Capital Management

advertisement

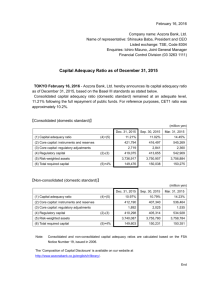

Capital Management • Outline – – – – – Definition of bank capital Role of bank capital Capital adequacy Shareholders’ viewpoint Trends in bank capital Definition of bank capital • Equity – Common stock, preferred stock, surplus, and undivided profits equals the book value of equity. – Market value of equity • Long-term debt – Subordinated notes and debentures – Interest payments are tax deductible • Reserves – Provision for loan losses (PLL) is expensed on the income statement – Reserve for loan losses is a capital account on the right-hand-side of the balance sheet Definition of bank capital As an example of what happens when banks charge off loans, assume that a bank has a PLL equal to $1,000,000 and the reserve for loan losses is $3,000,000. If the bank charged off $800,000 in loan losses during the year, the reserves for loan losses is calculated as follows: Reserves for loan losses, beginning of 199X $3,000,000 Less: Charge-offs during 199X 800,000 Plus: Recoveries during 199X on loans previously charged off 80,000 Plus: Provision for loan losses, 199X 1,000,000 Reserves for loan losses, end of 199X $3,280,000 Role of bank capital • Source of funds – Start-up costs – Growth or expansion (mergers and acquisitions) – Modernization costs • Cushion to absorb unexpected operating losses – Insufficient capital to absorb losses will cause insolvency – Long-term debt can only absorb losses in the event of institution failure • Adequate capital – Regulatory requirements to promote bank safety and soundness – Mitigate moral hazard problems of deposit insurance by increasing shareholders’ exposure to bank operating losses – Market confidence is important to depositors and other bank claimants Capital adequacy • Bank regulators and bank shareholders have different views of capital adequacy – Regulators are more concerned with the lower end of the distribution of bank earnings. – Shareholders focus more on the central part of the distribution, or the expected return available to them. – Regulators perceive that financial risk increases the probability of insolvency, as greater variability of earnings makes it more likely that negative earnings could eliminate bank capital. – Regulators must close banks due to capital impairment. – Excessive capital regulation could inhibit the competitiveness and efficiency of the banking system. Capital adequacy • Capital standards – Office of the Comptroller of the Currency (OCC) used a capital-deposit rate to measure capital adequacy in the early 1900s. This ratio was motivated by fears of bank runs. – The Federal Reserve Board (FRB) began using the Form for Analyzing Bank Capital (FABC) in the 1950s which classified assets into 6 different risk categories. By contrast, the OCC in the 1960s moved to a subjective system of capital evaluation (i.e., management quality, asset liquidity, operating expenses, deposit composition, etc.). – Problems with early standards: Different standards applied by different regulators (OCC, FRB, and FDIC). Not enforceable by law until the International Lending Act of 1983. Fairness was questionable with small banks required to keep higher capital requirements than large banks. Capital adequacy • Uniform capital requirements – Minimum primary capital-to-assets ratios established in 1981 by all three federal bank regulators (i.e., equity capital and reserves). A ratio of 5% to 6% was required. Some larger institutions increased their risk taking in response to this uniform capital requirement approach. – Risk-based capital requirements were established in 1988 under the Basle Agreement among 12 industrialized nations under auspices of the Bank for International Settlements (BIS). Like the FABC approach of the Fed, bank assets are classified into 4 categories by risk level. In 1998 an amendment was made to include rules for securities trading of banks. Two categories of capital: (1) Tier 1 or “core” capital and (2) Tier 2 or “supplemental” capital. : Capital adequacy Capital Tier 1 Tier 1 + Tier 2 (Total Capital) Risk-Adjusted Assets Total Assets 4% 3% 8% No Requirement COMPONENTS AND RULES GOVERNING QUALIFYING CAPITAL UNDER RISKBASED CAPITAL RULES COMPONENTS MINIMUM REQUIREMENTS TIER 1 (CORE) CAPITAL Must equal or exceed 4% or risk-weighted assets (RWAs) Common shareholder's equity and retained earnings Qualifying noncumulative perpetual preferred stock and related surplus Minority interests in equity accounts of consolidated subsidiaries Less: Goodwill and some intangible assets Subsidiaries of S&Ls in some cases No limit No limit, but regulatory warning against "undue reliance" No limit, but regulatory warning against "undue reliance" Capital adequacy TIER 2 (SUPPLEMENTARY) CAPITAL Limited to 100% of Tier 1 Allowance for Loan and Lease Losses Perpetual Preferred Stock Not Qualifying for Tier 1 Capital Hybrid Capital Instruments and Equity-Contract Notes3 Subordinated Debt and IntermediateTerm Preferred Stock Limited to 1.25% of RWAs No limit within Tier 2 No limit within Tier 2 Limited to 50% of Tier 1 Calculating Risk-Adjusted Assets: Assets Cash FNMA securities GO municipal bonds Home loans Commercial loans Total assets (1) In Thousands $ 100 1,000 1,500 3,000 5,000 $10,600 (2) (1)x(2) Risk Risk-Adj. Weight Assets 0.00 0.20 0.20 0.50 1.00 $ 0 200 300 1,500 5,000 $7,000 Capital adequacy • Risk-adjusted capital requirements for total capital: K = 8%[0(A1) + .20(A2) + .50(A3) + 1.0(A4)] K = 0.08[0($100) + .2($2,500) + .5($3,000) + 1.0 ($5,000)] = 0.08 [$7,000] = $560.00 Catagories of assets by credit risk are A1, A2, A3, A4: A1 -- Cash and U.S. government securities A2 -- Mortgage-backed bonds and government obligation (GO) municipal bonds A3 -- Home loans and municipal revenue bonds A4 -- Business, consumer, and other loans, other securities, and bank premises Off balance sheet rules: these items must first be converted to onbalance sheet “credit equivalent” amounts. Then these adjusted amounts are assigned to the different asset categories above. Example: Performance standby Conversion Risk Risk-adjusted letters of credit factor weight assets $1,000 x 0.50 0.20 $100 Capital adequacy • Market risk capital requirements (January 1998) – Institutions with more than 10% of total assets or $1 billion or more in trading account positions. – 8% risk-adjusted capital requirement on a daily basis based on market-to-market values of trading account securities. – Add to credit-risk-weighted assets or risk-adjusted assets after removing these securities from the previous calculation. Example: Previous risk-adjusted assets Remove GO munis trading account securities ($1,500 x 0.20) Value-at-risk (VAR) over the last 60 business days Risk-adjusted assets with market risk capital requirements $7,000 (300) 200 $6,900 – Stress tests need to be regularly performed on VAR models by experimenting with assumptions. These backtesting results allow VAR models to be continuously updated and improved. Capital adequacy • General market risk (financial market as a whole) – Value-at-risk (VAR) is normally calibrated to the 10-day 99th percentile standard. Example: over the past year records show there is a 1 in a 100 chance of losing $66.57 in any 10-day period. – VAR times a scaling factor (3 normally but it can be higher). Example: $66.57 x 3 = $200 – Must use: (1) an average VAR over the last 60 business days times 3, or (2) the previous day’s VAR. Latter condition only relevant to periods in which the financial markets are very volatile. • Specific risk (other risk factors including credit risk of the securities issuer and liquidity risk). – Scaling factor of 4 normally. – Add to risk-adjusted assets. Capital adequacy • Potential weakness of current risk-based capital requirements: – Differences in credit risk for most loans are not taken into account. – Book values are used rather than market values for most of the assets in the risk-adjusted assets calculations. – Regulatory requirements may change banks’ behavior in terms of allocation of loanable funds and investment decisions and possibly channel savings to less than the best uses. – Some kinds of bank risk are excluded, including operating risk and legal risk. – Portfolio diversification is not taken into account. Capital adequacy • FDIC has a vested interest in bank capital adequacy due to its deposit insurance activities. – Handling distressed banks: Depositor payoff Purchase and assumption (P&A via mergers and acquisitions) Provision of financial aid Charter of a Deposit Insurance National Bank (DINB or bridge bank) Reorganization – Variable-rate deposit insurance (in cents per $100 domestic deposits) implemented in 1994: Capital Level Well capitalized 0 Adequately capitalized Undercapitalized Risk Group A B 3 17 3 10 10 24 C 24 27 Shareholders’ viewpoint • Financial risk and share valuation % Change in EPS = % Change in EBIT [EBIT/(EBIT – Interest)] (in thousands of dollars) Low Debt Bad Net earnings before $9,000 Interest expenses (7,000) Net earnings 2,000 Taxes (@ 34%) (680) Earnings after taxes$1,320 High Debt Expected Good Bad $10,000 (7,000) 3,000 (1,040) $1,960 $11,000 (7,000) 4,000 (1,360) $2,640 $9,000 (9,000) -0-0-0- Expected $10,000 (9,000) 1,000 340 $ 660 Good $11,000 (9,000) 2,000 (680) $1,320 Common shares outstanding = 1 million Earnings per share (EPS) Percentage change in net earnings before interest expenses relative to expected outcome Percentage change in EPS relative to expected outcome $1.32 $1.96 -10% 0% -33% 0% $2.64 $0 $.66 $1.32 +10% -10% 0% +10% +33% -100% 0% +100% Shareholders’ viewpoint • Debt and bank valuation: VL VL = VU + tD Max VL VL = VU + tD - C VU VL = Total value with debt VU = Total value with no debt t = Tax rate D = Debt outstanding C = Regulatory costs Optimal Debt Level D Shareholders’ viewpoint • Corporate control – Greater debt increases the concentration of ownership among shareholders and thereby increases corporate control of the bank. – In banks that are not closely held there is the potential for agency costs related to conflicts of interest between owners and managers. – Hostile takeovers of banks with undervalued shares is a potential threat that tends to reduce agency costs. – Link management compensation to performance (e.g., stock options) to decrease agency costs. – Preemptive rights of shareholders reduces shareholder dilution and reduces agency costs to the extent that owner concentration is increased. Shareholders’ viewpoint • Market timing (debt versus equity usage, interest rate levels, and stock market levels) • Asset investment considerations (asset risk and capital needs to absorb potential losses) • Dividend policy (fixed dividend policy versus fixed payout dividend payout policy) • Debt capacity (financial slack or flexibility) • Transactions costs (private and public sales of equity) • Mergers and acquisitions (Financial Services Modernization Act of 1999) • Internal expansion (internal capital generation rate) ICR = (1/capital ratio) x ROA x Earnings retention ratio Rate at which a bank can expand its assets and still maintain its capital ratio.