Accounting Based Equity Valuation Model: One Period

advertisement

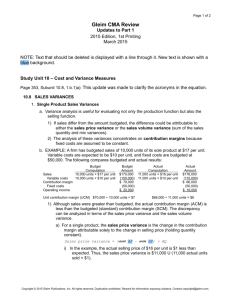

ACCT 2302 Fundamentals of Accounting II Spring 2011 Lecture 22 Professor Jeff Yu End of semester issues Please seek my help now rather than after the final exam. It will be too late to do it then, and I will NOT be able to help at that time. Don’t forget to complete the online course evaluation. I will submit your grade on access.smu.edu as soon as I finish grading. My intention is to give everybody as high of a grade as possible, but I first have to make sure it is fair with everybody in the class. I commit to grade fairly and consistently, and will assign grades strictly based on your relative performance within the class (NOT your needs). The two weeks after the final exam will be my “silent period.” I may NOT address ANY inquiries on your grade until May 17th. Final exam will NOT be returned, but you could see the score on Blackboard and make appointments with me staring May 17th to view it in my office. I will re-grade the entire exam for any grade disputes. Final Exam Information In this class room and at university-scheduled time (posted on the class schedule and explicitly stated in the syllabus). Please plan to arrive 10 minutes earlier. The exam will start when everyone in the room has an exam packet and will stop promptly after THREE hours! Please spread out as much as possible when you get seated. I may ask you to change seats if I determine that you sit too close to the other student. Your cooperation will expedite the exam handout process so that all students will have more time to work on the exam. This is a closed-book exam. You are only allowed to bring a onepage (A4 size) cheat sheet (double-sided is OK) and you must hand in the cheat sheet. The exam is cumulative. You will need a non-programmable calculator. Please bring one! Type of questions Multiple Choice Questions Include both conceptual and numerical questions. No partial credit on multiple choice questions. Problems Show your work in the space provided with legible and carefully labeled computations so that I can assign partial credit. If I cannot understand your computations, I will not assign partial credit. Studying for the exam • Carefully study lecture notes. • Re-work practice problems in the lecture notes, midterm exams and quizzes. They are the best predictors of final exam questions! • Practice using the posted practice questions on the class website. Warning: since they are written by other professor or used in other school, they may be very different from my final exam questions for this semester. Use these practice exams at your own risk. • Come to my Q&A session (May 2 in class) and office hours to clarify difficult materials. Review: Manufacturing Cost Flows Costs Balance Sheet Inventories Income Statement Expenses Raw Material Purchases Direct Labor Manufacturing Overhead Goods Sold How to show product cost flows using T-accounts? Review: MOH Application in job-order costing Manufacturing overhead is applied (allocated) to individual jobs (work-in-process) based on a ___________ rate (POHR). At the ________ of the period, calculate: POHR = Estimated total MOH cost / __________ total activity level ________ the period, calculate: Applied MOH = POHR * ________ activity level At the _______ of the period, calculate: _______ MOH - Applied MOH to determine whether MOH was underapplied or overapplied. Review: Job-Order Costing 1. If Applied MOH>Actual MOH, then MOH is ________ for the period. If Applied MOH<Actual MOH, then MOH is __________ for the period. 2. What is the journal entry to apply MOH to jobs during the period? 3. What is the adjusting journal entry to close the overapplied (underapplied) MOH to CGS at the end of the period? Review: Cost Behavior True Variable Cost (a=0, b>0) Total cost: Y=bX, increases with X Average cost: Y/X=b, constant Fixed Cost (a>0, b=0) Total cost: Y=a, constant Average cost: Y/X=a/X, decreases with X Mixed Cost (a>0, b>0) Total cost: Y=a+bX, increases with X Average cost: Y/X=a/X + b, decreases with activity level X. Review: Cost Function & High-low Method Cost Function: Y = a + bX (1) Select the highest- & the lowest- activity levels: Xh, Xl (2) Fit a line through the two data points: (Xh, Yh), (Xl, Yl) Yh =a + bXh Yl =a + bXl b=(Yh - Yl)/(Xh - Xl) a= ? The slope of the line: b = Variable Cost per unit The intercept of the line: a = Total Fixed Cost Review: The Contribution Format Income Statement Used primarily for external reporting Used primarily for Managerial Decision making Review: The Contribution Margin Method Break - even Point in Units Fixed Expenses CM per Unit Break - even Point in Sales Dollars Units sales to attain Target Profit Fixed Expenses CM Ratio Fixed Expenses Target Profit CM Per Unit Review: The Equation Method Let B.E.P. in units = X Sales – Variable Expenses – Fixed Expenses = NOI Price * X VC/unit * X $$$ B.E.P in sales dollars = B.E.P. in Units * Price $0 Review: CVP Analysis Expected profit (NOI) may change due to: a change in fixed expenses a change in CM per unit (=price - VC/unit) a change in sales volume: once the break-even point has been reached, NOI will increase by CM per unit for each additional unit sold. Two approaches to predict profit using CVP analysis: 1)Income Statement approach 2)Incremental approach: ΔNOI = ΔCM – ΔFE Review Margin of Safety (units, sales, percentage) Degree of Operating Leverage Sales Mix and Break-even Analysis Review: Steps for Implementing ABC 1. Define activity cost pools & activity measures. 2. Assign overhead costs to activity cost pools: first-stage allocation. 3. Calculate activity rates: for each activity cost pool, divide total assigned OH costs by estimated total activity levels. 4. Assign OH costs to the specific product or customer using the activity rates: second-stage allocation Assigned OH = Activity Rate * Actual activity level 5. Prepare management reports: calculate product margin and customer margin. Review: Profit Planning Budgeted Sales $ = budgeted sales in Units * unit price Expected cash collections (inflow) Budgeted Account Receivable Balance Budgeted Production units = budgeted Sales in Units + desired ending F.G. Inventory – beginning F.G. Inventory Review: Profit Planning Budgeted R.M. Purchase in units = budgeted Production in Units * R.M. needed for each unit + desired ending R.M. inventory – beginning R.M. Inventory Expected cash disbursements for R.M. (or Accounts Payable) Budgeted DL cost = budgeted DL hours * hourly rate (Adjust for “guaranteed hours” & higher hourly rate for overtime) Budgeted MOH cost (Important: calculation of POHR) Budgeted S&A expense Budgeted ending F.G. Inventory CASH Budget Review: Performance Evaluation Evaluation Tool Cost Center (controls costs only) Profit Center (controls costs & revenues) Investment Center (controls costs & revenues & Investments) Spending Variance; Standard Cost Variances Segmented Income Statement (Segment Margin) Return on Investment (ROI); Residual Income Review: Flexible Budget Flexible budget is prepared based on the actual activity level and is used for performance evaluation (control) purpose. Activity Variance = Flexible budget amount – planning (static) budget amount Spending Variance = Actual cost – flexible budget cost Spending variance is unfavorable if positive, favorable if negative; Spending variance captures the efficiency of cost control. Revenue Variance = Actual revenue – flexible budget revenue Revenue variance is favorable if positive, unfavorable if negative; Review: Standard Cost Standard vs. Budget: • A budget is set for total costs; • A standard is set for per unit cost; Quantity standards are set for each unit of production (How much units of input are needed for each unit of output?) SQ = standard quantity of materials allowed for the actual output SH = standard hours allowed for the actual output Price standards are set for each unit of input (How much should be paid for each unit of input?) Standard Price (SP) for materials Standard Rate (SR) for labor and overhead Review: Standard Cost Variances Materials Price Variance Materials Quantity Variance AQ(AP - SP) SP(AQ - SQ) Labor/VOH Rate Variance Labor/VOH Efficiency Variance AH(AR – SR) SR(AH – SH) AP (AR)= Actual Price (Actual Rate): the amount actually paid for each unit of the materials (labor or VOH). SP (SR)= Standard Price (Standard Rate): the amount that should Have been paid for each unit of the materials (labor or VOH). AQ (AH)= Actual Quantity (Actual Hour): the amount of materials (labor or VOH activity) actually used in the production. SQ (SH)= Standard Quantity (Stan. Hour) allowed for the actual output = actual production in units * standard quantity (hours) per unit Review: Materials Variances When material purchased ≠ material used To compute the PRICE variance, use the total quantity of raw materials PURCHASED. To compute the QUANTITY Variance, use only the quantity of raw materials USED. Review: Segmented Income Statement Sales - Variable Expenses Contribution Margin - Traceable Fixed costs Segment Margin NOI for the company = the sum of segment margins minus Common fixed costs. Important: CVP analyses using the segmented income statement! Review: ROI and Residual Income ROI = NOI ÷ AOA NOI Sales Sales AOA Turnover Margin RI = NOI - Required rate of return × AOA Review: equipment replacement decision In deciding whether to replace or keep existing equipment, consider the following relevant costs: Purchase or rental costs of new equipment Disposal value of old equipment Cost savings from using the more efficient new equipment instead of the old equipment Review: Decision to Add/Drop Segments Relevant factors to consider: (1)Segment margin (2)The interaction between segments Recall: Common fixed costs are unavoidable, hence irrelevant in the decision. Traceable fixed costs are avoidable. Review: Transfer Pricing decision Buyer: Max. transfer price = best price from outside suppliers Seller: Min. transfer price = VC per unit + Opportunity cost per unit Opportunity cost per unit = Total CM on lost sales / # of units transferred (1) If idle capacity = 0, then opportunity cost per unit = CM per unit, minimum transfer price = Market price (2) If idle capacity >= units transferred, then opportunity cost per unit = 0, minimum transfer price = VC per unit (3) If 0< idle capacity <= units transferred, then min. transfer price = w*VC per unit + (1-w)*Market price where the weight: w = idle capacity ÷ units transferred. Review: Decision to Accept/Reject a Special Order Similar to Transfer pricing: With ample idle capacity . . . Relevant costs usually will be the variable costs associated with the special order, plus any special processing cost or costs of special tools required. Without enough idle capacity . . . Relevant costs: the costs above, plus the opportunity cost of using the firm’s facilities for the special order. Review: “Make or Buy” Decision DECISION RULE Step 1: calculate the relevant costs of making each unit of the part after eliminating sunk costs and future costs that do not differ between making or buying the parts. Step 2: Compare the unit cost calculated from step 1 with the price offered by outside suppliers. Note: watch out for any relevant opportunity costs. Review: Optimal Use of Limited Resources When facing a limited resource constraint, the firm should produce products with the highest contribution margin PER UNIT OF SCARCE RESOURCE. Example: Product CM/unit MH/unit CM/MH A 18 9 2 B 20 4 5 C 16 5 3.2 If Machine hour is constrained, then the production order should be: B, C, A Review: Sell or Process Further? Decision Rule: process further only when the incremental revenue from such processing exceeds the incremental processing cost incurred after the split-off point. Joint costs are irrelevant to the decision. Review: DCF Analysis Net Present Value (NPV) Method Compare PV of all cash inflows with PV of all cash outflows that are associated with the project. If NPV >= 0, accept the project. Otherwise, reject it. Internal Rate of Return (IRR) Method Calculate IRR: the discount rate that sets NPV = 0. Accept the project if IRR >= the required rate of return (cost of capital). Otherwise, reject it. Review: Screening decision of Capital Budgeting NPV = PVs of cash inflows - PVs of cash outflows PV factor of IRR = Initial investment required Net annual cash inflow Payback Method: Payback period is the length of time that it takes for a project to recover its initial investment out of the net cash inflows. Simple rate Annual Incremental NOI = Initial investment of return Review: Tax effects in Capital Budgeting 1. Investments: No tax effect. Note: examples of investments include costs of new equipment, working capital needed, release of working capital, etc. 2. Tax-deductible cash expenses: (let tax rate=t) After-tax cost = (1-t)×cash expenses 3. Taxable cash receipts: After-tax benefit = (1-t)×cash receipts 4. Depreciation: Not cash flow, but tax deductible Depreciation tax shield = t × depreciation deduction Note: straight-line depreciation with 0 salvage value is assumed in calculating depreciation deduction. Homework Problem Dana Co.’s cost of capital is 10% and tax rate is 30%. It is deciding whether to repair an old machine (Project A) or to buy a new machine to replace it (Project B). Repairing the old machine costs $5,000 now, while buying a new machine costs $20,000 now. The old machine, after being repaired, will have the same useful life of 5 years as the new machine. But using the new machine will save the company $5,000 per year in operating costs during the next 5 years, compared with using the repaired old machine. The salvage value of the new machine at the end of year 5 is $3,000. The salvage value of the old machine is zero before the repair, but after the repair the old machine can be sold for $2,000 at the end of year 5. Q: (1) Ignoring any tax effect, which project has higher NPV? (2) For tax purpose, the cost of the new machine will be depreciated over 4 years on a straight-line basis with zero reduction for salvage value. What is the annual tax savings from the depreciation tax shield for Project B? (3) If Project A’s annual net cash inflow is $2,000 for the next 5 years and there is no depreciation deduction, what is the after-tax NPV for Project A?