Insurable income made simple

advertisement

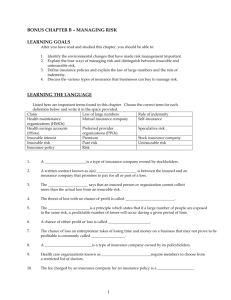

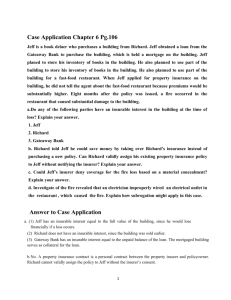

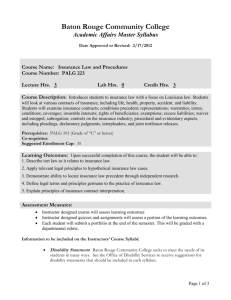

Peter Rushbrook National Technical Manager 28 January 2011 Insurable income made simple This week’s did you know? discusses how income protection insurance can be impacted by non-personal exertion income in certain circumstances. Insurable income is a complex area to understand. When implementing income protection for clients, advisers are often asked to explain how insurable income, investment income, and trail commissions work at claim time. As a simple rule of thumb, an offset, benefit reduction or income re-calculation at time of claim will not come into play if at time of application the correct amounts are declared as insurable income and the correct proportioning applies. The concept of insurable income is simply the amount of income that a client earns through personal exertion and before tax. For example, if a client has an insurable income of $10,000 per month and an investment income of $2,000, the personal exertion income is $10,000 per month and the insurable benefit can be up to 75 per cent of this amount. This is true for all amounts of non personal exertion income, called uninsurable income, which does not exceed 25 per cent of the insurable income. In this case the $2,000 is not included in the insurable income and is also ignored by the underwriter. Confusion may occur over what would happen if the client’s uninsurable income, such as dividends and interest, royalties or trail commission, increases from $2,000 to $10,000 per month after policy commencement and exceeds the 25 per cent limit. The simple answer is that nothing would happen. This additional uninsurable income will not reduce a partial or total disability benefit at time of claim with CommInsure as long as it was not included as insurable income or the uninsurable income was under the 25 per cent limit, at time of application. The simple reason behind this is that the client would have earned that money anyway and if they were unable to work due to a sickness or injury, the client would be out of pocket for the additional income. At time of application, if unearned or uninsurable insurable income exceeds 25 per cent of personal exertion income, a different method would be used. The reason for this is to provide a reasonable level of income whilst maintaining an incentive for the insured to return to work. If income exceeds 25 per cent Net income – after business expenses and before tax $60,000 p.a. (1) Unearned income (annual) $20,000 (2) Total income (1) + (2) $80,000 p.a. (3) 75 per cent of total income (3) (annual) $60,000 (4) Maximum sum insured (annual) $40,000 (4) – (2) or $3,333 per month The above table shows how to calculate insurable income in the event unearned income exceeds 25 per cent of personal exertion income. Whilst it is plausible that trail commission is a payment for past personal exertion income, in reality, in the event of a total or partial disability this income will usually continue. This poses a concern for financial advisers as to whether trail commission should be included in the insurable income. Where trail commission is included in insurable income, it may be offset at time of claim and included in monthly income. If it is not included, it will not be offset. Getting this right at time of application is therefore crucial. It is important to consult with the underwriters at time of application and to clearly disclose all insurable income components so that there is less risk of reassessment at claim time if uninsurable income is being received. Summary CommInsure will not offset trail commission, royalties and investment income as long as trail commission, royalties and investment income did not form part of the insurable income when calculating the monthly benefit. Important information This information was prepared by The Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 (CMLA) for the use of advisers only and is not to be issued or made available to members of the public. The taxation information and examples are of a general nature only and should not be regarded as specific advice. Advisers should refer to the relevant life company policy documents for further clarification. CommInsure is a registered business name of CMLA. Page 2 of 2