller side, total, and rule. 6. Record net income or net loss in the Balance Sheet columns by subtracting the smaller side from the larger side and adding the difference to the smaller side, total, and rule. 4–21 4–22 4–23 Finding Errors in the Income Statement and Balance Sheet Columns 1. Check to see that the amount of the net income or loss is recorded in the correct columns. 2. Verify the addition of all the columns. 3. Look to see if the appropriate amounts have been recorded in the Income Statement and Balance Sheet columns. 4. Verify, by adding or subtracting across each line, that the amounts carried over from the Trial Balance columns through the Adjustments columns into the Adjusted Trial Balance columns are correct. 5. Verify that the correct amounts of the revenue and expense accounts are transferred to the Income Statement columns. 6. Verify that the correct amounts of assets, liabilities, and owner’s equity accounts are transferred to the Balance Sheet columns. 4–24 4–25 4–26 Completion of the Financial Statements Since we have completed the work sheet for Conner’s Whitewater Adventures, we can now prepare the income statement, the statement of owner’s equity, and the balance sheet by taking the figures directly from the work sheet. 4–27 to Statement of Owner’s Equity (continued) 4–28 from the Income Statement to the Balance Sheet (continued) 4–29 from the Statement of Owner’s Equity 4–30 Journalizing Adjusting Entries The work sheet is not a journal, so we must journalize adjusting entries to update the ledger accounts. Take the information for these entries directly from the Adjustments columns of the work sheet. Debit and credit exactly the same accounts and amounts from the work sheet to the journal. 4–31 Journalizing Adjusting Entries Note that the entries have been posted 4–32 Posting Adjusting Entries When you post the adjusting entries to the ledger accounts, write the abbreviation “Adj.” in the Item column of the ledger account. 4–33 Matching Principle In adjusting accounts, notice that the intent is to make sure the expenses recorded match up or compare with the revenues of the same period of time. This is called the matching principle. 4–34 Income Statement Involving More Than One Revenue Account and a Net Loss When an organization has more than one distinct source of revenue, a separate revenue account is set up for each source. Harris Miniature Golf’s income statement is an example of a company has more than one revenue account. 4–35 Note that expenses are greater than revenues, resulting in a net loss. 4–36 Statement of Owner’s Equity with an Additional Investment and a Net Income 4–37 Statement of Owner’s Equity with an Additional Investment and a Net Loss 4–38 Income Statement for Preparing Balance Sheet 4–39 Balance Sheet for a Business Having More Than One Accumulation Depreciation Account 4–40 Balance Sheet with Statement of Owner’s Equity Included The information normally shown in the statement of owner’s equity is sometimes included as part of the owner’s equity section of the balance sheet. Computerized accounting programs frequently do not produce a separate statement of owner’s equity. 4–41 4–42