9515

advertisement

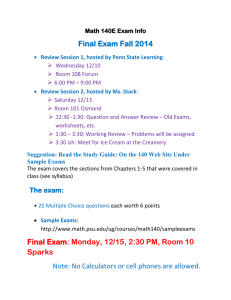

KOÇ UNIVERSITY MFIN550: Financial Markets and Instruments Dr. Recep Bildik rbildik@ku.edu.tr Teaching Assistant: Course Description: In last few decades, a dramatic, profound, exciting and irreversible revolution has occurred in the world’s financial markets and institutions. Boundaries between commercial banking and investment banking broke down and competition became increasingly global in nature. Many forces contributed to this revolution in inter-industry and inter-country barriers, including financial engineering technology, globalization and regulation. Then recently, the financial services industry experienced the worst financial crisis since the Great Depression in 1929. As the economic and competitive environments rapidly and unexpectedly change, volatility skyrocketed, attention to profit and risk become increasingly important. Financial markets now became a worldwide focal point of public more than ever. This course aims to instruct students about this fascinating revolution by examining the financial instruments and institutions that make up the financial markets. It describes the wide array of financial instruments available in today’s volatile markets as responses to the needs of borrowers, lenders, and investors for investing, financing operations, and controlling the various kinds of financial risk. The fundamentals of the role of these instruments and the financial markets in investment and financing decisions, the principles of pricing financial instruments, and detailed description of how they are used by market participants will be the focus of this course. This course provides comprehensive coverage of globalized financial markets with focus on how trading and operation of financial instruments such as stock, bonds, FX, derivatives and structured products occur. Important practical tools such as how to value, issue and trade financial securities will arm students to understand financial markets and manage the risk and return characteristics of financial instruments, both individually and in portfolios in dynamic investment environment. Real-life examples will be the important part of the course and be supported by using the Bloomberg in the class. Descriptive concept and technical features such as financial market microstructures, industry trends and characteristics, and regulation of markets are also included in this course. 1 This course is suitable especially for those interested in financial markets, banking, investments, asset management, risk management and corporate finance. However, it is not limited with these areas as professionals targeting C-level positions through different disciplines should also be equipped with certain degree of knowledge in finance and about financial markets in today’s competitive environment. Additionally, the operations and regulations in Turkish financial markets will be provided throughout the course, which will also be helpful for those who will take mantodatory licensing exams of Capital Market Board to work in the Turkish securities industry in the future. This course which consists of the foundations of investment management, would also serve as a prerequisite to certain Ms in Finance electives. Course Outline: The course will start with an introduction to financial markets, institutions and investment analysis. Then we will study formation of interest rates, the role of central banks and its’ monetary policy, and security valuation. Next, we will look at securities markets. We will learn about money, fixed income, mortgage, stock, foreign exchange, and derivatives markets by in-depth analysis of financial institutions and instruments in these markets as well as trading applications and experiences in real world. Relatively new areas in finance such as securitization off-balance sheet activities, non-interest based products and globalization of financial services will also be explained. Our focus on the actual practices of financial instruments helps students more fully to comprehend the features of risk management which will be the focal point of next course. As you can see from the following course outline, we will closely follow the outline of the text. Introduction and Overview of Financial Markets - Chapter 1: Introduction Chapter 2: Determinants of Interest Rates Chapter 3: Interest Rates and Security Valuation Chapter 4: The Federal Reserve System, Monetary Policy, and Interest Rates Chapter 5: Money Markets Chapter 6: Bond Markets Chapter 7: Mortgage Markets Chapter 8: Foreign Exchange Markets Chapter 9: Stock Markets Chapter 10: Derivative Securities Markets Bodie, Kane, and Marcus - Chapter 14: Bond Prices and Yields 2 - Chapter 16: Managing Bond Portfolios Chapter 20: Options Markets Chapter 22: Futures Markets Course Prerequisites: MFIN 501 Financial Management I Working knowledge of Excel is also required to derive the maximum benefit from this course. Course Material: Required text book: Financial Markets and Institutions: A Modern Perspective, Anthony Saunders & Marcia Millon Cornett, McGraw-Hill, 5th edition, 2012. We will also cover some chapters from the additional text book below; Investments, Bodie, Kane and Marcus, 8th editions, Irwin-McGraw Hill Relevant class material – such as lecture notes, problem sets, solution keys, etc. will be posted on the class web-page or handed-out in the classroom. Evaluation and Policies: Your final grade will be determined as follows; Class Participation Assignments / Quiz Midterm Exam / Project Final Exam 10 % of total grade 30 % of total grade 25 % of total grade 35 % of total grade The dates for the exams will be announced during the semester. No letter grades will be assigned to any individual component in the evaluation process. Letter grades will be assigned only at the end of the semester based on performance relative to the rest of the class. Class Participation: You will benefit from this course in proportion to the effort you put in by attending and preparing for a class through working on the assigned material. Your class participation grade will be based on your level of preparation for class throughout the semester which 3 will be evidenced by the quality of your questions, answers, and overall contribution to class discussion. It is my belief that we all learn much faster when we interact. In order to get the most out of the lectures, you need to ask questions when there is something unclear about the presented/assigned material. The more class discussions we have, the easier it will be to understand and remember the material. Therefore, it is essential that you read the assigned chapter before coming to class. This will also cutback on your studying time for the exams. Assignments: There will be assignments handed out as homework for the next class which consist of questions (multiple choice, short essay and short calculations) to help you to understand the chapter and get ready for the class discussion. Questions in the exams will be very similar to those on the problem sets. Therefore, you are expected to read the assigned material and do the homework. Exams: We will have a midterm exam / project and a final exam in this course. The exams will consist of multiple choice, short calculations, and short essay questions as well as short numerical problems. We will go over the exam procedures before the first exam. Other Course Policies: 1. If you miss a exam due to an officially documented vital reason that is approved by the University and also by me, you will have make-up exam. In all other cases where you miss an exam without a documented and approved vital excuse, you will receive a zero for that exam. 2. In the event that you think there is an error in grading, you will have one week to dispute your grade after the announcement of grades. After that, all grades become final. Any dispute needs to be in writing with a reasonable explanation. There will be no exceptions to any of the rules governing the exams. 3. All information needed for the examinations may not be presented in class. It is imperative that the textbook be read and studied. 4. Study Guidelines: If you are having trouble with a concept or problem see me as soon as possible. When you are studying, always think about the purpose, functionality, importance, and the implications of the issue studied by considering the big picture. In addition, reviewing the key words and the questions at the end of each chapter will also be useful in mastering the material and preparing for the examinations. 4 5. If you miss a class, it is entirely your responsibility to determine what you have missed including any administrative announcements I may have made. Some of the material covered on exams may not be in the text. Hence, you are urged to attend class regularly. 6. Should you have to leave class early, please have the courtesy of letting the instructor know before the beginning of the period and leave quietly so as not to disturb the other members of the class. 7. Academic Honesty is a must. All work you submit in this course is subject to the Koç University Academic Honesty principles. Academic dishonesty in this course will not be tolerated. Honesty and trust are important to all of us as individuals. Students and faculty adhere to the following principles of academic honesty at Koç University: Individual accountability for all individual work, written or oral. Copying from others or providing answers or information, written or oral, to others is cheating. Providing proper acknowledgment of original author. Copying from another student’s paper or from another text without written acknowledgment is plagiarism. Study or project group activity is effective and authorized teamwork. Unauthorized help from another person or having someone else write one’s paper or assignment is collusion. Cheating, plagiarism, and collusion are serious offences resulting in a F grade and disciplinary action. 5