Capital Markets

advertisement

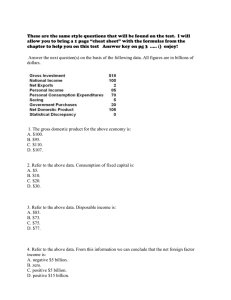

Capital Markets Savings, Investment, and Interest Rates Some Useful Terminology • Savings: Current income which is deferred for future consumption (i.e., not spent) Some Useful Terminology • Savings: Current income which is deferred for future consumption (i.e., not spent) National Income: $8,512.3 B + Dividend Payments, Interest, Gov’t Transfers, etc.: $582.5B - Taxes: $1,077.2 B = Personal Disposable Income: $8,017.6 B - Personal Consumption Expenditures: $7,727.2 B = Personal Savings: $290.4B (3.5% of Personal Income) Some Useful Terminology • Savings: Current income which is deferred for future consumption (i.e., not spent) National Income: $8,512.3 B + Dividend Payments, Interest, Gov’t Transfers, etc.: $582.5B - Taxes: $1,077.2 B = Personal Disposable Income: $8,017.6 B - Personal Consumption Expenditures: $7,727.2 B = Personal Savings: $290.4B (3.5% of Personal Income) • Note that there are many ways to save (savings account, bonds, stocks, etc.) Some Useful Terminology • Investment: The purchase of new capital goods. Some Useful Terminology • Investment: The purchase of new capital goods. – Gross Investment: Total purchases of new capital goods Some Useful Terminology • Investment: The purchase of new capital goods. – Gross Investment: Total purchases of new capital goods • Gross Private Investment: $1,611.2 B • Gross Public Investment: $355 B Some Useful Terminology • Investment: The purchase of new capital goods. – Gross Investment: Total purchases of new capital goods • Gross Private Investment: $1,611.2 B • Gross Public Investment: $355 B – Net Investment: Gross investment less depreciation of existing capital (capital consumption) • Net Private Investment: $500 B • Net Public Investment: $250 B NIPA Accounts • Recall, the accounting identity in the NIPA accounts: GDP = C + I + G + NX NIPA Accounts • Recall, the accounting identity in the NIPA accounts: GDP = C + I + G + NX • GDP = Gross Private Savings + Taxes + C NIPA Accounts • Recall, the accounting identity in the NIPA accounts: GDP = C + I + G + NX • GDP = Gross Private Savings + Taxes + C Gross Private Savings = I + (G-T) + NX I (Public + Private) : $1,966 B + (G-T): $106B + NX: - $559B Gross Private Savings: $1,513B (16% of GDP) NIPA Accounts • Recall, the accounting identity in the NIPA accounts: GDP = C + I + G + NX • GDP = Gross Savings + Taxes + C I + (G-T) + NX = Gross Private Savings I (Public + Private) : $1,966 B + (G-T): $123B + NX: - $487B Gross Private Savings: $1,513B Personal Savings ($290B) = Gross Private Saving ($1,513B) - Depreciation Interest Rates • What is an interest rate? Interest Rates • What is an interest rate? – The interest rate is the relative price of current spending in terms of foregone future income. Interest Rates • What is an interest rate? – The interest rate is the relative price of current spending in terms of foregone future income. – Example: if the interest rate is 5% (Annual), you must give up $1.05 worth of next year’s income in order to increase this year’s spending by $1. 1/1/03 1/1/01 1/1/99 1/1/97 1/1/95 1/1/93 1/1/91 1/1/89 1/1/87 Interest Rates:1987-2003 10 9 8 7 6 5 4 3 2 1 0 3 Mo. T-Bill Interest Rates:1987-2003 10 9 8 7 6 5 4 3 2 1 0 1/1/03 1/1/01 1/1/99 1/1/97 1/1/95 1/1/93 1/1/91 1/1/89 1/1/87 3 Mo. T-Bill 10 Year T-Note The Yield Curve Yield Curves • What determines the shape of the yield curve? – Segmented Markets Hypothesis – Expectations Hypothesis – Preferred Habitat Hypothesis Interest Rates:1987-2003 12 10 8 3 Mo. T-Bill 10 Year T-Note AAA Corp. 6 4 2 1/1/03 1/1/01 1/1/99 1/1/97 1/1/95 1/1/93 1/1/91 1/1/89 1/1/87 0 Interest Rates • • • • • • Treasury Securities (1 - 5%) Agency Securities (1 - 5%) Municipal Bonds (3 – 5%) Corporate Bonds (6 – 11%) Preferred Stock (5 – 15%) Asset Backed Securities (4 – 5%) Interest Rates • • • • • • Treasury Securities (1 - 5%) Agency Securities (1 - 5%) Municipal Bonds (3 – 5%) Corporate Bonds (6 – 11%) Preferred Stock (5 – 15%) Asset Backed Securities (4 – 5%) • “Risky” Rate = Risk Free Rate + Risk Premium Real vs. Nominal Interest Rates • As with any other variable, the nominal interest rate is in terms of dollars. (the cost of a current dollar in terms of forgone future dollars). To calculate the real interest rate, we need to correct for the purchasing power of those dollars. Real vs. Nominal Interest Rates • As with any other variable, the nominal interest rate is in terms of dollars. (the cost of a current dollar in terms of forgone future dollars). To calculate the real interest rate, we need to correct for the purchasing power of those dollars. • Exact: (1+i ) = (1+ r )*(1 + inflation rate) Real vs. Nominal Interest Rates • As with any other variable, the nominal interest rate is in terms of dollars. (the cost of a current dollar in terms of forgone future dollars). To calculate the real interest rate, we need to correct for the purchasing power of those dollars. • Exact: (1+i ) = (1+ r )*(1 + inflation rate) • Approximation: i = r + inflation rate 1/ 1/ 19 1/ 65 1/ 19 1/ 68 1/ 19 1/ 71 1/ 19 1/ 74 1/ 19 1/ 77 1/ 19 1/ 80 1/ 19 1/ 83 1/ 19 1/ 86 1/ 19 1/ 89 1/ 19 1/ 92 1/ 19 1/ 95 1/ 19 1/ 98 1/ 20 01 Real/Nominal Interest Rates 20 15 10 5 0 -5 -10 Inflation Real Nominal Real vs. Nominal Interest Rates • As with any other variable, the nominal interest rate is in terms of dollars. (the cost of a current dollar in terms of forgone future dollars). To calculate the real interest rate, we need to correct for the purchasing power of those dollars. • Exact: (1+i ) = (1+ r )*(1 + inflation rate) • Approximation: i = r + inflation rate • How can real interest rates be negative? Real vs. Nominal Interest Rates • As with any other variable, the nominal interest rate is in terms of dollars. (the cost of a current dollar in terms of forgone future dollars). To calculate the real interest rate, we need to correct for the purchasing power of those dollars. • Exact: (1+i ) = (1+ r )*(1 + inflation rate) • Approximation: i = r + inflation rate • How can real interest rates be negative? – Ex ante vs. ex post Present Value • With a positive interest rate, income received in the future is less valuable that income received immediately. Present Value • With a positive interest rate, income received in the future is less valuable that income received immediately. • At a 5% annual interest rate, $1.05 to be received in one year is equivalent to $1 to be received today (because $1 today could be worth $1.05) $1(1.05) = $1.05 Present Value • With a positive interest rate, income received in the future is less valuable that income received immediately. • At a 5% annual interest rate, $1.05 to be received in one year is equivalent to $1 to be received today (because $1 today could be worth $1.05) $1(1.05) = $1.05 • Therefore, the present value of $1.05 to be paid in one year (if the annual interest rate is 5%) is $1. Present Value • With a positive interest rate, income received in the future is less valuable that income received immediately. • At a 5% annual interest rate, $1.05 to be received in one year is equivalent to $1 to be received today (because $1 today could be worth $1.05) $1(1.05) = $1.05 • Therefore, the present value of $1.05 to be paid in one year (if the annual interest rate is 5%) is $1. • In general, the PV of $X to be paid in N years is equal to PV = $X/(1+i)^N Income vs. Wealth • Your wealth is defined and the present value of your lifetime income. Income vs. Wealth • Your wealth is defined and the present value of your lifetime income. • For example, suppose you expect your annual income to be $50,000 per year for the rest of your life. If the annual interest rate is 3%: Wealth = $50,000 + $50,000/(1.03) + $50,000/(1.03)^2 + …… = $50,000/(.03) = $1,666,666 (Approx) Household Savings • Without an active capital markets, household consumption is restricted to equal current income (that is, C=Y) Household Savings • Without an active capital markets, household consumption is restricted to equal current income (that is, C=Y) • With capital markets, the present value of lifetime consumption must equal the present value of lifetime income (assuming all debts are eventually repaid) A two period example • Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. A two period example • Suppose that your current income is equal to $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. • In the absence of capital markets, your consumption stream would be $50,000 this year and $60,000 next year. Future Consumption (000s) Consumption Possibilities 100 90 80 70 60 50 40 30 20 10 0 0 10 20 30 40 50 60 Current Consumption (000s) 70 80 90 100 Borrowing to increase current consumption • To increase your current consumption, you could take out a loan. Your current consumption would now be C = $50,000 + Loan Borrowing to increase current consumption • To increase your current consumption, you could take out a loan. Your current consumption would now be C = $50,000 + Loan • However, you must repay your loan next year. This implies that C’= $60,000 – (1.05)Loan Borrowing to increase current consumption • To increase your current consumption, you could take out a loan. Your current consumption would now be C = $50,000 + Loan • However, you repay your loan next year. This implies that C’= $60,000 – (1.05)Loan • For example, if you take out a $10,000 loan, your current consumption would be $60,000, while your future income would be $60,000 - $10,000(1.05) = $49,500 Futuer Consumption (000s) Consumption Possibilities 100 90 80 70 60 50 40 30 20 10 0 0 10 20 30 40 50 60 Current Consumption (000s) 70 80 90 100 Borrowing Limits Note that you need to be able to repay your loan next year. Therefore, $60,000 > (1.05)Loan Borrowing Limits • Note that you need to be able to repay your loan next year. Therefore, $60,000 = (1.05)Loan • Your maximum allowable loan is $60,000/1.05 = $57,143 (this is associated with zero future consumption) Borrowing Limits • Note that you need to be able to repay your loan next year. Therefore, $60,000 = (1.05)Loan Your maximum allowable loan is $60,000/1.05 = $57,143 (this is associated with zero future consumption) Therefore, your maximum current consumption is $107,143 Consumption Possibilities Futuer Consumption (000s) 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 80 Current Consumption (000s) 90 100 110 120 Consumption Possibilities Futuer Consumption (000s) 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 80 Current Consumption (000s) 90 100 110 120 Saving to increase future consumption • You could increase future consumption by saving some of your income (i.e. a negative loan). Suppose you put $20,000 in the bank, your current consumption is now $30,000. Saving to increase future consumption • You could increase future consumption by saving some of your income (i.e. a negative loan). Suppose you put $20,000 in the bank, your current consumption is now $30,000. • Next year, your bank account will be worth $20,000(1.05) = $21,000. Therefore, your future consumption will be $81,000 Consumption Possibilities Futuer Consumption (000s) 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 80 Current Consumption (000s) 90 100 110 120 Maximizing future consumption • Suppose you save your entire income. Your current consumption will be zero, but your future consumption will be C’ = $60,000 + $50,000(1.05) = $112,500 Consumption Possibilities Futuer Consumption (000s) 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 80 Current Consumption (000s) 90 100 110 120 Consumption Possibilities Futuer Consumption (000s) 120 100 80 60 40 20 0 0 10 20 30 40 50 60 70 80 Current Consumption (000s) 90 100 110 120 Suppose that the interest rate rises to 8% • Note that if you don’t borrow or lend, you are unaffected. Suppose that the interest rate rises to 8% • Note that if you don’t borrow or lend, you are unaffected. • At higher interest rates, your borrowing limit falls: Loan = $60,000/1.08 = $55,556 (higher interest rates are bad for borrowers) Suppose that the interest rate rises to 8% • Note that if you don’t borrow or lend, you are unaffected. • At higher interest rates, your borrowing limit falls: Loan = $60,000/1.08 = $55,556 (higher interest rates are bad for borrowers) • However, if you are saving, you receive more interest: $50,000(1.08) = $54,000 (higher interest rates are good for savers) Futuer Consumption (000s) Consumption Possibilities Current Consumption (000s) Future Consumption (000s) Consumption Possibilities Current Consumption (000s) The interest rate is the relative price of current consumption in terms of future consumption • When any relative price changes, there are two distinct effects that impact consumer behavior The interest rate is the relative price of current consumption in terms of future consumption • When any relative price changes, there are two distinct effects that impact consumer behavior – The substitution effect: as relative prices change, consumer typically alter purchases to favor the good that has become cheaper The interest rate is the relative price of current consumption in terms of future consumption • When any relative price changes, there are two distinct effects that impact consumer behavior – The substitution effect: as relative prices change, consumer typically alter purchases to favor the good that has become cheaper – Income Effect: Changing prices alter one’s purchasing power. When purchasing power falls/rises, purchases fall/rise How does rising interest rates influence savings decisions? How does rising interest rates influence savings decisions? • The substitution effect is unambiguous: as interest rates rise, current consumption becomes more expensive. Therefore, consumers spend less (i.e. save more) How does rising interest rates influence savings decisions? • The substitution effect is unambiguous: as interest rates rise, current consumption becomes more expensive. Therefore, consumers spend less (i.e. save more) • The income effect depends on your current situation: borrowers experience a negative income effect and therefore would spend less (save more) while savers experience a positive income effect and therefore would spend more (save less) Impact of rising interest rates Borrowers • Substitution effect: spend less (save more) • Income effect: Spend less (save more)___________ Net effect: Save More Savers • Substitution effect: spend less (save more) • Income effect: spend more (save less)___________ Net effect: ???? Aggregate Savings • At the individual level, we would need to consider income and substitution effects to determine the precise impact of rising/falling interest rates on savings behavior Aggregate Savings • At the individual level, we would need to consider income and substitution effects to determine the precise impact of rising/falling interest rates on savings behavior • At the aggregate level, new savings is very close to zero (i.e., there are approximately the same number of borrowers as there are lenders Aggregate Savings • At the individual level, we would need to consider income and substitution effects to determine the precise impact of rising/falling interest rates on savings behavior • At the aggregate level, new savings is very close to zero (i.e., there are approximately the same number of borrowers as there are lenders • Therefore, the income effects cancel out and higher interest rates have an unambiguous positive effect on savings Interest Rate (%) Aggregate Savings 9 8 7 6 5 4 3 2 1 0 0 10 20 30 Savings ($) 40 50 Again, assume that the interest rate is 5%, consider two individuals Person A • Current income: $10,000 • Anticipated future income: $50,000 Again, assume that the interest rate is 5%, consider two individuals Person A • Current income: $10,000 • Anticipated future income: $50,000 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Again, assume that the interest rate is 5%, consider two individuals Person A • Current income: $10,000 • Anticipated future income: $50,000 Wealth: $57,619 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Again, assume that the interest rate is 5%, consider two individuals Person A • Current income: $10,000 • Anticipated future income: $50,000 Wealth: $57,619 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Wealth: $57,619 Consumption vs. Wealth 70 0 60 50 10 40 30 20 10 50 0 0 10 20 30 40 50 57.6 60 70 Consumption and Wealth • With capital markets, consumption is not determined by current income, but by wealth (present value of lifetime income) Consumption and Wealth • With capital markets, consumption is not determined by current income, but by wealth (present value of lifetime income) • These two individuals, having the same wealth, should choose the same consumption Consumption vs. Wealth 70 0 60 50 10 40 30 20 10 50 0 0 10 20 30 40 50 57.6 60 70 Again, assume that the interest rate is 5%, consider two individuals • Person A • Current income: $10,000 • Anticipated future income: $50,000 Wealth: $57,619 Current Spending: $30,000 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Wealth: $57,619 Current Spending: $30,000 Again, assume that the interest rate is 5%, consider two individuals • Person A • Current income: $10,000 • Anticipated future income: $50,000 Wealth: $57,619 Current Spending: $30,000 Savings: -$20,000 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Wealth: $57,619 Current Spending: $30,000 Savings: $20,000 Again, assume that the interest rate is 5%, consider two individuals • Person A • Current income: $10,000 • Anticipated future income: $50,000 Wealth: $57,619 Current Spending: $30,000 Savings: -$20,000 Future Spending: $29,000 Person B • Current Income: $50,000 • Anticipated Future income: $8,000 Wealth: $57,619 Current Spending: $30,000 Savings: $20,000 Future Spending: $29,000 Consumption and Wealth • With capital markets, consumption is not determined by current income, but by wealth (present value of lifetime income) • These two individuals, having the same wealth, should choose the same consumption. • For a given level of wealth, those with high rates of income growth would be expected to be borrowers Interest Rate (%) Suppose that economic growth in the US rises. What should happen to aggregate savings? 9 8 7 6 5 4 3 2 1 0 0 10 20 30 Savings ($) 40 50 Suppose that economic growth in the US rises. What should happen to aggregate savings? 12 Interest Rate (%) 10 8 6 4 2 0 0 10 20 30 Savings ($) 40 50 Technology & Investment Demand • Recall that an economy has three sources of growth: labor, capital, and technology Production Technology • Recall that an economy has three sources of growth: labor, capital, and technology • The production function describes the relationship between output and the three Production (Holding Employment Fixed) Output Production (Holding Employment Fixed) 90 80 70 60 50 40 30 20 10 0 0 2 4 6 Capital 8 10 Marginal Product of Capital • The marginal product of capital is defined as the additional output produced by each additional unit of capital purchased. • In the previous slide, the first unit of capital generated 25 units of output while the second unit of capital raised total output from 20 to 45 • Therefore, the MPK of the first unit of capital is 25 while the MPK of the second unit of capital is 20 Output Diminishing marginal product implies that as the capital stock rises, the marginal product of additional capital falls 90 80 70 60 50 40 30 20 10 0 30 25 20 15 10 5 0 0 2 4 6 Capital 8 10 Marginal Product and Investment Demand • Recall that investment refers to the purchase of new capital equipment by the private sector Marginal Product and Investment Demand • Recall that investment refers to the purchase of new capital equipment by the private sector • Firms are profit maximizers and, hence, only take actions that increase firm value (present value of lifetime earnings) Marginal Product and Investment Demand • Recall that investment refers to the purchase of new capital equipment by the private sector • Firms are profit maximizers and, hence, only take actions that increase firm value (present value of lifetime earnings) • Therefore a firm will only buy a new piece of capital when the contribution of that capital to firm value is greater that its cost P(k) > PV(MPK) A Numerical example • Suppose that the current interest rate is 5% and that the cost of a unit of machinery is $100. Capital is assumed to depreciate at a rate of 10% per year. A Numerical example • Suppose that the current interest rate is 5% and that the cost of a unit of machinery is $100. • Given the technology from the previous slide, the marginal product of the first unit of capital is $25/yr. Income stream will this capital generate? • Year 1: $25 Year 2: $25(1-.10) = $22.50 Year 3: $25(1-.10)(1-.10) = $20.25 Year 3: $25(1-.10)(1-.10)(1-.10) = $18.23 ………… A Numerical example • What is the present value of this income stream? A Numerical example • What is the present value of this income stream? PV = $25/(1.05) + $22.50/(1.05)^2 + $20.25/(1.05)^3 + ……. A Numerical example • What is the present value of this income stream? PV = $25/(1.05) + $22.50/(1.05)^2 + $20.25/(1.05)^3 + ……. PV = $25/( i + depreciation ) = $25/(.15) = $167 • Is this a positive NPV project? Yes ( $167 > $100) A Numerical example • What is the present value of this income stream? PV = $25/(1.05) + $22.50/(1.05)^2 + $20.25/(1.05)^3 + ……. PV = $25/( i + depreciation ) = $25/(.15) = $167 • Is this a positive NPV project? Yes ( $167 > $100) • In fact, solving the above expression tells us that this is a positive NPV project for any interest rate under i = (MPK/Pk) – depreciation = ($25/$100) - .10 = .15 = 15% Interest rates and Investment 16 14 12 10 8 6 4 2 0 0 1 2 3 4 5 6 7 Interest rates and investment • Note that once the first unit of capital has been purchased, the second unit of capital only has a marginal product of 20. • Therefore, for this unit of capital to be a positive PV project, the interest rate must be lower than 20/100 - .10 = .1 = 10% Interest rates and Investment 16 14 12 10 8 6 4 2 0 0 1 2 3 4 5 6 7 Interest rates and Investment 16 14 12 10 8 6 4 2 0 0 1 2 3 4 5 Interest rates and investment • Diminishing marginal product of Capital guarantees that the demand for investment is downward sloping (increasing rates of investment require lower interest rates) • To get the total demand for loans, multiply the investment curve by the price of capital) Interest rates and Investment 16 14 12 10 8 6 4 2 0 0 100 200 300 400 500 Investment Demand • It is assumed that labor and capital are compliments. That is, when employment rises, the productivity of capital increases as well. Investment Demand • It is assumed that labor and capital are compliments. That is, when employment rises, the productivity of capital increases as well. • Therefore, as a rise in employment should increase the demand for capital and, hence, the demand for loans Investment Demand • It is assumed that labor and capital are compliments. That is, when employment rises, the productivity of capital increases as well. • Therefore, as a rise in employment should increase the demand for capital and, hence, the demand for loans • Further, any technological improvement should also raise the demand for investment A rise in investment demand 16 14 12 10 8 6 4 2 0 0 100 200 300 400 500 A rise in investment demand 25 20 15 10 5 0 0 100 200 300 400 500 Capital Market Equilibrium • For now, assume that there is no government and the US is a closed economy • Add up individual firm’s hiring decisions to get aggregate investment • Add up individual household decisions to get aggregate savings • A capital market equilibrium is an interest rate that clears the market (i.e.,savings equals investment) • Here, i*= 10%, S* = I*= 300 20 16 12 8 4 0 0 100 200 300 400 500 Example: Post-war Germany • It is estimated that 20-25% of Germany’s capital stock was destroyed during WWII. How would the German capital market respond to this? 20 16 12 8 4 0 0 100 200 300 400 500 Example: Post-war Germany • It is estimated that 20-25% of Germany’s capital stock was destroyed during WWII. How would the German capital market respond to this? • A lower capital stock decreases increases the productivity of new investment and, thus increases investment demand 24 20 16 12 8 4 0 0 100 200 300 400 500 Example: Post-war Germany • It is estimated that 20-25% of Germany’s capital stock was destroyed during WWII. How would the German capital market respond to this? • A lower capital stock decreases increases the productivity of new investment and, thus increases investment demand • The resulting higher equilibrium has a higher interest rate, higher savings and investment 24 20 16 12 8 4 0 0 100 200 300 400 500 Example:The Bubonic Plague • The Bubonic Plague, or “Black Death” ravaged Europe in the 1300’s. From 1347-1352, approximately 30% of the population in Europe was killed (25 million). What impact will this have on capital markets? 20 16 12 8 4 0 0 100 200 300 400 500 Example:The Bubonic Plague • The Bubonic Plague, or “Black Death” ravaged Europe in the 1300’s. From 1347-1352, approximately 30% of the population in Europe was killed (25 million). What impact will this have on capital markets? • A decrease in employment lowers the productivity of investment (labor and capital are complements) and, hence, investment demand 20 16 12 8 4 0 0 100 200 300 400 500 Example:The Bubonic Plague • The Bubonic Plague, or “Black Death” ravaged Europe in the 1300’s. From 1347-1352, approximately 30% of the population in Europe was killed (25 million). What impact will this have on capital markets? • A decrease in employment lowers the productivity of investment (labor and capital are complements) and, hence, investment demand • The result: lower interest rates, savings, and investment 20 16 12 8 4 0 0 100 200 300 400 500 Temporary vs. Permanent Shocks • Unlike labor markets, the timing and persistence of productivity shock are important 20 16 12 8 4 0 0 100 200 300 400 500 Temporary vs. Permanent Shocks • Unlike labor markets, the timing and persistence of productivity shock are important • New capital takes time to install. Therefore, productivity improvements must be long lasting to effect investment demand 20 16 12 8 4 0 0 100 200 300 400 500 Temporary vs. Permanent Shocks • Unlike labor markets, the timing and persistence of productivity shock are important • New capital takes time to install. Therefore, productivity improvements must be long lasting to effect investment demand • A temporary improvement in productivity will increase savings (as consumers smooth this extra income), but have no impact on investment 20 16 12 8 4 0 0 100 200 300 400 500 Temporary vs. Permanent Shocks • Unlike labor markets, the timing and persistence of productivity shock are important • New capital takes time to install. Therefore, productivity improvements must be long lasting to effect investment demand • On the other hand, a permanent technological improvement will increase investment, but have little impact on savings 24 20 16 12 8 4 0 0 100 200 300 400 500