Unit 5 * Revenue and Expense Accounts

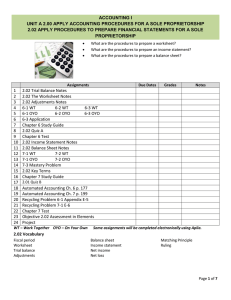

advertisement

Unit 12 – Worksheet, Adjustments, Financial Statements Eight-Column Worksheet • -how adjustments are first prepared on the worksheet (same way as 6 – column) …just need to add 2 columns for adjustments. • In the following order: – Trial Balance – Adjustments – Income Statement – Balance sheet Eight-Column Work Sheet • SEE FIGURE 6.5 (Page 221) Adjustment #1 (Supplies) • A count made of all supplies on hand shows $900 worth left on January 31. Total supplies purchased Less: Supplies left Supplies used $1000 900 $100 Supplies Jan.31 Balance 1000 Jan. 31 900 Supplies Expense 100 Jan. 31 • See Figure 6.6 – Page 223 100 Adjustment #2 (Prepaid Insurance) • In January, a $720, one year insurance policy was purchased. One month of the policy is now expired. Insurance for 1 year Per month (1/12 * 720) $720 $60 Prepaid Insurance Jan.31 Balance 720 Jan. 31 660 Insurance Expense 60 • See Figure 6.7 – Page 225 Jan. 31 60 Adjustment #3 (Prepaid rent) • On January 1st, rent of $5100 was prepaid for January, February, & March. Rent for 3 months Per month (1/3 * 5100) $5100 $1700 Prepaid Rent Jan.31 Balance 5 100 Jan. 31 3 400 700 Rent Expense 1 Jan. 31 700 • See Figure 6.8 – Page 226 1 Adjustment #4 (Depreciation-Equipment) • 20% per year (Declining Balance method – tax purposes) This year’s depreciation Per month (1/12 * 1920) Equipment Jan. 31 12 000 $1920 $160 Accumulated DepreciationEquipment Jan. 31 2400 31 160 Balance 2560 • See Figure 6.9 – Page 227 Depreciation ExpenseEquipment Jan. 31 160 Completing the Worksheet • See Page 227. – Add or subtract the adjustment to create your new total for the account. (balance sheet or income statement) • Net income/loss calculated the same way as before. (Debits > Credits = net loss and vice versa) - Double underline totals! 8-Column Worksheet (Steps) 1. 2. 3. 4. 5. Heading Trial Balance Data for adjustments (collect) Adjustments column (total, balance, rule) Transfer to income statement or balance sheet 6. Determine Net income/loss 7. Balance & rule the work sheet. 10 – Column Worksheet • Two extra columns added (Adjusted Trial Balance) – Purpose: to ensure ledger accounts still in balance • See Figure 6.10 (Page 230) 10-Column Worksheet (Steps) 1. 2. 3. 4. 5. Heading Trial Balance Data for adjustments (collect) Adjustments column (total, balance, rule) Transfer to adjusted trial balance. (recalculate balances where necessary) 6. Transfer to income statement or balance sheet 7. Determine Net income/loss 8. Balance & rule the work sheet. Preparing the Financial Statements • Financial statements are prepared from the work sheet. (Page 231-232) • New Expenses (from adjustments) are included in the income statement. • Accumulated Depreciation is shown as a subtraction from Equipment in the fixed asset section of the balance sheet.