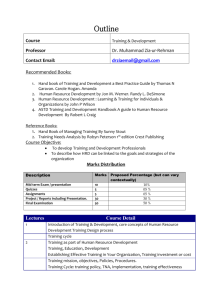

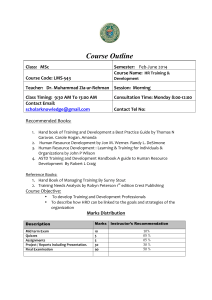

RADS - Unisa

advertisement

Dr Paul Jourdan, Integrated Development Consultant SAIMM, Cape Town, August 2010 Part I Africa’s Natural Resources • • • • • • Africa’s Natural Resources Agriculture – Contributes 40% of African GDP % provides livelihood for 60% of population, but largest user of scarce water – Enormous unrealised potential (low yields & only x% under cultivation) – But, agri-commodities exported without processing (beneficiation) Minerals – World’s top producer of numerous mineral commodities; – Has world’s greatest resources of many more; – Africa lacks systematic geo-survey: could be > resources; – But exported as ores, concs, metals: Need > beneficiation. Energy – Significant fossil fuels (oil, gas and coal) – Large biomass and bio-fuels potential (ethanol, bio-diesel) – Massive hydro-electric potential (Inga 45GW, Congo River 200GW) Forestry – 22% of African land is forested (650m hectares= 17% of world total); – Deforestation: Africa’s net change highest globally = -0.78% p.a; – Huge silviculture potential, but exported as logs/chips: need > bene. Fishing – Decline in catch rate (international poaching! over-harvesting); – 68% of marine protected areas under threat; – Aquaculture/mariculture still nascent (large potential) Tourism – Major potential (world’s greatest diversity: culture, flora, fauna, geomorphology) – Increasingly important source of livelihood Africa is well-endowed with mineral resources Mineral Production & Known Resources (‘04) (however, much of Africa is still un-surveyed) Mineral Production Rank Reserves Rank PGMs* 54% 1 60+% 1 Phosphate 27% 1 66% 1 Gold 20% 1 42% 1 Chromium 40% 1 44% 1 Manganese 28% 2 82% 1 Vanadium 51% 1 95% 1 Cobalt 18% 1 55+% 1 Diamonds 78% 1 88% 1 Aluminium 4% 7 45% 1 Also Ti (20%), U (20%), Fe (17%), Cu (13%), etc. *PGMs: Platinum Group Minerals Geology & Mineral Resources Areas covered with recent overburden (unknown underlying geology) African Geology Africa’s Undiscovered Resources Source: USGS; USGS Mineral Resources Program. The Global Mineral Resource Assessment Project Although private exploration spend is increasing, this isn’t an alternative to systematic geo-survey! Arica is 20% of the crust area and 15% of exploration spend Africa also has significant energy resources: fossil fuels (oil, gas, coal), HEP & geothermal Goethermal Potential: Great African Rift Valley Gulf of Guinea considered to be one of the world’s most prospective oil & gas terrains And Africa has huge HEP (Congo R: 200GW) Yet most Africans don’t have access to electricity and rely on biomass for energy! And Africa has huge water potential… (except for North Africa) Withdrawals by sector Region Agriculture Communities Industries Total As % of total % of internal resources x 10 6 m³/yr x 10 6 m³/yr x 10 6 m³/yr x 10 6 m³/yr % % 65 000 (85%) 5 500 (7%) 5 800 18%) 76 300 (100 %) 50.9 152.6 Sudano-Sahelian 22 600 (94%) 1 200 (5%) 300 (1%) 24 100 (100%) 16.1 14.2 Gulf of Guinea 3 800 (62%) 1 600 (26%) 700 (12%) 6 100 (100%) 4.1 0.6 Central 600 (43%) 600 (43%) 200 (14%) 1 400 (100%) 0.9 0.1 Eastern 5 400 (83%) 900 (14%) 200 (3%) 6 500 (100%) 4.3 2.5 Southern 14 100 (75%) 3 000 (16%) 1 800 (9%) 18 900 (100%) 12.6 6.9 Total 127 900 (85%) 13 000 (9%) 9 020 (6%) 149 920 (100%) 100 0 3.8 Northern But access (water infrastructure) is lacking! Source: FAO And agricultural potential... Part II Future Resources Demand & Prices The demand boom has disproportionately increased mineral prices! (also lower mineral supply elasticity) FeMn Ni Cu Cotton Cocoa Oil Soy Sugar Maize Beyond the US Toxic Assets Crisis? Source: IMF: www.imf.org/external/np/res/commod/chart1.pdf Asian Boom: New “scramble for resources”? High intensity, Africa’s new opportunity? High intensity, sellers market: Colonial system Low intensity, buyers market: stagnation & instability Steel- good proxy for most minerals How long will boom last? However, prices will fall with increasing supply over the medium-long term, but at a higher level (lower grades) Steel Intensity ? (all metals proxy) PRC India China + India > 2X pop’n of First World! ~$16k/capita Data Source: BHPB 2006 Part III Beyond a hole in the ground: Resource Sustainability? Minerals Sustainability? Resource Industry Linkages (beyond resource rents) 3. DOWNSTREAM 1. INFRASTRUCTURE: Puts in critical infra Use wasting asset (transport, energy) for other non-minerals to underpin growth in economic potential sustainable sectors 2. UPSTREAM Inputs: Plant, machinery, equipment, consumables, services, (export) Value-addition Beneficiation Export of resourcebased articles 4. TECHNOLOGICAL Linkages: HRD, R&D “Nursery” for new tech clusters, adaptable to other sectors The direct potential linkage is the provision of infrastructure that could be used to realise other resources potential (e.g. agriculture) expl. capital goods • geophysical • drilling • survey • etc. mining capital goods • drilling • cutting • hauling • hoisting, etc. processing cap. goods • crushers/mills • hydromet plant • materials handling • furnaces, etc. Refining Cap. Goods •Smelters •Furnaces •Electro winning cells •Casters Exploration Mining Mineral Processing Smelting & Refining exploration services • GIS • analytical • data processing • financing • etc mining services • mine planning •consumables/spares • sub-contracting • financing • analytical, etc processing services • comminution • grinding media • chem/reagects • process control • analytical, etc Refining services •Reductants •Chemicals •Assaying •Gas & elec supply Resources inputs sector (up-stream) has a comparative advantage in: Fabrication Cap.goods •Rolling •Moulding •Machining •assembling Fabrication Value adding services •Design •Marketing •Distribution •Services 1. Relatively large local market 2. Development of techs for local conditions 3. National asset: permits for concessioning with linkages conditionality The resource curse can be avoided! “Deepening” the resource sector linkages: development of the resource inputs & outputs industries is critical , Finland: 1970 on primary commodities (pc- mining & forestry) inverted U-curve, shifts to 1998 Finland:but e.g. Forestrymanufacturing curvegoods (mfgrew capital resources inputs & (machinery) & value-added outputs/beneficiation). exports (wood manufactures, pulp/paper) Thru’on investment in R&D! Chile: 1970 manufacturing Ucurve (ISI), but shifts to 1998 primary commodities (mining & agriculture) curve, after opening up its economy (coup) in the 70’s. Finland managed to shift from a 1970 resources (pc) trajectory to a 1998 manufactures (mf) trajectory, through the development of its resources inputs (machinery) and outputs (value-addition) sectors (source Palma, G. 2004) Using a natural comparative advantage to develop a competitive advantage Finland: The mature forestry industrial cluster 1997a FORWARD LINKAGES BACKWARD LINKAGES 1. Specialized inputs Chemical and biological inputs (for production of fibres, fillers, bleaches) 2. Machinery and equipment For harvesting (cutting, stripping, haulage) For processing (for production of chips, sawmills, pulverization) For paper manufacture (30% of the world market) 3. Specialized services Consultancy services on forest management Research institutes on biogenetics, chemistry and silviculture Source: Ramos 1998 p111 (CEPAL Review, #68, 12/1998); NATURAL COMPARATIVE ADVANTAGE Abundant forestry reserves and plantations (400-600m3 per capita)b SIDE LINKAGES Related activities Electricity generation Process automation Marketing Logistics Environment industries (paper) Mining (sulphuric acid) 1. Roundwood Sawnwood Plywood (40% of the world market) 2. Wood products Furniture For construction 3. Wood pulp 4. Paper and cardboard Newsprint Art paper (25% of the world market) Toilet paper Packaging Special products a: Generates 25% of Finland’s exports; b: Compared with 25-30m3 per capita in the rest of the world. HC Technology Strategy: (Norway: OG21 tech strategy) Prolong the life of the resources, migrate to exports of resource techs and value-added products: survive beyond resource depletion! >Tech exports >Gas VA R&D >recovery >resources The foreign resource capital “trade-off” In order to rapidly acquire the requisite capital and skills, African states have generally opted to realise their resource endowments through attracting foreign resource companies (TNCs & JRCs), rather than mainly relying on domestic capital. However, this “trade-off” comes with several possible “threats” 1.TNCs often have global purchasing strategies which are less likely to develop local suppliers (linkages), 2.TNCs tend to optimise their global processing (beneficiation) facilities which can deny local downstream opportunities; 3.TNCs locate their tech development (R&D) in OECD countries, thereby denying Africa the development of this critical sidestream capacity; 4.TNCs also tend to locate their high level HRD in OECD countries (often linked to their R&D university partners), which could deny African states the development of this seminal capacity; 5.In the longer term there are clearly political downsides to a resource sector dominated by foreign capital; 6.Finally there is the TNC “core competence” conundrum. Inappropriate Mineral Regimes Africa is not capturing mineral rents! High prices: colonial mineral regimes: Procolonisers/TNCs High Prices: WB “free mining” regimes- minimal linkages! High prices: Post-colonial regimes: Strongly national Steel- good proxy for most minerals Low prices: WB revisions: Overly pro-TNC! Extracting Greater Benefits? Beyond 1st-come-1st-served regimes? Exploration Terrains HIGH RISK Exploration Terrain Exploration License Automaticity RoR*/RRT tax Mining Charter type conditions *ROR: Rate-of-Return MID RISK Geo-Reserve Terrain •Further geosurvey; •Risk exploration for future stepin rights. Mining Licence LOW RISK Delineation Terrain Auction on: • rent share • Infra development • Up/downstream invest • equity (“mining charter”) • local HRD & R&D: Tech! Key Elements in Maximising the Developmental Impact (price discovery) Bid evaluation should be based on several transparent weighted criteria: • State revenue over the life of the concession; – – – – Tax, Royalties, Resource rent taxes (RRT), Annual investment into local HRD & R&D! • Excess capex: over-dimensioning of project infrastructure for use by other sectors:(transport, power, water, etc.) • Upstream investments (project inputs); • Downstream investments (beneficiation) • Technology transfer & local R&D Recent W.African Fe ore concession example: Direct project capex (mine, power, rail, port, water) circa $1.5bn, but by using the above concession criteria the top bid was at $4.4bn, including a downstream steel plant, river basin management (irrigation & agro-industries), a cement plant, 50%-100% extra infrastructure capacity and higher RRT. SA Example- The lost potential impact of concessioning the state’s manganese assets against developmental goals In 2002/3 the state’s manganese assets were given a diverse group of B-B BEE companies that have failed to optimise the potential developmental impacts of this world-class mineral asset (possibly the best unexploited manganese property in the world). Before these assets were “given” to the B-B BEE interests several steel majors had shown a great interest in acquiring them. This led to a high level check, in India & China, on the appetite for steel companies to establish a world scale steel plant in South Africa in exchange for this asset and the response was positive. Consequently it was that the state’s unique manganese resources should rather be auctioned against the following criteria: Job creation (direct & indirect); Downstream beneficiation (ferro-alloys, Mn, Mn salts, etc.); The establishment of a world-scale steel plant for flat & long products that would sell into the SA market at EPPs (export parity prices) and thereby discipline Mittal’s monopoly pricing; Revenue stream to government (royalty, taxes: RRT?); Technology transfer & local R&D; B-B BEE. Unfortunately this proposal was rejected and instead these assets were given to several B-B BEE companies that lacked the resources to optimise the propulsive impact of these national assets. A rough calculation on the potential jobs lost by this “give away” came up with a figure of over 100,000, mainly due to the impact of lowering steel prices to our manufacturing sector by 30% to 50% (after labour, steel is the most important input by value into SA’s capital goods sector). One of numerous opportunities lost! Facilitation of up- and down-stream linkages 1.Minerals are a finite national asset: build linkages into the concession (license) conditions (through “price discovery”) 2.Access to competitively priced feedstocks: • Downstream: restrict exports of crude resources: export tariffs? • Upstream: Capital goods- steel and special steels (poss. for regional iron/steel production facilities); 3.Access to concessionary capital: DFIs: local, regional,continental & global. Venture capital funds (PPPs with TNCs?); 4.Competitive currency (forex rate): Ameliorate the Dutch Disease by keeping windfall rents offshore and committing to long term physical & social infrastructure (drip-feed back into economy)? 5.Access to requisite skills: Dedicated HRD institutions (JV’s w/foreign Universities). Concession HR “indigenisation” conditions. Strategy to repatriate the huge African skills “Diaspora”? 6.Access to technology: Establish resources up- and down-stream research facilities (R&D PPPs?) and use of resource rents for R&D. Make tech transfer/development a concession condition! 7.Access to supply contracts: Ensure that equitable access for local suppliers. Judicious use of tariffs for infant industries. Ensure foreign supplier localisation through local content milestones? 8.Infrastructure: Establish world-class human (skills)& physical infra (transport, energy, water, telecoms, etc.) using resource rents. However! Africa’s huge resources potential is critically constrained by poor infrastructure •Africa is the highest continent (few navigable rivers), > infra cost and O&M cost; •93% of Africa in the tropics (ITCZ, high ppt): >cost of infrastructure provision and O&M; •Incoherent European balkanisation resulted in many African states being landlocked; •Africa has only 10% of land within 100km of coast (cf. 18% OECD & 27% Latin America) and •Only 21% of its people live within 100km of coast (cf. 69% OECD & 42% Latin America); Resulting in Africa having the world’s highest relative logistics costs (poor infrastructure) Africa’s potential could be realised through integrated Development Corridors (not a neocolonial “scramble for resources”) Resource-based African Development Strategy: 4 sub-strategies Minerals, Agric, Forestry Resource Processing Refining Resource Capital Goods & Services (generic tech) Lateral Migration into Unrelated knowledgebased Industries Intermediate products Fabrication Enhance resource-tech (HRD, R&D) capacity eg: process control construction equipment, atmospheric control, pumping, materials handling, etc, etc…. Resource-based African Development Strategy: 4 sub-strategies Minerals, Agric, Forestry Resource Processing Intermediate products Fabrication Refining Strategy 1: Beneficiation (RBI) Resource Capital Goods & Enhance resource-tech Strategy 2: Resource Inputs Services (generic tech) (HRD, R&D) capacity eg: process control construction equipment, atmospheric control, pumping, materials handling, etc, etc…. Lateral Migration into Strategy 3: Lateral Unrelated knowledgebased Industries Migration Strategy 4: Infrastructure Africa’s huge resources potential is critically constrained by poor infrastructure •Africa is the highest continent (few navigable rivers), > infra cost and O&M cost; •93% of Africa in the tropics (ITCZ, high ppt): >cost of infrastructure provision and O&M; •Incoherent European balkanisation resulted in many African states being landlocked; •Africa has only 10% of land within 100km of coast (cf. 18% OECD & 27% Latin America) and •Only 21% of its people live within 100km of coast (cf. 69% OECD & 42% Latin America); Resulting in Africa having the world’s highest relative logistics costs (poor infrastructure) Insurance and freight import values for selected groups of countries Freight & insurance as a % of cost 1985 1990 1995 1997 World total 4.6 5.5 4.4 4.1 Developed market economy countries 3.8 4.2 3.5 3.4 Developing countries total: of which: 7.7 11.2 7.4 6.5 Africa 11.3 10.6 11.3 10 America 6.7 12.8 6.4 5.6 Asia 7.7 11.2 7.4 6.5 Landlocked Africa: 14.8 15.8 10.7 .. East Africa 17.9 20.2 16.7 14.6 Southern Africa 12.5 11.5 9.9 .. West Africa 30 30.2 24.6 .. Least developed countries 13.8 14.6 12.5 Source: UNCTAD Africa’s logistics costs ~250% global average! “There are in Africa none of those great inlets, such as the Baltic and Adriatic seas in Europe, the Mediterranean and Euxine seas in both Europe and Asia, and the gulphs of Arabia, Persia, India, Bengal, and Siam in Asia, to carry maritime commerce into the interior parts of that great continent: and the great rivers of Africa are at too great a distance from one another to give occasion to any considerable inland navigation.” Smith, Adam. 1976 [1776]. An Inquiry into the Nature and Causes of the Wealth of Nations. Chicago: University of Chicago Press (Cannan’s edition of the Wealth of Nations was originally published in 1904 by Methuen & Co. Ltd. First Edition in 1776). page 21 Catalyse other Sectors & Areas (agri, tourism, etc.) Infrastructure: transport, energy, skills, R&D e.g. plant, equipment, after-market, etc. Processing capital goods Intermediates capital goods Feedstocks & Tech. (bene.) Exploitation . capital goods: BEYOND COMMODITIES? Use Asian resource demand to kick-start a Intermediates Resources Processing (feedstocks) Strategy Exploitation Resource-based African Development “RADS” Exploitation services: e.g. financial, technical, consumables, logistics, energy, skills, etc. Processing services Intermediates services Resource inputs: key to tech development Manufacturing (e.g. cap goods) Recap: Schematic RADS Phasing (relative economic importance) Phase 1 I Phase 2 Phase 3 Phase 4 Resource Beneficiation (value-addition) Resource Exploitation Densification Infrastructure II Resource Infrastructure Skill intensity (HRD) III IV Unskilled resource labour Rents from Resource diversification industries Diverse tax base Resource rents (tax) Resource Inputs production & Lateral migration (diversification) V Resource R&D. high level skills and tech development VI Complex regulation, M&E, arbitration, governance Local judicial system VII Contract/license resource & infra (PPP) governance Resource Exploitation & infrastructure phase Resource Consumables & HRD phase Resource R&D, capital goods & services phase Lateral migration & diversification phase Schematic RADS Phasing (relative economic importance) Phase 1 I Phase 2 Phase 3 Phase 4 Resource Beneficiation (value-addition) Resource Exploitation Densification Infrastructure II Resource Infrastructure Skill intensity (HRD) III IV V VI Unskilled resource labour Resource rents (tax) Rents from Resource diversification industries Diverse tax base Resource Inputs production & Lateral migration (diversification) Local Resources Technology Development isR&D. Critical for Resource high level skills and tech development Progression! Complex regulation, M&E, arbitration, governance Local judicial system VII Contract/license resource & infra (PPP) governance Resource Exploitation & infrastructure phase Resource Consumables & HRD phase Resource R&D, capital goods & services phase Lateral migration & diversification phase Parliament SA Government Stakeholders: Labour, Business, Civil Society Ministries: DMR, DME, EDD, DTI, DST, NT, DPE, etc. SOEs & State Institutions (Nat. Treasury) (EDD) IDC: (Nat. Treasury) (DMR) (DST) “Future Fund” “Mindevco”* “RCCC”* CGS “MRTC”* • Hold all state equity in mining & beneficiation; • Hold & develop state Strategic Mineral assets; • Hold & dev. “partially known” mineral assets; • 1st sight of all new CGS geo-data (3m); • Partner BEE co’s, <50%. • Develop systems for resources competitive concessioning; • Dev. assessment criteria & relative weightings; • Oversee resource auctions/concessions; • M&E of concessions & licenses. • Categorise SA into “known”, “unknown” & “partially known” assets; • M&E of all exploration/ prospecting licenses; • Work w/Mindevco in ID & dev. of new assets; • Accel. geo-mapping & ID of new assets • Offshore fund to accumulate min. rents: RRT &, poss, royalties. • “Drip feed” back into local & regional economies for longterm: 1. infrastructure, 2. HRD, 3. geo-knowledge & 4. tech development • Develop a SA resources tech & HRD strategy; • Rebuild/reinforce the tech cluster: Mintek, Necsa, CSIR (ex Comro), etc. & HRD cluster (HEIs); • M&E of resource tech cluster & resource HRD institutions (HEIs, etc.). * proposed “Mineral Development Corporation”, “Resources Concessions & Compliance Commission”, “Mineral Resources Technology Commission” 1. Mineral resources are a wasting asset that must be optimised whilst still extant; 2. Resource-rich economies generally perform worse than resource-rich economies (“resource curse”); 3. If the resource-linkages cannot be made, then the minerals are probably best left in the ground! Thank You paulj1952@gmail.com