analyzing and adjusting comparable sales

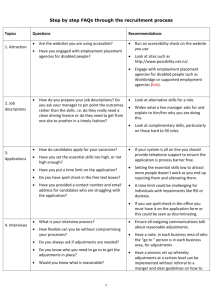

advertisement

Chapter 9 ANALYZING AND ADJUSTING COMPARABLE SALES CHAPTER TERMS AND CONCEPTS Automated valuation model Matched pair (AVM) Multiple regression Comparison process Percentage adjustment Date of sale Physical elements Depreciated cost method Physical unit of comparison Direct comparison method Sales adjustment grid Economic unit of comparison Sales graph Elements of comparison method Terms and conditions of sale Gross income multiplier (GIM) Total property comparison Linear regression Unit of comparison Location elements Value range Lump-sum dollar adjustment 2 LEARNING OUTCOMES 1. Name the four elements of sales comparison. 2. List the three adjustments. rules for making 3. Name the three types of adjustments most commonly used. 4. Explain how a value conclusion is reached. Which is more attractive to buyers? ELEMENTS OF COMPARISON Terms and Conditions of Sale Time of Sale Location Physical Features Elements of Comparison PRICE VS. TERMS OF SALE • Seller Financing Better or worse than Standard? • Assumed Financing Better terms? • Seller-Paid Points Generally, Buyer pays points. In a Buyer’s market, Seller may pay points COMPARING & ADJUSTING SALES • Identify and Compare Sales Characteristics • Make Market-Derived Adjustments that are: Reasonable Are consistent among the sales Explain the price differences between the sales & subject RULES FOR MAKING ADJUSTMENTS Adjust the Sale to the Subject Use Market-Derived Adjustments Adjust in the Proper Order Terms/conditions Time Location Physical features TYPES OF SALES ADJUSTMENTS • Lump Sum Dollar • Percentage • Units of Comparison The Adjustment Process Figure 9-2 URAR FORM ANALYSIS GRID Figure 9-4 12 UNITS OF COMPARISON SALES ADJUSTMENTS Total Property Price of similar sale May involve ranking the sales Physical Units Price per square foot, price per acre Price per room Price per dwelling unit Economic Units Price per buildable dwelling unit Price per developable building area Gross income multipliers GRAPHING THE SALES 14 USING MATCHED PAIRS Adjusting Sales with the Direct Market Method Finding Adjustments for Size Subject: 2,600 SF living area Sales: Similar, except different in size Adjustment: Search for sales differing only in size USING MATCHED PAIRS Evidence o 2,500 SF o 2,700 SF Calculation: o Sale Size Price o B= 2,700 SF $280K o A= 2,500 SF $270K o Difference 200 SF $10 K Adjustment for Size: $10,000÷200 SF = $50 SF Change ESTIMATING ADJUSTMENTS BY DEPRECIATED COST Difference Subject has 440 SF garage Comparable sale has no garage Unit cost new is estimated at $33.50/SF Cost New of Garage Size 440 SF @ $33.50 per SF Total replacement cost o 440 SF X $33.50 per SF = $14,470 ESTIMATING ADJUSTMENTS BY DEPRECIATED COST Depreciation Age of subject garage = 29 yrs Economic life = 100 yrs % depreciation = 29/100 = 29% Amount of depreciation is 29% of $14,470 or $4,275 Adjustment Amount Cost new Less: Depreciation $14,470 - $4,275 Equals: Amt. of adjust rounded $10,000 ADJUSTING FOR SALE TERMS OR CONDITIONS Using Linear Regression to Analyze Sales Figure 9.8 AUTOMATED VALUATION MODELS • Computer Software Program Analyzes data in specified area or neighborhood Relates results of database search to subject property information imputed into the model. • When Applied to an Individual Property It Is Not an Appraisal. • An AVM May Become the Basis for an Appraisal ARRIVING AT AN INDICATED VALUE ARRIVING AT AN INDICATED VALUE Review the Entire Approach Comparability Activity levels Adjustment accuracy Statistical limits Lagging the market Motivation ARRIVING AT AN INDICATED VALUE Review the Sales Data Sales data Adjustments Estimate Value Range Value range shown by comparable Upper and lower limits Select a Final Value SUMMARY Analyzing and adjusting comparable sales rely on two main methods: the direct comparison method and the elements of comparison method. The direct comparison method simply compares the overall desirability of each sold property with that of the subject, without any adjustments. The elements of comparison method compares the sales with reference to the details of four critical elements: the terms and conditions of sale, the time of sale, the location elements, and the physical elements of the properties.