Planning the Petroleum Sector

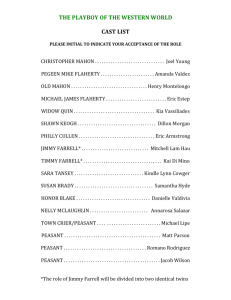

advertisement

Conference on the Economy 2008 The Petroleum Industry and the Economy Some thoughts on meeting the challenges of the 21st Century Gregory McGuire Presentation Outline Introducing the Works of Trevor Farrell Assessing the Current Context Farrell’s Themes and Industry Evolution. Ideas on the Future Farrell’s Major Concerns Planning Capability in the Energy Sector Engaging MNC and Technology Acquisition National Ownership Technological Capability and Industrial Policy Some Early Conclusions of Farrell Oil industry has failed to provide Trinidad with the development one might have expected.(1974) Failed to play role of dynamic sector – weak productive linkages with rest of the economy Venturing downstream (Plastics etc) remains a option to be explored Some Early Conclusions of Farrell Resource based industrialization was misleading because : – Supply side approach to the definition of what is to be produced – Static comparative advantage is easily lost.( 1988) Planning is a poorly developed function in the Caribbean (1980) Some Early Conclusions of Farrell A technological capability still does not exist over a whole range of activities necessary for running the oil industry .( 1979) The country clearly had the worst of the deals in the two petroleum nationalizations of the early seventies due inpart to psychological weaknesses of negotiators and poor planning. ( 1976) Some Early Conclusions of Farrell In the development of the JV at Point Lisas the local strategy was too narrowly focused on getting the plants built rather than acquiring technological capability. ( 1986) Assessing the Context International and Local Current Global Trends and Issues Developed world not driving demand growth but could drive demand destruction Reduced Transnational Company role in favor of National Oil Companies Emerging supply sources give no assurance of supply stability Increasing commoditization of gas and LNG Demand growth no longer driven by developed economies The Power of NOCs Source: Frank Kuijlaars- Oil & Money 2007 Supply Dynamics Three of five largest decrease came from OPEC .Suggesting initial attempts to stabilize prices. LNG Commoditization Oil Prices Which way ? Rising Oil Prices 120 100 US$/bbl 80 60 40 20 0 86 87 88 89 90 91 92 93 94 95 96 97 98 99 0 Source: Appendix table 6 1 2 3 4 5 6 7 8 Years Demand from Non OECD countries and market psychology have been the principal drivers. Back to the Future Real Oil Prices 1980-2008 ( 2006 dollars) 90.0 80.0 70.0 50.0 40.0 30.0 20.0 10.0 Source: US EIA. Annual Energy Outlook 08 Ye ars 20 07 20 04 20 01 19 98 19 95 19 92 19 89 19 86 19 83 0.0 19 80 US$/bbl. 60.0 Oil Prices : Which Way ? •Declining Non -Opec Supply . •New supply sources mainly in non “friendly” areas. •NOC vested interest •Declining Economic Growth : OECD & Non OECD •New supply sources: Brazil, Heavy Oil Tech. •Convulsions within OPEC •Bearish market psychology •Fuel Switching •Peak oil theory losing steam Oil Prices : Which Way? Some Critical EWS – Real oil prices have climbed back to 1982 levels – IEA, EIA and OPEC have all lowered demand forecasts for 2009 – Short term supply disruptions e.g. Ike and Gustav Nigeria, Georgia have had no discernible impact on prices. – China is not imported gasoline for two months; instead exported surplus stock. Rising Gas Prices 12 Figure 6 US Natural Gas Prices 1994-08 ( Henry Hub) US$/MMbtu US$/MMbtu 10 8 6 4 2 0 94 95 96 97 98 99 Source: Table 6 0 1 Years 2 3 4 5 6 7 8 Gas Price Forecast Henry Hub Spot Prices 14 12 10 8 6 4 2 Source US EIA This forecast was produced before the current crisis. Henry-Hub prices this morning quoted at 6.75/mmbtu lowest level in four years. no v se p l ju m ay m ar n ja no v se p l ju m ay m ar n ja no v se p l ju m ar m ay ja n 0 What does this mean ? Henry Hub vs NCMA Well Head Prices 10 9 8 US$/MMBTU 7 Avg. Diff. 48% 6 5 4 3 2 1 0 2003 2004 2005 2006 2007 Years Henry Hub NCMA Price Local Industry Context The Big Picture Resumption of long term decline in Crude oil production Significant slowing in the rate of gas utilization and production Decline in both exploratory and development drilling over last two years. The Big Picture Refining at the cross roads. – Upgrade project – Costs – Markets Long overdue modernization The Big Picture World class primary petrochemical business. World class LNG business. Limited national participation in value chain Only initial steps at downstream expansion led by local private sector. The Big Picture Industry growth slowed by rising capital costs, market uncertainly and tougher local terms. Stagnation at the national enterprises. Massive expansion in skill training to match requirements of the industry. Long Term Production Decline Figure 13 Crude Oil Production (000bbls/d) 250 "000 bbls/day 200 150 100 50 Source Table A8 Years 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 0 Refinery Output Figure 14 Refinery Product Slate ( 2006) Other 4% Gasoline 17% Fuel Oil 32% Reg Gasoline 7% Unf Gas/Ref Feed 6% Kerosene 11% Source: Petrotrin Gas Oil / Diesel 23% Still a relatively high percentage of low value fuel oil . Gas Consumption 1995-2006 4000 3500 (MMscfd) 3000 2500 2000 1500 1000 500 0 1995 1996 1997 Ammonia Heavy Industrial 1998 1999 2000 Methanol Light Industrial 2001 2002 2003 2004 Power Generation LNG 2005 Metals 2006 LNG Dominates Gas Utilization Farrell’s Themes Planning and the Energy Sector Successful Planning – Farrell’s Six Preconditions 6. Quality Information 5. Willingness Of Policy Makers to plan 4. Sophisticated Understanding of planning 1. Effective Organizational Apparatus 2. Cadre of Skilled people 3. Effective Control Over Energy Sector Approach: AFROSIBER Nine Point Planning Methodology – – – – – – – – Assess Context Forecasting Resource evaluation Objectives Strategies and Implications Balances Execution Review Assessment Planners were mainly project managers concerned with getting the physical plant off the ground. A handful of people were entrusted with the responsibility for projects were not enough to do the kind of planning required. Planners did not have the level of information required and relied on the information provided by technology supplier. Recent Approaches Vision 2020 Energy met criteria of skilled cadre, and information requirements . Widening Gap between plan and what is being implemented. Organizational Apparatus remains basically the same as 30 yrs ago, with the same personalities. Farrell’s Themes Engaging MNC’s and Technology Acquisition Philosophy Major concern ; the level of benefits the country receives from MNC’s in the form of Technology Acquisition and Value Added. TNC’s don’t willingly transfer technology . Host Governments need to develop the national capacity to acquire required technology. Assessment It is clear that the areas where the country has developed a capability have been only those areas which the companies needed to develop locally st to carry out their activities. Technological capability still does not exist over the whole range of activities necessary for running the industry . Current State The relationships with ANLG suggest that technology acquisition is still not a specific item on the agenda and that weaknesses in dealings with the Multinational persist. – PM’s cry for a better deal from ANLG Farrell’s Themes National Ownership Philosophy We cannot plan for what you could not control. Multinationals run the business in their own interest This is so even when they are engaged in a JV arrangement The primary aim of Nationalization is to create a national vehicle to build national technological capability in the sector. History and Performance Nationalization and national ownership in sector since 1969. Features: – Rescue Nationalization – Cosmetic Nationalization – Direct Investments Process reversed during the 1990’s with privatization of bulk of direct investment assets Assessment An effective and meaningful genuine nationalization would possess the following features: – Effective local control of the nationalized properties – The actual exercise of such control for the furtherance of development goals – The targeting of areas of real economic significance Assessment Farrell study highlighted breath weaknesses: – Major projects and construction – Research and development – Economics and Planning Transportation – International marketing Assessment Farrell study highlighted Depth weaknesses: Exploration and Marine production Petrochemicals Genaeral administration Purchasing Information and Data Processing Assessment in a 1979 study of industry Farrell concluded : – Nationalization is unlikely to work even in the short run unless ways are found for tackling the basic skills deficits in the are of the critical functions State of the National Enterprise Fully Owned, Petrotrin National Gas Company National Energy Corporation Equity Tringen PPGPL ANLG – Train 1 and 4 State of the National Enterprise THE CASE OF PETROTRIN The Refiner’s Economic challenge Refinery location issues – Raw materials, markets, utilities, labour supply Capital investment – Fixed and working capital Refining costs Project and payout time Economics of impurities The Developing Country Problem Access to low cost secure crude supply Lack of capital for investment Diseconomies of scale and small refineries Market demand and refinery output imbalance Lack of design and construction capability Lack of managerial, commercial and technical expertise Main Products LPG Aviation Gasolene Motor gasolene Kerosene/Avjet Gas Oil/ No. 2 Fuel Oil Fuel Oil Bitumen Sulphur Refinery Throughput 1994-2008 August Ytd 180 161.2 157.8 160 145.5 MBPCD 140 120 100 154.7 151.26 149.7 148.5 136.3 158.8 151.21 123.2 107.1 100.2 103.6 103.5 80 60 40 20 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Aug Ytd 180 10 160 9 140 8 7 120 6 100 5 80 4 60 3 40 2 20 1 0 0 1994 1995 1996 1997 1998 1999 2000 Throughput Refinery Utilization 2001 2002 2003 2004 2005 2006 Sales Indicative Margin 2007 2008 Aug Ytd US$/Bbl MBPCD or Refinery Utilization Refining & Marketing Performance Indicators INCOME STATEMENT - R&M (TT$MM) 2000 2001 2002 2003 2004 2005 2006 2007 Audited Audited Audited Audited Audited Audited Audited Audited 10,695 10,968 8,443 11,392 11,749 18,878 24,106 24,872 9,393 1,302 9,672 1,296 7,310 1,133 9,949 1,443 10,200 1,549 15,880 2,998 21,722 2,384 21,669 3,203 811 825 775 756 762 850 967 980 - - - 11 25 83 80 77 125 126 126 147 155 141 200 196 Abandonment Depletion - - - 3 15 13 4 34 Abandm't Finance Costs - - 2 2 27 12 15 41 100 114 95 157 196 185 269 302 Post Ret.Medical Benefit - - 7 16 43 90 37 47 Other Expense/(Income) Total Expenses 60 1,096 77 1,142 105 1,110 95 1,187 32 1,255 33 1,407 (12) 1,560 (70) 1,607 Income Before Tax 206 154 23 256 294 1,591 824 1,596 Taxation (PPT/UL) Net Earnings (5) 201 (6) 148 (1) 22 (15) 241 (12) 282 (280) 1,311 (386) 438 (481) 1,115 TT$MM Gross Revenue Less : Cost of Sales Gross Margin Less : Expenses Operating Expenses Variable Pay Depreciation & Amortization Corporate Overheads Refining at the crossroads Refinery Sustainability Specifications Petrocaribe & Caricom Gas & LNG Oil Prices Cost Challenges to the refining Industry Petronas : A benchmark National Enterprise: Founded in 1974 Total Assets ( 2004) US$ 53 billion compared to NGC/Petrotrin $3 billion. Business : Fully integrated oil and gas , gas processing, liquefaction, LNG shipping regas, shipping property investments. Petronas Group: 94 wholly owned subsidiaries, 55 associated companies 14 countries. Technological Capability and Industrial Policy Philosophy At the heart of our ability to win the game with the TNC’s is the technological capability That is ; the ability to find one’s problems and needs and find ways to meet and solve them. Local Content in Energy Local content policy formulated Permanent local content committee appointed Need to build on achievements – Labidco etc Need to provide resources Enterprise development Local enterprise development vital for the continued meaningful growth o f the industry. CL Financial is an outstanding example of what is possible by a local enterprise Policy makers should learn lessons of that experience in order to inform the way forward. Thoughts on Moving Forward Place technology acquisition and technological capability back on the agenda. Develop that Cadre of skills personnel involved in the planning and Management of the Sector. Make strategic use of state equity participation to expand downstream and down the value chain.