Option Skew??

advertisement

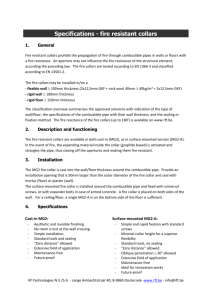

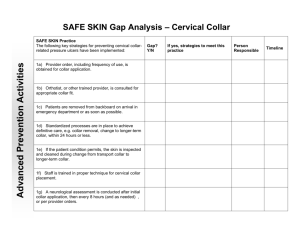

1 Options Collars Steve Meizinger ISE Education Education@ISEoptions.com 2 Required Reading For the sake of simplicity, the examples that follow do not take into consideration commissions and other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of a given strategy. An investor should review transaction costs, margin requirements and tax considerations with a broker and tax advisor before entering into any options strategy. Options involve risk and are not suitable for everyone. Prior to buying or selling an option, a person must receive a copy of CHARACTERISTICS AND RISKS OF STANDARDIZED OPTIONS. Copies have been provided for you today and may be obtained from your broker, one of the exchanges or The Options Clearing Corporation. A prospectus, which discusses the role of The Options Clearing Corporation, is also available, without charge, upon request at 1-888-OPTIONS or www.888options.com. Any strategies discussed, including examples using actual securities price data, are strictly for illustrative and educational purposes and are not to be construed as an endorsement or recommendation to buy or sell securities. 3 Refresher » Put options give holders the right to sell the stock at the strike price, but not the obligation, for that right they pay a premium » Puts can insure portfolios although the cost of the put must be considered » Call options give writers the obligation, but not the guarantee to sell the stock at the strike price for that obligation they receive a premium 4 Altering risk/reward » Is there a way to insure your stock/portfolio without buying the puts outright? 5 Option Collar » The Option Collar strategy is a protective strategy that allows investors to limit their downside risk by selling an upside call option » Normally this strategy is employed subsequent to the purchase of the stock, thereby protecting the sale price of the stock 6 Definition of Option Collars » The purchase of a put and the simultaneous selling of a call » The goal of an option collar is for downside protection with a minimal cost » The economics of the trade depends on the price of the stock in relation to the downside put and the upside call sold and also the implied volatility of each 7 Construction of a collar » XYZ stock is trading 46.90 and investor is nervous about the next 53 days and a possible drop in the stock but does not want to sell the stock » Action: Buy 53 day 40 strike put ($.75) and sell 53 day 55 strike call ($.60) for a total debit of $.15 8 Rights and Obligations » Investor has the right to sell the stock with the purchase of the put option at $40 until expiration, 53 days in this example » Investor has the obligation to sell the stock at $55 if the call purchaser chooses to exercise any until expiration (53 days) 9 Example of the collar at expiration Stock at Expiration Cost of Collar Value of 55 Call sold Value of 40 Put bought Stock relative to 46.90 Profit &Loss 60 -.15 -5 0 13.1 7.95 55 -.15 0 0 8.1 7.95 50 -.15 0 0 3.1 2.95 46.9 -.15 0 0 0 -0.15 45 -.15 0 0 -1.9 -2.05 40 -.15 0 0 -6.9 -7.05 35 -.15 0 5 -11.9 -7.05 30 -.15 0 10 -16.9 -7.05 25 -.15 0 15 -21.9 -7.05 10 Collar risk-reward prior to expiration 11 Risk-reward at expiration 12 Components of collar » Covered call (long stock with a call option sold), in this case 55 strike covered call in conjunction with a downside put for protection 13 Advantages of Collars » Guarantees minimum selling price during the life of the collar » Relative low cost compared to outright put purchases » Ownership of stock is maintained until exercise or assignment even though stock declines are being protected 14 Disadvantages of a Collar » Investor caps further stock appreciation to the upside call sold » Modest downside risk is maintained although limited to the put strike held 15 Collars act like spreads? » If the call and put are the same expiration date the collar acts like a spread with clearly defined risk and reward tradeoffs » Collars are a synthetic long call vertical » A minimum and maximum value is created until expiration of the collar 16 Why use collars? » Bullish on a stock long term although “nervous” about the stock in the shorter term » Do not want to pay for the puts outright, willing to finance them with the selling of call 17 Options are about risk and return » Collars are not free » Question: Would you be willing to have your stock called away at the strike price? 18 Concentrated stock positions » If an investor has a large position in one, or a few stocks, collars can help reduce risk » The selection of the long put and the sold call allow an investor to select their own risk reward tradeoffs while controlling risk 19 Outcomes: Do Nothing » Stock is not collared- Investor would continue to have unlimited upside with substantial downside risk 20 Outcomes: Collar with Call assigned » Stock finishes in the money at expiration and investor sells their stock at the upside call strike price (best scenario), sell stock at $55 » Maximum value realized under collar strategy 21 Outcomes: Put exercised » Stock falls and investor can exercise their put option, selling stock at the lower put strike price, sell stock at $40 » Minimum value created under collar strategy 22 Outcomes: Neutral stock movement at expiration » Stock ownership is maintained with a small increased cost depending on initial debit amount » Further consideration must be given to possibility of reentering the position in the future » Alternatively the collar can be rolled forward to future months in the last couple of days prior to expiration if there is any time premium left in the shorter term options » Neither minimum nor maximum realized 23 Considerations for Collars » Strike price- Must balance risk and reward and recognize your rights and obligations with the varying strike prices » Time- Investors must choose the time frame they would like to protect and select that month 24 Considerations for Collars » Rolling- As time moves forward option theta reduces the option time values, investors can choose to roll your options to further out months » Volatility- Option skew can sometimes alter these trades, option markets are efficiently priced and “price in” potential rapid price drops by allowing for higher put implied volatilities 25 Option Skew?? » Option skew- Correlation between volatility and direction » Normally volatility increases at lower prices, but by how much? » Also called “fat tails” especially to the downside, stocks tend to drop faster than they rise 26 Concerns » Are you really willing to sell your stock at the call strike price or are you just trying to finance the put? » Put skew develops in many stocks that hurts the economics of the trade. This creates a challenge as puts “tend” to trade at higher to slightly higher prices than calls based on implied volatilities (of course many professionals would contend that option pricing is very efficient) » Skew is mostly determined by supply and demand factors from the marketplace 27 Summary » A long underlying position can be protected using the long put and short call position » The selection of the strike prices for both the put and call depends on the amount of protection required » Collars limit your upside but protect the downside » The collar is a cheap protection method although this cheapness must be balanced against the obligations undertaken 28 ISEoptions.com 29