5.02 Classroom

Essential Standard 5.00

Understand business credit and risk management.

1

Objective 5.02

Understand risk management and insurance.

2

Topics

•

•

•

• Types of risk

Ways to handle risks

Business Insurance

Uninsurable risks

3

Types of risk

4

Types of Risk

•

•

•

•

• What is risk?

The possibility of incurring a loss.

What is risk management?

It is a systematic process of managing risk to achieve set objectives.

5

Types of Risk

• Different types of risk:

Economic and non-economic

Pure risk and speculative

Controllable risk and uncontrollable

Insurable risk and uninsurable

6

Types of Risk continued

• Economic

Results in financial loss.

Three categories of economic loss:

Personal risk – Result in personal losses

Property risk – Loss of personal or business property including money, buildings and vehicles.

Liability risk – Harm or injury to other people or their property because of your actions.

Example: Fred’s Diner incurred a loss due to a fire.

7

Types of Risk continued

•

• Non-economic

May result in embarrassment or inconvenience without financial impact.

Example: Requesting for customers to move to another check-out lane.

Pure

Threat of a loss without an opportunity for gain.

Example: Frost damages a strawberry patch.

8

Types of Risk continued

•

•

Speculative Risk

Offers the chance of gain or loss.

Example: Mary opened a shoe store that operated for only six months.

Controllable Risk

Occurs when conditions can be controlled to lessen the chance of harm.

Example: Sears installed centralized customer service stations in order to increase convenience.

9

Types of Risk continued

•

•

Uncontrollable Risk

Cannot be controlled or reduced by your actions.

Example: Riding along a highway with other speeding automobiles.

Insurable Risk

Meets criteria of an insurance company for coverage.

Example: An artist purchased insurance to cover his collection.

10

Types of Risk continued

• Unpredictable amount of loss

Example: A competitor of Staples, an office supply store, moved right across the street.

11

Ways to handle risks

12

Ways to Handle Risks

Avoid

Transfer

Insure

Assume

13

Ways to Handle Risks

•

•

Avoid the risk

Declining to engage in particular activities.

Example: A book company decline an order to produce 6000 books in one day.

Transfer the risk

Allowing someone else to assume the risk.

Example: A book company has a contract for a trucking company to transport its books.

14

Ways to Handle Risks continued

• Insure the risk

Purchasing insurance to cover risk.

Example: General Electric sells insurance to customers to cover their appliances.

Assume risk

Finishing an activity and accepting full responsibility

Example: Mary runs a coffee shop and offers a variety of services.

15

Business insurance

16

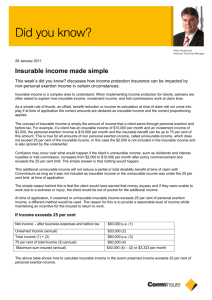

Business Insurable Risks

• Personnel

Health insurance provides protection against the high costs of individual health care.

Disability insurance provides payments to employees who are unable to work for an extended period due to serious illness or injury.

Life insurance pays the amount of the insurance policy upon the death of the insured.

17

Business Insurable Risks continued

•

•

Property

Insurance is purchased to protect business from financial loss due unsuspectingly damages to their buildings, equipment, and building contents, including inventory.

Business Operations

Coverage as a result of accidents, injuries, and property damage.

18

Types of Uninsurable Risks

Economic Conditions

Consumer Demand

Action of Competitors

Technology Changes

Local Factors

Business Operations

19

Health insurance coverage

20

Health Insurance Coverage

•

•

Hospital insurance

Classified as medical insurance.

Covers for most or all of the charges during a stay in the hospital.

Surgical Insurance

Covers all or part of the surgeon’s fees for an operation.

21

Health Insurance Coverage continued

•

•

Regular medical insurance

Covers fees for nonsurgical care given in the doctor’s office, the patient’s home, or a hospital.

Major medical insurance

Covers cost of extended and specialized care out of the hospital such as medicine and special nursing care.

22

Health Insurance Coverage continued

• Comprehensive Medical Policy

Combines the features of hospital, surgical, regular, and major medical insurance.

23

Health Insurance Coverage continued

Dental Insurance

Contains deductible and coinsurance to reduce the cost of premiums.

Covers examinations, X rays, cleaning and filling.

Covers dental injuries resulting from accidents.

Covers part or all of complicated dental work such as crowns or bridges.

24

Health Insurance Coverage continued

• Vision Care Insurance

Cover eye examinations, prescription lenses, frames, and contact lenses.

Some plans cover the cost of laser eye surgery that eliminates the need for glasses.

25

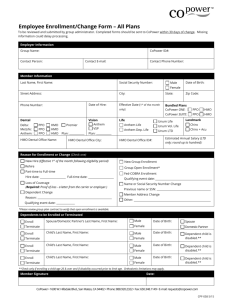

HEALTH INSURANCE PROVIDERS

• Health insurance may be obtained through employer related groups. They include:

Group health insurance

Managed care plans

Health Maintenance Organizations (HMO)

Preferred Provider Organizations (PPO)

State Government Programs

26

HEALTH INSURANCE PROVIDERS

• Group Health Insurance

Most popular way to buy health insurance.

Companies pay part or all of the premium for their employees.

27

HEALTH INSURANCE PROVIDERS

• Managed Care Plans

•

Health Maintenance Organization (HMO)

Consists of a staffed medical clinic to serve members.

Members are entitled to a wide range of prepaid health care services, including hospitalization.

Preferred Provider Organization (PPO)

Provides a group of physicians, a clinic, or a hospital that contract with an insurance company.

Providers agree to charge a set fee for services.

Members are encouraged but not required to use the PPO services.

28

HEALTH INSURANCE PROVIDERS

• State Government Assistance

Workers Compensation that provides medical and survivor benefits for people injured, disabled, or killed on the job.

29

Life insurance

30

Life Insurance Principles

•

•

Life insurance protects survivors against financial loss associated with death.

Two basic types:

Term

Permanent

31

Types of Life Insurance

Term Life Insurance

Provides financial protection from losses resulting from a death during a definite period or term.

Least expensive form of life insurance.

Only life insurance that is purely life insurance without savings and investments.

32

Types of Life Insurance continued

Permanent Life Insurance

Has cash value and an investment feature.

Part of the premium paid is used for insurance that provides protection.

The insurance company invests part of the premium.

33

Types of Life Insurance continued

Group Life Insurance

Covers a group of people.

Offers term rather than permanent insurance.

Individual is covered by their employer

34