Building a brand

advertisement

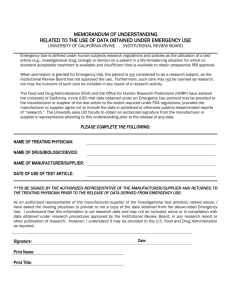

Serguei Netessine Modern Supply Chains: from competition to collaboration What made me thinking about cooperation vs. competition (1997) Some data 50 45 Searched ISI within Management Science, Operations Research and M&SOM 40 35 30 25 20 Key word "Competition" Key word "Cooperative" 15 10 5 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Plan for today • Motivation: evolution of supplier management in the automotive industry. • Practical vices and virtues of collaboration. • Tools for studying cooperative behavior: • Cooperative game theory • Contract theory • Repeated games and reputations • Empirical work Sourcing in the automotive industry • Most parts of the car are outsourced (70% in value) • 80% of the life-time cost is defined in the R&D process stage • Precise engineering specifications are often difficult, require joint expertise of the supplier and the assembler • There are many forms of vertical relations with suppliers, from integration to partnerships to arm’s length relations (markets). 5 Dramatic differences across manufacturers in supplier management approaches • Arm’s length relations: minimal information exchange (bidding on prices) and low interdependence. • Partnerships/collaboration: knowledge-sharing routines of proprietary information (production processes, design, market). 6 How Toyota collaborates with suppliers Collaborative supplier management is an often cited reason of Toyota’s financial success. 7 How does collaboration help? – Cost reduction. 8 Vices and Virtues of Collaboration • Benefits of collaboration (Pyke and Johnson, 2003) • Lower cost, higher quality, improved product performance • Most significant benefit is faster new product introduction • Factors that determine the degree of collaboration • • • • Strategic importance of the purchased component Number of suppliers in the market Complexity of the component and modularity of component architecture Uncertainty in production cost, quality, delivery lead time, etc. • Examples • Boeing / GE, Rolls-Royce, Pratt & Whitney • Ford / Lear • Consumer electronics company / contract manufacturer • CPFR, ECR and now “Jointly agreed growth” in retail 9 Pros and cons of collaboration • Why collaborate? • What hinders collaboration? 10 11 Approach 1: Cooperative Game Theory • Axiomatically defined in the 50s, but research even in economics is quite limited relative to non-cooperative game theory. • In essence, solutions often boil down to integer programming problems (e.g., finding the core of the game). • Nevertheless, applications in Operations Management are limited • The focus is on division of profits after forming coalitions, not on actions of players – hard to swallow for operations people. • Typically, grand coalition is shown to be in the core of the game (not terribly surprising). • Hard to show anything analytically, even for deterministic problems… Some research examples • Key recent authors : Granot and Granot (UBC), Greys Sosic (USC), Mahesh Nagarajan (UBC), Moshe Dror (Arizona) • Topics: inventory centralization, pooling queues, sharing fixed costs. Good references: • M. Nagarajan and G. Sosic. Game-theoretic analysis of cooperation among supply chain agents: review and extensions. EJOR. • Dror, M, and B.C. Hartman. 2011. Survey of Cooperative Inventory Games and Extensions. J. of Operational Research Society, 62, 565-580. • Brandenburger, A. and H. Stuart, Biform Games. Management Science 2007, 53, 537-549. Approach 2: Contract Theory • Kim, S.-H. and S. Netessine, 2011. Collaborative Collaborative Cost Reduction and Component Procurement Under Information Asymmetry. Working Paper, http://www.netessine.com. • Developed a model that captures pros and cons of collaborative cost reduction • Collaboration brings lower cost and higher efficiency to the supply chain, but both parties need to chip in Mutual efforts are required • Key source of inefficiency: Information asymmetry about costs • How does a procurement contract affect an incentive to collaborate? • Identify conditions that lead to high degree of collaboration • Amount of cost reduction • Demand uncertainty • Supply chain parties’ relative contribution to collaboration Model setup • One manufacturer, one supplier • Uncertain demand and inventory risk for the end-product • Random demand D: IGFR with pdf f and cdf F • End-product retail price is fixed at r • Uncertain component unit cost during product design • Collaborative cost reduction is an outcome of mutual efforts q = “Collaboration level” a = Elasticity of manufacturer’s effort em = Manufacturer’s effort es = Supplier’s effort • Linear cost of effort: kmem and kses • Inspired by: Roels, G., U. S. Karmarkar, S. Carr. 2010. Contracting for collaborative services. Management Science. 56(5), 849-863. Component cost reduction through collaboration c Higher collaboration level q Lower expected unit cost & smaller uncertainty around it cq = G 1 (1| q ) D0 D1 = dD 0 G 1 ( z | q ) c d = D1/D0 = % reduction in expected unit cost 0 q 1 = % reduction in unit cost uncertainty For analytical tractability, assume: 1. Conditional distribution G(·|q) of c is uniformly distributed 2. Lower support bound of c is constant Sequence of events Manufacturer decides when to offer a contract Contract commitments Demand and unit cost are uncertain; their distributions are common knowledge Screening contract Demand is realized Manufacturer sells the end products in the market Manufacturer exerts effort Stage 1 Supplier exerts effort Supplier privately learns his type (i.e., cost is realized) Stage 2 Supplier begins production of components Supplier delivers the components and financial transactions are made Summary of results and insights • Collaboration is a double-edged sword for the supplier, it may be optimal not to collaborate • Lower expected unit cost Potential for higher profitability • Lower uncertainty in unit cost Danger of being held up by the manufacturer ex-post • Larger demand variability maps to a higher collaboration level • Not because the supply chain parties become cooperative, but because the manufacturer induces the supplier to increase the pie size and then eats more of it • Expected Margin Commitment (EMC) • Hold-up problem under price commitment, but the manufacturer does not benefit from cost reduction • EMC: Effective in resolving both issues • Manufacturer prefers EMC to a screening contract when: • Collaboration leads to a significant reduction in unit cost • Demand variability is small or modest • EMC in practice: Japanese auto industry Approach 3: Relational Contracting, Repeated Games and Reputation • Now famous Folk Theorem (Friedman 1970) states that, in infinitely repeated games, almost any equilibrium (including collaboration) can be sustained if discounting of the future payoffs is not too high. • Interpretation: value of future relationship sustains collaboration. • Implications for supply chains: even very simple coordinating contracts that don’t work well in a single-period setting can work quite well in infinitely-repeated relationships. • See Plambeck and Taylor papers (several of them), Ren, Cohen, Ho and Terwiesch (empirical + modeling). • The downside: it is very hard to show anything interesting beyond this basic result. F. W. McFarlan, W. C. Kirby, and T. Y. Manty. Li & Fung 2006. HBS Case 307077, Harvard Business School, Boston. 2007. G. W. Loveman and J. O’Connell. Li & Fung (Trading) Ltd. HBS Case 396075, Harvard Business School, Boston. 1995. Li & Fung Limited: What Does it Do? Buyers outsource sourcing to Li & Fung Has a global platform of suppliers Finds suppliers that are matching the buyer Allocates orders between suppliers Insures good behavior (Quality, information, etc.) Global Platform of Suppliers Food Products: Olam International D. E. Bell and M. Shelman. Olam International. HBS Case 509002, Harvard Business School, Boston. 2009. Olam’s Global Network New breed of Sourcing Intermediaries Explaining Intermediaries Information Mediation (+) Intermediary has an informational advantage (price discovery, local knowledge, etc.) Economies of Scale (+) By consolidating demand from multiple buyers, intermediaries can split fixed costs Wal-Mart What can Li and Fung do that Wal-Mart can’t? Wal-Mart has scale (US$ 350B v/s US$ 13B)* Wal-Mart has local knowledge (189 stores in China, 50K local employees) Scale and Information Benefits ?? These make us think the existing explanations are not complete Is there another explanation for Intermediaries? Why Li & Fung? Stated Reasons Changing economic conditions Political Risks Trade barriers rise and fall Exchange Rates Fluctuate Getting supplier to do “the right thing for you” (good behavior) Insuring product quality Keeping proprietary information safe Adequate capacity building and booking “Preferences over Suppliers change over time” “Supplier compliance is a major business and reputation risk” “Li and Fung ensures good Supplier Behavior and keeps us flexible” Alternate Sourcing Strategies Direct Sourcing Mediated Sourcing Supplier Buyer Supplier Buyer Supplier Supplier Intermediary Belavina, E. and K. Girotra, 2011. The Relational Advantages of Intermediation. Forthcoming, Management Science. Preferences over suppliers change over time, Repeated Game Due to changing sourcing costs Transportation costs Currency, tariffs, pass-through input costs Good/Bad Behavior, Contractual Incompleteness Supplier does not reserve appropriate levels of capacity Proper information sharing Supplier does not conform to environmental and social norms Findings • Sourcing is rich in opportunities for suppliers to behave bad. In such environments it often pays off to commit to long-term relationship - promise future business to your supplier to elicit good behavior. These commitments come at a cost of flexibility. • Intermediaries allow to relieve the tradeoff between committed long-term relationships and flexible sourcing. • Why? Because to fulfill the promise of future business intermediaries can use business coming on behalf of multiple buyers. If one buyer does not want to source from the supplier, the other buyer might. • This is why intermediaries are much better in the modern global sourcing world. This is a novel explanation of why intermediaries can help you source better. • A follow-up paper: • A supply chain with many self-interested tiers/levels can perform better than a supply chain with fewer tiers. Approach 4: Empirical Work • Alliances: a long-standing form of company collaboration. • Long history of studying alliance formation, dissolution and behavior in the field of strategy. • Multi-market competition studies: competing in multiple markets may soften competition in favor of collaboration. • Hard to get data on supply chain alliances, and even supply chain contracts. • Ren, Cohen, Ho and Terwiesch – the study of relational forecast sharing in a semiconductor industry. • But there are other industries in which data is readily available. Airline Alliance Involves Various Activities… ● Codeshaing agreement: sell tickets on flights operated by partner airlines ● Reciprocal Frequent Flyer Program ● Cost reduction: facility and personnel sharing, joint procurement Alliance Considerations Policy Makers’ Concerns Airlines’ Defense • Overlapping markets • Reduced competition • Fare and capacity collusion • Raised entry barriers for other airlines • Precursor of a merger • Operational efficiency, consumer benefits • Higher flight frequency • Easier connections • Cost benefits passed on to consumers • Competition • “Remain independent and continue to compete with others” Li, J. and S. Netessine. 2011. Partnering with Competitors - An Empirical Analysis of Airline Alliances and Multimarket Competition. Working Paper, http://www.netessine.com. UA/US Flight Network Before Alliance UA/US Flight Network After Alliance Conceptual Model Airline City-pair 1998 1999 ------------------------------------------------------------------------------>2006 1 UA … Jan 2003 United and US Airways M 1 US … M 1 DL … M 1 CO … M 1 NW … M 1 AA … M Nov 1998 Continental and Northwest Alliance Jun 2003 DeltaContinental – Northwest Alliance Findings • In the post alliance era, airlines are more likely to enter/stay (additional 10%) and increase capacity (5 more flights/week) in the markets where their partners possess a strong market power. • This finding cannot be explained by traditional operational models which predict that capacity increases with higher competition, and hence it should decrease under alliances. • The reason this happens: increasing market pricing power due to collaboration • Increasing pricing power ($8.6 one way coupon, $18 round-trip) • For policy markets: monitor post-alliance changes, and require airlines not to increase overlap with partners on certain routes • For airline practitioners: may have over-adjusted capacity, probably in order to please alliance partners and increase zones of influence of the alliance. Summary • There is a notable movement among companies from pure competition towards the mix of competition and collaboration. • Research on collaboration in operations management is lagging behind but beginning to take shape. • There is a variety of promising methodologies: • Cooperative games (not so promising). • Contract theory applications (somewhat promising). • Repeated games (quite promising). • Empirical work (very promising). • Much of this work is very recent – join the party!