Chapter 2 - Hondros Learning

Chapter 2

Relevant Characteristics

Chapter 2: Objectives

Upon completion of this unit, you will be able to:

• Define relevant characteristics and their importance in appraising.

• Identify the Green MLS.

• Review heating system energy efficiencies.

• Contrast qualitative analysis and quantitative adjustments.

Chapter 2: Objectives (con’t)

• Recognize the value of EEM’s and borrowing power.

• Define paired sale adjustments.

• Identify how to compare data to calculate a property’s value.

• Describe cost and payback.

Key Terms

• Energy Efficient Mortgages (EEMs) Mortgages offered by HUD which take into account the energy costs of the house, and allow the borrower to extend his/her debt to income ratios to take into account the lower energy costs.

• Green MLS A Multiple Listing Service (MLS) which has added sufficient fields so that energy efficient items can be reported, and therefore, appraisers can find them and make appropriate adjustments for them.

Key Terms (con’t)

• Paired Sale Adjustment In appraisal, the theory that an appraiser can find two sales which are identical in every respect except one, and from that one difference, derive the appropriate, market based adjustment for the difference.

Key Terms (con’t)

• Qualitative Analysis is a method used after any quantitative adjustments have been applied that employs the appraiser’s judgement in forming opinions relying on such methods as relative comparison analysis (bracketing), ranking analysis, and/or personal interviews. The method requires the appraiser to have good judgement and reasoning skills.

Key Terms (con’t)

• Quantitative Adjustments is a method that requires the recognition of the differences between the comparable data and the subject property and assigning either a dollar or percentage amount as an adjustment.

Key Terms (con’t)

• Relevant Characteristics Those characteristics of a property, whether location, physical, legal, or economic, which affect value.

• Typical Purchaser In the context of appraisal, who the person(s) most likely to buy the property would be - appraisers analyze typical purchaser behavior.

Relevant Characteristics

Relevant characteristics:

Standards Rule 1-2 (e) states that an appraiser must:

• “ Identify the characteristics of the property that are relevant to the type and definition of value and intended use of the appraisal, including: (i)its location and physical, legal, and economic attributes ”. [2012-2013

USPAP, lines 510-512]

Relevant Characteristics (con’t)

• A relevant characteristic is any characteristic of the property that affects value in the eyes of a typical purchaser.

• Appraisers need to identify those characteristics and make the appropriate adjustments in the appraisal process.

Relevant Characteristics (con’t)

• Example - a small, open front porch or deck may not affect value; but a screened and glassed “Florida” room may well affect value, because it is a buyer expectation for that kind of home, in that market.

Relevant Characteristics (con’t)

Relevant characteristics will vary by:

– Age.

– Type.

– Price range of home.

• This is because relevant characteristics are tied to typical purchaser expectations .

– For example, in many parts of the country, in new homes, central air conditioning is a typical purchaser expectation.

Energy Efficiencies – Heating Systems

• Many lending requirements (such as

Fannie Mae) require automatic heat.

• Heating systems can be categorized by:

– Type (forced air or hot water or steam).

– Fuel (oil, coal, gas, electric).

– Age (when the buyer anticipates having to replace it).

– Efficiency (how efficient the system is).

Energy Efficiencies – Heating Systems

• In some circumstances, the fact that the heating system was a relevant characteristic might be very apparent; in others, you may have to dig.

– For example: If one of your comparables mentioned “Being sold as is. Furnace is over

30 years old and not functioning,” most appraisers would assume that the buyer discounted the price of the home to reflect this immediate repair.

Energy Efficiencies – Heating Systems

The fuel used to heat matters to buyers.

– Buyers moving from the Midwest to the

Northeast are often uncomfortable with oil heat, as they have never used it before.

– Gas is the predominant heating fuel used in the United States.

– Electricity has been deregulated in many areas, resulting in higher prices. Electricity is generated by a variety of methods, from nuclear energy (space age) to coal.

Calculating a Property’s Value

• Many appraisers are used to calculating an overall effective age for the property, which often takes into consideration the age of component parts, including furnaces, windows, roofs, etc.

• The age of component parts matters to buyers.

In the agent’s comments section of the MLS, you will typically see things like “new roof, new furnace, new hot water heater.”

Appraisers and Real Estate Agents

• As an appraiser, you need to work with real estate agents on a regular basis.

– Agents can be good sources of information on why a buyer rejected House B, but bought

House A, etc.

Appraisers and Real Estate Agents

(con’t)

• An agent might report: “Two of their kids have major allergies and asthma. They refused to look at anything that didn’t have hot water heat.”

• That data impacted that sale to that buyer, but whether the fact that this particular home has hot water heat may or may not be a relevant characteristic to a typical buyer.

Calculating Green

• Here’s a list of items you may not have always thought of as “green”, but you may have already been making adjustments for in your appraisals:

– New vinyl clad thermal pane windows, with double or triple panes, as opposed to wood frame single pane double hung windows.

– Vinyl siding with rigid board insulation underneath, as opposed to what it is covering - either original wood siding, or possibly other siding installed over the wood.

Calculating Green

(con’t)

• Appliances included are all less than two years old and are high efficiency models, as opposed to older ones.

• High efficiency air conditioning system combined with a high efficiency gas furnace, versus 25-year old original electric heat pump system.

Calculating Green

(con’t)

• Discernible insulation, as opposed to little or no discernible insulation, which could be:

– Found in floorboards.

– Evidence of blown in insulation in walls, which can be seen by “plugs” (round to oval shaped pieces of siding which were removed, insulation blown in, and then the piece of siding plugged back into the wall).

– Found on the seller’s property disclosure lists information about the existence of insulation.

Calculating Green

(con’t)

• With the continuing evolution of green building techniques, and the advances in green technology, as appraisers, we will be facing several shades of green.

– For example, the subject property may have a new gas forced air furnace with electric central air, but one of the comparables may have a geo-thermal heat pump. Does that matter to the buyer? How did the buyer take that into account when formulating an offer?

Energy Efficient Mortgages

• Energy Efficient Mortgages (EEMs) would take potential energy savings into account.

Key elements include:

– Used to finance energy improvements up to

10% of the appraised value.

– Work must be complete in 180 days of loan closing. Appraiser must verify improvements.

– HERS report MUST be completed no earlier than 120 days before closing.

Energy Efficient Mortgages

(con’t)

• The two important parts of the program are that:

– Borrowers can finance energy improvements into a mortgage, and qualify for more of a mortgage loan because of the lowered utility costs with a more efficient home.

– EEMs require a home energy rating system

(HERS) report.

Energy Efficient Mortgages

(con’t)

• At one time, Fannie Mae offered EEMs. They have now downgraded this to an “energy efficient feature”.

• Full details can be found at www.efanniemae.com

• Energy Improvement Feature, per Fannie Mae is designed to provide:

– “ sustainable funding for improvements to lower homeowner costs through energy efficiency”.

EEM and Buyer’s Borrowing Power

What does the EEM do for a buyer’s borrowing power?

• Let’s look at the example

For a standard home without energy improvements:

– Buyer's total monthly income $5,000

– Maximum allowable monthly payment at 29 percent debt-to-income ratio $1,450

– Maximum mortgage at 90 percent of appraised home value $303,720

EEM and Buyer’s Borrowing Power

(con’t)

For an energy-efficient home (2000 IECC)*:

– Buyer's total monthly income $5,000

– Maximum allowable monthly payment at 33 percent debt-to-income ratio $1,650

– Maximum mortgage at 90 percent of appraised home value $345,611

– Added borrowing power due to the Energy

Efficient Mortgage $41,891

– *Interest rate four percent, down payment of 10 percent, 30-year term, principal & interest only (tax & insurance not factored.)

EEM and Buyer’s Borrowing Power

(con’t)

• The borrower now has an additional $200 a month to spend on his house payment, instead of utility costs.

• He can spend almost another $42,000 on a house.

– Would an adjustment of $42,000 be justified?

That size of an adjustment is a red flag for both appraisers and underwriters.

Adjustments

• How can you derive an adjustment?

– You should find a “paired sale”—two homes exactly alike in every respect, except for one feature, and the difference in prices can be attributed to that feature.

– When you don’t have a paired sale consider analyzing the data you have with respect to heating systems.

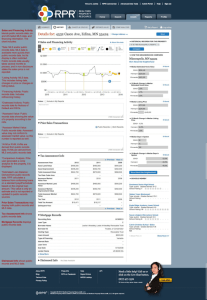

– Look at chart on the next page, comprised of homes which are similar in terms of: location, age, style, size, amenities, but vary in types of heating.

Adjustments

This data would indicate a difference of:

• $5.05 per square foot for gas heat over the standard electric heat pump.

• $12.63 between the electric heat pump and the geothermal heat pump.

• $7.58 per s.f. between the gas forced air/electric central air over the geothermal heat pump.

Adjustments

Assuming that your subject property has the newer gas furnace/electric air conditioning configuration, and comp. #1 has a geothermal heat pump, based on the statistics we derived, the adjustments would look like this:

– Subject

– 2300 square feet

– Energy adjustment

Comp. #1

2300 square feet

-$17,434 ($7.58 x

2300 square feet)

Window Adjustments

• Assume you are appraising a 50-year old home, which has original, wooden, single pane, double-hung windows with an aluminum storm and screen combination over the windows.

• Let’s use the chart on the next slide to illustrate your comparables or “comps.”

Window Adjustments

Comparing the Data

• In looking at the data, the price indicated would be the price per square foot you have calculated after making known adjustments.

In other words, in your market, in specific price ranges, you have undoubtedly already developed and use current market-driven adjustments for things like:

– Garages

– Additional baths

– Porches, fireplaces, decks

– Remodeling

– Overall condition

Comparing the Data

(con’t)

• Comps one, four, and seven all have:

Vinyl siding; replacement windows; rigid board insulation.

• The adjusted prices per square foot are:

$100.00, $99.75 and $100.75. As is true in the real world of appraising, they do not neatly fall into the same pile. But, the median is $100.00, and the mean

(average) is $100.17.

Comparing the Data

(con’t)

• Comps two, five and eight are all brick.

– Comp. #2 has original windows, attic floor insulation (original) and an adjusted price of

$95.

– Comp. #5 has replacement windows, and blown in insulation, and an adjusted price of

$99.

– Comp. #8 has replacement windows, floor insulation only, and an adjusted price of $97.

Comparing The Data

(con’t)

• When comparing the data it’s helpful to build a chart, like you see below.

Comparing The Data

(con’t)

• This indicates a difference of $2.00 per square foot for replacement windows, and

$2.00 per square foot for blown in insulation.

Comparing The Data

(con’t)

• Comps #3 and #9 both are frame, with original windows and attic floor insulation.

Their adjusted prices are $93 and $92.50, respectively. These are so close that it would be defensible for an appraiser to use either one to develop an adjustment.

Comparing The Data

(con’t)

• Comp. #6 is frame, with attic floor insulation, and replacement windows. It sold for $95 per square foot, suggesting an adjustment of $2 per square foot for windows, which is the same adjustment we derived from the analysis of the brick homes.

Comparing The Data

• We can compare comparables one and seven, and we have derived $2.00 per square foot for windows.

• We can derive another $2.00 per square foot for siding and $2.00 per square foot for insulation.

Comparing The Data

• This data indicates the following adjustments, per square foot, after other adjustments have been made:

– Brick or vinyl versus frame = $2.00

– Replacement windows = $2.00

– Blown in insulation = $2.00

Quantitative Adjustments

• At the end of the report, all appraisers are aware that however they derive an adjustment, they should be able to defend it.

• Quantitative Adjustments is a method that requires the recognition of the differences between the comparable data and the subject property and assigning either a dollar or percentage amount as an adjustment.

Qualitative Analysis

• Qualitative Analysis is a method used after any quantitative adjustments have been applied that employs the appraiser’s judgement in forming opinions relying on such methods as relative comparison analysis (bracketing), ranking analysis, and/or personal interviews. The method requires the appraiser to have good judgement and reasoning skills.

Greening the MLS

To review - A Green Multiple Listing Service

(MLS) is a Multiple Listing Service (MLS) which has added sufficient fields so that energy efficient items can be reported, and therefore, appraisers can find them and make appropriate adjustments for them.

Greening the MLS

(con’t)

When a MLS decides to “go green”, it adds searchable fields, allowing appraisers to sort and filter comparable sales for things like:

• Triple pane windows

• Ground source heat pumps

• High efficiency furnaces

• Upgraded insulation packages

• HERS or LEED® ratings

Greening the MLS

(con’t)

A broad sample from green MLS systems shows the ability to search on common fields, including:

• Thermal windows, (U rating and whether or not low e)

• Heating system, by type - e.g. geo thermal

• Onsite energy producing features, such as solar panels

• On demand hot water heaters

• Water savings features, such as cisterns and rain barrels

• Materials used: Bamboo flooring, low or no VOC

• Dual flush toilets

Greening the MLS

(con’t)

• Skylights

• ENERGY STAR appliances

• Use of only native plants for landscaping

• Permeable driveways

• Drought tolerant plants

• Air purification systems

• Any type of third party rating, including date, level, etc.

• Costs to operate the utilities

Portland, Oregon MLS

• One of the early adapters of a green MLS was

Portland, Oregon, which began tracking the sales of green certified homes in 2007.

• A study completed in 2011 showed that new certified green homes in the Portland

Metropolitan Area sold for $223 per square foot versus $185 per square foot for non-certified homes.

• The study also showed that green homes sold faster and for more money than non-certified homes.

Portland, Oregon MLS

(con’t)

• Appraisers know when more information is available to use without “digging,” the more likely we are to use it.

• Since MLS systems are computerized, crunching the numbers are that much easier – which is why –

– The Portland, Oregon MLS was able to assert that green homes sold for more money and more quickly.

Green - Cost and Payback

• Cost does not necessarily equal value. So, appraisers need to determine:

– the cost of green features

– the contribution to the value of the house.

– the amount of time needed to pay back the additional cost of the feature.

Calculating Cost and Payback

• Calculating cost and payback varies.

• Most residential buyers can do a simple pay back calculation by taking the cost of the item, and dividing it by the monthly or yearly savings to determine the payback.

Calculating Cost and Payback

(con’t)

For Example

• A builder offers triple pane windows and an extended insulation package on a basic $250,000 house.

• The upgrades cost $10,000. For the basic house, energy consumption, electricity, and gas is estimated to be $200 a month, with the upgrades, the cost of electricity and gas is estimated to be $100 a month.

• Payback period is calculated as $10,000 ÷ $100 = 100 months; or slightly over 8 years —which may make this an option for the family who expects to be in the house

15 years.

Calculating Cost and Payback

(con’t)

• What about if the payback period is lower?

For example:

– The homeowner is choosing between electric heat and ground source heat pump.

– Installation cost for ground source heat pump is $5,000.

– Anticipated energy savings are at least

$1,000/yr.

– That’s a payback period of just five years!

Calculating Cost and Payback

(con’t)

• HUD has an easy to understand, “walk you through the process” article at: http://www.hud.gov/

• <For Example> Some items can conserve in more than one way. E.G. - a tankless hot water heater saves both fuel and water. With traditional water heaters, homeowners have to turn on the water and let it run until it is hot enough to use. A tankless heater provides hot water on demand.

Tax Credits

• Homeowners should be aware - that any tax credits or incentives they received to install energy saving features generally do not impact subsequent buyers.

• They should also consider that the typical purchaser will discount any incentives he or she is not receiving.

Tax Credits

(con’t)

• Greta Green installed solar panels on the roof of her house to generate electricity and cut her electric bill. Her bill is now about one third of what it was before. The annual savings on her electric bill is about $1,500.

• Her solar panels cost $20,000 - $10,000 (which was paid for by a grant from her power company).

• Greta also received a $3,000 tax credit in the year she installed the panels.

Tax Credits

(con’t)

• Greta may think: “These panels cost me

$20,000, so the price of my house should be another $20,000.”

• However, the buyer will be looking at

Greta’s house in comparison to other homes in similar locations, of similar size and utility, and will only be comparing the costs of electricity from one house to another.

Tax Credits (con’t)

• An astute buyer will also question the typical life expectancy of solar panels and any maintenance they require.

• If the panels have a life expectancy of 15 years and have been in place for 12 years, the buyer knows that to continue the use of panels will likely require an investment of $20,000 - possibly more, possibly less in approximately three years.

Tax Credits

(con’t)

• It is unknown whether the grant from the power company or the tax credit will be available. From the buyer’s perspective, it is the same as having to replace the roof within three years.

• Finally, technological advances occur rapidly in the building industry; it may no longer make sense to replace solar panels. It may be more energy efficient to invest in another energy saving feature, like photovoltaic shingles.

Chapter Summary

• Relevant characteristics are those things that matter to buyers, and therefore, matter to appraisers.

• It is our job to analyze market behavior and derive adjustments when they are appropriate.

• Some items which you may have mentally been classifying as either “outmoded” or “functionally obsolete” may, in fact, be items which, when replaced, are typically replaced with more energy efficient items.

Chapter Summary

(con’t)

• It’s important to understand the “Green

MLS,” and why it’s valuable in appraising.

• Also, when appraising green properties, it’s key to compare all of your data, understand cost vs. payback, and how tax credits may come into play.

Chapter 2: Quiz

1. Jose is in the market for a new home and has narrowed his choices down to two. One has a ground source heat pump and the other has a conventional heat pump. The homes are identical except for this feature.

The cost of the ground source heat pump is an additional $4,000. The estimated energy savings provided by the ground source heat pump is estimated at $67/month. What is the anticipated payback time for the upgraded heat pump?

a. 2 years b. 4 years c. 5 years d. 10 years

Chapter 2: Quiz

1. Jose is in the market for a new home and has narrowed his choices down to two. One has a ground source heat pump and the other has a conventional heat pump. The homes are identical except for this feature. The cost of the ground source heat pump is an additional $4,000.

The estimated energy savings provided by the ground source heat pump is estimated at $67/month. What is the anticipated payback time for the upgraded heat pump?

a. 2 years b. 4 years c. 5 years d. 10 years

Chapter 2: Quiz

2. An advantage to a Green MLS is that a. every agent uses it.

b. it is paperless.

c. it provides known adjustments for green features to appraisers and agents.

d. it provides more information on green features in homes than typical MLS services do.

Chapter 2: Quiz

2. An advantage to a Green MLS is that a. every agent uses it.

b. it is paperless.

c. it provides known adjustments for green features to appraisers and agents.

d. it provides more information on green features in homes than typical

MLS services do.

Chapter 2: Quiz

3. Karl, a buyer, is looking at new homes. Karl anticipates he will be in this house no more than 5 years, because of his job. Below are four options for energy efficient upgrades available to him, the estimated cost of the upgrade, and the energy savings per month.

Which of these features would make sense for Karl to invest in?

a. high energy gas furnace – it’s $2,000 more with anticipated energy savings of $1,500 per year b. extra insulation package – $2,000 more with anticipated energy savings of $30 a month c. on demand gas hot water heater – it’s $5,000 more with anticipated energy savings of $300 a year d.

triple pane windows – $3,600 with anticipated energy savings of $17 a month

Chapter 2: Quiz

3. Karl, a buyer, is looking at new homes. Karl anticipates he will be in this house no more than 5 years, because of his job. Below are four options for energy efficient upgrades available to him, the estimated cost of the upgrade, and the energy savings per month. Which of these features would make sense for Karl to invest in?

a. high energy gas furnace – it’s $2,000 more with anticipated energy savings of $1,500 per year b. extra insulation package – $2,000 more with anticipated energy savings of $30 a month c. on demand gas hot water heater – $5,000 more with anticipated energy savings of $300 a year d. triple pane windows – $3,600 with anticipated energy savings of

$17 a month

Chapter 2: Quiz

4. A relevant characteristic is a. any difference between the subject and a comparable.

b. any item unique to a home.

c. one defined by USPAP as being relevant.

d. one which impacts the value of the property.

Chapter 2: Quiz

4. A relevant characteristic is a. any difference between the subject and a comparable.

b. any item unique to a home.

c. one defined by USPAP as being relevant.

d. one which impacts the value of the property.

Chapter 2: Quiz

5. Which of the following features would most likely appear in an MLS system which has been “greened”?

a. number of bathrooms b. on-site energy producing items c. type of heating d. type of roofing material

Chapter 2: Quiz

5. Which of the following features would most likely appear in an MLS system which has been “greened”?

a. number of bathrooms b. on-site energy producing items c. type of heating d. type of roofing material