Impairment of Assets:

IAS 36

Wiecek and Young

IFRS Primer

Chapter 16

Impairment of Assets

2

Related standards

IAS 36

Current GAAP comparisons

IFRS financial statement disclosures

Looking ahead

End-of-chapter practice

Related Standards

3

FAS 157 Fair value measurements

FAS 144 Accounting for the impairment or

disposal of long-lived assets

FAS 142 Goodwill and other intangible

assets

FAS 141 Business combinations

Related Standards

4

IFRS 3 Business combinations

IAS 16 Property, plant and equipment

IAS 17 Leases

IAS 27 Consolidated and separate financial

statements

IAS 28 Investments in associates

IAS 31 Interests in joint ventures

IAS 38 Intangible assets

IAS 40 Investment property

IAS 36 – Overview

5

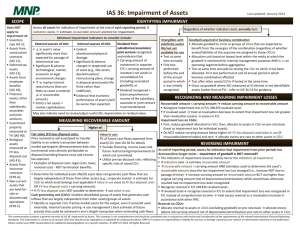

Objective and scope

Identifying an asset that might be impaired

Recognizing and measuring an impairment

loss for an individual asset

Recognizing and measuring an impairment

loss for cash-generating units and goodwill

Reversing an impairment loss

Disclosure

IAS 36 – Objective and Scope

6

IAS 36 ensures that assets are reported on

the statement of financial position at no more

than the entity can recover from their use or

sale.

May be an impairment loss—“the amount by

which the carrying amount of an asset or a

cash-generating unit (CGU) exceeds its

recoverable amount”

IAS 36 – Objective and Scope

IAS 36 excludes:

–

–

–

–

–

–

–

7

inventories

assets arising from construction contracts

employee benefit assets

deferred tax assets

financial assets under IAS 39

non-current assets or disposal groups held-forsale

investment property, biological assets based on

FV measurements

IAS 36 – Objective and Scope

8

IAS 36 – Identifying an Asset that

May Be Impaired

Assets

–

–

–

Intangibles with indefinite lives, those not yet

ready for use, and goodwill

–

–

9

end of each reporting period

assess for indications of impairment

if indications of impairment, test for impairment

annually

test for impairment regardless of indications of

impairment

IAS 36 – Identifying an Asset that

May Be Impaired

Indication of impairment? Consider:

10

IAS 36 – Identifying an Asset that

May Be Impaired

Testing for impairment:

Estimate asset/CGU’s recoverable amount. If

recoverable amount is greater than the

carrying amount – no impairment.

Recoverable amount - higher of:

–

–

11

fair value less costs to sell, and

value in use

IAS 36 – Identifying an Asset that

May Be Impaired

12

For assets that do not generate independent

cash flows on their own – group into cashgenerating units (CGUs)

CGU – “the smallest identifiable group of

assets that generates cash flows that are

largely independent of the cash flows from

other assets or groups of assets”

IAS 36 – Identifying an Asset that

May Be Impaired

13

Fair value less costs to sell = proceeds from arm’slength sale of an asset/CGU between

knowledgeable willing parties less incremental direct

costs of its disposal

Best measure: arm’s-length bargained price in a

binding sales agreement in an active market.

Hierarchy of appropriate methods to establish fair

value

Disposal costs: e.g., legal costs, transaction taxes,

removal costs, costs to put in condition for sale

IAS 36 – Identifying an Asset that

May Be Impaired

Value in use = present value of the future

cash flows expected from asset/CGU’s use

and ultimate disposal

Two approaches:

1.

2.

14

Most likely cash flows from use and disposal

discounted using risk-adjusted discount rate.

Probability-weighted cash flows from use and

disposal discounted using remaining riskadjusted discount rate.

IAS 36 – Identifying an

Asset that May Be Impaired

15

Estimated cash flows with a 40% probability they will

be $120 and a 60% probability they will be $80.

Value in use?

Method 1: Most likely cash flows = $80. This amount

is discounted using a rate that takes into account all

risks including the uncertainty of the cash flow

amounts.

Method 2: Expected value of cash flows = (120 ×

40%) + (80 × 60%) = $96. This amount is discounted

using a rate that includes remaining risks.

IAS 36 – Recognizing and Measuring an

Impairment Loss for an Individual Asset

If recoverable amount < carrying amount:

Dr. Impairment loss

$

Cr. Accumulated impairment losses

16

$

Recalculate depreciation rate.

If recoverable amount > carrying amount: no

impairment

IAS 36 – Recognizing and Measuring an

Impairment Loss for CGUs and Goodwill

CGU’s carrying amount

= carrying amount of all assets used to

generate the relevant stream of cash flows

Includes assets

–

–

17

directly involved, and

those allocated to the CGU on a reasonable basis

IAS 36 – Recognizing and Measuring an

Impairment Loss for CGUs and Goodwill

Goodwill allocated to a CGU or group of

CGUs not larger than an “operating segment”

that is:

–

–

–

18

expected to benefit from synergies of a

combination

at lowest level in organization that manages the

goodwill

not on an arbitrary basis

IAS 36 – Recognizing and Measuring an

Impairment Loss for CGUs and Goodwill

If part of CGU with allocated goodwill is sold:

–

–

19

allocate goodwill between portion sold and portion

remaining

base on relative value of the CGU sold to portion

retained

IAS 36 – Recognizing and Measuring an

Impairment Loss for CGUs and Goodwill

Testing CGUs for impairment

CGUs with related G/W not allocated

specifically:

–

–

CGUs with G/W allocated to it

–

–

20

Test when an indication of impairment

Loss = CGU carrying amount excluding G/W recoverable amount

Test at least annually

Loss = CGU carrying amount including G/W –

recoverable amount

IAS 36 – Recognizing and Measuring an

Impairment Loss for CGUs and Goodwill

Impairment loss for a CGU or group of

CGUs:

–

–

21

assign loss to carrying amount of G/W allocated

to the CGU or group

allocate remainder to assets in CGU on basis of

relative carrying amounts

Loss is impairment loss for individual assets

in CGU

IAS 36 – Reversing an Impairment Loss

22

No reversal of impairment loss for G/W

For other assets, reversal permitted if

estimates used to determine recoverable

amount have changed

IAS 36 – Reversing an Impairment Loss

For an individual asset:

–

–

23

reversal limited to an increase to what asset

would have been, net of

depreciation/amortization, if no impairment had

been recognized initially

unless accounted for under the revaluation model

– when full reversal is permitted

IAS 36 – Reversing an Impairment Loss

For a CGU:

–

–

–

24

reversal is allocated to the assets of the unit,

excluding G/W

on basis of relative carrying amounts

restrictions on individual assets still apply

IAS36 – Disclosure

For each class of assets:

–

–

–

25

amount of impairment loss/loss reversals in P&L

line item where loss/reversal is reported

amount of impairment loss/loss reversals on

revalued assets in OCI

IAS36 – Disclosure

Individually material loss/reversal:

–

–

–

–

26

explanation of events and circumstances

nature of asset/CGU

how recoverable amount is determined

amount of loss/reversal

IAS36 – Disclosure

For G/W and intangibles with indefinite lives:

–

–

–

–

27

considerably more information provided

enable users to assess reliability of impairment

testing

for individually significant intangible assets/CGUs

if individually insignificant, disclose amounts

Current GAAP Comparisons

28

–

Pages 19 to 20 of 49 of

http://www.ey.com/Global/assets.nsf/International/

IFRS_US_GAAP_vs_IFRS/$file/US_GAAP_vs_IF

RS.pdf

–

Pages 82 to 84 of 164 of

http://www.kpmg.co.uk/pubs/IFRScomparedtoU.S

.GAAPAnOverview(2008).pdf

IFRS Financial Statement Disclosures

Cadbury Schweppes plc

–

Impairment policy note for goodwill and

acquisition intangibles

–

Page 93 of 153

Goodwill Note 14

–

29

http://www.cadbury.com/Reports/2007AnnualRep

ort.pdf

Page 104 of 153

Looking Ahead

IAS 36

–

–

–

–

Impairment

–

–

30

two recent revisions

resulting from project on business combinations

changes to IAS 27 and IFRS 3 – released in 2008

related to impairment test for goodwill

part of longer term convergence

no short or medium term changes likely

End-of-Chapter Practice

31

16-1 Three years ago, Ace Airlines (AA) was granted

permission to schedule flights on the popular and profitable

Newalta to Oldsford route, provided it also serviced Remoteville

which is considerably further north than Oldsford. As a result,

AA set up a facility in Oldsford and a small office and

maintenance bay in Remoteville. Remoteville is sparsely

populated and not accessible except by air. AA’s controller now

wants to review the Remoteville assets for impairment due to

the continuing losses on the Oldsford-Remoteville route, but is

not familiar with IAS 36.

Instructions

Write a short memo to AA’s controller, identifying how he

should proceed in determining whether the Remoteville assets

are impaired.

End-of-Chapter Practice

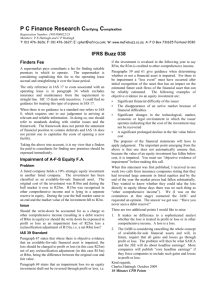

16-2 Waix Ltd. (WL) is a manufacturer with a number of product lines, one

of which is the production of parts for residential telephone sets. Recently

there have been indications that the market for this product is likely to

decline significantly, and WL is assessing various assets for impairment.

The following assets are used specifically to manufacture these parts:

Tools and dies

Specialized equipment

General equipment

Cost

____

$ 10

50

30

Accumulated

Depreciation

$ 6

35

18

The tools and dies and specialized equipment have no resale value other

than for scrap, although the general equipment could be sold or used

profitably in one of WL’s other product lines. WL plans on continuing

production of these parts for two more years in order to fill its existing

commitments. The present value of the net cash flows from the next two

years’ production of these parts is $26 and the estimated net amount that

could be recovered if these assets were sold today is $15.

32

End-of-Chapter Practice

16-2 Instructions

a)

b)

c)

33

Briefly discuss whether these assets should be assessed for

impairment individually or as part of a cash-generating unit.

Assuming the assets are allocated to a CGU made up of the

three types of assets identified, determine whether an

impairment loss needs to be recognized, and if so, in what

total amount.

Prepare the entry needed to record any impairment loss

indicated, assuming these assets are reported in separate

asset classes.

End-of-Chapter Practice

16-3 Firstall Corp. (FC) acquired four divisions of a competitor eight years

ago in a business combination transaction, paying $25 more than the fair

value of the identifiable assets acquired. The goodwill was determined to

be 100% attributable to the operations of the East Division and the South

Division. Although these two divisions are cash-generating units in their

own right, there was no basis on which to allocate the goodwill between

them. FC has identified the combined divisions as one CGU for assessing

goodwill impairment on an annual basis. At the end of the most recent

year, the following information is available:

Carrying Amount

East Division

$ 75

South Division

125

Goodwill

25

FC has determined that the estimated recoverable value of the two

divisions together is $215.

34

End-of-Chapter Practice

16-3 Instructions

a)

b)

c)

35

Identify the asset, cash-generating unit, or group

of CGUs that FC should use to test for

impairment.

Is there an impairment loss at the end of the

current year? Explain how you determined your

answer.

If applicable, indicate how any impairment loss

should be accounted for. Be specific.

End-of-Chapter Practice

16-4 In this chapter, flag icons identify areas where there are

GAAP differences between IFRS requirements and national

standards.

Instructions

Access the website(s) identified on the inside back cover of this

book, and prepare a concise summary of what the differences

are that are flagged throughout the chapter material.

36

Copyright © 2010 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

by Access Copyright is unlawful. Requests for further

information should be addressed to the Permissions

Department, John Wiley & Sons Inc., 111 River Street, Hoboken,

NJ 07030-5774, (201) 748-6011, fax (201) 748-6008, website

http://www.wiley.com/go/permissions. The purchaser may make

back-up copies for his or her own use only and not for

distribution or resale. The author and the publisher assume no

responsibility for errors, omissions, or damages caused by the

use of these programs or from the use of the information

contained herein.