mt_2_w01_331_soln - University of Windsor

advertisement

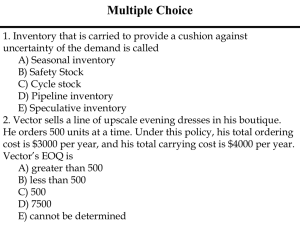

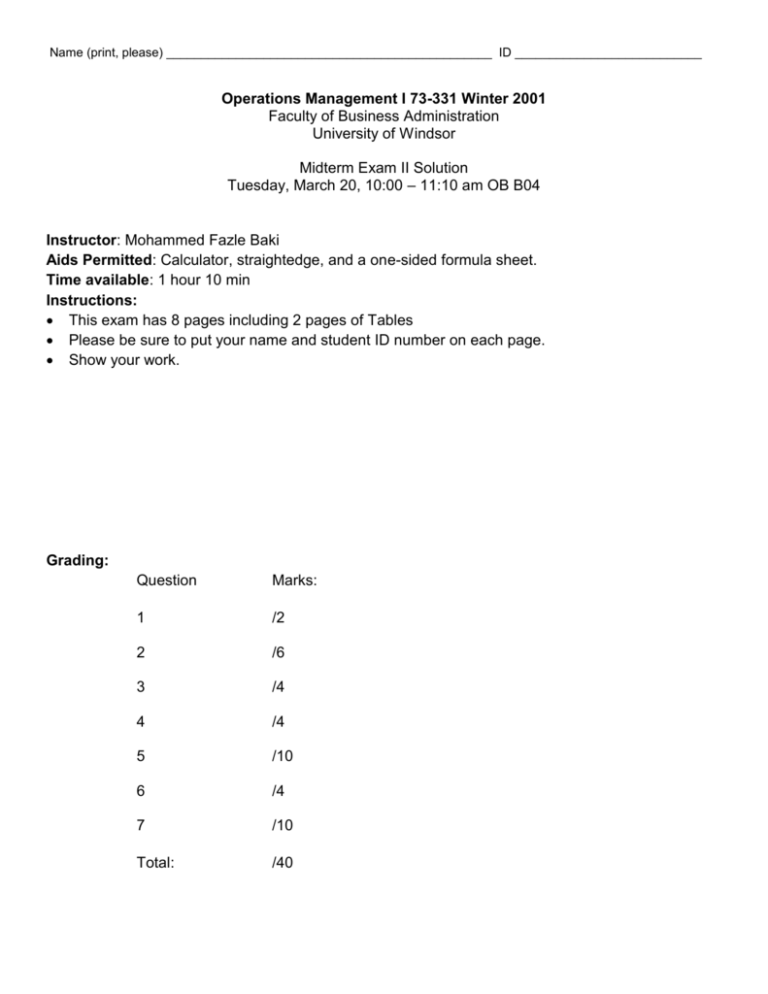

Name (print, please) _______________________________________________ ID ___________________________ Operations Management I 73-331 Winter 2001 Faculty of Business Administration University of Windsor Midterm Exam II Solution Tuesday, March 20, 10:00 – 11:10 am OB B04 Instructor: Mohammed Fazle Baki Aids Permitted: Calculator, straightedge, and a one-sided formula sheet. Time available: 1 hour 10 min Instructions: This exam has 8 pages including 2 pages of Tables Please be sure to put your name and student ID number on each page. Show your work. Grading: Question Marks: 1 /2 2 /6 3 /4 4 /4 5 /10 6 /4 7 /10 Total: /40 Name:_________________________________________________ ID:_________________________ Question 1: ( 2 points) Compute the EOQ for an item with annual holding cost rate 20%, unit cost $5.00, ordering cost $60, and monthly demand of 1000 units. Answer EOQ 2 K h 2(60)(100 12) 1200 units (0.20)(5.00) Question 2: (6 points) Montgomery Associates produces switches for scientific equipment and has gathered information about the production of its 6-13 switches: Annual production rate 2,000 units Annual demand rate 1,000 units Cost per switch $10 Annual holding cost Setup cost $80 20% a. (2 points) Find the optimal size of each production run. Answer EPQ 2 K 2(80)(1000) 400 units 1000 h1 (0.20)(10)1 P 2000 b. (2 points) Find the optimal cycle time. Answer Cycle time Q* 400 0.4 years 1000 c. (2 points) What is the maximum dollar amount invested in the inventory? Answer Maximum Inventory = 1000 Q * 1 4001 200 units P 2000 Since each unit costs $10, maximum dollar amount invested in inventory =200(10)=$2,000 2 Name:_________________________________________________ ID:_________________________ Question 3: (4 points) Harold Gwynne will start a sandwich-making business. He needs to buy breads, meats and cheeses, and condiments. He applies the EOQ formula for each item separately using the same interest rate on every item. The unit costs and the computed EOQ values are as shown below: Breads Meats and Cheeses Condiments Cost per unit $0.5 $4 $2 EOQ (units) 200 100 50 a. (2 points) If Harold wants to use the EOQ order quantities, what maximum dollar investment in inventory does he need? Answer Maximum dollar investment=(200)(0.5)+(100)(4)+(50)(2)=$600 b. (2 points) If Harold has only $300 available to invest in the inventory, find the optimal order quantities. Answer m Amount available 300 0.5 Amount needed by the EOQ solution 600 Order quantity Breads Meats and Cheeses Condiments 200(0.5)=100 100(0.5)=50 50(0.5)=25 Question 4: (4 points) Suppose that the annual demand is normally distributed with a mean of 1000 and a standard deviation of 100. Assume that the lead-time is 3 months. a. (2 points) What are the mean and standard deviation of the lead-time demand? Answer 3 Lead - time mean, 1000 250 units 12 3 Lead - time standard deviation, annual 100 50 units 12 b. (2 points) If a (Q, R) policy is used with the reorder point, R = 335 units, find the corresponding standardized loss function, L(z). What is the expected number of shortages per cycle? Answer R z z R 335 250 1.7 . From the Table, L(z) = 0.0183 50 Therefore, expected number of shortages per cycle, n L( z ) 50(0.0183) 0.915 units 3 Name:_________________________________________________ ID:_________________________ Question 5: (10 points) Irwin sells a particular model of fan, with most of the sales being made in the summer months. Irwin makes a one-time purchase of the fans prior to each summer season at a cost of $40 each and sells each fan for $55. Any fans unsold at the end of summer season are marked down to $30 and sold in a special fall sale. a. (2 points) What is the underage cost per unit? Answer cu selling price - purchase price 55 40 $15 b. (2 points) What is the overage cost per unit? Answer c0 purchase price - salvage value 40 30 $10 c. (2 points) Suppose that probability(demand1000)=0.6. Enrique, the purchasing manager, says that an optimal order quantity is 1000 units. Is Enrique right? Show your work. Answer p cu 15 0.6 cu co 15 10 Since probability(demand1000) = 0.6 = p, an optimal order quantity is 1000 units. So, yes, Enrique is right. d. (2 points) If the demand is uniformly distributed between 400 to 1400 units, find the optimal order quantity. Answer Q * a p(b a) 500 0.6(1400 400) 1000 units e. (2 points) If the demand is normally distributed with a mean of 900 and a standard deviation of 120, find the optimal order quantity. Answer Area=0.10 Hence, the area between mean and z = 0.6-0.5 = 0.1 (Area (2)) From the Table, z = 0.25 for area = 0.0987 (nearest to 0.1) Q * z 900 (0.25)(120) 930 units Probability First, find the z for which area on the left = p = 0.6 (Area (1)+(2)) 100 (2) (1) (3) =900 z = 0.25 Demand 4 Name:_________________________________________________ ID:_________________________ Question 6: (4 points) Riverside Furniture produces two furniture pieces J-123 and H-234 using a single lathe. The company uses a rotation cycle policy with a cycle time of 0.1 year. J-123 H-234 Annual production rate 30,000 40,000 Annual demand rate 12,000 18,000 a. (2 points) Compute the production quantities for each product in each cycle. Answer Production quantity in each cycle, Qi i T Since, T 0.1 year, we get the following production quantities in each cycle: Production cycle quantity in each J-123 H-234 12,000(0.1)=1,200 units 18,000(0.1)=1,800 units b. (2 points) Compute the proportion of time the lathe is idle. Answer Production time in each cycle, T1,i Qi Pi Hence, we get the following production times in each cycle: Production times in each cycle J-123 H-234 1,200/30,000=0.04 year 1,800/40,000=0.045 year Thus, idle time in each cycle = cycle time – production time for J-123 – production time for H-234 = 0.1-0.04-0.045 = 0.015 year Hence the proportion of time the lathe is idle = idle time/cycle time = 0.015/0.1 = 0.15 = 15% 5 Name:_________________________________________________ ID:_________________________ Question 7: ( 10 points) A supplier has quoted the following discount schedule. Category Order Size Unit Cost 1 0-499 $5.00 2 500-1999 $4.05 3 2000 and over $3.20 Inventory holding costs are 20% per year, it costs $50 to place an order, and annual demand is 20736 units. What order quantity should be selected? Answer (1.5 points) Price level: c3 = $3.2 per unit (cheapest) 2 K 2(50)( 20736) 1800 units Optimal order quantity (EOQ), Q * h 0.20(3.20) The quantity is not feasible, because the price level is available for order quantity of 2000+. Hence, a candidate for optimal order quantity is 2000 units and the next price level must be considered. (1.5 points) Price level: c2 = $4.05 per unit 2 K 2(50)( 20736) 1600 units Optimal order quantity (EOQ), Q * h 0.20( 4.05) The quantity is feasible, because the price level is available for order quantity of 500-1999. Hence, a candidate for optimal order quantity is 1600 units and it is not necessary to consider any other price levels. (3 points) Order quantity 2000 units hQ (0.2)(3.20)( 2000) $640 Annual holding cost = 2 2 K 50( 20736) Annual ordering cost = $518.4 Q 2000 Annual cost of item = c3 20,736(3.20) $66,355.2 Total annual cost = 640+518.4+66,355.2=$67,513.6 (3 points) Order quantity 1600 units hQ (0.2)( 4.05)(1600) $648 Annual holding cost = 2 2 K 50( 20736) Annual ordering cost = $648 Q 1600 Annual cost of item = c2 20736(4.05) $83,980.8 Total annual cost = 648+648+83,980.8=$85276.8 (1 point) Conclusion: The minimum total annual cost is obtained from an order quantity of 2000 units. Hence the optimal order quantity is 2000 units with a total annual cost of $67,513.6 6