EWEA's next 20 Year Offshore Network Development Plan?

advertisement

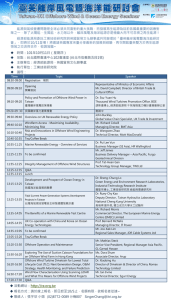

Iceland and the European offshore electricity grid Justin Wilkes Policy Director The European Wind Energy Association More than 700 members from almost 60 countries • • • Manufacturers with a leading share of the global wind power market Component suppliers Research institutes National wind and renewable associations • • • • Developers Electricity providers Finance and insurance companies Consultants • Contractors • www.ewea.org/membership This combined strength makes EWEA the world’s largest and powerful wind energy network EWEA Lead Sponsors Tackling the flexibility challenge Variability is an inherent characteristic of every power system Flexible generation is largely provided by gas, hydro and to a lesser extent biomass Large scale DSM and new energy storage remain unavailable in the short term An economically viable power system with large amounts of RES will require changes in all 3 areas Source: IEA 2011, Harnessing Variable Renewables Momentum for grid development in Europe is evident • Already in September 2009 EWEA published its “Offshore Network Development Master Plan” • North Seas Countries Offshore Grid Initiative signed by 10 countries in 2010 – ongoing work • Offshore Grid is a key part of the European Infrastructure Package • Second ENTSO-E 10-year network development plan in the making Prominent grid infrastructure projects: • UK/Norway under consideration • NorGer - Germany/Norway ministerial agreement • Krieger’s Flak (Germany – Sweden and Denmark on hold) with EERP financing • Cobra cable (Netherlands/Denmark) with EERP financing • East-West interconnector, EIB loan (Ireland/Wales) • BritNed, EIB loan (UK/Netherlands) • Skagerrak 4 (Denmark/Norway) EWEA’s 20 year offshore network development plan Global cumulative wind power capacity 1990-2007 (MW) • All necessary grid updates to transport all electricity produced by planned, proposed, under construction and operating offshore wind farms to European electricity consumers in an economically sound way • Recommends building a transnational offshore grid infrastructure to connect: 40 GW by 2020 150 GW by 2030 EWEA’s 20 year offshore network development plan Global cumulative wind power capacity 1990-2007 (MW) • Based on: - Existing TSO plans - TradeWind scenarios • Added value of plan: - Provides step by step timetable for grid development - Suggested capacities - Integrated with development/concession zones Offshore grid design •Lines/branches: submerged HVDC cables characterised by transmission capacity, •Offshore nodes: offshore platforms containing HVDC conversion equipment, switchgear etc. to serve as: –common connection points for a number of offshore wind farms; –common connection points for a number of other marine generators; and –intersection (junctions) of network branches. •Onshore nodes: connection points to interconnect the offshore transmission grid to the onshore transmission grid. EWEA’s 20 year offshore network development plan Global cumulative wind power capacity 1990-2007 (MW) Source: EWEA 2009 EWEA concept one of many Building the European offshore grid Global cumulative wind power capacity 1990-2007 Benefits (MW) • Predictable energy output • Connections to more than one country • Power trading between countries • Viable alternative to onshore grid construction • Connection to other marine renewable energy sources • More economical utilisation of grid through shared use • More energy security • More interconnection capacity means more firm power • Build a single European electricity market to benefit all consumers BUT: Iceland not yet part of these considerations Current EU approach to facilitate grid developments Current TEN-E programme is insufficient COM investment estimates 2010-2020: • Electricity: 140 bn € (onshore, offshore and smart grids at transmission and distribution level) • Gas: 70 bn € TEN-E budget 2007-2013 was increased from 155 mln € to currently 5.1bn € 2014-2020 in the „Connecting Europe Facility“ and revised guidelines on TEN-E Agreement on Trans-European Networks Main elements: • Priority infrastructure corridors agreed – all renewables focussed – Northern Seas offshore grid – North-South electricity interconnections in Western Europe – North-South electricity interconnections in Central Eastern and South Eastern Europe – Baltic Energy Market Interconnection Plan in electricity • Priority thematic areas agreed – electricity highways – smart grids – national/regional TSO coordination (along the lines of CORESO, CECRE) • PICs and PTAs have: – Permitting and planning deadlines of 3 ½ years (binding...) – Access to CEF/TEN-E funding A European Offshore/Supergrid What is needed from the European stakeholders (+TSOs and Regulators): • A European approach towards an optimised European electricity system should be promoted. • Acknowledge that a European Offshore/Supergrid will be beneficial rather than costly for consumers. • Design and implement schemes that favour investment decisions, and ensure a cost recovery for the investors, especially on cross-border projects, which require a more coordinated approach. • Coordination is critical for tackling the challenges of potential distortions created by different interconnection regimes. Recommendations for Iceland • Explore bilateral cooperation possibilities in energy policy in general – Particularly with the UK (in progress) • Make best use of regional cooperation fora – North Seas Countries Offshore Grid Initiative – ENTSO-E regional group for North Sea grid development • Use EU legislation – Renewable Energy Directive 2009/28 cooperation mechanisms Recommendations for Iceland • Explore business case for electricity exports to UK • Explore feasibility of HVDC interconnectors – Address technology challenge – Address financial risk Ongoing challange: How to create a facilitating environment for private and public investments in energy infrastructure in the EU • Issue for TSOs/private investors: Most interconnectors might have good business case, but access to equity is difficult • Private investors often lack awareness on why investments in energy infrastructure are viable (low ROR, but also low risk, especially interesting for institutional investors) • Environment slowly changing: e.g. Mitsubishi engagement in Tennet to jointly invest in four offshore grid connections in Germany Need to create a better investment framework for infrastructure Investments: recognised in the European Infrastructure Package TEN-E budget should be used to leverage private finance, be that EC Project bonds or equity, rather than grants EWEA’s next 20 Year Offshore Network Development Plan? Thank you www.ewea.org EWEA 80 RUE D’ARLON B-1040 BRUSSELS T: +32 2 213 1811 F: +32 2 213 1890 E: ewea@ewea.org