Islamic Banking Vs. Interest Rate

advertisement

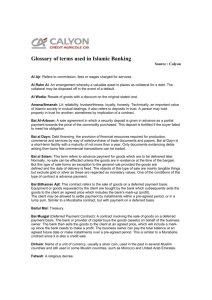

Islamic Banking Vs. Interest Rate Economic System Islamic & Conventional Islamic View Objective Justice and Equity (Economic & Social) Law Divine and unalterable Rights & Responsibilities • Rights of possession but limitation • on ownership and disposition • Compulsory (Zakat) and Voluntary • (Sadaqa) charity • Collective welfare more important • than individual welfare • Freedom restricted to divine will • Ethics dominate efficiency Conventional Objective Profit maximization and efficiency Law Man made and evolutionary Rights & Responsibilities • Unconditional rights to ownership •and disposition • Voluntary charity • Individual welfare more important •than collective welfare • Freedom restricted to changing •norms of society • Efficiency dominates ethics Concept of Riba (Interest) What is Riba (Interest) ? Practice of charging financial interest or a premium in excess of the principal amount of a loan Two explanations provided : Verses related to Riba were revealed towards the end of the Prophet’s life and therefore little history of cases where people asked him about the term Riba was already well known and therefore the Prophet did not elaborate any further The second explanation is a more plausible reason. Lending Practices before Prohibition of Riba (Interest) • Person sells goods on credit for a certain period. If the price is not paid within a certain period, an amount was added to the price and the repayment period was extended. • Person lends money with the understanding that an additional amount would be paid besides the principal within a fixed period. • A rate would be agreed between the borrower and the lender and would be paid along with the principal at the end of the period. If the period was extended, then the rate was increased for the extended period Riba (Interest) in Shariah • Definition in Shariah: Riba refers to the “premium” that must be paid by the borrower to the lender along with the principal amount as a condition of a loan or for an extension in the duration of loan • Four characteristics define the prohibited Riba Positive and fixed ex-ante (includes variable rate) Tied to a time period and amount of loan Payment guaranteed regardless of the outcome of the borrowed loan Practice is sanctioned and enforced by Law Rationale for the Prohibition of Riba (Interest) • Riba and economic & social injustice Riba is a form of economic and social exploitation and violates the core Islamic belief of social justice Lender guaranteed a positive return without sharing any risk with the borrower who assumes all risks including his skills and labor Riba is differentiated from trade, which promotes risk sharing that leads to equitable returns distribution and a more just economic system • Nature of Money Money is not treated as commodity and has no intrinsic utility Money is not held as a subject matter of trade Commodities can be of different qualities whereas money has no quality Money cannot be identified in a transaction of exchange Use is restricted to act as a medium of exchange and measure of value Rationale for the Prohibition of Riba (Interest) ‘Cont’d’ • Promotion of Profit and Risk Sharing Sharing of risks and uncertainties of enterprise is critical in Islamic financial contracts Risk and profit sharing is essential for a return on entrepreneurial effort and financial capital Shareholder is liable for the debts to the extent of his capital and earns dividend when profit is earned Creditor lends money without owning the enterprise and claims interest regardless of profit and loss of the enterprise. Creditor runs the risk of only the solvency of the borrower but not the success of the enterprise Murabaha – Mode of Financing • Originally used as a type of a sale contract and not as a mode of financing. The Shariah scholars have allowed Murabaha as a mode of financing due to practical difficulties in the current economic set up. It used as a device to escape interest (Riba) to carry out real objectives of the Islamic economic system, and it used only as a transitory step under strict conditions and where equity partnerships are not practical • Conditions of Murabaha Must comply with the rules of sale Sale basis and not for financing purposes cannot be used for payment of wages or account payables Default by the end-user the financier has recourse to only the items financed no penalty or further mark up allowed Basis of Profit the type of product, creditworthiness of the buyer and length of time the product is financed Modern Murabaha Contract • It’s a Combination of Deferred Sale Contract and Cost plus Profit Sale. This contract includes the following parties: Vendor or the original seller of the Product Financier, Intermediary or the Islamic Bank The buyer or the end-user of the Product Murabaha Financing Structure I Murabaha Financing Structure II Issues with Murabaha • Use of Promise Bilateral promises in contracts where both counter values are deferred is widely prohibited • Use of Profit Rates and Benchmarks Profit rates is determined based on market interest rate such as LIBOR (London Interbank Offer Rate) • Different pricing for cash and credit transactions Credit price is higher than cash price and the longer the credit period the higher is the credit price • Murabaha appears similar to conventional trade finance Substitution of interest rate by profit rate Same Item Repurchase (Bai-al-Einah) • Practiced in south east Asia (Malaysia) • Variant of a Murabaha contract • The vendor or seller in a Murabaha contract is different from the buyer or client of the Bank • The vendor in Bai-al-Einah is the same as the client • The bank buys the commodity from the client and resells the same to client at a higher price on a deferred payment basis Repurchase (Bai-al-Einah) Structure Distinction between Murabaha and Bai-el-Einah • Murabaha • Bai-el-Einah The seller and buyer are different The seller and the buyer are The financing is related to the price of the commodity The financing is cash for cash and it may not bear any relationship to the commodity. The contract cannot be renewed or renegotiated at maturity The contract may be renewed a number of times and would be no different than conventional loans with compound interest. the same References Iqbal, Zamir. An Introduction to Islamic Finance "Theory and Practice" John Wiley & Sons. Print.