37kb

advertisement

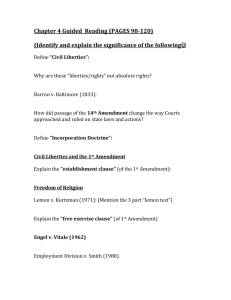

SUMMARY TABLE ON PROPOSED NON-BUDGET CHANGES TO THE INCOME TAX ACT s/n. 1 2 Legislative Changes Brief Description of Legislative Changes Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] Refinement to tax deductible donation rules There is currently lack of consistency in how the deduction is apportioned against exempt income. We propose to amend the Act such that with effect from Year of Assessment (“YA”) 2013, the Government will not attribute donations to tax exempt income. All donations will thus be deducted only against taxable income. This also enhances donors’ tax savings from the deduction for their donations and can encourage philanthropy. Sections 13H, 13V, 37, 37B and 37M [Clauses 6, 10, 29, 30 and 34] Enhancement to CPF Minimum Sum Topping-Up (“MSTU”) Scheme Miscellaneous amendments Sections 13, 13O, 13P, 13U, 13W, 13X and 13Y [Clause 51] Economic Expansion Incentives (Relief from Income Tax) Act – section 97M [Clause 52] The Minimum Sum Topping-Up Scheme has Section 39 been progressively liberalised over the years in [Clause 35] terms of the benefactors/beneficiaries, tax relief and top-up limits. This proposed amendment liberalises the Minimum Sum Topping-Up Scheme by extending tax relief for cash top-ups made to parents-in-law and grandparents-in-law. 1 s/n. 3 Legislative Changes Brief Description of Legislative Changes Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] Tax exemption of receipt of Workfare payments The various Workfare payments (i.e. Workfare Section 13 Income Supplement payouts, Workfare Bonus [Clause 3] Scheme payouts, the Workfare Special Payment, and the Workfare Special Bonus) are intended to supplement the income of lower-wage workers and encourage them to stay at work. The amendment exempts Workfare payments from tax in the hands of the recipients. 4 Tax exemption of National Service Recognition Award The National Service Recognition Award was Section 13 announced in 2010 to provide sustained [Clause 3] recognition to Singapore citizens who serve National Service. The total value of the National Service Recognition Award, paid out in three tranches, is between $9,000 and $10,500 for each National Serviceman by the time he completes his Operationally Ready NS training cycle. The first tranche is deposited in the serviceman's Post Secondary Education Account while the second and third tranches are paid into the CPF accounts The proposed amendment exempts NSmen from tax on the National Service Recognition Award granted to them in recognition of their National Service. 5 1 Extension of 2 the 0 tax treatment of Scottish Limited Partnership (SLP) members of Lloyd’s syndicate to the Limited Liability To achieve parity of treatment across different Section 26A partnership members of Lloyd’s syndicate, the [Clause 24] current tax treatment for Lloyd’s SLP members will be extended to Lloyd’s LLP members1. The LLP members of Lloyd’s syndicate will be taxed, at the partnership level, at the non-resident non-individual tax rate without any partial tax exemption. They may also be eligible for the tax incentives applicable to insurance companies (i.e. concessionary tax rate or tax exemption for qualifying income from insurance and Currently, only LLPs registered in the UK can be members of Lloyd’s syndicate. 2 s/n. Legislative Changes Brief Description of Legislative Changes Partnership (LLP) members reinsurance business, and the tax deduction for special reserve of approved general insurer), subject to meeting the incentive conditions. Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] These proposed changes will take effect from YA 2008, which was the time when Lloyd’s syndicate first admitted LLP members. 6 7 8 Introduction of review date for tax deduction for expenditure incurred for R&D projects approved by EDB under section 14E Section 14E was introduced in Budget 1980 to Section 14E grant deduction for selective R&D projects [Clause 16] approved by the Economic and Development Board (“EDB”). Section 14E confers up to a 200% deduction for expenditure incurred on approved R&D projects. There is currently no review date for Section 14E. Alignment of tax treatment for financial instruments (on revenue account) with the new accounting standards for small entities With effect from 1 Jan 2011, eligible entities Section 34A may prepare their financial accounts using the [Clause 25] Singapore Financial Reporting Standards (FRS) for Small Entities. Extension of the International Arbitration Tax Incentive The International Arbitration Tax Incentive was Section 13V introduced in 2007 to encourage the provision of [Clause 10] international arbitration services in Singapore. It grants a 50% tax exemption on the incremental qualifying income derived by approved law A review date of 31 Mar 2015 for the deduction is introduced to allow us to review the incentive in a timely manner. With the adoption of the Singapore Financial Reporting Standards for Small Entities, small entities will be given the option to align their tax treatment for their financial instruments on revenue account, with the new accounting treatment so as to ease their compliance. This change is similar to the option that was given to companies when FRS39 was introduced. 3 s/n. Legislative Changes Brief Description of Legislative Changes Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] firms from international arbitration cases heard in Singapore. The incentive expired on 30 June 2012. The incentive will be extended, with enhancements, for another 5 years. Enhancements include expanding the scope of qualifying income to include income from cases which, if not for the case having been settled, would have been heard in Singapore. 9 Enhancement to tax deduction regime for donations Amendments are made to allow tax deduction to Section 37 (a) donations for specified purposes; and (b) [Clause 29] donations with benefits-in-return to the donor or persons related to the donor. (a) Donations for specified purposes A donation for specified purposes is one where the donor states conditions as to the purposes for which his donation can be applied. All donations for specified purposes will be eligible for 250% tax deduction if the following requirements are satisfied: (i) Except where the recipient is the Government, the specified purpose advances an object of the recipient that is set out in its governing instruments; (ii) None of the specified purposes must be to advance the interests (whether directly or indirectly) of a particular race, belief or religion; (iii) The specified purpose should not advance the interests of particular individuals or companies; and (iv) If the specified purpose cannot be fulfilled, the recipient should be authorised to apply it to advance other 4 s/n. Legislative Changes Brief Description of Legislative Changes Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] charitable objectives in its governing instruments; and (v) The donation must be made to a qualifying recipient of tax deductible donations. (b) Donations with benefits-in-return to the donor or parties related to the donor It is common to receive some benefit for donations made to qualifying recipients. The donations net of the value of the benefit received will be eligible for 250% tax deduction. The basis of determining the value of the benefit will be determined through consultation and provided for in the subsidiary legislation. 10 Refinement to Working Mother’s Child Relief One of the conditions of claiming Working Fifth Mother’s Child Relief is that the child has to be a Schedule Singapore citizen as at 31 December of the year. [Clause 50] As a result, working mothers whose child had passed away before 31 December of the year will not be able to claim the relief. The change seeks to remove the unintended effect of the “as at 31 Dec” condition so that working mothers will be able to claim Working Mother’s Child Relief on a child who has passed away in the year preceding the relevant YA. 11 Provision of powers for Minister for Finance to delegate his authority to approve an amalgamation of companies under section The tax framework under Section 34C is Section 34C intended to give effect of tax neutrality to [Clause 26] qualifying amalgamations as if there is no cessation of the existing businesses by the amalgamating companies (and hence no acquisition of new businesses by the amalgamated company), and all assets and liabilities that exist prior to the amalgamation are transferred and vested in the amalgamated company. 5 s/n. Legislative Changes Brief Description of Legislative Changes Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] 34C A qualifying amalgamation is defined as any amalgamation of companies that are made pursuant to section 215F of the Companies Act, section 14A of the Banking Act, and such other amalgamation of companies as the Minister may approve. To facilitate the processing of applications made for an amalgamation to be treated as a qualifying amalgamation under section 34C, the definition of “qualifying amalgamation” will be amended to allow Minister to delegate his authority to such person as the Minister may appoint. 12 Repeal of certain provisions related to imputation system With the abolition of the imputation system, and the move to one-tier corporate income tax system, provisions relating to tax treatment for exempt dividends ceased to have effect from 1 Jan 2008. Certain of these sections are repealed, with consequential changes made to section 107 of the Income Tax Act. The other provisions will be repealed in due course. Sections 13, 13I, 13K and 107 [Clauses 3, 7, 8 and 48] 13 Removal of certain tax provisions relating to Hindu Joint Family With the removal of registration of a Hindu Joint Family in the Business Registration Act in 2002, it is no longer possible to register a Hindu Joint Family locally. Accordingly, the Income Tax Act is amended to align with the Business Registration Act. Sections 2, 26A, 35, 36, 37, 39, 42, 43, 61, 63 and Second Schedule [Clauses 2, 24, 27, 28, 29, 35, 36, 37, 45, 46 and 49] 14 Refinement to tax deductibility of voluntary contributions Eligible companies (SEP principals e.g. taxi Section 14 companies) are allowed tax deduction on [Clause 12] qualifying voluntary contributions made by them to the Medisave Accounts of SEPs (e.g. taxi hirers). The SEPs are also exempted from tax on 6 s/n. Legislative Changes Brief Description of Legislative Changes made by an eligible company to the Medisave Account of a Self Employed Person (“SEP”) these contributions. To qualify for tax deduction, a voluntary contribution made by an eligible company to the Medisave Account of a SEP needs to be tax exempt income of the SEP. Amendment to Income Tax Act [Clause in Income Tax Amendment Bill] This amendment allows a voluntary contribution made by an eligible company to the Medisave Account of a SEP to be tax deductible without a requirement for it to be tax exempt income of the SEP, subject to conditions. 7