Reading: Nominal Versus Real Exchange Rates

advertisement

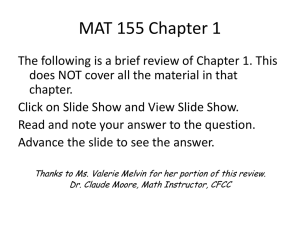

Nominal Versus Real Exchange Rates Nominal Exchange Rate Nominal exchange rates simply refer to the quoted rates we observe in the market. For example, on September 14th Bloomberg.com reported the GBP-USD exchange rate at 1.6217. Thus, the nominal exchange rate tells you how much of one currency you will receive for another (in the above case $1.6217 for each British pound). Occasionally, you will see the term nominal effective exchange rate. This term is simply the weighted average value of a country's currency relative to a basket of currencies, with the weights being determined by the importance (percentage) of each foreign country to the foreign trade of the home country. Real Exchange Rate A real exchange rate is where the effects of inflation have been taken into account. Essentially, the real exchange rate can be defined as the nominal exchange rate adjusted for inflation differentials among the countries. As with the nominal exchange rate, you will sometimes see the term real effective exchange rate. Again, this is a weighted average of the real rates as noted above. The real exchange rate is calculated as follows: Real exchange rate = (nominal exchange rate* X home country price) / (foreign country price) *Where the nominal exchange rate is expressed as the number of foreign currency units per one home currency unit. Example: Assume the nominal GBP-USD exchange rate of 1.6217. Now assume the price level (for some basket of goods) in the UK is 100 pounds and for the same basket of goods in the U.S. the price is $85.00. Calculating the real exchange rate for the British pound gives us the following: (1.6217 x 100)/85 = 1.9079 Note: Higher relative prices are associated with an appreciation (or rise) in the real rate. When the real exchange rate is high or rising, the relative price of goods at home is higher than the relative price of goods abroad. Over time, a high and/or appreciation of the real exchange rate indicates that the foreign price (in the above example in the U.K.) of a bundle of goods has risen relative to the price in other countries (in the above example in the United States). This case can lead to an eventual increase in the importation of foreign goods. On the other hand, when the real exchange rate is low, this can encourage exports. Real Effective Exchange Rates for the U.S. Dollar and Canadian Dollar The World Bank Group estimates real exchange rates for many countries. The data is presented in an index form. The chart below presents the data for the USD and CAD from 2003 to 2011. Look at the chart and make sure you can interpret what both currencies were doing in terms the reported real rate and the implications for both as noted above. Real Exchange Rates, USD and CAD 120 Index 2005 = 100 115 110 105 100 USD 95 CAD 90 85 80 2003 2004 2005 2006 2007 2008 2009 2010 2011