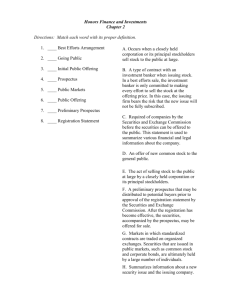

Introduction to Perspective on Security Law

advertisement