Tax Guidelines

advertisement

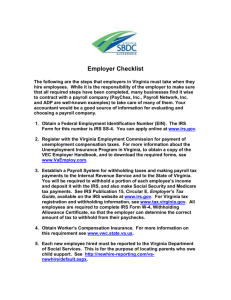

Employment Tax Laws LAUSD Small Business Boot Camp Version 08.a Presenters IRS IRS Partner IRS Leveraged Presenter EDD Jimmy Wong Taxpayer Education and Assistance Taxpayer Assistance Center: 1-888-745-3886 Agenda • Employee vs. Independent Contractor • Reporting Requirements for Independent Contractors • Employer Responsibilities • Reporting and Deposit Requirements Employee vs. Independent Contractor Employee vs. Independent Contractor Employee: An individual who performs services for you and is subject to your control regarding what will be done AND how it will be done. Independent Contractor: An individual who performs services for you, but for whom you control only the result of the work. Types of Workers • Employees – Common law – Statutory • Corporate officer • Unlicensed construction contractor (state) • Independent contractors Common Law Employment • Common law evolved slowly over the years based on court decisions on individual cases. • Common law rules of employment are the total of all court decisions on employment. Common Law Employment (continued) Person who hires an individual to perform services has the right to control the manner and means of performing those services, whether exercised or not. The right to discharge a worker at will and without cause is strong evidence of right to control. What Can Happen If I Misclassify My Workers? • Costly audits by the IRS, the EDD, and the Dept. of Industrial Relations due to: – Worker claims for injury/unemployment. – Worker informants. – Competitor informants. • Additional taxes, penalties, and interest. • Revocation of state/local licenses. Worker Classification Factors • Behavioral control • Financial control • Relationship between parties • Case-by-case basis Voluntary Classification Settlement Program • • • • • Optional program to reclassify workers Applies to future tax periods Must meet eligibility requirements Apply by filing Form 8952 Must enter into a closing agreement Resources • Business and Specialty Tax Hotline 800-829-4933 • Visit IRS.gov – Click on “Businesses” tab, “Employment Taxes” in the left navigation – Search Keyword “worker classification” • Worker classification resource handout Resources (continued) • Pub 1779, Independent Contractor or Employee • Pub 15 (Circular E), Employer’s Tax Guide • Pub 15-A, Employer’s Supplemental Tax Guide • Form SS – 8, Determination of Worker Status Resources (continued) • DE 44, California Employer’s Guide • DE 231, Information Sheet - Employment • DE 38, Employment Determination Guide • DE 1870, Determination of Employment Work Status Resources (continued) • Employment Status Course www.edd.ca.gov/Payroll_Taxes/Web_Based_Seminars.htm • Employee or Independent Contractor Tax Seminar www.edd.ca.gov/Payroll_Tax_Seminars/ • EDD Payroll Tax Forms and Publications www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm Reporting Requirements for Independent Contractors Form W-9, Request for Taxpayer Identification and Certification • Reports: – Payee’s correct name – Payee’s Taxpayer Identification number Backup Withholding Requirements • Withhold 28 percent of income if: – Payee does not provide TIN – Payee provides incorrect TIN – IRS notifies payer of incorrect TIN • Withholding time frames – begin with first payment over $600 – until payee provides correct TIN TIN Matching Program • Benefits: – Match payee name with Form W-9 – Match TIN with IRS records – Decrease backup withholding and penalty notices – Reduce the error rate in TIN validation • e-services verification available California Backup Withholding Requirements • If required to remit federal backup withholding to IRS, withhold 7 percent of income. • Remit to Franchise Tax Board: www.ftb.ca.gov/individuals/WSC/Backup_Withholding.shtml Reporting Independent Contractors to EDD DE 542, Report of Independent Contractor(s) – $600 or more for services in a calendar year. – Applies to services provided by sole proprietor. Form 1099-MISC Filing Requirement • Report payments of $600 or more paid in the course of your trade or business to non-employees annually. • Report payments of at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. • Provide required copies timely to: – Payees by January 31 – IRS by last day of February • Exception awareness Potential Penalties • Failure to file correct information returns by due date • Trust fund – imposed when taxes withheld are not sent to IRS – 100% of taxes, for taxes not sent to IRS – potential backup withholding for payer Federal Forms and Due Dates • Form 945 to IRS, due January 31 • Form 1099-MISC to: – Independent contractor, due January 31 – IRS, due last day of February • Form 1096 (with Forms 1099) to IRS, due last day of February NOTE: Obtain Form W-9 from independent contractor prior to first payment. State Forms and Due Dates Form DE 542 Issue to EDD Due The earlier of 20 days from entering into contract, or making payment Employer Responsibilities Employer’s Federal Requirements • Obtain Federal Employer Identification Number with Form SS-4 • Complete federal forms – W-4, Employee’s Withholding Allowance Certificate – Form I-9, Employment Eligibility Verification • Notify IRS of address change Employer’s State Requirements • Obtain a Workers’ Compensation Insurance policy. www.dir.ca.gov/dwc www.statefundca.com • Apply for state employer account number. DE 1, Registration Form for Commercial Employers When Hiring New Employees • Obtain DE 4, Employee’s Withholding Allowance Certificate, if status/allowances claimed differ from Form W-4. • Submit DE 34, Report of New Employee(s). Employee Notification Requirements • DE 35, Notice to Employees • DE 2511, Paid Family Leave • DE 2515, State Disability Insurance • DE 2320, For Your Benefit • Written separation notice to employees. Posting Requirements Generally, federal and state laws require that employers post complete, up-to-date versions of labor notices and other required posters. Current posting requirements are available at: www.taxes.ca.gov/Payroll_Tax/postingreqbus.shtml Recordkeeping • Maintain wage, earning, deduction, and withholding records on employees. • Provide earning statements to each employee, each payday. • Retain employee records and returns for at least four years. Reporting and Depositing Requirements 2013 Federal Payroll Taxes Employer pays: • FUTA: 0.6% for the first $7,000 paid to each employee as wages during the year • FICA Social Security: 6.2% on first $113,700 (wage base limit) • FICA Medicare: 1.45% on all wages 2013 Federal Payroll Taxes (continued) Employee pays: • FICA Social Security: 6.2% on first $113,700 (wage base limit) • FICA Medicare: 1.45% on all wages • Federal Income Tax: Refer to Pub 15 2013 State Payroll Taxes STATE UI Unemployment Insurance ETT Employment Training Tax Employer pays 3.4% 0.1% Employee pays Wage Limit $7,000 $7,000 PIT SDI State Disability Personal Income Tax Insurance (State Income Tax) 1.0% DE 44 $100,880 None Electronic Federal Tax Payment System • Methods – Visit www.eftps.gov – Call toll-free 800-555-4477 • Free • Available 24/7 • Taxpayers guided through process • Third party deposit verification State Electronic Filing and Payment Methods e-Services for Business • Fast, easy, and secure ways to manage your payroll taxes online. • View and edit your returns/reports prior to submission. • Available 24 hours a day, 7 days a week. State Payroll Tax Deposit Methods • DE 88, Payroll Tax Deposit • Electronic Funds Transfer • Credit Card (Telephone or Internet) State Payroll Tax Reporting Forms DE 88, Payroll Tax Deposit DE 9, Quarterly Contribution Return and Report of Wages DE 9C, Quarterly Contribution Return and Report of Wages (Continuation) Forms and Due Dates State Period DE 9 DE 9C 1st Quarter DE 9 DE 9C 2nd Quarter DE 9 DE 9C 3rd Quarter DE 9 DE 9C 4th Quarter Jan., Feb., March Apr., May, June July, Aug., Sep. Oct., Nov., Dec. Due by April 30 July 31 October 31 January 31 Federal Payroll Tax Reporting Forms • Form 941, Employer’s Quarterly Federal Tax Return • Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return – Schedule A, Multi-State Employer and Credit Reduction Information Return • Form 944, Employer’s Annual Federal Tax Return Federal Payroll Tax Reporting Forms (continued) • Form W-2, Wage and Tax Statement • Form W-3, Transmittal of Wage and Tax Statements Form 941, Quarterly Federal Tax Return • First Quarter (Jan. - March) due April 30 • Second Quarter (April - June) due July 31 • Third Quarter (July - Sept.) due Oct. 31 • Fourth Quarter (Oct. - Dec.) due Jan. 31 Penalty and Interest Prevention • Classify workers properly. • File all documents and returns timely. • Make all payments timely and in full. • Use electronic filing and payment methods to reduce errors. • Respond timely to all correspondence. California Tax Service Center Thank You! Questions?