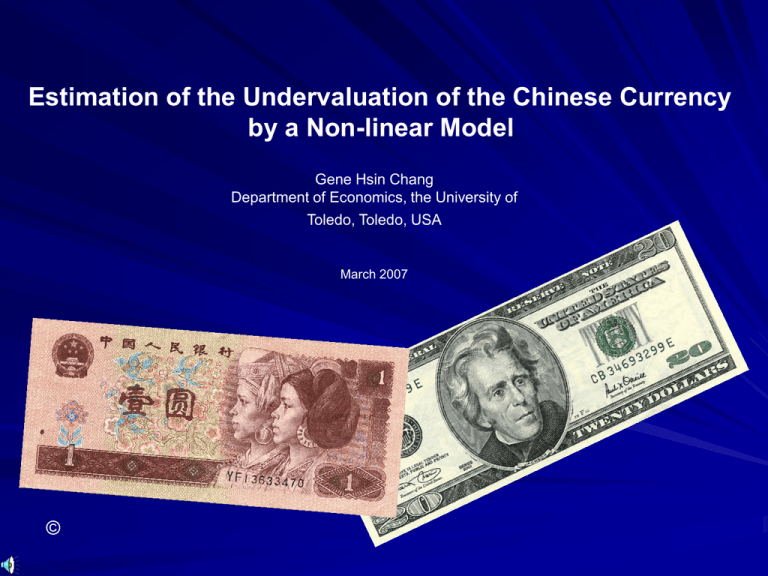

Year - Gene Chang, University of Toledo

advertisement

Estimation of the Undervaluation of the Chinese Currency

by a Non-linear Model

Gene Hsin Chang

Department of Economics, the University of

Toledo, Toledo, USA

March 2007

©

Background

Senate Bill:

by Charles Schumer (D., N.Y.) and Lindsey

Graham (R., S.C.)

Currency manipulation by China.

If no RMB revaluation, imports from China can

be subject to 27.5% tariff.

Vote by July.

Background

House China Currency Act:

by Congressmen Duncan Hunter (R., Calif.) and Tim

Ryan (D., Ohio)

Currency manipulation as a "prohibited export subsidy"

by China, under Article VI of the GATT.

If no RMB revaluation, trigger an antidumping or

countervailing duty. Prohibition of importation of

Chinese defense products

US Trade with China

(million dollars)

250,000

200,000

Total

Deficit

150,000

100,000

50,000

19

85

19

87

19

89

19

91

19

93

19

95

19

97

19

99

20

01

20

03

20

05

0

Estimates of Undervaluation of

RMB

Jeffrey Frankel (2004): Using Rogoff model and

found that yuan is 42% undervalued

Lardy and Goldstein (2003): 15%-25%

undervalued. No formal model provided.

Gene Chang: Linear regression model: 19.2%

undervalued

Gene Chang and Shao (2004): linear model with

control of heteroskedasticity: 22.5%

undervalued.

Estimates of Undervaluation of

RMB

Zhang and Pan (2004): 15-22%

undervalued.

Steve Hanke and Michael Connoly (2004

WSJ): No undervaluation

Ronald McKinnon: No revaluation, at most

1%.

Robert Mundell: No need for revaluation

for RMB

Approaches to estimate Equilibrium

Value of Yuan

Determination in the short-run: Supply

and demand for the foreign exchanges

Estimating supply and demand for the

foreign exchanges, including trade

balance and current account balance.

Approaches to estimate Equilibrium

Value of Yuan

Determination in the long-run

Absolute purchasing power parity

Real Exchange Rate (RER)

RER = (E X PChina) / PU.S.

If absolute PPP holds, RER = 1

Data are available now for abs PPP

Approaches to estimate Equilibrium

Value of Yuan

Determination in the long-run

Purchasing power parity

E = PU.S. / PChina

Relative purchasing power parity

% depreciation in E

= inflation U.S. – inflation China

Problems with using relative PPP to

estimate equilibrium value of yuan

Real Exchange Rate of Countries

Estimation of Equilibrium Value

of Yuan

Why is RER greater than 1 for poor

countries?

The Balassa-Samuelson hypothesis

The Bhagwati-Kravis-Lipsey hypothesis

RER is a function of per capita income

level

Estimation of Equilibrium Value

of Yuan: Model Specification

Model with control of the income level:

RER = f (GDP per capita)

Data for RER

Linear or Rogoff log linear

(ln) RER = a + b X (ln) GDP per capita

Control heteroskedasticity

Estimation of Equilibrium Value

of Yuan: Simple OLS

Using the world sample to obtain the

estimates and the prediction equation

Intercept

Coefficients Standard

error

4.28039

0.15922

GDP p.c. -0.13386

0.01320

t -statistics

26.88387

-10.14495

Simple Linear Model: OLS

RER i c ( a b GDPpci ) 1 i

The Rogoff Model

ln RER = a + b ln GDPpc + ε

Coefficients

a

b

0.68742

-0.38561

Sum of Squared Errors of the log RER

values: 11.105

Sum of Squared Errors of the true values*:

856.44

The Rogoff Specificatgion

RER i c ( a b GDPpci ) 1 i

The New Non-linear Model

The new model

Non-linear regression equation

RER = c + (a + b GDPpc)-1 + ε

The New Non-linear Model

Regression results

Observations:160

Sum of squared errors: 299.0869

Estimated coefficients

a: 0.18903852

b: 0.023503552

c: 0.010

The New Non-linear Model

RMB Undervaluation Estimation

Non-linear Model

Year

GDP pc

2001

RER

actual

RER

predicted

Valuation

P-value**

1978

662

1248

1371

1502

1692

2394

2656

2876

2.00

3.26

4.13

4.15

4.44

4.83

4.28

4.09

4.90

4.59

4.53

4.47

4.38

4.09

3.99

3.91

59.2%

28.9%

8.9%

7.2%

-1.4%

-18.1%

-7.4%

-4.8%

0.084

1985

1986

1987

1991

1994

1995

1996

0.187

0.299

0.406

0.384

0.263

0.372

0.424

RMB Undervaluation Estimation

by Non-linear Model

Year

GDP pc

2001

RER

actual

RER

predicted

Valuation

P-value**

1998

3315

3506

3756

4020

4305

4647

4999

5462

4.27

4.41

4.46

4.53

4.59

4.55

4.32

3.96

3.76

3.69

3.62

3.54

3.46

3.36

3.27

3.16

-13.7%

-19.5%

-23.5%

-28.0%

-32.7%

-35.3%

-32.0%

-25.3%

0.437

1999

2000

2001

2002

2003

2004

2005*

0.409

0.357

0.319

0.304

0.278

0.286

0.315

Fittings of Different Models

1000

Sum of Square

Errors

800

600

400

200

0

Sum of Square

Errors

Rogoff

OLS

Non-linear

856.4

539.9

299.1

Comparison of various models

Year

OLS

Hetero

Rogoff

Non-linear

1978

1980

1981

1984

1986

1987

1990

1992

1993

52.3%

48.7%

42.3%

30.5%

20.7%

-0.7%

-2.5%

-16.3%

-32.2%

51.3%

44.9%

40.2%

33.8%

19.7%

-8.9%

-5.0%

-19.7%

-35.2%

6.2%

-2.8%

-16.2%

-45.6%

-70.2%

-118.8%

-126.2%

-162.4%

-201.7%

59.2%

55.8%

50.1%

38.7%

28.9%

8.9%

6.0%

-9.3%

-26.1%

Comparison of various models

Year

OLS

Hetero

Rogoff

Non-linear

1994

1995

1998

1999

2000

2001

2002

2003

2004

2005*

-21.9%

-9.1%

-11.3%

-15.8%

-18.2%

-21.0%

-23.8%

-24.4%

-19.6%

-11.5%

-24.3%

-12.6%

-8.9%

-14.3%

-18.4%

-20.1%

-23.2%

-22.5%

-19.2%

-181.0%

-153.6%

-162.4%

-173.9%

-180.2%

-187.5%

-194.6%

-196.0%

-184.4%

-164.6%

-18.1%

-7.4%

-13.7%

-19.5%

-23.5%

-28.0%

-32.7%

-35.3%

-32.0%

-25.3%

gyz

Re

-50.00%

-100.00%

pub

Bel lic

a

Co

ngo Camb rus

, De odi

a

m.

Re

p.

Ind

ia

Sou Ukrai

th A ne

fr

Vie ica

tn

B u am

lga

ria

C

Ban

h

gla ina

Phi desh

lipp

Ind ines

one

si a

Ru

Ita

ssi

an Thail ly

Fed

a

era nd

Ho

tion

ng

Ko Hung

a

ng,

Ch ry

i

Fin na

lan

Fra d

nc

Un

ited Swed e

en

Ki

Ko ngdom

rea

,R

ep

Jap .

a

Sau Kuw n

di A ait

rab

Ven

Zam ia

ez u

bia

Co ela, R

ngo

B

, Re

p.

Kyr

Under/over-valuation of currencies (2001)

by hetero-controlled linear model

100.00%

50.00%

0.00%

-150.00%

The theoretical justification for the

Rogoff-Frankel regression model

Why is the regression mean (predicted

line)) serves as the equilibrium exchange

rate?

Why does the error term (residual)

measure the magnitude of the under or

over valuation?

The theoretical justification

for the Rogoff-Frankel

regression model

• The Rogoff-Frankel regression model

RER i f ( GDPpci ) i

Theoretical Justification

• Starting from a simple version

• n trading countries

• All are of the same economic size

and at the same development level

(same GDP per capita level).

Theoretical Justification

• Country i's trade balance (net exports) is

a function of its overvaluation or

undervaluation.

X i a(RER i -RER*)

• where Xi is the next exports of country i.

RER* is the equilibrium real exchange rate.

RERi is the real exchange rate of country i,

and a is a positive constant.

Theoretical Justification

• If the country revalues/devalues its

currency back to the equilibrium

level thus, then its trade is in

balance Xi = 0.

• Conversely, if its trade is not

balanced, its currency is not at the

equilibrium level.

Theoretical Justification

• Globally, all trade deficits and

surpluses shall be cancelled out.

Summarize all countries trade, and

note that it must be globally

balanced: .

n

X

n

i

a (RER i RER*) 0

i

RER

i

i

i

n RER*

Theoretical Justification

• The equilibrium real exchange rate

RER* is determined by

1

RER*= RER i

n i

Theoretical Justification

• So, the equilibrium exchange rate is

the mean of the real exchange rates.

• Further, the difference between RERi

and RER*, , measures the under- or

overvaluation.

With different GDP sizes

• Let si be country i's share of the

global trade.

• The net exports volume of country i

will be affected by si.

• X as (RER -RER*)

i

i

i

n

n

n

i

i

i

• X i asi (RER i RER*) a si (RER i RER*) 0

With different GDP sizes

•

n

s RER

i

i

• Because

• RER*

n

i

n

RER* si

s

n

i

i

1 , so,

s RER

i

i

i

i

• Hence the equilibrium RER is trade share

weighted average of RERs of all trading

countries.

With the Balassa-Samuelson

effect

•

RER*=f ( GDPpc)

• there are m income-per-capita groups in the

world. There is only one country in each incomeper-capita group:. Without loss of generality, let

us assume that the income-per-capita level

follows the same order, where group 1 is the

poorest and group m is the richest. The nominal

exchange rates of all countries are at the

equilibrium levels. That is, all of them are trade

balanced:

X (e* ) 0 j 1,..., m

j

j

With the Balassa-Samuelson

effect

• PjT the price of tradable goods of country j

• PjNT the price of the non tradable goods of

country j.

• k is the share of the tradable in the GDP.

•

T

NT

Pj kPj (1 k ) Pj

With the Balassa-Samuelson

effect

• The law of one price, or the principle of

purchasing power parity, only applies to the

tradable. The equilibrium exchange rate is:

•

•

e*j

P

T

PjT

PT

the price of the tradables of the numeraire

country

*

numerair

e

PT

T 1

P

With the Balassa-Samuelson

effect

• equilibrium real exchange rate of a

country at income group j is:

RER j *

e*j P

Pj

e*j kP T e*j (1 k ) P NT

kP (1 k ) P

T

j

NT

j

ke*j P T (1 k )e*j P NT

ke*j P T (1 k ) PjNT

• Hence the equilibrium real exchange rate

RER* is a function of the price of nontradable of the country.

With the Balassa-Samuelson

effect

• The B-S effect implies the

nontradable price in poor countries is

lower,

• P NT g (GDPpc )

j

j

• with

• g '(GDPpc) 0

With the Balassa-Samuelson

effect

• Hence,

RER j *

ke*j P T e*j (1 k ) P NT

ke*j P T (1 k ) g (GDPpc j )

• RER * (GDPpc) f (GDPpc)

• and f’ < 0

The Balassa-Samuelson effect

• Let country ij denote country i in income-percapita group j. Each group j has nj countries.

Drop the assumption that each country is in

equilibrium, but assume all of them are of the

same trade volume size, we have the net exports

of country ij be determined by its real exchange

rate against the equilibrium value:

•

X ij a (RER ij -RER j *)

The Balassa-Samuelson effect

• Globally, all trade deficits and

surpluses shall be cancelled out.

Summarize all countries trade, and

note that it must be globally

balanced:

•

m

nj

X

j

i

ij

0

The Balassa-Samuelson effect

•

m

nj

X

ij

m

nj

j

i

a (RER ij RER j *) 0

j

i

m

nj

m

nj

m

j

i

j

i

j

• RER ij RER* j n j RER* j

The Balassa-Samuelson effect

• Then the following is true, the above equation is

true:

•

1

RER* j

nj

nj

RER

i

ij

j 1,..., m

• This shows that the equilibrium vales of the real

exchange rates is the means of the real exchange

rates of all countries in the same income groups.

The Balassa-Samuelson effect

• If each country ij adjust its RERij to

the mean of RERs of its income

group, then their trade is balanced

as indicates.

• The country's under- or

overvaluation currency can be

measured by the deviation from the

mean of RERs of its income group.

Trading across income groups

• Let Xi be any country, which can be

at different income level (but we

maintain the assumption that their

volume of trade is the same, or, its

net exports is only affected by its

under or overvaluation of exchange

rate but not the GDP size).

Trading across income groups

• X i a(RER i - RER i *)

• RER* E (RER i ) f ( ,GDPpc)

• where is the parameter(s).

• X i a(RER i - RER i *) a[RER i - f ( ,GDPpci )]

Trading across income groups

• The condition of balance of the global

trade X a[RER - f ( ,GDPpc )] 0

n

n

i

i

•

n

[RER

i

i

i

i

- f ( ,GDPpci )] 0

i

Trading across income groups

• Suppose we use the Rogoff-Frankel

model to regress RERi on GDPpc,

would the estimated RER be the

consistent estimate of , that satisfy

the condition of global trade balance?

Trading across income groups

• The regression model is

•

•

RER i f ( ,GDPpci ) i

Suppose that the regression method is a nonlinear least square or maximum likelihood

estimation. Then it implies to minimize with

respect to the parameters:

• min

2

[RER

f

(

,GDPpc

)]

i

i

i

Trading across income groups

• If the specification is Chang 2006:

RER* f ( ,GDPpc) c (a b GDPpc)1

Trading across income groups

• The first order condition of nonlinear

least square regression is,

•

2

[RER

f

(

,GDPpc

)]

i

i

i

2 {[RER i f ( ,GDPpci )]

f ( ,GDPpc i )}

i

0

Trading across income groups

• The first-order-condition with

parameter c in the regression

estimation will lead to

f ( ,GDPpci ) 1

c

Trading across income groups

• Then,

•

1 2

[RER

c

(

a

b

GDPpc

)

]

i

i

c i

2

1

{[RER

c

(

a

b

GDPpc

)

]

i

i

i

2

1

[RER

c

(

a

b

GDPpc

)

]1

i

i

i

0

f ( ,GDPpci )}

c

Trading across income groups

• By using MLE or nonlinear LS, the

estimates for parameters are

asymptotically consistent. The

estimated model servers as the

equilibrium values of the exchange

rates of trading countries, taking

account of the Balassa-Samuelson

effect.

Trading across income groups

• Our model is justified by three reasons:

• first, if a country adjusts its exchange rate to , its

trade is balanced as Xi = 0.

• Secondly, if all countries adjust their exchanges

to , each country is own trade balanced.

• Finally, by using Chang's model specification or

linear specification, the global trade balance

condition is always satisfied by the MLE estimates,

even if each country itself has trade surplus,

which is caused by an undervalued currency, or

has trade deficit, which is caused by an

overvalued currency.

Summary

The long run equilibrium value of RMB provides

the best information about the trend of the

valuation of RMB.

Absolute PPP with control of the BalassaSamuelson effect is the best approximation

available for the long-run equilibrium value of a

currency.

The suggested non-linear model provides better

fitting for the data than previous models.

Concluding Remarks

RMB is undervalued by 25.5% in 2005,

hence the revaluation pressure

continuously presents.

RMB has revalued substantially in real

term in 2005 by a nominal revaluation and

a higher inflation rate (10.46%) in the GDP

deflator.

Concluding Remarks

The magnitude of undervaluation will diminish in

near future due to: (1) revaluation of the nominal

exchange rate of RMB, and (2) a higher inflation

rate in China than that in U.S.

The undervaluation will intensify as China is

growing rapidly.

The net result depends on the relative

magnitudes of the two opposite forces. But

RMB revaluation represents the general trend,

which is in response to the market pressure.