DTCC Global Trade Repository

advertisement

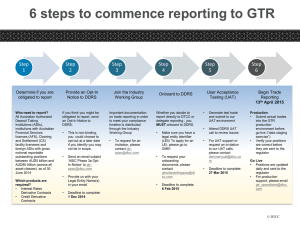

Global Trade Repositories Industry DTCC Deriv/SERV November 2012 © DTCC DTCC Deriv/SERV: A short history • 2003: DTCC establishes Deriv/SERV subsidiary providing confirmation matching for OTC credit derivatives (CDS) market • 2006: Users request confirmation service expanded to “warehouse” confirmed CDS trades - Trade Information Warehouse (TIW) is ‘born’ • September 2008: Lehman Bros default – the Trade Repository is ‘born’: – TIW becomes source of CDS data for marketplace, regulators/supervisors and the public – DTCC works with OTC Derivatives Regulators Forum (ODRF) to develop & implement regulatory and public reporting • Weekly summary market data is posted on www.dtcc.com. • DTCC Regulator portal established in January 2010 – over 40 regulators world-wide currently subscribed and receiving transaction data and aggregate exposure reporting • Summer 2009 : G20 Summit in Pittsburg. • July 2010: DTCC establishes London-based subsidiary DTCC Derivatives Repository Ltd. DDRL) to house the global equity derivatives repository and maintain global CDS data identical to US database • 2010/2011: Through industry selection process (via ISDA and AFME) from potential service providers , DTCC identified to provide Trade Repository services for all 5 asset classes (CDS and Equities already with DTCC) • 2012: Global trade repository service operationally live for Interest Rates and Commodities reporting under voluntary reporting regime to primary regulators © DTCC 2 Global Legislation – at a glance ODRF – OTC Derivative Regulator Forum • G15 made commitments to the ODSG (OTC Derivative Supervisor Group) to increase transparency of OTC Derivative transactions • These commitments included amongst others to provide the ODSG and ODRF regulator groups with better data through reporting – – – Entity position level data provided to the appropriate firms prudential supervisor/s Aggregated industry data provided to the broader ODRF Market specific data provided to market regulators of certain jurisdictions Product Credit Rates Equities Commodities FX Market through TIW G16 dealers G15 Dealers G14 Dealers core AFME members Sept 2008 Dec 2011 July 2010 March 2012 January 2013 Products All – cleared and un-cleared All – cleared and un-cleared All – cleared and un-cleared Financial oil uncleared All – cleared and un-cleared. Excludes spot. Notional Coverage 99% 2,500,000 Rec’s 70% (est) 4,000,000 Rec’s 60% (est) 600,000 rec’s Limited Not known Yes Yes No No No Users Live Public data 3 © DTCC Key Principals: Public Reporting • Public Report provide: – Aggregated and anonymous industry level information – Updated on a weekly basis – Includes week on week changes • Multiple reports available (trade volumes and notionals): – By product type and customer type – By currency denomination – By reference entity or index names/versions © DTCC 4 6-Oct-12 6-Sep-12 6-Aug-12 6-Jul-12 6-Jun-12 6-May-12 6-Apr-12 6-Mar-12 6-Feb-12 6-Jan-12 6-Dec-11 6-Nov-11 6-Oct-11 6-Sep-11 6-Aug-11 6-Jul-11 6-Jun-11 6-May-11 6-Apr-11 6-Mar-11 6-Feb-11 6-Jan-11 6-Dec-10 6-Nov-10 6-Oct-10 6-Sep-10 6-Aug-10 Credit Public Data Net Open Notional Weekly CZECH REPUBLIC 1,200,000,000 1,000,000,000 800,000,000 600,000,000 CZECH REPUBLIC 400,000,000 200,000,000 - Date sourced for the last week of each month © DTCC 5 16-Oct-12 16-Sep-12 16-Aug-12 16-Jul-12 16-Jun-12 16-May-12 16-Apr-12 16-Mar-12 16-Feb-12 16-Jan-12 16-Dec-11 16-Nov-11 16-Oct-11 16-Sep-11 16-Aug-11 16-Jul-11 16-Jun-11 16-May-11 16-Apr-11 16-Mar-11 16-Feb-11 16-Jan-11 16-Dec-10 16-Nov-10 16-Oct-10 16-Sep-10 16-Aug-10 16-Jul-10 Credit Public Data Activity - Weekly CZECH REPUBLIC 1,400,000,000 1,200,000,000 1,000,000,000 800,000,000 600,000,000 CZECH REPUBLIC 400,000,000 200,000,000 - © DTCC 6 Credit Public Data Single Name Activity Average Weekly Average Reference Entity Notional (USD Number of EQ) Trades/Week REPUBLIC OF ITALY 6,307,935,662 371 FRENCH REPUBLIC 5,383,252,798 415 KINGDOM OF SPAIN 3,878,507,146 316 FEDERAL REPUBLIC OF GERMANY 2,980,624,379 171 FEDERATIVE REPUBLIC OF BRAZIL 2,955,634,543 253 STATE OF FLORIDA HONG KONG SPECIAL THE CITY OF NEW YORK ITAU UNIBANCO S.A. DNB BANK ASA 6,250,000 6,250,000 6,226,923 6,153,846 6,142,253 1 1 1 1 1 Trades Per Count of Day Ref Entities 0-2 460 2-4 212 4-6 147 6-8 60 8-10 38 10+ 83 Total 1,000 © DTCC 7 Credit Public Data Single Name: CM & Restructuring Reference Entity ABB INTERNATIONAL FINANCE LIMITED ABBOTT LABORATORIES ABN AMRO BANK N.V. ABU DHABI ABU DHABI NATIONAL ENERGY COMPANY ACCOR ACE LIMITED ACOM CO., LTD. Average Average Average Daily Monthly Number Restructuring % Clearing Notional Trades/Day Dealers (USD EQ) 12.3 15,000,000 2 > 95% 12 12,500,000 3 5-25% 2.3 2,500,000 0 > 95% 12 15,000,000 3 > 95% 6.7 5,000,000 0 > 95% 14.7 20,000,000 4 > 95% 13.7 50,000,000 5 25-75% 11.3 10,000,000 3 > 95% © DTCC 8 Credit Public Data Single Name: Coupon & Tenor Average Reference Entity Coupon Number of Trades per Day 3I GROUP PLC 0.25% <1 3I GROUP PLC 1.00% 3I GROUP PLC Average Daily Notional (USD 1Y 2Y 3Y 4Y 5Y 6Y EQ & %) < 1% 0% 0% 0% 0% 0% 0% 1 90% - 99% 7% 2% 4% 7% 32% 1% 3.00% <1 1% - 10% 0% 0% 0% 0% 69% 0% 3I GROUP PLC 5.00% <1 < 1% 0% 0% 0% 0% 0% 0% 3I GROUP PLC 7.50% <1 < 1% 0% 0% 0% 0% 100% 0% 3I GROUP PLC 10.00% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2% 5% 5% 25% 1% - - 3I GROUP PLC TOTAL 5,000,000 3M COMPANY 0.25% 3M COMPANY 1.00% 3M COMPANY 3.00% - - 0% 0% 0% 0% 0% 0% 3M COMPANY 5.00% - - 0% 0% 0% 0% 0% 0% 3M COMPANY 7.50% - - 0% 0% 0% 0% 0% 0% 3M COMPANY 10.00% - - 0% 0% 0% 0% 0% 0% 3M COMPANY TOTAL - 1 > 99% 7,500,000 © DTCC 9 Credit Public Data Indices: On-the-Run vs Off-the-Run Reference Entity 5 Year Maturity – On-the-run Avg Daily Avg Daily Notional Contracts Traded Notional % After 1 After 2 After 3 Roll Rolls Rolls CDX.NA.IG.14 CDX.NA.IG.15 CDX.NA.IG.16 CDX.NA.IG.17 17,847,000,000 15,117,000,000 20,306,000,000 16,819,000,000 233 211 287 268 9% 14% 15% 1% 3% 1% ITRAXX EUROPE SERIES 13 ITRAXX EUROPE SERIES 14 ITRAXX EUROPE SERIES 15 ITRAXX EUROPE SERIES 16 18,936,000,000 14,298,000,000 20,142,000,000 17,545,000,000 311 227 324 365 8% 10% 13% 1% 1% 0% 319,000,000 233,000,000 332,000,000 282,000,000 22 18 23 20 12% 29% 21% 2% 6% 1% ITRAXX JAPAN SERIES 13 ITRAXX JAPAN SERIES 14 ITRAXX JAPAN SERIES 15 ITRAXX JAPAN SERIES 16 © DTCC 10 Rates Public Data – CZK Product FRA BasisSwap CapFloor Currency CZK CZK CZK Gross Notional (Native) Gross Notional (USD EQ) Trade Count 1,135,173,000,000 58,853,838,808 701 27,613,239,550 1,431,627,735 48 185,610,762,937 9,623,119,939 83 1,348,397,002,487 69,908,586,482 832 Average $42,012,371.68 © DTCC 11 Key Principals: Regulatory Reporting • Regulatory access dependent upon setup • Access controls and permissions depending on jurisdictional coverage – Access levels differ for prudential regulators, market regulators or central banks – Access to public reports, standardised reports and to ad-hoc report output (55 so far in 2012) • Transaction level data for certain regulators where access approved • Examples of standardised reports can include: – Exposure by reference entity – Counterparty exposure © DTCC 12 GTR Organic Growth Europe EMIR/ESMA •Functional growth of GTR as global requirements are defined for each asset class in each location. Japan - JFSA US - Dodd Frank ODRF Electronic Snapshot Platform © DTCC 913 Global Regulatory Outlook 2012 Q1 2012 Jan US Feb Q2 2012 Mar Apr May 2013 Q3 2012 Jun Jul Aug Q4 2012 Sep Oct Nov Q1 2013 Dec Feb Mar Apr May CFTC Credit & Rates Compliance Reporting (12 Oct) ODRF Commodities Compliance (30 Mar) SEC Sequencing Statement (12 Jun) Q3 2013 Jun Jul Aug Q4 2013 Sep Oct Nov Dec All data electronic – Credit & Rates CFTCSD registrations (Dec 31) All data electronic – Equities, FX & CFTC Equities, FX & Commodities Commodities Compliance Reporting (10 Jan) Non-SD/MSP All data Non-SD/MSP Reporting All Classes electronic –All Classes CFTC Swap Definitions (10 Jul) Japan Jan Q2 2013 DTCC draft TR Architecture proposal for JFSA and BOJ complete JFSA reporting requirements proposal published to DTCC and industry (24 Mar) DTCC rule proposal for JFSA complete (late April) JFSA TR Rules Effective (01 Nov) Hong Kong JFSA Regulatory Compliance Reporting (April 1) Back loading of all open positions as of April 1 TR Registration Open (18 May) HKMA HKTR-GTR Connectivity Validation Testing HKMA GTR Functional Testing Amendments to legislation (Q4) HKMA Industry UAT Response to previous consult published (11 Jul) HKMA Production Launch (TBC) HKMA Compliance Reporting (TBC) Taiwan Gre-Tai NDF, FX, Vanilla Swaps, Taiwan-Equity Compliance Reporting (01 Apr) Singapore DTCC response to MAS Consultation Paper submitted (26 Mar) Gre-Tai FX Forwards, Vanilla FX Options Compliance Reporting (31 Dec TBC) DTCC response to MAS Consultation Paper submitted (31 August) Gre-Tai All Products Compliance Reporting (30 Jun TBC) Compliance Reporting ( Mid 2013) DTCC response to MAS draft legislation India USD/INR interbank & FCY- INR Options (31 May) Phase III and IV compliance dates TBD by RBI Cross Currency Interbank forwards (CLS currencies) FCY- INR Interbank forwards & FCY –FCY Options (31 Aug) Canada DTCC awaits dates TBD by Canada EU ESMA technical standard consult response due (5 Aug) ESMA rules published (30 Sep) EC approves rules (31 Dec) ESMA-MIR Compliance Reporting ( Rates & Credit (1 Jul 2013 ) Summary RAG Status Australia Legislation complete ( 31 Dec TBD) Closing Comments to Proposals (15 June) Comments to Exposure Draft (20 August) Russia NSD announces TR (TBD) FFMS Reporting Compliance (Aug 2011) Russian Derivatives Conference in Moscow (11 Sep) Australia Compliance Reporting (Mid 2013 TBD) Target delivery date cannot currently be met Significant delivery risk exists, target date still possible On track Complete FFMS Reporting Anticipated Compliance (Dec 2012) Appendix Global Regulatory Outlook (continued) 2012 Q1 2012 Jan Feb Q2 2012 Mar Apr May 2013 Q3 2012 Jun Jul Aug Q4 2012 Sep Oct Nov Q1 2013 Dec Jan Feb Q2 2013 Mar Apr May Q3 2013 Jun Jul Aug Q4 2013 Sep Oct Nov Dec Argentina Brazil Chile Mexico China Outreach in progress Indonesia Awaiting publication of detailed rules and dates Korea Saudi Arabia South Africa Closing Comments to Proposals (1 Jun) Financial Markets Bill passed (TBD) Regulations passed (TBD) DTCC visit to South Africa ( 11 Jun) Switzerland Summary RAG Status Target delivery date cannot currently be met Turkey Significant delivery risk exists, target date still possible On track Complete Global Legislation – at a glance US US – Trade Repository rules under Dodd-Frank (CFTC rules): • December 20th, the CFTC approved rules for real-time reporting (Part 43) & swap data recordkeeping and reporting requirement (Part 45) Key reporting dates:` • CFTC has defined compliance dates that apply to both real-time public dissemination and regulator data (PET/confirmation). Initial compliance are below but these are still to be finalized: • Credit and Interest Rates (SD/MSP’s) – Oct 12th, 2012 • FX, Equities and Commodities (SD/MSP’s) – Jan 10th, 2013 • All asset classes – non-SD/MSP reporting begins April 10th, 2013 Reporting obligations • • DFA – one sided dealer reports all. SEF-DCO – are obligated. Reporting Requirements Real time – 30 minutes after execution – block - public disseminated PET – e.g. non cleared 1 hour after execution Confirmation – e.g. non cleared from confirm execution. 30mins for electronic, 24 hours for paper. Valuations – Daily reported T+1 Back loading. Final rules still pending (relating to reporting): • • SEC final reporting rules Extra-territoriality © DTCC 616 Global Legislation – at a glance Asia Hong Kong, Japan and Singapore moving ahead. • Growing support across the region for a global data set to ensure transparency of OTC derivatives markets Hong Kong • • • • Hong Kong has functionally completed its new financial regulations and has begun to build a repository for local trades. Regulators and market participants have expressed interest in establishing a system for trades to be reported through DTCC, serving as an industry “agent” to the Hong Kong repository. Phased reporting compliance by May 2013 Product coverage – initially Rates Swaps in HKD and NDF’s Japan The legal framework for trade reporting established. Under the law, Japan FSA can collect trade data or delegate that authority to an off-shore entity, Officials indicate they prefer to use established repository providers TR rules effective November 2012 Reporting compliance start 1st April 2013 Product coverage – Rates, Credit, Equities, FX Singapore The Monetary Authority of Singapore (MAS) has indicated that its regulatory regime will be consistent with the structure outlined by the (ODRF). Consultation paper published January 2012 DTCC have worked with MAS to set-up a Data Center in Singapore to support APAC region © DTCC 717 Global Legislation – at a glance Europe European Market Infrastructure Regulation (EMIR): Goal is to increase transparency to allow identification of systemic risk issues by regulators Establishes reporting obligation Outlines business/operational requirements for Trade Repositories Estimated go live 6 month window from compliance date of the 1st Jan 2013 Markets in Financial Instruments Directive & Regulation (MiFID & MiFIR): Goal is to introduce more completeness of post-trade transaction reporting than exists today Trade Repositories register as Approved Reporting Mechanisms (ARMs) to help identify market abuse (MAD/MAR) Estimate compliance for end 2014/beginning 2015 Reporting obligations • • • • both sides report without duplication recognition of non dealer limitations Reporting party has the choice of reporting route. Listed products. The Futures and Options Association (FOA) which is the listed market equivalent of ISDA are engaging with certain Euro regulators to highlight the amount of reporting that already exists for listed products and try to persuade ESMA that there is duplication here. Reporting Requirements ESMA Final draft of Technical Standards to be approved by 31st December 2012. All Derivatives, not just OTC. End of Day, key economic fields (PET) Valuations/Collateral. Participants have 90 days to report derivative contracts that are outstanding on 16 August 2012, and are still outstanding on the reporting start date of respective asset classes. Participants have 3 years to report derivative contracts entered into before, on or after 16 August 2012, that are not outstanding on or after reporting start date of respective asset classes. © DTCC 18 3 Global Legislation – at a glance Europe Cont’d Legislative Scope Event scope Who reports Data elements definition frequency Push/ pull EMIR All derivatives Each trade Counterparties and CCPs (without duplication ) ESMA Level T+1 2 Pull Mechanism (regulatory access) MiFID + MiFIR All instruments Counterparties (both) ESMA Level T+1 2 Push to regulators (transmit reports) Each trade © DTCC 419 EU Legislation time line EMIR Level 1 text released on 15 June 2012 EMIR draft standards (Level 2 text) to be open for consultation before week ending 25th June for 5-6 weeks consultation. Level 1 text to go through final phase of procedural approval by the council 20 and 21 June 2012 To be published in EU’s official journal by end of July 2012 Level 2 text to be presented by ESMA on September 30 To be finalised by end of December/early January 2012 Registration of TR by January 1 2013 Level 1 text to be effective mid- late August 2012 Mandatory reporting Phased approach per asset class Credit & Rates- 1, July 2013 Other asset classes 1, Jan 2014 20 © DTCC 5 DTCC Global Trade Repository solution GTR Services & Operating Model - Core solution Core solution: • Single interface for global regulatory reporting • Rules based regulator access to positions • Participants reporting to enable regulatory position management • Replication to local regulators where required • Public price dissemination where required • Cross-asset including 5 main OTC asset classes © DTCC 10 Global Coverage DTCC Global Trade Repository • • • • • • Offices in NY, London and Brussels Offices in Tokyo and Singapore soon Rules based regulator access to positions Participants reporting to enable regulatory position management Replication to local regulators where required Public price dissemination where required Connected local repository (US SDR) • One trade message Global Data One Record • One interface • Multiple regulatory solutions • Participant entity logic • Reporting rules logic GTR • Regulator entitlement logic Data Entitlements & rules logic JPN TR Local repository Direct Regulatory Access. © DTCC 11 Global Trade Repository services: Connectivity Supported Connectivity • • • • • MQ Secure FTP Web Service Web Upload SWIFT Message Formats • • CSV FpML © DTCC 12 DTCC Global Trade Repository solution One Global Record GTR ADMIN FIELDS • Data fields based on ESMA Final Draft technical standards for the regulation on OTC Derivatives, CCPs and Trade Repositories, June 2012 GTR primary fields (common across all regulators) • 59 data fields is a subset of the core 125 PET fields that has already being built in the GTR solution to support Dodd Frank requirement. JFSA Only required fields • 90% of ESMA fields are common to the current ODRF/DF/JFSA requirements. ESMA Only required fields CFTC Only required fields HKMA Only required fields © DTCC 13 ESMA Requirements- TR Table of fields Table 1 PARTIES TO THE CONTRACT • Reporting timestamp • Counterparty ID • ID of the other counterparty • Name of the counterparty • Domicile of the counterparty • Corporate sector of the counterparty • Financial or non-financial nature of the counterparty • Broker ID • Reporting entity ID • Clearing member ID • Beneficiary ID • Trading capacity • Counterparty side • Contract with non-EEA counterparty • Directly linked to commercial activity or treasury financing • Clearing threshold • Mark to market value of contract • Currency of mark to market value of the contract • Valuation date • Valuation time • Valuation type • Collateralisation • Collateral portfolio • Collateral portfolio code • Value of the collateral • Currency of the collateral value • • • • • Table 2 - Common Data FIELD Section 2a - Contract type Taxonomy used Product ID 1 • • • • • Product ID 2 Underlying Notional currency 1 Notional currency 2 Deliverable currency • • • • • • • • • • • • • • • • • • • • • • • • • • • • • Section 2b - Details on the transaction Trade ID Transaction reference number Venue of execution Compression Price / rate Price notation Notional amount Price multiplier Quantity Up-front payment Delivery type Execution timestamp Effective date Maturity date Termination date Date of Settlement Master Agreement type Master Agreement version Section 2c - Risk mitigation /Reporting Confirmation timestamp Confirmation means Section 2d – Clearing Clearing obligation Cleared Clearing timestamp CCP Intragroup Section 2e Interest Rates • • • • • • • • • • • • • • • • • • • • • • • • • • Fixed rate of leg 1 Fixed rate of leg 2 Fixed rate day count Fixed leg payment frequency Floating rate payment frequency Floating rate reset frequency Floating rate of leg 1 Floating rate of leg 2 Section 2f – Foreign Exchange Currency 2 Exchange rate 1 Forward exchange rate Exchange rate basis Section 2g - Commodities General Commodity base Commodity details Energy Delivery point or zone Interconnection Point Load type Delivery start date and time Delivery end date and time Contract capacity Quantity Unit Price/time interval quantities • • • • • • • Section 2h - Options Option type Option style (exercise) Strike price (cap/floor rate) Section 2i - Modifications to the report Action type Details of action type © DTCC 14 DTCC Global Trade Repository solution GTR Functionality and Message Interfaces Message Type Message Summary RT (Real-Time) Provide real-time price information for public dissemination • RT messages are not included in Regulatory position reports. • GTR Rules determine whether or not to disseminate the price *Not needed for DCO* PET (Primary Economic Terms) Transaction level trade message. • Trades reported via PET are included in Regulatory position reports. • Transaction Types supported include Trade, Novation, Termination, Amendment, etc • GTR reported position will take into account all reported transactions for a USI Confirm Confirmed details of trade • Trades reported via Confirm are included in Regulatory position reports. • Transaction Types supported include Trade, Novation, Termination, Amendment, etc • GTR reported position will take into account all reported transactions for a USI Snapshot Full and Partial Portfolio position report. • Positions reported via Snapshot are included in Regulatory position reports. • May be combined with transaction messages to report position. Valuation Report valuation of a position to the GTR • Valuation provided per USI Event Processing Provide Data related to events which result in trade modification to large numbers of trades across counterparties (compression, credit events, etc) • Provided by event processors / vendors (e.g. TriOptima, TIW) © DTCC 15 Snapshot vs. Life Cycle Day 1 Day 2 Day 3 SnapShot – full file Replace. • • • • • Day 1 Day 2 Partial SnapShot – Delta Reporting • • • • • Day 1 Day 2 Increase The is a method of uploading your full portfolio. Each file overwrites all of the previous records. can be done at a frequency of the users choice. The GTR provides a variance report. The GTR stores the historical records The is a method of uploading only what has change in your portfolio. Either a full record or an economic within a full record which replaces the previous record. can be done at the frequency of the users choice. The GTR provides a variance report. The GTR stores the historical records Life Cycle – Transaction based. • • • • • This is a method of sending in just specific transaction data. There are various transaction types such as increase, termination, novation etc. The GTR takes the previous days record then adds the transaction to create a new transaction can be done at the frequency of the users choice. The GTR stores the historical records © DTCC 16 Exchange Traded flow chart Counterparty B Clearing Agent β Derivatives Exchange/S EF α CCP/Clearing house Exchange can send “primary economic terms” incl. USI to GTR near real time for α and β Global Trade Repository Counterparty A/Execution broker Clearing Agent Local FSA Current MiFID transaction reporting Client Client Reporting interface/Middleware Operational flow Reporting flow © DTCC 18 Global Trade Repository services: Participant Reporting • Participants see: – Trades submitted by the participant – Trades submitted by other parties where the participant is named as the counterparty – Trades submitted by or against other legal entities that the participant is permissioned (explicit permission granted) to see • Certain trade attributes will be masked from counterparties (internal trade ref, trade valuation, trader id) • Reporting suite will include: – Submission reports – Position reports – Reconciliation/break reports © DTCC 19 International Identifiers 3 main identifiers which have growing international support: • Counterparty - Legal entity identifier (LEI) • Trade – Unique trade identifier (UTI) / Unique swap identifier (USI) • Product – Taxonomy / Unique product identifier (UPI) © DTCC 22 International Identifiers Counterparty - Legal Entity Identifier (LEI) Overview: • • • • Common schema to identify market participants and some related data LEI is backed by global political and regulatory community and you can register a CICI (CFTC Interim Compliant Identifier) via https://www.ciciutility.org/. Contact the helpdesk by email LEITestFile@dtcc.com CFTC finalized rules requiring firms to register for an LEI within 90 days of reporting (interim LEI is known as the CICI) Industry (group of trade associations) has recommended principles and a proposed solution to the regulatory community – • Initial design focuses on information that can be publicly validated – • ISO 17442: 18 alphanumeric and 2 check digits Address, jurisdiction, limited hierarchy SIFMA official document on LEI (http://www.sifma.org/uploadedfiles/issues/technology_and_operations/legal_entity_identifier/lei-preliminary-scope-plan.pdf) Trade Repository implications: • Only one LEI per legal entity conflicts with the way firms use their account structure today – • Each GTR identifier will have a namespace + value – – • Funds manager, branch locations, PB designations, trading strategy/desk identifiers Mapping table managed by repository Multiple alternate ID’s can be set-up by each participant in the GTR (LEI, CICI, BIC, AVID) Other considerations include data privacy issues, LEI for individuals, and impact of non-participating jurisdictions © DTCC 23 International Identifiers Trade - Unique Trade Identifier (UTI) / Unique Swap Identifier (USI) • A Unique Swap Identifier (UTI) must be assigned to every new transaction • Unique global trade IDs are required in order to ensure accurate identification of reported trades. This will improve the ability to reconcile trades both with and between counterparties, CCPs and TRs, and reduce the likelihood of duplicate reporting. • ESMA has placed the responsibility of creating UTIs on the counterparties to the contract. • The UTI should remain constant despite any changes reporting parties might make to their own internal trade references • USI/UTI gaining global recognition © DTCC 24 International Identifiers Product – Taxonomy / Unique Product Identifiers (UPI) • This is the identifier that is to be used to describe the underlying product • Today each firm creates it’s own set of product identifiers which drive risk aggregation, system defaults, and various workflows within the organization • No clear direction on timing of a UPI • Eventually UPI may be used to default field values within the trade • ISDA worked with the industry to develop a high-level matrix of taxonomy values – – • The GTR will leverage these taxonomy values as identifiers of products reported by participants Each asset-class has a unique taxonomy but a common structure Link to ISDA OTC Taxonomies and UPI - http://www2.isda.org/otc-taxonomies-andupi/ © DTCC 25 Current clearing timelines 2012 2013 27th Nov Draft RTS 29th April Entry into force 27th Dec Endorsement by Commission 28th March Accept by Council And Parliament 2014 28th July Latest potential date for CCP authorisation 28th October CCP authorisation Window opens 30th May Notification for the clearing obligation 28th April Notification of Authorised CCPs obligation © DTCC 34 Clearing obligation • All OTC derivative contracts must be cleared if: – The contract has been determined to be clearable and is notified in ESMA’s public register – top down and bottom up process • ESMA to decide within 6 months of notification date – There is a CCP authorised to clear that class of contracts • Not likely before April 2014: – For a non-financial, the contract value exceeds the clearing threshold • If one asset class goes over the threshold, all need to be reported • Exemptions: intragroup transactions © DTCC 35 Clearing thresholds for non-financials • For a non financial, below these thresholds, clearing obligation does not apply: (a) EUR 1 billion in gross notional value for OTC credit or equity derivative contracts; (b) EUR 3 billion in gross notional value for OTC interest rate, FX and commodity derivative contracts; (c) EUR 3 billion in gross notional value for OTC foreign exchange derivative contracts; (d) EUR 3 billion in gross notional value for ‘other’ OTC derivative contracts •Definition of non-financial counterparty –EMIR Article 2, page 58 – Offset by hedging transactions which are not included in the gross notional value •Definition of hedging – ESMA RTS Article III.V, para 58-72 © DTCC 36 Contact Information Europe and Middle East Daniel Olajide dolajide@dtcc.com Hanna Svensson hsvensson@dtcc.com Daniela Aulinger daulinger@dtcc.com + 44 207 650 1433 + 44 207 650 1546 +44 207 650 1545 Asia-Pacific Katherine Delp Shoko Kitamura +81 3 6721 8876 +81 3 6721 8876 Kdelp@dtcc.com Skitamura@dtcc.com Canada, North, Central and South America. John Dimeglio jdimeglio@dtcc.com John Kim jkim@dtcc.com Frank Lupica flupica@dtcc.com + 1 212 855 3531 + 1 212 855 3104 + 1 212 855 2430 Global GTR Lead Andrew Green + 44 207 650 1410 agreen1@dtcc.com Onboarding Hotlines: North America 1-888-382-2721 (Option 3, 2, and 1) Europe and Asia +44 (0)20-7136-6328 (Option 2 and 2) GTR_onboarding@dtcc.com © DTCC 26