Slide - AMSE

advertisement

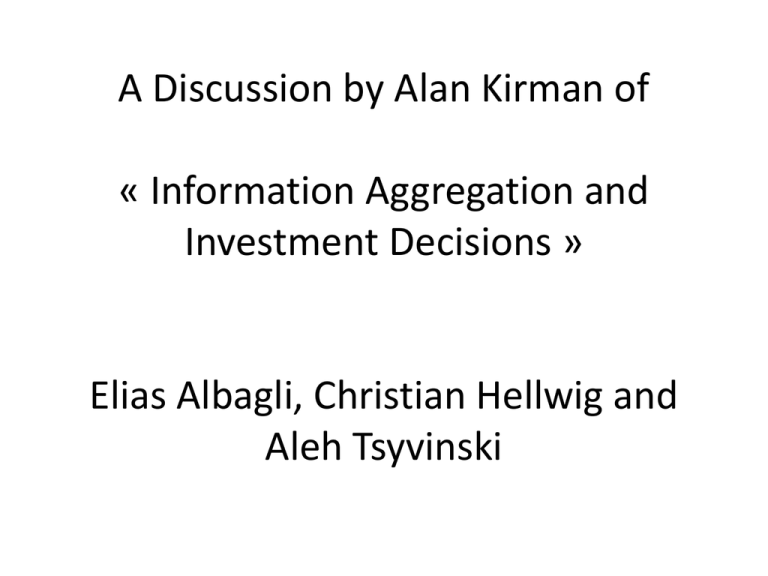

A Discussion by Alan Kirman of « Information Aggregation and Investment Decisions » Elias Albagli, Christian Hellwig and Aleh Tsyvinski What is being modelled and what is the modelling framework? • The authors look at the price of a firm’s shares and how information about the firm is integrated into that price. • The firm’s share price is related to the firm’s investment decisions. Managers get information from their share price. • Given the assumptions the share price exceeds the expected value of dividends. • Not only a relation but a predictable one! Older doubts • When other determinants of investment are controlled for, share prices do not seem to explain much of the variation in investment in any of the G7 countries. • For some countries, there is evidence that an estimate of the component of share prices not related to available information is correlated with investment to a statistically significant degree. However, the magnitude of this relationship is too small to be meaningful economically, and the design of the tests are biased towards such a finding. Tease OECD 1993 Some recent evidence • « we find strong positive correlation between the amount of private information in price and the investment-to-price sensitivity. This relation is robust to the inclusion of controls for managerial information, analyst coverage, capital constraint, and firm size, as well as to a variety of different specifications. • Overall, our results are consistent with the hypothesis that some information in price is new to managers and that managers learn it from the price and incorporate it in their investment decisions.The possibility that prices guide managers in their investment decisions implies that financial markets affect the real economy. » • Chen et al. (2007) The Review of Financial Studies Who has information about what? • The « fundamental » value q of the firm is drawn from a normal distribution • There is a « demand shock » • The continuum of shareholders each hold one share and receive a signal which is drawn from a normal distribution with mean q • They decide whether to hold their share or to sell and the market is equilibrated by setting their supply equal to the uninformed demand which is rationalised later in the paper. A first question • What is happening here is that information from those outside the firm which the manager does not have is getting incorporated into the signal. • Although this basic idea is justified in a number of recent papers (knowledge about demand or rival products) how realistic is it to assume that the large number of shareholders all receive independent signals about the fundamentals? • This recalls the comment by Poincaré on Bachelier’s thesis A warning • Quand des hommes sont rapprochés, ils ne se décident plus au hasard et indépendamment les uns des autres ; ils réagissent les uns sur les autres. Des causes multiples entrent en action, et elles troublent les hommes, les entraînent à droite et à gauche, mais il y a une chose qu'elles ne peuvent détruire, ce sont leurs habitudes de moutons de Panurge. Et c'est cela qui se conserve Henri Poincaré Report on Bachelier’s Ph D thesis 1900 7 This raises further questions • Although this is a market for the shares of one firm they are being sold on a market which is cleared by an auctioneer, thus the mechanism and timing of decisions is not taken into account whereas shares are now traded through a CDA in which there is continuous updating of the price as a result of the trades of the individuals. • Isn’t there a discrepancy between the time for the forming of supply and that for investment decisions? Two key features • First the price function must be invertible for all of this to work • The idea is that the marginal trader has to have an increasing expected dividend to make him willing to pay a higher price. • This convexity will produce the wedge between V(z) and P(z) Two questions • What happens next time? Shares have now been transferred to new people. • Who are they and how will they now behave? • What would happen if the actors in this story read the paper?