Inventory Control Models

advertisement

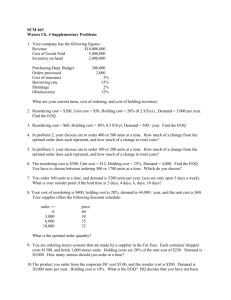

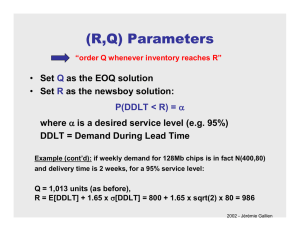

Inventory Control Models Ch 5 (Uncertainty of Demand) R. R. Lindeke IE 3265, Production And Operations Management Lets do a ‘QUICK’ Exploration of Stochastic Inventory Control (Ch 5) We will examine underlying ideas – We base our approaches on Probability Density Functions (means & std. deviations) We are concerned with two competing ideas: Q and R Q (as earlier) an order quantity and R a stochastic estimate of reordering time and level Finally we are concerned with Servicing ideas – how often can we supply vs. not supply a demand (adds stockout costs to simple EOQ models) The Nature of Uncertainty Suppose that we represent demand as: D = Ddeterministic + Drandom If the random component is small compared to the deterministic component, the models of chapter 4 will be accurate. If not, randomness must be explicitly accounted for in the model. In this chapter, assume that demand is a random variable with cumulative probability distribution F(t) and probability density function f(t). Single Period Stochastic Inventory Models These models have the objective of properly balancing the cost of Underage – having not ordered enough products vs. Overage – having ordered more than we can sell These models apply to problems like: Planning initial shipments of ‘High-Fashion’ items Amount of perishable food products Item with short shelf life (like the daily newspaper) Because of this last problem type, this class of problems is typically called the “Newsboy” problem The Newsboy Model At the start of each day, a newsboy must decide on the number of papers to purchase. Daily sales cannot be predicted exactly, and are represented by the random variable, D. The newsboy must carefully consider these costs: co = unit cost of overage cu = unit cost of underage It can be shown that the optimal number of papers to purchase is the fractile of the demand distribution given by F(Q*) = cu / (cu + co). Determination of the Optimal Order Quantity for Newsboy Example Computing the Critical Fractile: We wish to minimize competing costs (Co & Cu): G(Q,D) = Co*MAX(0, Q-D) + Cu*MAX(0, D-Q) D is actual (potential) Demand G(Q) = E(G(Q,D)) (an expected value) Therefore: 0 0 G (Q) Co MAX (0, Q x) f x dx Cu MAX (0, x Q) f x dx Q Q 0 0 G (Q) Co Q x) f x dx Cu x Q) f x dx Here: f(x) is a probability density function controlling the behavior of ordering Applying Leibniz’s Rule: d(G(Q))/dQ = CoF(Q) – Cu(1 – F(Q)) F(Q) is a cumulative Prob. Density Function (as earlier – of the quantity ordered) Thus: G’(Q*) = (Cu)/(Co + Cu) This is the critical fractile for the order variable as stated earlier Lets see about this: Prob 5 pg 241 Observed sales given as a number purchased during a week (grouped) Lets assume some data was supplied: Make Cost: $1.25 Selling Price: $3.50 Salvageable Parts: $0.80 Co = overage cost = $1.25 - $0.80 = $0.45 Cu = underage cost = $3.50 - $1.25 = $2.25 Continuing: Compute Critical Ratio: CR = Cu/(Co + Cu) = 2.25/(.45 + 2.25) = .8333 If we assume a continuous Probability Density Function (lets choose a normal distribution): Z(CR) 0.967 when F(Z) = .8333 (from Std. Normal Tables!) Z = (Q* - )/) From the problem data set, we compute Mean = 9856 St.Dev. = 4813.5 Continuing: Q* = Z + = 4813.5*.967 + 9856 = 14511 Our best guess economic order quantity is 14511 (We really should have done it as a Discrete problem -- Taking this approach we would find that Q* is only 12898) Newsboy’s Extensions Assuming we have a certain number of parts on hand, u > 0 This extends the problem compared to our initial u = 0 assumption for the single period case This is true only if the product under study has a shelf life that extends beyond one period Here we still compute Q* will order only Q* - u (or 0 if u > Q*) Try one (in your Engineering Teams) : Do Problem 11a & 11b (pg 249) Lot Size Reorder Point Systems Earlier we considered reorder points (number of parts on hand when we placed an order) they were dependent on lead times as a dependent variable on Q, now we will consider R as an independent variable just like Q Assumptions: Inventory levels are reviewed continuously (the level of on-hand inventory is known at all times) Demand is random but the mean and variance of demand are constant. (stationary demand) Lot Size Reorder Point Systems Additional Assumptions: There is a positive leadtime, τ. This is the time that elapses from the time an order is placed until it arrives. The costs are: Set-up cost each time an order is placed at $K per order Unit order cost at $C for each unit ordered Holding at $H per unit held per unit time (i.e., per year) Penalty cost of $P per unit of unsatisfied demand Describing Demand The response time of the system (in this case) is the time that elapses from the point an order is placed until it arrives. Hence, The uncertainty that must be protected against is the uncertainty of demand during the lead time. We assume that D represents the demand during the lead time and has probability distribution F(t). Although the theory applies to any form of F(t), we assume that it follows a normal distribution for calculation purposes. Decision Variables For the basic EOQ model discussed in Chapter 4, there was only the single decision variable Q. The value of the reorder level, R, was determined by Q. Now we treat Q and R as independent decision variables. Essentially, R is chosen to protect against uncertainty of demand during the lead time, and Q is chosen to balance the holding and set-up costs. (Refer to Figure 5-5) Changes in Inventory Over Time for Continuous-Review (Q, R) System The Cost Function The average annual cost is given by: G (Q, R ) h(Q / 2 R ) K / Q p n( R) / Q Interpret n(R) as the expected number of stockouts per cycle given by the loss integral formula (see Table A-4 (std. values)). And note, the last term is this cost model is a shortage cost term The optimal values of (Q,R) that minimizes G(Q,R) can be shown to be: 2 ( K pn( R )) Q h 1 F ( R ) Qh / p Solution Procedure The optimal solution procedure requires iterating between the two equations for Q and R until convergence occurs (which is generally quite fast) We consider that the problem has converged if 2 consecutive calculation of Q and R are within 1 unit A cost effective approximation is to set Q=EOQ and find R from the second equation. A slightly better approximation is to set Q = max(EOQ,σ) where σ is the standard deviation of lead time demand when demand variance is high. Ready to Try one? Lets! Try Problem 13a & 13b (pg 261) Start by computing EOQ and then begin iterative solution for optimal Q and R values Service Levels in (Q,R) Systems In many circumstances, the penalty cost, p, is difficult to estimate. For this reason, it is common business practice to set inventory levels to meet a specified service objective instead. The two most common service objectives are: 1) 2) Type 1 service: Choose R so that the probability of not stocking out in the lead time is equal to a specified value. Type 2 service. Choose both Q and R so that the proportion of demands satisfied from stock equals a specified value. Computations For type 1 service, if the desired service level is α then one finds R from F(R)= α and Q=EOQ. Type 2 service requires a complex interative solution procedure to find the best Q and R. However, setting Q=EOQ and finding R to satisfy n(R) = (1-β)Q (which requires Table A4) will generally give good results. Comparison of Service Objectives Although the calculations are far easier for type 1 service, type 2 service is generally the accepted definition of service. Note that type 1 service might be referred to as lead time service, and type 2 service is generally referred to as the fill rate. Refer to the example in section 5-5 to see the difference between these objectives in practice (on the next slide). Comparison (continued) Order Cycle 1 2 3 4 5 6 7 8 9 10 Demand 180 75 235 140 180 200 150 90 160 40 Stock-Outs 0 0 45 0 0 10 0 0 0 0 For a type 1 service objective there are two cycles out of ten in which a stockout occurs, so the type 1 service level is 80%. For type 2 service, there are a total of 1,450 units demand and 55 stockouts (which means that 1,395 demand are satisfied). This translates to a 96% fill rate. Example: Type 1 Service Pr 5-16 Desire 95% Type I service Level F(R) = .95 Z is 1.645 (Table A4) From Problem 13: was found to be 172.8 and was 1400 Therefore: R = Z + = 172.8*1.645 + 1400 R = 1684.256 1685 Use Q = EOQ = 1265 Example: Type 2 Service Pr 5-17 Require Iterative Solution: Q0 EOQ 1295 n( R1 ) 1 * Q0 63.25 L Z1 n( R1 ) .3673 172.8 Z1 .065 & 1 F R =.474 from Table A4 Q1 n( R1 ) 63.25 n( R1 ) EOQ 1 F R 1 F R Q1 63.25 2 .474 1265 63.25 2 .474 2 1405 2 Example: Type 2 Service Pr 5-17 (cont.) n R2 1 Q1 .05*1405 70.25 L Z 2 70.25 0.408 172.8 Z 2 0.02 & 1 F ( R2 ) 0.508 R2 Z 2 1397 Q2 70.25 .508 1265 2 70.25 .508 n R3 0.05*1411 70.54 L Z 3 70.54 172.8 0.4097 Z 3 .02 R3 Z 3 1397 SAME so Stop! Q, R = 1411, 1397 2 1411 (s, S) Policies The (Q,R) policy is appropriate when inventory levels are reviewed continuously. In the case of periodic review, a slight alteration of this policy is required. Define two levels, s < S, and let u be the starting inventory at the beginning of a period. Then If u s, order S u If u s, don't order (In general, computing the optimal values of s and S is much more difficult than computing Q and R.)