Greenlight Capital

advertisement

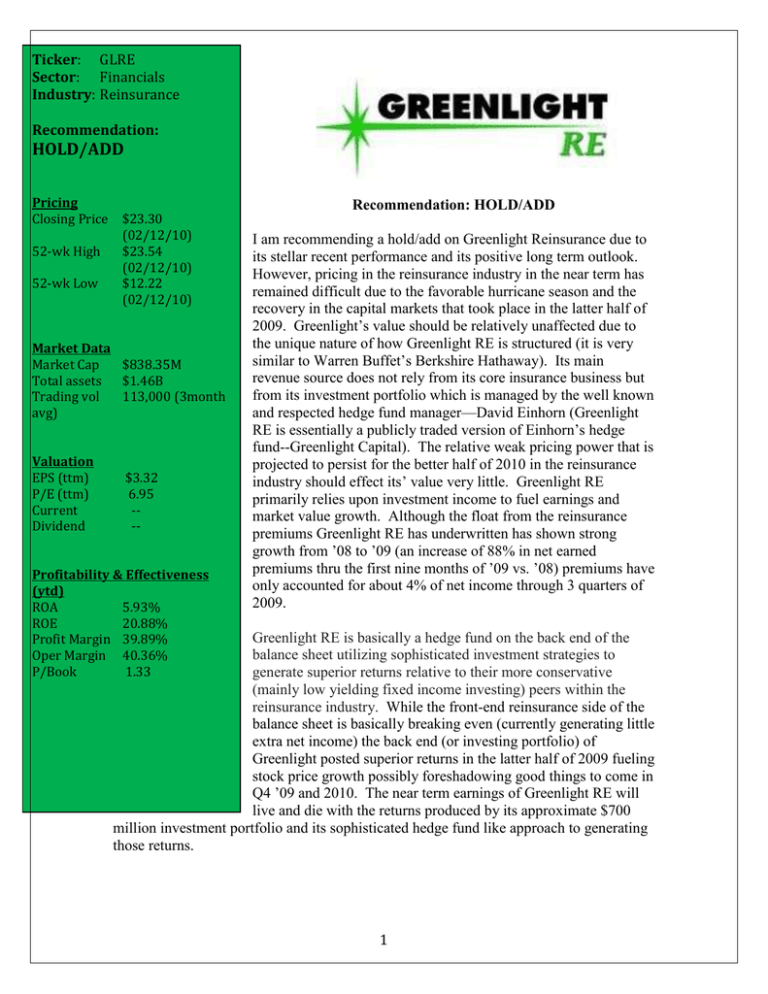

Ticker: GLRE Sector: Financials Industry: Reinsurance Recommendation: HOLD/ADD Pricing Closing Price 52-wk High 52-wk Low $23.30 (02/12/10) $23.54 (02/12/10) $12.22 (02/12/10) Market Data Market Cap $838.35M Total assets $1.46B Trading vol 113,000 (3month avg) Valuation EPS (ttm) P/E (ttm) Current Dividend $3.32 6.95 --- Profitability & Effectiveness (ytd) ROA 5.93% ROE 20.88% Profit Margin 39.89% Oper Margin 40.36% P/Book 1.33 Recommendation: HOLD/ADD I am recommending a hold/add on Greenlight Reinsurance due to its stellar recent performance and its positive long term outlook. However, pricing in the reinsurance industry in the near term has remained difficult due to the favorable hurricane season and the recovery in the capital markets that took place in the latter half of 2009. Greenlight’s value should be relatively unaffected due to the unique nature of how Greenlight RE is structured (it is very similar to Warren Buffet’s Berkshire Hathaway). Its main revenue source does not rely from its core insurance business but from its investment portfolio which is managed by the well known and respected hedge fund manager—David Einhorn (Greenlight RE is essentially a publicly traded version of Einhorn’s hedge fund--Greenlight Capital). The relative weak pricing power that is projected to persist for the better half of 2010 in the reinsurance industry should effect its’ value very little. Greenlight RE primarily relies upon investment income to fuel earnings and market value growth. Although the float from the reinsurance premiums Greenlight RE has underwritten has shown strong growth from ’08 to ’09 (an increase of 88% in net earned premiums thru the first nine months of ’09 vs. ’08) premiums have only accounted for about 4% of net income through 3 quarters of 2009. Greenlight RE is basically a hedge fund on the back end of the balance sheet utilizing sophisticated investment strategies to generate superior returns relative to their more conservative (mainly low yielding fixed income investing) peers within the reinsurance industry. While the front-end reinsurance side of the balance sheet is basically breaking even (currently generating little extra net income) the back end (or investing portfolio) of Greenlight posted superior returns in the latter half of 2009 fueling stock price growth possibly foreshadowing good things to come in Q4 ’09 and 2010. The near term earnings of Greenlight RE will live and die with the returns produced by its approximate $700 Analyst: Tyler Peglow million investment portfolio and its sophisticated hedge fund like approach to generating Email: ktsqmb@mail.missouri.edu those returns. Aaron Foster adfrhc@mail.missouri.edu 1 Company Overview Greenlight Capital Re, LTD is a Cayman Islands-based specialty property and casualty reinsurer. The company offers excess loss and quota share products in the property and casualty market. Within the property and casualty reinsurance segment, underwriting operations are analyzed using two categories: frequency business, and severity business. Frequency business is characterized by contracts containing a large number of small losses stemming from multiple events. Severity business is typically characterized by contracts with the potential for losses originating from one event or multiple events (think large infrequent events). The company’s investment portfolio is managed by DME Advisors, LP. Their assets are managed according to a value-oriented equity-focused strategy that complements the Company's business goal of long-term growth in book value per share. (Greenlightre.ky) Greenlight Capital RE was founded in 2004, and went public in May of 2007 at $19 per share. David Einhorn (co-founder) manages the company’s investments as chairman of DME Advisors, LP. Einhorn has had considerable experience and success in the financial markets has founder of Greenlight Capital RE—a hedge fund based out of New York. Greenlight Capital RE was founded by Einhorn in 1996 with an initial $1 million dollar capital raise. Greenlight Capital RE has since grown to over $6 billion in assets under management in just 14 years as Einhorn significantly outperformed broad market indices over the time period attracting many large institutional investors to his fund. While returns suffered in 2008, Greenlight has returned since inception, net of all fees and expenses, more than 22% compared to the measly 6% return of the S&P 500 over that same time period. Quite an impressive feat when you factor into the fact that Einhorn has been investing through two recessions (the 2000 tech bubble and 2008 credit crisis) which saw broad indices in each bear market fall more than 50%. Reinsurance Business Greenlight is focused on bringing a disciplined and differentiated underwriting strategy that will allow it to mitigate losses and capture steady gains from its reinsurance business. Greenlight Re offers excess of loss and quota share products in the property and casualty market, focusing on customized solutions rather than participating in broadly available opportunities—trying to create small niche opportunities. Their business is mostly sourced through reinsurance brokers, providing the company with variable-cost global distribution (commissions are based on gross premiums written). The company seeks to maximize long-term results rather than manage for interim or GAAP performance. Management is compensated based on multi-year underwriting performance rather than premium volume or short-term results which should help smooth operating earnings over time and help their underwriting strategy stay smart and conservative (think AIG). Greenlight seeks to act as lead underwriter for most premiums written as they look to find niche opportunities rather than commodity type deals. Greenlight also enjoys an excellent credit rating of A- (4th highest of 15 ratings) through 2 A.M. Best--a full-service credit rating organization dedicated to serving the financial services industries. Such a high credit rating will help to attract more reinsurance contracts in the future has insurer’s will feel safer trading contracts with such a highly rated credit worthy institution (again think AIG). The company is also under Cayman Islands law and as such is not obligated to pay taxes on either income or capital gains. Greenlight manages the business on the basis of one operating segment, property and casualty reinsurance, in accordance with the qualitative and quantitative criteria established by the US GAAP. Within the property and casualty reinsurance segment, they analyze their underwriting operations using two categories: Frequency business o Characterized by large number of small losses Less volatile than severity Has greater predictability in margins, ROE Severity business o Characterized by potential large infrequent losses Clients buy protection to remove volatility from B/S Results can be volatile from period to period Details of gross premiums written are provided below: Frequency Severity Total Three months ended September 30, Nine months ended September 30, 2009 2008 2009 2008 ($ in thousands) ($ in thousands) $ 62,238 94.3% $ 27,787 73.7% $ 176,084 84.7% $105,432 78.8% 3,745 5.7 9,897 26.3 31,817 15.3 28,378 21.2 $ 65,983 100.0% $ 37,684 100.0% $ 207,901 100.0% $133,810 100.0% Gross Premium Details: Represents a 75% increase year over year for 3Q 2009 Represents a 55% increase year over year through 3 quarters of 2009 Greenlight is rapidly growing market share in the reinsurance industry. 3 Ratio Analysis: Due to the opportunistic and customized nature of Greenlight RE’s underwriting operations, expect different loss and expense ratios in both frequency and severity businesses from quarter to quarter. The following table provides the ratios for the nine months ended September 30, 2009 and 2008: Loss Ratio Acquisition Cost Ratio Comp Composite Ratio Internal Expense Ratio Composite Ratio Nine months ended Nine months ended September 30, 2009 September 30, 2008 Frequency Severity Total Frequency Severity Total 60.8% 49.0% 58.1% 35.4% 64.3% 44.9% 37.4% 8.0% 30.6% 53.5% 8.8% 38.8% 98.2% 57.0% 88.7% 88.9% 73.1% 83.7% 9.1% 13.8% 97.8% 97.5% The loss ratio is calculated by dividing loss and loss adjustment expenses incurred by net premiums earned. We expect that our loss ratio will be volatile for our severity business and may exceed that of our frequency business in certain periods. The acquisition cost ratio is calculated by dividing acquisition costs by net premiums earned. This ratio demonstrates the higher acquisition costs incurred for our frequency business than for our severity business. The composite ratio is the ratio of underwriting losses incurred, loss adjustment expenses and acquisition costs, excluding general and administrative expenses, to net premiums earned. Similar to the loss ratio, we expect that this ratio will be more volatile for our severity business depending on loss activity in any particular period. The internal expense ratio is the ratio of all general and administrative expenses to net premiums earned. We expect our internal expense ratio to decrease as we continue to expand our underwriting operations. During the nine months ended September 30, 2009, our net earned premiums increased 88.4% while our general and administrative expenses increased 24.0% as compared to the corresponding 2008 period, resulting in a lower internal expense ratio. The combined ratio is the sum of the composite ratio and the internal expense ratio. It measures the total profitability of our underwriting operations. This ratio does not take net investment income or other income into account. The reported combined ratio for the nine months ended September 30, 2009 was 97.8% compared to 97.5% for the same period in 2008. Given the nature of our opportunistic underwriting strategy, we expect that our combined ratio may be volatile from period to period. 4 Outlook and Trends in Reinsurance Business The rebound of the financial markets in the latter half of 2009 has restored many insurers’ balance sheets putting downward pressure on reinsurance pricing in the near term. Underwriting capacity has become more available in the property and casualty market which has resulted in a delay of expected price increases in various financial insurance products. In addition, the lack of large catastrophes in 2009 to date has preserved capital in the property and casualty industry alleviating a lot worries insurers had in the middle of 2009—this could mean less business for reinsurers in the near term. Greenlight appears to be well positioned to compete for attractive opportunities as they continue to grow their market share and create more brand recognition within the reinsurance industry. In addition there are still market participants who continue to suffer from capacity issues even after the rebound of the financial markets in the latter half of 2009 creating greater niche opportunities. These opportunities could increase if financial and credit markets report large losses and the industry keeps consolidating through mergers and acquisitions decreasing the number of market participants. Greenlight (from its 3Q ’09 10-Q) believes opportunities are likely to arise in a number of areas, including the following: lines of business that experience significant loss experience lines of business where current market participants are experiencing financial distress or uncertainty business that is premium and capital intensive due to regulatory and other requirements Has Greenlight continues to grow their brand recognition expect large annual growth increases in gross premiums underwritten. However, depending upon the accuracy of Greenlight RE’s underwriting, large growth in premiums underwritten may not increase net income. Unforeseeable catastrophic events or shoddy underwriting may hamper large increases in gross premiums underwritten resulting in an unprofitable reinsurance business making the company’s value that much more reliant on Einhorn and his investment acumen. 5 Investments As of September 31st, 2009 Greenlight RE had an investment portfolio with an approximate market value of $700 million managed by an affiliate of Greenlight RE— DME Advisors. DME Advisors is a related party and affiliate of David Einhorn, Chairman of the board of directors and founder of the hedge fund Greenlight Capital. DME Advisors implements a value-oriented investment strategy by taking long positions in perceived undervalued securities and short positions in perceived overvalued securities. DME Advisors aims to achieve high absolute rates of return while minimizing the risk of capital loss. Pursuant to the advisory agreement, DME Advisors is allowed performance compensation equal to 20% of the net income of the Company’s share of the account managed by DME Advisors, subject to a loss carry forward provision. The loss carry forward position allows DME Advisors to earn reduced incentive compensation of 10% on net investment income in any year subsequent to the year in which the investment account incurs a loss, until all the losses are recouped and an additional amount equal to 150% of the aggregate investment loss is earned. This is where most all of the value in Greenlight RE is derived. Where most reinsurers invest a majority of their floats and investment portfolios into low yielding fixed income safe assets Greenlight RE takes a much different approach. Under Chairman David Einhorn (who is also head of DME Advisors) Greenlight RE employs a sophisticated hedge fund type style of investing geared towards generating excess returns and creating greater value. In this regard Greenlight RE is very similar to Warren Buffet’s Berkshire Hathaway— both insurance companies are mere “cover” companies that more or less give investors access to professional money managers like Buffet and Einhorn without all the rules and stipulations (minimum amount of capital and lock up of funds for a predetermined amount of time) of a hedge or private equity fund. Both company’s values rely almost solely upon the investments made in the financial markets by these two great money managers and much less on their respective core insurance businesses. This fact makes Greenlight RE’s operating earnings much more volatile than the industry as a whole. More than 95% of the net income Greenlight has earned through 3 quarters of 2009 has been derived from their investment portfolio while the core insurance business has accounted for less than 5% spanning that same time period. The value of Greenlight RE lives and dies quarter to quarter with the investment returns generated from Einhorn’s positions. These positions include: o o o o o o Long equities Short equities Credit default swaps – sells and buys Interest Rate Options Distressed debt Investment grade corporate debt 6 o o o o Commodity’s Warrants Swaps Futures Clearly the portfolio of Greenlight RE is managed much more like a hedge fund and much less like a conservative institution intent on preserving capital (as with most reinsurers). Investment Guidelines: (From Greenlight’s 2008 10-K Report) The investment guidelines adopted by our Board of Directors, which may be amended or modified from time to time take into account restrictions imposed on us by regulators, our liability mix, requirements to maintain an appropriate claims paying rating by ratings agencies and requirements of lenders. As of the date hereof, the investment guidelines currently state: • Quality Investments: At least 80% of the assets in the investment portfolio are to be held in debt or equity securities (including swaps) of publicly-traded companies and governments of the Organization of Economic Co-operation and Development, or the OECD, high income countries and cash, cash equivalents or United States government obligations. • Concentration of Investments: Other than cash, cash equivalents and United States government obligations, no single investment in the investment portfolio may constitute more than 20% of the portfolio. No more than 10% of the assets in the investment portfolio will be held in private equity securities. • Liquidity: Assets will be invested in such fashion that we have a reasonable expectation that we can meet any of our liabilities as they become due. We periodically review with the investment advisor the liquidity of the portfolio. • Monitoring: We require our investment advisor to re-evaluate each position in the investment portfolio and to monitor changes in intrinsic value and trading value and provide monthly reports on the investment portfolio to us as we may reasonably determine. • Leverage: The investment portfolio may not employ greater than 5% indebtedness for borrowed money, including net margin balances, for extended time periods. The investment advisor may use, in the normal course of business, an aggregate of 20% net margin leverage for periods of less than 30 days. 7 DME Advisors Investment portfolio consists of the following: (Source: 2008 10-K) As of December 31, 2007 Long % Short % Long % Short % 11.8% 0.0% 0.1% 0.0% 65.8 (39.3) 91.0 (51.7) 1.9 — 1.2 0.0 — (0.2) 0.7 (7.6) 79.5% (39.5)% 93.0% (59.3)% As of December 31, 2008 Ot Debt Securities Equities & Related Derivatives Equities - Unlisted Other Investments TOTAL The following table represents the composition of our investment portfolio, by industry sector, based on the percentage of assets in our investment account managed by DME Advisors as of December 31, 2008: Sector Basic Materials C Consumer Cyclical Consumer Non-Cyclical Energy Fi Financial Healthcare InInIndustrial Technology Utilities Total Capitalization Large Cap Equity (≥$5 billion) Mid-Cap Equity (≥$1 billion) Small Cap Equity (<$1 billion) Debt Instruments Other Investments Total Long % Short % Net % 5.3% (5.3)% 0.0% 5.5 (5.8) (0.3) 2.5 (3.4) (0.9) 6.3 (1.5) 4.8 20.6 (18.4) 2.4 1.9 (2.6) (0.7) 20.9 (2.5) 18.4 12.6 (0.1) 12.5 3.9 0.0 3.9 79.5% (39.5)% 40.1% Long Short Net % % % 16.9 % (22.1 )% (5.1 )% 32.7 (16.2 ) 16.6 16.2 (1.1 ) 15.1 11.8 (0.0 ) 11.6 1.9 (0.2 ) 1.9 79.5 % (39.5 )% 40.1 % Notes on Financial Positions: They are short (net) large cap equity Long small cap equity Long debt instruments 8 Net Investment Income: InI Inter Gains (losses) Interest, dividend & other income Interest Investment advisor compensation Net investment income (loss) Three months ended Nine months ended September 30, September 30, ($ in thousands) ($ in thousands) 2009 2008 2009 2008 $ 39,648 $(121,075) $ 170,846 $ (89,008) 2,997 4,368 12,725 17,308 (3,570) (4,611) (11,006) (13,112) (6,447) 3,509 (23,898) (7,734) $ 32,628 $(117,809) $ 148,667 $ (92,546) Nearly all the value Greenlight RE has created in book value this year ($152 million) is directly attributable to their net investment income (Einhorn’s financial positions). o This is why I refer to Greenlight RE has: “A Hedge Fund with an Insurance Business” Business Performance Pre-2009 Revenues from net reinsurance premiums earned have increased each of the last 3 years (2006 they were still private, also 1st year in reinsurance business), from $26.6M in 2006 to $114.9M in 2008. With this, expenses relating to the reinsurance business (namely underwriting losses) have also increased substantially. Nonetheless, the reinsurance side has done a very good job of covering their own expenses and earning net positive incomes. For simplicity’s sake, I chose to expense out General & Administrative expenses from the reinsurance net premiums earned, and came up with a net loss of $2.5M for 2006, a net gain of $7.68M for 2007, and a net gain of $4.06M for 2008 (2008 10K). The company, however, does not consider General & Administrative expense as a part of the reinsurance business, therefore their reported numbers for underwriting income are much higher than what I just suggested. I included G&A expenses on my reinsurance income calculation just to show that investment side truly is being operated free of charge. The other area of income, investments, is what will ultimately make or break this company. While money can be made in the reinsurance side, its main purpose is to lay the table for the investment side. As you will see in a chart below, Greenlight’s Net Income is almost a direct reflection of their Net Investment Income. The track record here is a little bit longer, as Einhorn has been investing people’s money since before the Internet bubble. As has already been mentioned, Einhorn has proven himself to be an expert at allocating capital. That success, so far, has translated to the reinsurance company, with the exception of 2008. 9 In 2008, the investment portfolio reported a loss of 17.6% for the year (S&P 500 was down 37.2%), compared to a gain of 5.9% in 2007. 2006 was a great year for the portfolio, achieving returns of 24.4% (2008 10K). The company states their primary financial goal is to increase long-term value in fully diluted book value per share. In 2008, the fully diluted book value per share decreased 19.2%, following an increase of 16.1% per share in 2007 (2008 10K). Net Investment Income & Net Income 2008 2007 2006 ($ in thousands, except per share and share amounts) Summary Statement of Income Data Gross premiums written Net premiums earned Net investment income (loss) Loss and loss adjustment expenses incurred, net Acquisition costs, net General and administrative expenses Net income (loss) $ $ 162,395 114,949 $ 127,131 98,047 $ 74,151 26,605 (126,126) 27,642 58,509 55,485 41,649 39,507 38,939 9,671 10,415 13,756 (120,904 ) 11,918 35,325 9,063 56,999 $ $ Fiscal Year 2009 2009, so far, has been an excellent year for the company. The reinsurance business continues to grow its revenues (although a small % of net income). Through three quarters, net premiums earned are already nearly 30% above where they were for the whole year of 2008. With that, underwriting losses have also grown, however net premiums earned still cover all expenses (including G&A) by over $3.5M. The company reported underwriting income at $17.2M thus far in 2009, compared to $13.2M at the same time last year (3Q report). The investment portfolio has also shown significant gains as the financial markets started to gain footing in early to mid-year 2009. Greenlight’s investment portfolio has reported a net gain of $148.7M, or a return of 24.2% (S&P up 18%), for the nine months ended September 30, 2009. Over the same period last year, the company reported a net investment loss of $92.5M, or 12.9% (3Q report). 10 During the first nine months of fiscal year 2009, fully diluted book value per share has increased by $4.07 per share, or 30.0%, to $17.62 per share from the $13.55 per share at year-end 2008 (3Q report). Greenlight RE Highlights David Einhorn is one of the most successful investors of the past decade Focus on superior returns on both sides of the balance sheet (but we all know value will mainly come from investments) Favorable tax treatment due to Cayman Islands location Disciplined, differentiated underwriting strategy A- (excellent) financial strength rating from A.M. Best Little leverage in investment operations Has a rather large “short” exposure—profiting in down markets $50 million personal investment by Chairman David Einhorn (owns over 17% of company—interests aligned with investors Investment Risks and Concerns Limited loss experience Exposure to natural disasters Needs to maintain letters of credit Competitive industry Lack of operating history 11 Conclusion I am recommending a hold/add on Greenlight Reinsurance. While pricing in the reinsurance industry is forecasted to remain subdued through the first half of 2010 it should affect the value of Greenlight RE very little. Greenlight (like Berkshire Hathaway) relies heavily on their net investment income to drive book value (over 95% of net income has come from their investment portfolio since Greenlight’s IPO in 2007) and will continue to do so. Greenlight is structured like a liquid hedge fund utilizing the skills of the respected and well known hedge fund manager--David Einhorn who has significantly outperformed the S&P 500 over his investing career. Secondly, being that the IFM Fund is long only equities, Einhorn could give the fund some “short” exposure possibly creating greater diversification within the fund and earn the fund higher risk-adjusted returns. If Einhorn’s history is a good predictor of future success the IFM Fund can expect to achieve 15-20% annual returns with Greenlight RE—assuming Einhorn can earn returns with Greenlight RE similar to his historical returns with his hedge fund Greenlight Capital. An investment in Greenlight RE is merely an investment in a liquid hedge fund backed by a manager with an extraordinary historical performance. While Greenlight RE may be somewhat riskier due to its more volatile revenue structure and lack of operating history relative to other reinsurers, it has potential to be the next Berkshire Hathaway (albeit a little bit riskier). Einhorn has beaten the S&P 500 by nearly 15% for the last 14 years—it is hard to argue with performance. Sources 10-k report 10-q report Greenlightre.ky Scribd.com Yahoo! Finance Google Finance Reuters S&P Net Advantage Mergent Online Bigcharts.com 12