- The Law

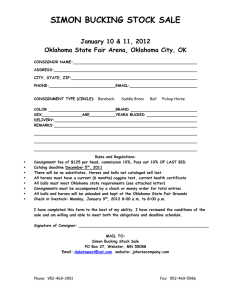

advertisement

LEGISLATIVE HISTORY The service of ‘Transport of Goods by Road’ was brought into the service tax net for the first time with effect from 16.11.1997 as the service provider was designated as “goods transport operator” i.e. any commercial concern engaged in the transportation of goods other than a courier agency. It was also provided under the sub-rule 2(1)(d) that, in relation to service provided by a goods transport operator, every person who pays or is liable to pay the freight either himself or through his agent was made responsible for collecting the service tax and remitting the same to Government. The levy remained in force only from 16.11.1997 to 1.6.1998. SUPREME COURT STRIKES DOWN THE LEVY OF SERVICE TAX On 27.7.1999 in the case of Laghu Udyog Bharati vs. Union of India (2006) 4 STT 322, the Supreme Court struck down the sub-rule 2(1)(d) under which the service receiver was made liable to collect and pay service tax. The Govt however validated it through the insertion of Section 116 and 117 of the Finance Act, 2000 and Section 158 of the Finance Act, 2003. Fresh procedure was prescribed to pay the tax due for the period 16.11.1997 to 1.6.1998 REVIVAL OF THE LEVY OF TAX ON SERVICE OF TRANSPORT OF GOODS BY ROAD Budget proposals for the financial year 2004-05 incorporated proposal for service tax on ‘goods transport agency’ instead of the ‘goods transport operator’. The actual levy of tax was put on hold through an executive instruction dated 10.9.2004. Committee has been set up to look into appropriate mechanism/modalities for collection and payment of service tax by commercial concerns as ‘goods transport agency’. Notification has been issued in December 2004, so as to make the levy effective from 1.1.2005 TAXABLE CATAGORIES OF TRANSPORT SERVICES The tax on services of 1. transport of goods by Air Service U/s 65 (105) (zzn), 2. transport of goods in containers by Rail Service U/s 65 (105) (zzzp) 3. transport of goods, other than water through Pipeline or other Conduit U/s 65 (105) (zzz) has also been introduced in addition to taxable service of ‘transport of goods by road’ to which we are confining the present discussion. TAXABLE SERVICE OF TRANSPORT OF GOODS BY ROAD The ingredients spelt out in the definition are as follows :1. The service is provided or is to be provided to a customer 2. The service must be in relation to carriage of goods. 3. The carriage of goods must be by road. 4. The goods must be carried in a goods carriage WHAT IS A ‘GOOD TRANSPORT AGENCY’ ? “means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called;” After 1.5.2006 ‘any person’ providing service as a Goods Transport Agency is liable to Service Tax earlier the words used were ‘Commercial Concern’. The word ‘Person’ when generally used without any qualification means not only a natural person, but also a juristic or artifical person. MEANING OF ‘CONSIGNMENT NOTE’ AND ISSUING OF ‘CONSIGNMENT NOTE’ MADE MANDATORY ‘When a person deposits the goods with any transporter for the purpose of transport to a given destination, the transporter issues the lorry receipt or consignment note to the person depositing the goods’. Under Rule 4B from 1.1.2005 it is mandatory to issue a serially numbered consignment note containing the prescribed particulars: The name of the consignor and consignee Registration number of the goods carriage in which the goods are transported Details of the goods transported Person liable for paying service tax, whether consignor, consignee or the goods transport agency. No specific form has been prescribed for the purpose of issuing consignment note. MEANING OF ‘GOODS’ Under Section 65(50) of the Act the word ‘Goods’ has the same meaning assigned to it in clause (7) of Section 2 of the Sale of Goods Act, 1930- “goods’ means every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be served before sale or under the contract of sale”. WHAT IS THE MEANING OF ‘GOODS CARRIAGE’ ? The medium of transport must be a ‘goods carriage’ “Goods carriage” has the meaning assigned to it in clause (14) of Section 2 of the Motor Vehicles Act, 1988” As per Section 2(14) of the Motor Vehicle Act, 1988, “goods carriage” means “Any motor vehicle constructed or adapted for use solely for the carriage of goods or any motor vehicle not so constructed or adapted when used for carriage of goods”. The word ‘motor vehicle’ will cover all the mechanically propelled vehicles like trucks, light carriage vehicles, trailers, cars etc SERVICES NOT TAXABLE Goods transport agency accepting goods from other goods transport agency – If the goods transport agency accepts goods for carriage from other goods transport agency then he will not be liable for service tax as the other goods transporter agency is not a customer. Carriage of goods on animals, human being, hand carts, or bullock carts, etc, which does not involve use of motor vehicle is excluded as they are not covered under the definition of ‘goods carriage’. EXEMPTION TO THE EXTANT OF 75 PERCENT ON VALUE OF TAXABLE SERVICE Only 25 percent of the freight paid will be subjected to service tax at the prescribed rate. The exemption will not be available if the goods transport agency has:1. taken Cenvat credit of duty on input or capital goods used for providing taxable services, or 2. taken Cenvat Credit of service tax on input services used for providing taxable service, or 3. availed exemption on cost of goods and materials sold to the recipient of the service, in terms of Notification No. 12/2003-ST, dated 20.6.2003 CONSIGNORS/CONSIGNEES CAN AVAIL THE 75% ABATEMENT Consignors/Consignees can pay tax only on 25% of the ‘value of taxable service’. Subject to the condition that the ‘goods transport agency’ had fulfilled the conditions prescribed in the Notification No. 12/2003 ST dated 20.6.2003. Obtain a declaration from the ‘goods transport agency’ to the effect that such agency have not availed Cenvat benefit or benefit of Notification No. 12/2003 VALUE-BASED EXEMPTION ON CONSIGNMENTS Notification No. 34/2004-S.T. dated 3.12.2004 grants full exemption from tax in the following two situations:1. where the gross amount charged on all consignments transported in a goods carriage does not exceed Rs. 1,500. 2. where the gross amount charged on an ‘individual consignment’ transported in a good carriage does not exceed Rs. 750. An ‘individual consignment’ for the purpose of (b) above means all goods transported in a goods carriage for a consignee. CERTAIN SPECIFIED PERSONS MADE RESPONSIBLE FOR PAYING SERVICE TAX As per the provisions of Sec 68 (2) the liability to pay service tax in the case of service of transport of goods by road has been shifted to the service receiver or other specified person. The person i.e. consignor or the consignee making payment of freight to the taxable service provider, is responsible for payment of service tax to the Government Account. ISSUANCE OF INVOICES, BILLS, CHALLANS Taxable service provider required to issue invoice, bill or challan within 14 days from either the date of completion of provision of service or receipt of any service charges whichever is earlier. Such document should be serially numbered and should contain the name, address of the service provider and the service receiver as well as description, classification and value of service provided and service tax payable thereon. To avail CENVAT credit by the recipient of taxable service, the amount of ‘education cess' and ‘secondary and higher education cess' should be shown separately on the invoice. STC no./ Registration no. of the service provider should also be mentioned on the invoice. Document must also contain the consignment note number, date and gross weight of the consignment. ISSUANCE OF CONSIGNMENT NOTES Rule 4B of the Rules prescribes that the goods transport agency shall issue a ‘consignment note’. Consignment Note should be serially numbered and would contain the names of the consignor and consignee, the vehicle registration number, details of goods transported, details of place of origin and destination, and the person i.e. consignor / consignee/ goods transport agency liable to pay service tax. PROCEDURAL RELAXATIONS CONSIGNMENT NOTES In case of small cargo, where the goods transport agent is not aware of the vehicle registration number at the time when he receives the goods and issues consignment note, he may mention the nonavailability of vehicle registration number on the copy issued to the consignor & the same may be noted afterwards, he should mention the number consignment note-wise, in the records. In trans-shipment of goods en-route, the records of registration numbers of the vehicles carrying such goods under a consignment note must be recorded as soon as the said information is available to the goods transport agent. RESPONSIBILITIES OF THE GOODS TRANSPORT AGENCY 1. 2. Mandatory to issue a consignment note under Rule 4-B and also an invoice, bill/Challan under Rule 4-A in respect of consignment on which service tax is payable. The sole responsibility for availing exemptions correctly, and for determining the value of the taxable service and the service tax payable is on the goods transport agency. For payment of service tax, concession has been allowed to the goods transport agency:Where the consignor and the consignee are both non-specified persons (like individual, HUF etc), the responsibility for collection and payment of service tax to Government account rests with the goods transport agency. Where either the consignor or the consignee, or both of them, is a specified persons under sub-clause (v) of Rule 2(1)(d), the agency need not collect service tax from the consignor and, consequently, has no responsibility to remit the service tax. RESPONSIBILITIES OF THE CONSIGNOR & CONSIGNEE All specified persons must get themselves registered under the Service Tax Provisions. If the specified person is the consignor, it must ensure to receive the consignment note and invoice from the goods transport agency. It need not pay the service tax due to the goods transport agency. If the consignor is liable to pay freight, it must directly remit the service tax due to Government account. This can be done either on monthly basis or quarterly basis, as per Rule 6(1) of the Service Tax Rules. If the consignee is liable to pay freight, the consignment note / invoice will still be handed over to the consignor only by the goods transport agency. It will be the responsibility of the consignor to transmit the documents to the consignee. The consignee shall then directly pay the tax due to Government account. I sincerely acknowledge the guidance and feedback received from my colleagues specially Mr. Naveen Garg, Chartered Accountant & Mr. Arvind Sharma, Advocate. R-13/24, RAJ NAGAR, OPP. A.L.T.C., GHAZIABAD PH: 0120-2820380, 2821407