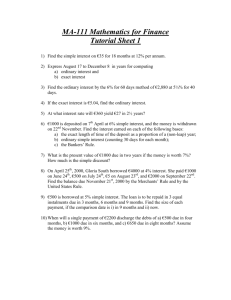

Interest_Sect2_6_7

advertisement

Sections 2.6, 2.7 Three commonly encountered (but not the only) methods for counting days in a period of investment: The “actual/actual” method is to use the exact number of days for the period of investment and to use 365 days in a year. (The table in Appendix A (page 587) is useful with this method.) Simple interest computed with this method is called exact simple interest. The “30/360” method is to assume that each calendar month has 30 days and that the calendar year has 360 days. Simple interest computed with this method is called ordinary simple interest. The number of days between two given dates can be found by using 360(Y2 – Y1) + 30(M2 – M1) + (D2 – D1) where Y1 = year of first date Y2 = year of second date, M1 = month of first date M2 = month of second date D1 = day of first date D2 = day of second date The “actual/360” method is to use the exact number of days for the period of investment but to use only 360 days in a year. Simple interest computed with this method is called the Banker’s Rule. (A “30/actual” method or a “30/365” method could be defined, but rarely is either one of these used in practice.) Suppose that $2500 is deposited on March 8 and withdrawn on October 3 of the same year, and that the interest rate is 5%. Find the amount of interest earned, if it is computed using (a) exact simple interest, With the help of Appendix A, 209 we obtain 2500 (0.05) —— = $71.58 . 365 (b) ordinary simple interest, First we obtain the number of days from 30(10–3) + (3–8) = 205. 205 Then, we obtain 2500 (0.05) —— = $71.18 . 360 (c) the Banker’s Rule. With the counting done in part (a), 209 we obtain 2500 (0.05) —— = $72.60 . 360