Document

advertisement

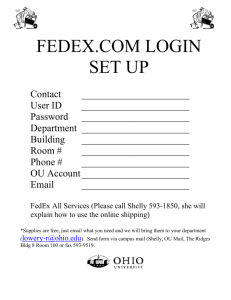

MIS 480 GROUP PROJECT INFORMATION TECHNOLOGY FOR COMPETITIVE ADVANTAGE Derrell Carter Gerald Lommen Dana Perkins CIO Wish List • Competitive Advantage • Adding value • Setting strategic agendas Reference #1 IT Contribution Matrix CONTRIBUTION COMMODITY DIFFERENTIATOR CRITICAL Critical Commodities *** Critical Differentiators *** USEFUL Useful Commodities Eliminate/Migrate Reference #23 IT Impact on Competitive Advantage • Prime Mover – Recognized leader in industry • Barriers to Entry – High infrastructure cost • High Switching Costs – Initial customer buy-in Reference #5 IT Impact on Competitive Advantage • Changes Industry Structure, Alters Rules of Competition • Gives Companies New Ways to Outperform Rivals • Spawns New Business/Divisions from Existing Operations Reference #5 Challenges in Exploring IT • Focusing IT efforts to support business strategies • Using IT innovations to develop new, superior strategies • Devising and managing strategies to deliver low-cost, high-quality IT services • Choosing right platform Using IT for Competitive Advantage Building CA is like a NASCAR race • Everyone starts with similar vehicles – Ideas, tools, goals • Fine tuning during course of the race – Alter strategy/focus • Changes give drivers advantage to lead/win the race Using IT for Competitive Advantage • Advances in IT affect competition and the sources of competitive advantage • IT is more than hardware/software – Data, automation • IT should be used company-wide to bolster value chain Using IT for Competitive Advantage • Explore three successful company’s – FedEx – Package Tracking & Logistics • By Derrell Carter – Baxter Health Care – Medical Supplies • By Gerald Lommen – Sabre Inc. - Technology Distribution • By Dana Perkins Why using IT as a CA is important IT Pros & Cons • Rewards are high if used properly, but success is not guaranteed • IT’s obsolescent nature makes it time sensitive for CA • Competition is using same thing to beat you Federal Express • Package Tracking and Logistics – Derrell Carter FedEx At-a-Glance • Overnight delivery, transportation, information and logistics solutions • Headquartered in Memphis, TN; 215,000 employees worldwide • Created in 1973 by Fredrick W. Smith Reference #7 Company info-Cont. • 30% market share for B2C deliveries • 2000 Revenue of $20 billion • 5 million daily shipments to 210 countries (90% of world’s GDP) • 100 million daily electronic transactions • 650 aircraft, 60,000 vehicles Reference #11 Birth of Overnight Delivery • Federal Express invented the ground/air express industry • Industry growth came from three trends – globalization of business – demand for value-added services – advances in IT and uses for process efficiencies Reference #7 Major Products Customer Characteristics • Businesses looking to reduce distribution costs through logistics operation • Anyone needing reliable, next-day delivery • State-to-state, country-to-country • Dell, National Semiconductor, Omaha Steaks, Cisco Systems Competitors • UPS-Since 1986 has spent $9 billion on IT, formed five alliances to build logistics software; ships more than 55% of Internet orders • DHL-has spent $1.25 billion on worldwide logistics system • TNT-launched one-stop online resource for distribution and delivery Reference #7 IT Structure • Robert B. Carter-Exec. VP & CIO; reports to CEO • Responsible for setting IT strategy and developing apps & IT infrastructure • 5,000 IT employees worldwide • Seven domestic data centers (Memphis, Leiden, Holland & Singapore) Reference #9 IT Structure-Cont. • FedEx invests $1.5 billion annually in IT infrastructure, capital and expenses • IT systems provide around-the-clock global support (applications, networks and data centers) Reference #9 IT Structure-Cont. • IT dept. has history of innovation – Gave customers free PCs and software to track shipments – Issued first handheld scanners and bar codes – Launched first online package tracking website (1994) – Developed software for customer networks Reference #8 Support from the top • IT has a prominent place in strategic business discussions, allowing funding, focus and initiatives to flow • CEO views IT as the core element of FedEx’s business formula • “Information about the package is as important as the package itself.” Fred Smith Reference #7 Critical Difference • Package tracking and logistics capabilities • FedEx wanted to be wherever business was, help customers take advantage of international market Reference #7 History of Innovation 1979-----1984-------1985------1986-------------1993--1994-------> COSMOS--------------------------------------------------------------------> PowerShip----------------------------------------------------> Bar coding----------------------------------------> SuperTracker------------------------> MultiShip-----------------> Internet tracking-> Reference #2 Critical Difference -Cont. • COSMOS (1979)-kept track of all packages handled by FedEx; computer network relayed data on package movement, pickup, invoicing & delivery • Managed people, packages, routes & weather on real-time basis Reference #10 Critical Difference-Cont. • COSMOS linked to central database in Memphis (used bar coding at each stage of delivery cycle) • PowerShip (1984)-provided most active customers with proprietary online services – Frequently used addresses, label printing, online pickup requests, tracking Reference #10 Critical Difference-Cont. • MultiShip (1993)-allowed customers to process packages shipped by other providers • Electronic Data Interchange (EDI)allowed FedEx to track back through customer supply chain to provide logistics management services – Transportation, inventory control, purchasing, sales & customer support Reference #10 How’s it Used • Dell-direct sell for PCs; FedEx provided system for tracking and monitoring PC assembly orders; allows for custom-built orders & short delivery time Reference #7 How’s it Used • National Semiconductor-outsourced warehousing to FedEx; six factories ship to FedEx distribution center, reduced delivery cycle from four weeks to two days; distribution costs went from 2.9 % to 1.2 % of sales Reference #7 How It’s Used-(Cont.) • Omaha Steaks-orders simultaneously relayed to warehouse and FedEx; FedEx generates tracking and shipping labels, orders sent to FedEx hub for delivery Reference #7 How It’s Used-(Cont.) • Cisco-coordinates Cisco’s shipping, to eliminate warehousing costs; FedEx created system that automatically selects routes and most effective mode of transportation; all info available over Internet Reference #2 Challenges to Sustainability • UPS taking lead in ground shipping and online purchase delivery by copying FedEx system • UPS handles 55% of all online purchases, 11% revenue growth in 1999 • FedEx handles 10% of online purchases, 8% revenue growth Reference #4 Challenges-Cont. • FedEx still leads overnight shipping (39% share) • FedEx made customers adopt its proprietary system • UPS designed universal system • Partnered with Oracle & IBM Reference #3 Race for the Future • Wireless access to web-based tracking info from any device, worldwide • FedEx Ground – real-time tracking & delivery confirmation info – in-vehicle computers – ring scanners Reference #10 Race for Future-Cont. • FedEx Return system • Signature imaging • ISIS – Extends biz intelligence apps via Internet across supply chain Reference #8 References (1) Competing Interests; CIO, Oct. 1, 1995; Author: Richard Pastore (2) Core IS Capabilities for Explaining IT; Sloan Management Review, 1998; Author: Leslie Willcocks, et.al. (3) Ground Wars; Newsweek, May 21, 2001 (4) Gaining an Edge: It’s All About IT; Computerworld, Nov. 16, 1998; Author: John Verity (5) How Information Gives You Competitive Advantage; Harvard Business Review, July-Aug. 1985; Author: Michael E. Porter, et.al. (6) Strategic Information Systems Revisited: A Study in Sustainability; MIS Quarterly, 1994; Author: Kettinger, et.al. References (7) FedEx Corp.: Structural Transformation Through E-Business; University of Hong Kong, 2000; Author: Pauline Ng (8) Are We There Yet?; CIO, June 1, 1997; Author: James P. Saviano (9) Next Day Change Guaranteed; CIO, May 15, 2001; Author: Mark Gordon (10) FedEx website (www.fedex.com) (11) Hoovers.com website (www.hoovers.com) Baxter Health Care • Medical Supplies – Gerald Lommen American Hospital Supply Corporation (AHSC) Product Line • Hospital and laboratory sector – General and specialized patient care items (intravenous solutions, gloves, gowns, syringes, etc.). – Biomedical & industrial laboratory supplies. • Medical specialty products – Diagnostic equip – Surgical inst Reference #12 –Heart valves –Blood-collection systems Early Stages of Race (AHSC) • Tel-American was result of initial move to a customer order entry system in early 1960’s. – West Coast manager put punch cards in hospital’s purchasing department and in AHSC distribution center. Card punches were read and duplicated at AHSC. Reduced problems with late and incomplete deliveries. Reference #12 Early Stages of Race (AHSC) • (Cont.) – System quickly picked up by 200 other customers – Into mid-1970’s, promoted as part of a hospital materials management system. – Example of an “accidental” strategic system. – “We changed the industry, we really did” said AHSC product manager. Reference #12 AHSC/ Baxter Customer Characteristics • 1970s – Customers were brand loyal and not very sensitive to supply cost. – Hospitals, accounting for 2/3 of revenue, and labs, accounting for 1/4. – Supplies and associated logistical costs made up 30-45 percent of hospital costs. Reference #12 Race to Competitive Advantage (AHSC) • ASAP (Analytic Systems Automatic Purchasing) succeeded Tel-American in mid-1970s. – Developed by laboratory mfg division. – Five versions through 1984. – Gradual improvements in input methods, from punch card system connected directly to AHSC mainframe to PC input. Reference #12 Race to Competitive Advantage (AHSC) – Eventually automated entire purchasing process for customer except actual approval. • ASAP succeeded in several ways. – Competitive advantage gained because competitors first had to computerize their own inventories in order to offer computerized system to customers. 50 percent of orders came through ASAP. Reference #12 Race to Competitive Advantage (AHSC) • (Cont.) – Salesmen spent less time with paperwork and more time selling. Evidenced by sales tripling between 1975 and 1984 with little to no increase in sales staff. – Shifting of order entry and related activities to customer saved time and money. – “The computer is at the heart of our success” said AHSC CEO. Reference #12 AHSC/Baxter IT Organization and Budget • Hospital Systems Division had organizational responsibility for ASAP. – Six to nine people full-time for ongoing maintenance of ASAP. – Reported through Corporate Vice President for Planning and Services to CEO Reference #12 AHSC/Baxter IT Organization and Budget • $30 million to build ASAP • $3 million annual operating costs Reference #12 Company Info • American Hospital Supply Corporation (AHSC) through ASAP’s glory years. – Sales increased by 13 percent a year, from $1 billion in 1975 to $3.5 billion in 1984. – Profits increased about 18 percent per year. Reference #12 Mid-race Adjustments (Baxter) • AHSC completed merger with Baxter in 1987. ASAP was a “major plus” in Baxter’s consideration. • CA started to disappear – Development staff had little time for enhancements. – Competitors had systems that were competitive and, in some cases, technically superior. Reference #13 Baxter Healthcare Product Line • BioScience – Therapeutic proteins to treat blood-related diseases – Vaccines – Blood-collection containers • Medication Delivery – Intravenous solutions & equipment. • Renal – Dialysis solutions & Equipment. Reference #15 Mid-race Adjustments (Baxter) • Consulting study resulted in development of ASAP Express, an allvendor system. – Cooperative effort between Baxter and General Electric Information Services. The latter providing telecommunications network. – Hospitals would enter orders for participating vendors in standard format. Baxter orders processed through ASAP and others routed to clearinghouse for pickup. Reference #13 Mid-race Adjustments (Baxter) • (Cont.) – Baxter expected benefits in multiple ways, including: revenue from vendors, control over customer contact point, and additional product “pull-through” (free hardware and software for purchase commitments). Reference #13 Mid-race Adjustments (Baxter) • ASAP Express was an immediate success—used by 2,300 hospitals to reach 1,500 vendors—but during early to mid-1990’s: – Saw little change in functionality because IS staff was too busy fighting fires. – Baxter was losing market share to other healthcare companies. Reference #14 Mid-race Adjustments (Baxter) • (Cont.) – Customers felt limited by proprietary format and limited functionality (orders). – Baxter felt ASAP was becoming a millstone around their necks. Reference #14 AHSC/ Baxter Customer Characteristics • 1990s – Customers more supply cost sensitive and less brand loyal. – More alternative sites (doctor’s offices, walkin emergency and medical centers). Reference #14 Racing into the Future (Baxter) • In mid 1990’s, Baxter changed its competitive approach, moving to an open environment with the OnCall system. – Jointly developed with other players in the hospital supplies market, to combat market fears of a new Baxter domination on EDI. TSI Software (now Mercator) supplied software. Reference #14 / 16 Racing into the Future (Baxter) • (Cont.) – Using generic format, OnCall mapped data entry from customer into a standard format that was converted to internal format when received by vendor. – Customers such as hospitals and healthcare providers buy a kit to facilitate business with specific vendor, which could include vendorunique capabilities—a strategic differentiator for Baxter. Reference #14 / 16 Racing into the Future (Baxter) • In 2000, Baxter—with four other healthcare suppliers—added another open environment option, Global Healthcare Exchange. – Operates as an independent company with suppliers having an equity interest. Reference #17 Racing into the Future (Baxter) • (Cont.) – Internet exchange intended to streamline procurement by providing single source for health-care purchases. – Users now number more than 100 suppliers and 400 hospitals. Reference #17 Racing into the Future (Baxter) • OnCall and Global Health Exchange reflected Baxter’s new strategy. – Use information from open environment to develop value-adding applications to customers. – Demonstrate to customers the cost-reduction opportunities from using these tools. Reference #14 / 17 Company Info • Baxter Healthcare – $6.9 billion sales and $738 million earnings from continuing operations in 2000. – Sales up 50 percent from 1996. Reference #15 References (12) Harvard Business School case 9-186-005, copyright 1985 (13) Harvard Business School case 9-188-080 copyright 1988 (14) Harvard Business School case 9-195-103 copyright 1994 (15) Baxter Healthcare web site (www.baxter.com) (16) Mercator web site (www.mercator.com.au) (17) Global Health Exchange web site (www.ghx.com) Sabre Incorporated • Technology Distribution – Dana Perkins Company History • Sabre Inc. (Semi-Automated Business Research Environment) • 1959-60 American Airlines & IBM joint venture, 1964 nation wide, Spun Off March 2000 • AMR Corp parent company to American Airlines owns 80% of Sabre Reference #19 Company Size • 2000 Revenues of $2.6 billion ($1.94 billion airline infrastructure business sale to EDS) • Headquarters: Dallas/Fort Worth, Texas • 6,000 employees located in 45 countries Reference #19 Company Size – Cont. • Connects > 59,000 travel agents • Provides travelers content from 450 airlines, 53,000 hotels, 54 car rental companies, eight cruise lines, 33 railroads and 228 tour operators Reference #19 Major Products • Get There • Travelocity • Virtuallythere Reference #18 / 19 Major Products – Cont. • eMergo • Web-enabled application service provider (ASP) • Comprehensive portfolio of airline industryspecific IT solutions includes 18 products • Complete Airline IT solution Reference #18 / 19 Major Products – Cont. • Provide IT products to Airlines, Travel Agencies, and Corporations • Management Software and Service Support for: •Air cargo •Airline, Car, & Hotel Res. •Airport Operations •Crew Scheduling •Dining & Cabin Services •Flight Operations •Finance Systems Reference #19 •Airplane Maint. & Repair •Planning & Scheduling •Price & Yield Mgnmt •Revenue Maximization •Target Marketing •Sales & Marketing •Consulting Serendipitous Creation • Sabre technology was developed to satisfy customer desires • Employee’s all over the world required to access flight schedules and seat information real time • Sabre developed a system which the industry adopted Reference #18 Customer Characteristics • Travel industry participants • Geographically spread out • Require timely, specific information • Service demanding customers who require accurate flexible travel customization • Extremely accurate aircraft maintenance and part scheduling Reference #22 IT Structure • IT Department organizational chart: • The CIO is also a Senior Vice President • Carol A. Kelly • Reports directly to CEO • Responsible for the development of internal system architecture, and delivery of systems that support Sabre business process Reference #18 / 19 / 21 IT Structure • March 2001 IT Mega deal with EDS • • • • $2.2 Billion over 10 Years Transferred 4200 IT people to EDS “Wholesale outsource of IT” Retained control through CIO and small contract monitoring staff Reference #21 IT Structure • How many people work in the IT department: • Less than 100 and shrinking • Annual IT budget • Less that .1% of earnings Reference #18 The Critical Difference • Wholesale outsourcing • “Big, gutsy, bold move, giving up the data centers that once formed the core of its business” • “They obviously don't view anything as a sacred cow," Reference #21 / 22 System History • Brand new system, little history • Past mega deals lessons learned • Not always successful • Constant monitoring • Requires occasional renegotiation Reference #18 How’s it Used • Complete outsourcing designed to reduce costs, and allow Sabre to focus on its travel marketing and ticket distribution business and related operations, including eMergo the application software suite Reference #19 References (18) Phone Interview with Mike Berman VP Corporate Communications (0815, 30OCT01 #817-967-0001) (19) Company Web Site (www.sabre.com) (20) Lessons learned, insights gained; Informationweek, May 8, 2000; Author: Larry A. Olsen (21) Sabre sells IT Business to EDS; Computerworld, March 19, 2001; Author: Michael Meehan (22) EDS to boost Sabre’s ASP; Internetweek, March 26, 2001; Author: Jade Boyd (23) Dr. Mary Lacity Difficult to Use IT to Gain a Sustainable Competitive Advantage • Business strategies may change • Competitors always seeking to copy (IT cannibalism) • Customer expectations change • Availability of financial resources for research and development Key Features of these Successful Systems • FedEx • Developed package tracking and logistics system that serves a air/ground express industry. Used EDI to maximize information exchange with customers, opening door for added value, increased revenue streams Key Features of these Successful Systems • Baxter • Automation of previously manual processes made the supply chain more efficient and effective. Had jump on other suppliers in making use of computers • Sabre • Created an IT application that was adopted by the industry • Spun off into own company Lessons Learned • Competitive advantage IT development often “accidental” • Competitive use of IT has to be an integral part of business strategy • Quick business reflexes and a clear vision are required to sustain CA using IT and win the race Reference #6 QUESTIONS?