Global Telecommunications

advertisement

Global Telecommunications

Presented by:

Ben Asuncion

Olga Ryabchinskaya

Murtaza Dhanani

Ali Shahkarami

OVERVIEW

Introduction to the Telecommunications Industry

Manitoba Telecom

British Telecom

Sprint-Nextel

Summary

Telecommunications History

Prior to modern communications

Morse & Vail

Telegraph

Register

Smoke &

Drums

Early History

1792

Claude Chappe

Fixed Telegraphy

1838

Transatlantic

Telegraph Cable

1839

Wheatstone &

Cooke

Electrical Telegraph

1866

Commercial

Telephone

1876

Bell

Conventional

Telephone

1878

1901

Marconi

Transatlantic Wireless

Communication

Telecom Monopolies

Alexander Graham Bell patented the

telephone on March 7, 1876

Once the Bell patents expired in 1894,

thousands of competitors began wiring the

nation

By 1907, Bell rivals controlled 51 percent of

local service

In response to the burgeoning competition,

American Telephone and Telegraph (AT&T)

began buying up rivals

AT&T

Formation of government regulated “natural

monopoly”

“One Policy, One System, Universal Service”

Gov’t raised barriers to entry

The more difficult it was to launch competitive

service, the more secure was the company’s

market share

“Competition resulted in duplication of

investment,” and that states were justified in

denying requests by rivals to deploy new lines

Firms that enjoy government protection from

competition, and for whom rates of return are

guaranteed through regulation, face less financial

pressure to innovate or operate efficiently

AT&T

1970: FCC allows competition into the long

distance services

Local service was still protected

Mid 1970: US Justice Department files

antitrust lawsuit based on complaints by MCA

& other long distance service providers

1982: AT&T settled with government

requiring them to divest their local operating

companies, and restrict its services to the

long distance market

Formation of the “Baby Bells”

AT&T

“Baby Bells”

Allowed to keep local services

SBC, Verizon, BellSouth and Qwest

$.62/min

$.20/min

US Telecom Statistics

Canadian Telecom Statistics

Telecommunications History

Key Telecom Metrics

Current Telecommunications Industry

Wired Telecommunications Carriers

Wireless Telecommunications Carriers

Cable and other Program Distribution

Telecom Metrics

EBITDA Margin

EBITDA / Total Revenue

Churn Rate (1 - Retention Rate)

Proportion of contractual customers or subscribers who leave a

carrier during a given time period

Reduced by creating barriers to exit

ARPU

Contracts

Proprietary technology

Loyalty programs

Avg Revenue Per Unit OR Avg Revenue per User

Includes revenues billed to each customer for usage

Also includes revenue generated from incoming calls

ARMU

Average Margin per User

Alternative to ARPU, which focuses narrowly on revenue per unit

Margin is based on profitability of customers

Wired Telecommunications

Oldest & once largest sector of industry

Wires & Cables connecting to central

offices maintained

All transmissions

routed through

switching

equipment

Wired Telecommunications

Traditionally, voice used to be main

type of data transmitted over wires

Now include transmission of all types of

graphic, video, and electronic data

Mainly transmitted over internet

Efficiencies through technology

Wired Telecommunications

Packet Switching Networks

Traditional One-Path Switching

Wired Telecommunications

Voice requires small capacity compared

to data, video, and graphics

Bandwidth

Frequency band: specific range of

frequencies in the radio frequency

spectrum (RF)

Voice signal = 3 kHz

Analog TV signal = 6 MHz (2000x as wide)

Channel Capacity: amount of discrete

info reliably transmitted over a channel

Wired Telecommunications

Improvements from Telecom Co’s

Replacing copper wires with fibre optic

Allows for 25 times more data than cable

Allowing for transmission of new services

Cable

TV, Video-on-Demand, High-speed

internet, and telephone

Mostly, carrier’s leverage existing copper

lines to provide DSL

Lower

transmission capacity & speed

Less capital expenditures

Global Telephone Calls

Wired Telecommunications

Wireline CapEx$

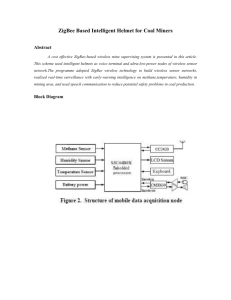

Wireless Telecommunications

Transmit voice, graphics, data, and

internet access through the

transmission of signals over networks

of radio towers

Signal is transmitted through an antenna

into the wireline network

New technologies allow them to

compete with wireline

How it works

Wireless Telecommunications

Generations of Wireless Access

0G – mobile radio telephone systems that

preceded modern cellular mobile

technology

1G – Analog cellphone standards that

were introduced in the 1980’s

2G – PCS – second-generation wireless

Difference:

radio signals are digital VS analog

More efficient and greater reception

Intermediate advancements: 2.5G, 2.75G

Wireless Telecommunications

3G – Third Generation

Ability to transfer simultaneously both

voice and non-voice data

Momentous capacity and broadband

capabilities to support greater numbers of

voice and data customers & higher data

rates at lower incremental cost than 2G

Radio spectrum bands are subsequently

licensed to operators (5MHz channel)

Greater capacity and improved spectrum

efficiency

Canada ~ License Costs

US ~ License Costs

License term usually 15 years

One of 8 similar auctions conducted

Wireless Telecommunications

High input fees for the 3G service licenses

Great differences in the licensing terms

Current high debt of many telecommunication

companies, making it more of a challenge to build

the necessary infrastructure for 3G

Health aspects of the effects of electromagnetic

waves

Lack of 2G mobile user buy-in for 3G wireless

service

High prices of 3G mobile services in some

countries, including Internet access

Wireless Telecommunications

4G – Fourth Generation

Spectrally efficient system

High network capacity (at least 10 times greater than

3G)

Nominal data rate at high speeds (100 Mbps at

stationary conditions and 20 Mbps at 100 miles/hr)

Smooth handoff across heterogeneous network

Seamless connectivity and global roaming across

multiple networks

High quality of service for next generation multimedia

support (real time audio, high speed data, HDTV video

content, mobile TV, etc)

Interoperable with the existing wireless standards

All IP system, packet switched network

Wireless Telecommunications

Wireless Service Revenues & ARPU

1999 - 2004

Revenue

$ Billions

ARPU ($)

12.0

70.0

$59.3

10.0

$53.9

$53.8

$51.0

$55.7

60.0

$47.4

50.0

8.0

40.0

6.0

$9.5

4.0

2.0

$7.2

$5.4

$4.6

30.0

$8.1

20.0

$6.0

10.0

-

1999

2000

2001

Wireless Service Revenue

Source: CRTC data collection

2002

2003

2004

ARPU

International Wireless

Investment

Where is the industry now?

Product Mix

Profitability

Capital Expenditures

Cable & Other Service Providers

Provide television & other services

Generate revenue through subscriptions & service

fees

Primarily installation & advertising sales

Charge a fee for services

Transmission of programming

Cable Systems: fiber optic & coaxial cables

Direct Broadcasting Satellite (DBS)

Orbiting satellites to customers’ receivers (mini-dishes)

Voice over IP

Using existing networks to infiltrate the telecom industry

Third largest national provider in Canada

MTS AllStream

Table of contents

Current Financial Position

Company History and Overview

Company Analysis

Financial Analysis

Forecasting and Recommendations

Current Market Position

10/28/06

Industry:

Telecom

Ticker Symbol:

MBT-T

Share Price:

43.15

P/E:

29.80

EPS:

1.45

Dividend:

2.6 (Yield, 5.66%)

Shares Outstanding:

68,098,707

Dividend payout expected: $175 million (2006)

Return on MTS compared to TSX

Share Performance This graph compares the cumulative total return on MTS’s

Common Shares over the last nine years with the cumulative total return of the

S&P/TSX Composite Index, assuming a $100 investment at the initial offering price of

$13.00 and reinvestment of dividends.

MTS Allstream Focused Markets

MTS offers a full suite of wireline voice, high-speed Internet and data, next

generation wireless, directory, digital television, security and alarm monitoring

services.

History on MTZ

Manitoba Telecom Services Inc. (MTS) was founded by the Manitoba

government in 1908.

In 1996 Manitoba was privatized.

In January 1999 MTS partnered with Bell Canada to form Intrigna,

which was a company created to expand telecommunications options

for the business market in Alberta and British Columbia.

In August 1999 MTS completed work on a new trunked (digital) radio

system known as FleetNet 800 , technology licensed from neighboring

Sasktel

2000 Initiated broadband service in Manitoba

In 2004, MTS acquired Allstream (formerly AT&T Canada) for $1.7

billion and merged both companies. This acquisition made MTS the

third largest national telecom in Canada. MTS also ended its strategic

alliance with bell in 2004

History Cont.

July, 2005 MTS Allstream acquired Delphi Solutions Corp by purchasing its

outstanding shares for $15 million in cash. The acquisition was an important

step in positioning the company to take advantage of the migration of customer

networks to converged Internet Protocol (“IP”) technologies.

Dec 7th, 2005 former BCE executive Pierre Blouin was named new Chief

Executive Officer of Manitoba Telecom Services Inc. and MTS Allstream Inc,

replace longtime CEO Bill Fraser.

September 12, 2006 MTS Allstream acquires Valley Cable Vision (local cable

company serving 3700 cable customers)

October 02, 2006 MTS Allstream announces Voluntary Reduction Program for

Manitoba Employees. Part of TP2.

Key Individuals

Pierre Blouin CEO 2005~ a seasoned

telecommunications executive, who spent 20 years +

at BCE Inc.

2003 - 2005 Group President, Consumer Markets, Bell

Canada. Responsible for all of Bell’s consumer

products –nearly $10 billion in business annually.

2002 - 2003: CEO of BCE Emergis

2000 - 2002: CEO of Bell Mobility

Kelvin A. Shepherd. President, MTS (Manitoba)

2006~

CTO of MTS 2000 ~ 2005

20 years with Saskatchewan Telecom.

Key Individuals cont.

Thomas E. Stefanson

Current Positions:

Manitoba Telecom Services Inc., chr. &

dir.

Associations:

Fellow of the Institute of Chartered

Accountants - F.C.A.

Officer since 1989.

Wayne S. Demkey, CA Executive Vice

President, Finance & CFO;

Joined MTS in 1996 1996.

11 years as senior manager at KPMG

Company Analysis

Manitoba network coverage

across Canada.

Manitoba network coverage in Canada runs across majority of the country,

with services in several fields

Operating Revenue 2001-2005

2500

2000

1500

Revenue in

Millions

1000

500

0

2001 2002 2003 2004 2005

Revenue Breakdown per

Segment 2001-2005

700

600

Data Revenues

500

Local Voice

Revenues

Long Distance

Revenues

Wireless

Revenues

400

300

200

100

0

2001 2002 2003 2004 2005

% change in revenue

Customer Growth

Enterprise Solution Customer

base

MTS Consumer and B2B

solutions

Consumer: MTS provides several services for its consumer based market. The

major accountability for future growth in the consumer brand is from wireless

services, IP-based data connectivity, high-speed internet and digital television.

B2B: Operating under the Allstream brand, Enterprise Solutions division is a

strong national competitor in the Canadian telecommunications market. This

division has a solid track record of developing innovative solutions that help

mid-sized and large businesses compete more effectively.

Consumer Market Division

MTS’s Consumer Markets division, is one of Canada’s strongest

communications franchises.

During 2005, there was overall growth from its operations, with

particularly strong performance from wireless, Internet and

digital television services.

In total revenues from these growth services grew by 18% in

2005. Wireline telephony business faced competition from the

long-anticipated entry of the cable companies in this market.

Future Goals to Increase

Profitability

In the fourth quarter of 2005, MTS launched its Transition Phase II – a twoyear, $100 million cost reduction (now raised to 120 million) initiative designed

to align its cost structure to the new market realities, and increase profitability.

MTS has already achieved $30 million in annualized expense savings as at

January 31, 2006. On 30th Sept they had reached $78 million of these savings.

On February 28, 2006, MTS announced the implementation of a new

management structure that will help the team become a more cohesive

organization, move closer to cost savings target, and drive more profitable

growth in the marketplace.

EPS trend for the last 5 years

The Sharp incline in EPS from 03 to 04 was due to the acquisition of Allstream

MTS EPS Analysis

For the twelve months ended December 31, 2005, EPS from continuing

operations climbed to $2.74, which is up by 10.9% or $0.27 from 2004. This

increase is primarily attributable to the consolidation of Allstream’s financial

results beginning June 4, 2004, together with growth in our Manitoba division and

synergies realized.

EBITDA for the 5 year period

ended 2005

Restructuring costs

Reason for sharp increase in

restructuring cost.

• Total predicted acquisition of Allstream would be approximately $90 million.

• These expenses included severance and other employee-related costs, as

well as costs to consolidate facilities, systems and operations.

• This amount includes (i) costs of $24.0 million that were incurred and

included in the accounting for the acquisition of Allstream; (ii) $23.0 million

that was expensed and $23.0 million that was capitalized for restructuring

and integration costs incurred in 2004 and 2005; and (iii) $19.7 million

restructuring and integration costs that were recorded as a liability as part of

the purchase price allocation.

Competition

Stock Price Analysis

MBT Vs Telus.

MBT vs BCE

Information for 2006

Third Quarter dividend : $0.65

FCF increase: 24.1% ($191.8 million)

Cost reduction under TP2: $70 million

Revenue increase due to Growth: (15%) $44 million

Data Connectivity Revenue Increase: 58.9%

Wireless Revenue Increase: 12.9%

Increase in Cellular Customers: 11.6%

Digital Television Customer Increase: 36.8%

High-Speed Internet Customer Increase: 18.2%

No Tax expense until 2014, due to Purchase of Allstream

Expected Financials for 2006

MTS Allstream Income Trust?

In evaluating a possible conversion to an income trust, management

and the Board of Directors carried out an extensive review.

An analysis of MTS's current and future cash flows and requirements

to sustain the Company was carried out. In addition to ongoing

operations expenses included in EBITDA, MTS also incurs additional

significant cash costs.

These include capital expenditures, interest expense, deferred charges

and net funding of the MTS pension plan.

The Board believes long-term shareholder value can best be achieved

by continuing to follow MTS's proven strategies for delivering value to

shareholders. (2004)

MTS Take over?

With recent announcements regarding no tax protection for

income trusts. MTS is becoming an attractive target to take

over.

RBC Capital Markets analyst Jonathan Allen increased his price

target from $50 to $54 on speculation the company would be a

takeover target.

"We believe MTS's tax losses of $2.7 billion including

depreciation have become more much attractive and there is a

high probability of MTS being acquired over the next year in

our view," Allen wrote in a note to clients.

In the absence of a take over bid Manitoba Tel shares are

valued at $46 per share as a going concern.

Fisher’s Valuation Approach

Criteria

Details

Superiority in Financial skills,

Production, Marketing,

Research

-Clear strongly positioned Annual Reports

-CapEx, Asset Impairment costs: Fairly High

-R&D: Moderate to High

People Factor

-Management: Knowledgeable in the field, top management with plenty of experience. And

history of long term presence within a company.

Investment Characteristics

-Good Market position

-Wireless Growth, Data tech growth, cable tv growth

P/E Ratio

P/E 29.8

Stock Price over 9 years

Recommendation

Speculative

Buy

British Telecom

Company Snapshot

BT Group plc is

a public limited company

registered in England and Wales and listed on the London

stock Exchange and NYSE

Price US$ 54.380

P/E 15.70

Dividend & Yield: 2.83 (5.30%)

Current Number of shares held

(millions) 8,876

Full Time Employees: 104,400

Shares

Weighted Average Number of Shares

8,377 8,668

6,642 6,592

1998

1999

8,676

8,581 8,422

7,406 7,383

2000

2001

2002

Year

2003

2004

2005

2006

BT

BT vs. FTSE350

BT vs. DOW

Average Revenue per Customer

275

271

270

265

265

265

260

255

254

251

250

245

240

2002

2003

2004

2005

2006

BT History

1981- Formation of British Telecom

1982- End of BT’s monopoly w/grant of a license to Mercury

Communications

1984- Privatization

1990’s joint venture with “ Electricity Supply Board”

1991- trading name Change to 'BT'

1991- The remaining state holdings in the company were sold

1994- Joint venture with MCI: “Concert Communication

Services”

2001- demerger

2005- BT acquired El Segundo, California-based telecoms giant

Infonet

2005- Openreach segment was opened

2006- BT acquired online electrical retailer Dabs.com

Governance

Chairman

Sir Christopher Bland

Member of the Prime Minister's Advisory Panel on the Citizen's

Charter

1996-2001 chairman of the BBC Board of Governors

1982-1994 chairman of the Hammersmith and Queen Charlotte's

Hospitals

1995-1996 chairman of the Private Finance Panel

1977-1985 chairman of printers and publishers Sir Joseph Causton

& Sons

1972-1979 deputy chairman of the Independent Broadcasting

Authority and chairman of its Complaints Review Board

Governance

CEO

Ben Verwaayen

Since joining BT Group 1997, he had been with Lucent

Technologies Inc ( his position on leaving was was vice chairman

of the management board, he previously was executive vicepresident )

Prior to joining Lucent, Ben worked for KPN in the Netherlands for

nine years as president and managing director of its subsidiary

PTT Telecom

Education: Master's degree in law and international

politics from the State University of Utrecht, Holland.

Governance

CFO

Hanif Lalani

Since joining BT in 1983, he has held a variety of roles in the

BT’s UK and international divisions:

1998, finance director BT Northern Ireland

1999, was appointed chief executive of BT Northern Ireland

1999-2000, chairman of OCEAN Communications (BT's subsidiary in the

Republic of Ireland)

2002, was appointed managing director BT Regions.

2002, Hanif returned to London as chief finance officer for BT Wholesale

Education: BA Honours degree in mathematics, operations,

research and economics from Essex University.

Market Position & Power

1984’s the Telecommunications Act

1984-1900 only BT and Mercury were licensed to

provide fixed line telecom networks in the UK.

1990s, new national Public Telecommunications

companies entered the market.

BT’s operations regulated by British telecoms

operator Ofcom (imposing obligations such as meeting reasonable requests to

supply services and not to discriminate)

Current Market Share Data

The FTSE 350 Index incorporates the largest 350 companies by capitalization which

have their primary listing on the London Stock Exchange

Current Technologies

Traditional

Telephone exchanges or switches, trunk network and

local loop connections

Universal Service Obligation (USO)

Newer

Broadband internet service

Bespoke solutions ( made to fit customer’s needs)

IT

BT Group

BT Retail-retail telecoms to consumers

BT Wholesale- Wholesale telecoms core trunk network

Openreach- fenced-off wholesale division, tasked with ensuring that all rival operators have

equality of access to BT's own local network

BT Global Services- Business services and solutions (formerly BT Ignite and BT Syntegra)

BT Exact- Consultancy and internal IT solutions.

Group operations- handles security, research and development, and other functions for BT

Group Plc such as legal services

Connections

Broadband and Retail Connections

35000

30000

25000

Broadband customers ('000)

20000

Retail connections (retail &

residentials, in 000's)

15000

10000

5000

0

2003

2004

2005

2006

BT's recent developments

BT has recently announced its first step into 3G with the

launch of a combined Wi-Fi, 3G and GPRS tariff, known as

BT Datazone.

BT is investing 75% of its total capital spending, in its

new Internet protocol(IP) based 21st Century Network

(21CN)

In June 2006, BT launched BT Total Broadband - new

broadband packages

BT Vision (a broadband Television service )

Strategy

Financial Analysis

Headline financials - historical

summary

Operation Analysis

Revenue Breakdown (2006)

Revenue by customer segment

0%

26%

35%

Major corporate

Business

Consumer

Wholesale

Other

27%

12%

Revenue Breakdown per

Segment 2002-2006

in millions

Revenue by Customer Segment

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

2002

2003

Major corporate

2004

Business

Consumer

2005

Wholesale

2006

Other

financials - lines of business

* Before specific items

** Operating free cash flow (EBITDA less capital expenditure)

Company Analysis

As of Q1 ended 30 June ’06:

Free Cash Flow

Free Cash Flow Chart

Year ended 31 March ’06

* Before specific items

Free cash flow £1.6bn for 2006

Profit before tax* £2.2bn up 5% on last year

Earnings per Share Analysis

Earnings per Share Analysis

CapEx & Profit

Revenue, Operating Profit, Net Cash inflow from Operating

activities, CapEx

25,000

20,000

Revenue

15,000

Operating Profit

10,000

Net cash inflow from

operating activities

5,000

Capital expenditure

0

-5,000

2002

2003

2004

2005

2006

Performance

Fisher’s Valuation Approach

Fisher’s Valuation Approach

Criteria

Details

Superiority in Financial skills,

Production, Marketing,

Research

-Clear Annual Reports

-Britain’s first Wi-Fi cities & 3G

-CapEx, Asset Impairment costs: reasonable

-R&D: Moderate

People Factor

-Management: Knowledgeable in the field, long-term managers

-Long-term management & employees ( Training the management from within the org)

Investment Characteristics of

Some Business

-Strong Market position & power

-G3 & IT sectors potentials

-Wireless Growth

-Dow Jones Telecom Sustainable Index Award winner for last five years

P/E Ratio

P/E 15.70

Recommendation

Buy

Agenda

1.

2.

3.

4.

5.

Company Background

Products/services

Financial analysis

Fisher’s valuation approach

Recommendation

1. Company Background

Company Snapshot

Ticker Symbol: S

Index Membership:

S&P 500

S&P 100

S&P 1500 Super Comp

Sector: Technology

Industry: Diversified Communication

Full Time Employees: 79, 900

Company Snapshot

Using avg growth based on Q3 results:

(As of Nov 6/06)

Last Quote 19.05

P/E

40.53

# of Shares 2987.5M

52wk Range

Volume

Market Cap

Rev.

NI

EPS

Div/Share

Yield

% Held by Insiders

1.25

% Held by Institutions 86

40 778.67B

1 381.33M

0.47

0.01

0.5%

15.95-26.89

33 962 100

55.46B

Stock Price Behavior Daily

(1985-2006)

Stock Price Behavior 1985-present

Sprint-Nextel vs. S&P Telecom

5-yr Daily (2001-2006)

Sprint-Nextel vs. NASDAQ

Composite 5-yr Daily (2001-2006)

Sprint-Nextel vs S&P 500

5yr Daily (2001-2006)

General Background

Founded: 1899, Cleyson Brown, landline telephone

(Bell System’s competitor); HQ: Virginia

Steady growth through acquisitions

Enter long-distance voice: acquire ISACOMM (1981), US Tel. (1984)

Sprint-MCI $129B merger (1995) falls through

Mission: “To be No. 1 in providing a simple, instant, enriching and

productive customer experience.”

Global Tier 1 backbone operator

3rd largest wireless network in US; 51.9M subscribers ($668 in

revenues / subscriber in 2005)

Largest independent local telephone provider

Industry pioneer

Secured spot in 2.5Ghz range

General

Background Con’t

Founded: 1987, Morgan O'Brien

Focus on wireless

5th leading provider in US mobile phone industry

18.5M subscribers; southern US-popular

Market-defining innovation

Loyal customer base

General

Background Con’t

Sprint-Nextel merger Aug. 12/05

Shareholders “overwhelmingly approved”

Affiliates “strongly opposed” ($19.58B in problems over 3 yrs)

Post-Merger: Forced Acquisitions

-

$1.3B: Sprint’s PCS affiliate US Unwired (2005);

0.5M direct customers

-

$4.3B (announce): PCS affiliate Alamosa Holdings

(2005); 1.48M potential customers

-

$98M: Enterprise Communications (2006); 52K

customers to Wireless division

-

$6.5B (announce): the largest of Nextel's affiliates

to end Nextel Partners' opposition to any changes

by Sprint in relation to the NEXTEL merger (2006);

2M direct customers

Competition

Timeline: Sprint, Nextel

1976: $1bil. Rev (Sprint- S)

1980s: Enter long distance; leader: fiber-optic network & packet data

network (S)

1990s: Global leader: voice & data services (S)

1992: Internet pioneer (S)

1993: First provider: local, long dist., wireless (S)

1996: 1st Digital wireless network (S)

1996: iDen tech. – talk of the industry (Nextel-N)

1998: Fiber-optic connection (N)

2000: Worldwide service: largest digital wireless coverage (N)

2001: Walkie-talkie; 1st Java phone (N); Transatlantic IP backbone (S)

2002: 1st Wireless national network (S); 1st GPS phone (S)

2003: 1st To begin conversion to next-generation packet network (S)

2004: NASCAR partnership (N); EV-DO plans (S)

Strategy

Customer experience

Innovation, R&D: pioneer in industry

Focus on wireless, broadband

Operational efficiencies: restructuring, costsavings, R&D direction: -ve EBIT

Key Awards

Innovation

- Outstanding Corporate Innovator 2005

- 1st In innovation category 2006

Management

- 2nd most admired company in Telecom

- Institutional Investor: #1 in Telecom: most

shareholder-friendly

Fortune Magazine 2006: #59/100 of best companies

to work for

Credit risk management

HRC's Corporate Equality Index: 100%

Management

Corporate Governance Quotient:

“Sprint-Nextel is better than 45.6% of

S&P500 companies and 96.6% of

Telecom. Services companies as of Oct

06.”

Management

Timothy M. Donahue

Executive Chairman

Nextel: Jan. 1996

President and Chief Operating Officer

Fortune 200: record-setting performance

Forbes: top-rated CEO in Telecom. 2005

John Carroll University, BA (Eng. Literature)

NE regional president for AT&T Wireless Services operations

(1991-1996)

On the Boards of Kodak, John Carroll Univ., NVR, Inc.

Management

Gary D. Forsee

President and Chief Executive Officer

Sprint: May 2003

Appointed to National Security Telecom. Advisory Committee

by Bush in 2004

BusinessWeek: 1 of best leaders 2005, 1 of 19 best

managers 2004

Sprint emerges as 1 of strongest competitors

Sprint's equity value rises 72%

University of Missouri (BS in engineering)

Awarded an honorary Doctor of Engineering degree (2005)

18 years at AT&T and Southwestern Bell

VP of gov’t sales and programs (AT&T's Federal Systems)

Management

Paul Saleh

Chief Financial Officer

Nextel: Sept. 2001: Executive VP and CFO

Institutional Investor: best Telecom. CFO 2004, 2005, 2006

Treasury & Risk Management 2005: 1 of 100 most influential

people in finance

Public Company CFO of the Year Award: 2003, 2006

Univ. of Michigan (MBA-Finance; MS, BS in electrical

engineering)

VP, CFO: Walt Disney Int. (1997-2001)

Senior VP, Treasurer: The Walt Disney Company

Major holders

Holder

Position

# Shares

%

Reported

Foresee

CEO

1,514,910

0.051

Aug 12/06

Donahue

Executive Chairman

902,316

0.030

Aug 12/06

Saleh

CFO

626,383

0.021

Aug 12/06

Capital Research & Mng Company

187,876,882

6.37%

Jun. 30/06

Growth Fund of America Inc.

54,221,007

1.84%

Jun. 30/06

All Insiders and 5% Owners

Institutional, Mutual Fund Owners

1.25%

86%

Current Technologies

3G wireless networks (EV-DO) (data network)

- upgrade Ev-Do Rev A (2007): faster speeds

- old: 2.4Mbs download, 0.15Mbs upload

- new: 3.1Mbs download, 1.8 upload

- CapEx $7B by 2007

2G iDEN (Nextel)

Not Compatible Networks

2.5, 2.75, 3G CDMA (Sprint) (voice networks)

- marketing costs 2008 for conversion

Future Technologies

VoIP

Mobile TV

WiMax (4G: 15Mbits)

Data

netowrk

Pioneer

$3 CapEx

100M people by 2008

Broader coverage

Competitive edge

Implications

Operate on 2.5Ghz

Excited?

Not So Much!

2. Products & Services

Segments

Wireless: strong growth

Local: spun off 2006: EMBARQ

Long Distance: losing money

Wireless Segment

Voice

Local

Long distance

Walkie-talkie

Data transmission

Wireless imaging

Internet access

Messaging and email services

Wireless entertainment

Local Segment

Voice services

Data services

Sale of communication equipt.

Switched access services

Long Distance Segment

Internet service

End user ISP

Backbone operations

Data services

ATM

Frame relay

Revenues & Costs

Total

2001, 17%

2001, 24%

2002, 23%

2003, 23%

2002, 18%

2004, 23%

2005, 24%

39%

26%

30%

33%

39%

37%

51%

37%

47%44%

Total

Revenues

2003, 17%

Total Costs

2004, 16%

2005, 15%

Wireless

Long Distance

Local

44%

36%

36%

38%

20%

46%

65% 46% 47%

39%

Wireless

Long Distance

Local

Revenues & Costs

Wireless

Wireless Costs

2001, 21%

Costs of

services and

products

2002, 20%

2003, 20%

2004, 20%

1%

2005, 23%

3%

34%

34%

50% 51%

43% 46% 51%

Selling,

general and

administrative

Restructuring

26%

29%

28%

Depreciation

Revenues & Costs

2001 13%

2002 13%

Local

Revenues

2003 12%

9%

10%

12%

13%

2004 17%

2005

19%

Local

Voice

15%

66%

Data

70%

76%

Other

77%

78%

Local Costs

Costs of

services and

products

2001, 25%

2002, 26%

2003, 25%

2004, 23%

2005, 23%

1% 2%

1%

2%

1%

25%

29%

50%

47%

44%

44% 45%

Selling,

general and

administrative

Restructuring

30%

29%

28%

Depreciation

Revenues & Costs

5%

2001, 10%

4%

2002, 11%

Long Distance

Revenues

2%

2003, 12%

3%

2004, 11%

Long Distance

2005

19% 21% 23% 24% 24%

Voice

61%

Data

62%

63%

Internet

64%

66%

Other

Long Distance Costs

2001, 11%

2002, 16%

2003, 15%

14%

2%

2004, 10%

17%

2005, 8%

34%

23%

69% 38% 44% 55% 50%

Costs of

services and

products

Selling,

general and

administrative

Restructuring

18%

24%

27%

25%

Depreciation

Decreasing Long-Distance Voice Revenues

(US$, millions)

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

2000

2001

2002

2003

2004

2005

2006

Cost (US$, millions)

Long Distance: Restructuring Costs

4,000

3,661

3,000

2,000

1,688

1,000

1,564

194

15

0

2001

2002

2003

Year

2004

2005

3. Financial Analysis

P/E 40

Revenues and Relationships from CF statement

US$ in Millions

40,000

30,000

20,000

10,000

0

-10,000

2000 2001 2002 2003 2004 2005

-20,000

Years

CF from Op.

Activities

Net Cash Used in

Investing Activities

Net Cash Used in

Financing Activities

Net Increase in Cash

& Equivalents

Revenues

Observations

Revenue growth: slow down

Misleading revenues; Rev > CF from Op. Act.

Losing $, often saved by tax savings

Growing revenues, CF from Op. Activities

Good underlying business

Lose $ from asset impairment, restructuring

- $1.66B: litigation (2001)

- $1.2B: BRS spectrum fair value decline

(2003)

- $3.54B: equipment (2004)

Interest Expense, Cap Ex, Net Investments (Cash)

$4,000

Expenditure (millions)

$2,000

Interest expense

$0

2000

2001 2002

2003

-$2,000

2004 2005

Capital expenditures

-$4,000

Net cash used in investing

activities

-$6,000

Net income/loss

-$8,000

-$10,000

Time

Financing Activities

Constant interest expense

Cash from financing activities: used

mainly to fund capital investments,

working capital requirements, retire

debt (2005)

2003-4: borrow little due to lower

CapEx (mostly), continuously

improving Operating CF

CapEx is expected to increase

Observations Con’t

Large CapEx vs. CF from Op. Activities

CapEx:

- ≈ $3B always there (to maintain network

reliability, upgrade capabilities for providing new

products/services, meet capacity demands)

- iDen/CDMA tech, mkt, $7B Ev-Do Rev. A (2007)

- $3B WiMax (2006-8)

- $19.58B in acquisitions due to merger (2005-2007)

- TOTAL: $29.58B/4yrs = $7.4B/yr + $3B/yr =

$10.4B/yr

Borrow more debt to finance CapEx

Dividends & Earnings

Div 2006: $0.10

Buyback $6B common shares over 18 months (starting Aug 2006)

Q3: 91M common shares for $1.5B ($16.48/sh; Aug. market price/share: ≈

$16-17)

2006 shares 2987.5M (due to merger)

BUT: cannot afford to buy back

Dividends & Earnings

Value (US$)

Dividends/Share vs EPS

1.25

1.00

0.75

0.50

0.25

0.00

-0.25

-0.50

-0.75

-1.00

-1.25

2000

2001

2002

2003

Year

2004

2005

Diluted EPS (common)

Dividends/common share

More Observations

Merger: double cash (buy back $6B)

Cost of merger: goodwill, FCC licenses,

customer relationships

Rev, Op Costs, Op Income, NI,

CapEx Relationships

Snapshot of Relationships

40,000

Operating Revenues

US$ in Millions

30,000

20,000

Operating Costs

10,000

0

-10,000

2000 2001 2002 2003 2004 2005

Operating

Income/Loss

Net Income/Loss

-20,000

CapEx

-30,000

-40,000

Years

2006 Expectations

Net Revenue: $41M

Wireless: high single-low double digit

growth

Long distance: mid single digit loss

CapEx $6.3B

$14.5B NPV synergies from Nextel

merger

4. Fisher’s Valuation Approach

Fisher: Superiority in Financial skills,

Production, Marketing, Research

Annual reports: clear, desired info

past 2000; prior: not enough info

Cost control: COGS, interest expense

Restructuring, Asset Impairment

costs, CapEx

Innovation: high R&D

Large mkt campaigns: not always

meet expectations

Overall: 1.5/5

Fisher: People Factor

Fair treatment: pleased employees

HRC's Corporate Equality Index:

100% score Fortune 2006: #59 (from

67): Top 100 companies to work for

Corp. Gov: fair treatment

shareholders, directors’ composition

Corporate Governance Quotient score

Overall 4.5/5

Fisher: Investment Characteristics of

Some Business

Position in market

Market share

Tier 1 implications

Less licensing from others; more to

firm

Wireless growth, WiMax potential

Overall 4/5

Fisher: P/E Ratio

Expected vs. realistic growth:

P/E 40.53 (NI for Earnings, 2006 data)

DDM: 9.75%

Overall: 0/5

5. Recommendation

Not Buy

…in 1.5yrs at a cheaper price?

SUMMARY

APPENDIX CHARTS

Wireline Local & Long Distance Revenues

1993 - 2004

$ Billions

16.0

14.0

12.0

10.0

$8.7

$8.4

$7.9

$7.9

$7.7

$5.1

$5.4

$5.9

1993

1994 1995 1996

Local services

$8.7

$8.7

$7.1

$6.7

$6.5

$5.9

$6.9

$7.3

8.0

6.0

4.0

2.0

$6.4

$5.3

$6.5

$6.5

$6.9

$6.8

1998

1999 2000 2001 2002

Long distance services

2003

1997

* 1997 local services decrease is due to survey method change

Source: CRTC data collection

Wired Access Lines

1993 - 2004

Million Lines

25.0

20.0

15.0

5.1

5.4

5.7

5.9

11.6

11.8

12.0

12.2

6.2

6.6

12.2

12.4

7.2

7.6

7.4

7.2

7.3

7.1

13.2

12.8

12.8

12.7

12.5

10.0

5.0

12.7

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

Residential line

Source: CRTC data collection

Business line

Internet Service Subscribers

2000 - 2004

Thousands

3,500

3,000

2,500

2,933

2,969

2,483

2,025

2,000

1,500

943

1,000

500

412

0

2000

2001

Dial up

Source: CRTC data collection

2002

Cable

2003

2004

DSL

AT&T