Finance Study Guide 2 – Answers - IDEA IB Math

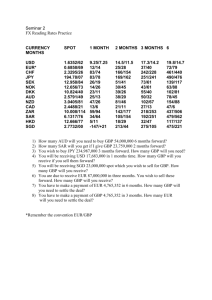

advertisement

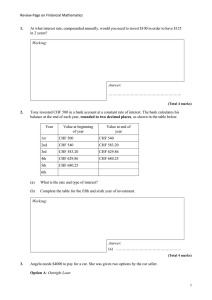

Name: Date Due: Mon. Oct. 22, 2012 Finance Study Guide 2 1. Tony invested CHF 500 in a bank account at a constant rate of interest. The bank calculates his balance at the end of each year, rounded to two decimal places, as shown in the table below. Year (a) (b) 1st 2nd 3rd 4th 5th Value at beginning of year CHF 500 CHF 540 CHF 583.20 CHF 629.86 CHF 680.25 Value at end of year CHF 540 CHF 583.20 CHF 629.86 CHF 680.25 6th CHF 734.67 734.67 * 1.08 = CHF 793.44 680.25 * 1.08 = CHF 734.67 What is the rate and type of interest? Complete the table for the fifth and sixth year of investment. Working: The rate is 40/500 = 0.08 = 8%. Answer: (a) 8%; this is compound interest. (Total 4 marks) 2. Miranti deposits $1000 into an investment account that pays 5% interest per annum. (a) What will be the value of the investment after 5 years if the interest is reinvested? “Reinvested” = compound interest. Use Apps > Finance > TVM Solver: N=5*1=5 I% = 5 PV = -1000 (It’s negative because when we look at interest we’ll ignore it) PMT = 0 FV = 0 (placeholder for unknown) P/Y= 1 C/Y = 1 (Does not say how often it is compounded, which implies annually) after you’ve entered everything, move the cursor next to FV (final value) and hit ALPHA -> ENTER FV = 1276.281563 It will be worth $1276.28 (2) Page 1 of 4 Name: Date Due: Mon. Oct. 22, 2012 Finance Study Guide 2 How many years would it take Miranti’s investment of $1000 to double in value? TVM Solver: N = 0 (placeholder for unknown) I% = 5 PV = -1000 PMT = 0 FV = 2000 (to double, she would need to have 2 * 1000) P/Y= 1 C/Y = 1 (Does not say how often it is compounded, which implies annually) after you’ve entered everything, move the cursor next to N (number of compounding periods) and hit ALPHA -> ENTER N = 14.20669908 (b) Because it is compounded once per year, # of years = 14.206609908. She will not get the extra interest until the end of that year, though, so… It will take 15 years for Miranti’s investment of $1000 to double in value. (4) At the beginning of each year Brenda deposits $1000 into an investment account that pays 5% interest per annum. Interest is calculated annually and reinvested. (c) How much would be in Brenda’s account after 5 years? The easiest way is to make a table, and work through it one year at a time. Year Start of the Year Working End of Year 1 1000 1000 (1 + 5/100) 1050 2 1050 + 1000 = 2050 2050 (1 + 5/100) 2152.50 3 (add 1000) 3152.50 3152.50 (1 + 5/100) 3310.125 4 (add 1000) 4310.125 4310.125 (1 + 5/100) 4525.63125 5 (add 1000) 5525.63125 5525.63125 (1 + 5/100) 5801.912813 After 5 years, there would be $5801.91 in Brenda’s account. (4) (Total 10 marks) Page 2 of 4 Name: Date Due: Mon. Oct. 22, 2012 Finance Study Guide 2 3. The following is a currency conversion table: FFR USD JPY GBP French Francs (FFR) 1 p q 0.101 US Dollars (USD) 6.289 1 111.111 0.631 Japanese Yen (JPY) 0.057 0.009 1 0.006 British Pounds (GBP) 9.901 1.585 166.667 1 For example, from the table 1 USD = 0.631 GBP. Use the table to answer the following questions. (a) Find the values of p and q. p = 1/6.289 = 0.1590077914… p = 0.159 (first write unrounded) q = 1/0.057 = 17.54385965… q = 17.544 (to 3 d.p. to match the table) (2) (b) Mireille wants to change money at a bank in London. (i) How many French Francs (FFR) will she have to change to receive 140 British Pounds (GBP)? There are several ways you could do this: (1) Set up a proportion : x FFR 1 FFR x = 1386.138614 (1386.14 FFR) = 140 GBP 0.101 GBP (2) Set up an equation: x * 0.101 = 140 and solve for x For all of these, Mireille will have to change 1386.14 FFR. (ii) The bank charges a 2.4% commission on all transactions. If she makes this transaction, how many British Pounds will Mireille actually receive from the bank? Commission is 2.4%: 140 * 2.4/100 = 3.36 GBP Mireille will actually receive 140 – 3.36 = 136.64 GBP. (4) (c) Jean invested 5000 FFR in Paris at 8% simple interest per annum. Paul invested 800 GBP in London at 6% simple interest per annum. (i) How much interest in FFR did Jean earn after 4 years? Simple interest: I = CRN/100; I = ?, C = 5000, R = 8, N = 4 I = 5000 * 8 * 4/100 = 1600 FFR (ii) How much interest in US Dollars did Paul earn after 4 years? Simple interest: I = CRN/100; I = ?, C = 800, R = 6, N = 4 I = 800 * 6 * 4/100 = 192 GBP, but question asked for it in USD: From table, exchange rate from GBP to USD is 1.585: 192 * 1.585 = $304.32 (iii) Who had earned more interest after 4 years? Paul earned more interest than Jean after 4 years. (iv) Explain your reasoning in part (c) (iii). To compare, turn Jean’s interest into USD also: 1600 * 0.159 = $254.40 Paul earned $304.32, which was more. (7) (Total 13 marks) Page 3 of 4 Name: Date Due: Mon. Oct. 22, 2012 Finance Study Guide 2 4. The following table shows the monthly payments needed to repay a loan of $1000 with various rates and time periods. Table of Monthly Repayments per $1000 Annual interest rate Loan Term (months) 5% 5.5% 6% 6.5% 12 87.50 87.92 88.34 18 59.74 60.21 60.62 24 45.94 46.38 46.84 30 37.66 38.11 38.57 36 32.16 32.62 33.09 42 28.25 28.72 29.20 48 25.33 25.81 26.30 Sarah takes out a personal loan for $24 000 to buy a car. She negotiates a loan for three years at 6 per annum interest. (a) Calculate the exact monthly repayment she will make. Since it is 6% interest, use the third column. 3 years = 36 months (5th row) Table is only per $1000, so we will multiply by 24: 24 * 33.09 = $794.16 88.75 61.12 47.25 39.04 33.56 29.70 26.80 (2) (b) Find the exact total of the repayments she will make. $794.16 for 36 months: 36 * 794.16 = $28589.76 (2) Beryl took out a loan of $10 000 for 18 months. The total she paid for the loan was $10 837.80. (b) Find the rate of interest charged on the loan. Monthly payment: 10837.80 ÷ 18 = 602.10… but the table is per 1000, so we’ll divide that by 10 to get a monthly payment of $60.21. Look at the 18% row until you see monthly payment that matches $60.21… Beryl’s rate of interest was 5.5%. (2) (Total 6 marks) Page 4 of 4