Church and Christian Ministry Financial Management

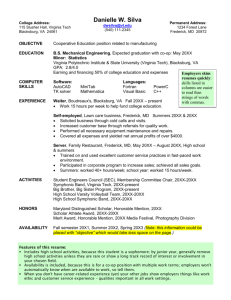

advertisement

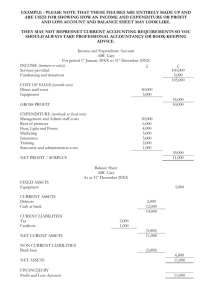

Church and Christian Ministry Financial Management By Corey A. Pfaffe, CPA, PhD; Fall 2013 Accounting Methods Accrual Basis; GAAP (Generally Accepted Accounting Principles) Cash Basis Modified Cash Basis Sample Local Church December 31, 20xx Assets Current Assets Cash Marketable Securities, at market value Receivables Property, Plant & Equipment Land & Buildings, at cost Furniture, Fixtures & Equipment, at cost Less Accumulated Depreciation $17,000 45,000 2,000 1,250,000 200,000 -350,000 Total Assets Liabilities & Fund Balances Current Liabilities Accounts Payable Accrued Liabilities Notes Payable $64,000 1,100,000 $1,164,000 $12,000 8,000 15,000 $35,000 Long-term Debt Mortgage Payable 570,000 Total Liabilities 605,000 Fund Balances Unrestricted Temporarily Restricted Permanently Restricted Total Liabilitites & Fund Balances 476,000 35,000 48,000 559,000 $1,164,000 Accrual (GAAP) Balance Sheet Assets Liabilities, current & longterm Fund Balances, unrestricted & restricted Sample Local Church Year Ended December 31, 20xx Temporarily Permanently Unrestricted Restricted Restricted Revenues Contributions Investment Gains and Losses $780,000 $70,000 Total $5,000 $855,000 6,000 6,000 Investment Income Auxiliary--Camp Miscellaneous 4,000 32,000 4,000 4,000 32,000 4,000 Released from Restrictions 55,000 -55,000 881,000 15,000 Total Revenues 0 5,000 901,000 Expenditures Ministry Teaching & Preaching Music Youth Occupancy Auxiliary--Camp Interest Miscellaneous Total Expenditures Increase (decrease) in Fund Balances Fund Balances, January 1, 20xx Fund Balances, December 31, 20xx 456,000 52,000 62,000 190,000 35,000 28,000 12,000 456,000 52,000 62,000 190,000 35,000 28,000 12,000 835,000 0 0 835,000 46,000 15,000 5,000 66,000 430,000 20,000 43,000 493,000 $476,000 $35,000 $48,000 $559,000 Accrued (GAAP) Statement of Activity Revenues & Expenditures are categorized in columns based on donor restrictions. Ending Fund Balances reported here must equal Balance Sheet amounts. Expenditures are reported by Activity. GAAP Supplementary Information: Functional Expenses Sample Local Church Year Ended December 31, 20xx Program Compensation Management Fund- & General Raising Total $434,000 $89,000 $523,000 Office Expenses 19,000 22,000 41,000 Depreciation 12,000 39,000 51,000 Utilities 5,000 73,000 78,000 Repairs & Maintenance 2,000 31,000 33,000 28,000 28,000 13,000 68,000 81,000 $485,000 $350,000 $0 $835,000 Interest Miscellaneous Total Expenditures Expenditures that were reported by activity on the Statement of Activities are recategorized based on function (program, management & general, or fundraising) and nature. Cash Basis Balance Sheet Sample Local Church December 31, 20xx Assets Current Assets Cash Marketable Securities, at market value Total Assets $17,000 45,000 $62,000 Fund Balances General Fund $51,000 Designated Funds 11,000 Endowment Funds 0 Total Fund Balances $62,000 A portion of the cash and equivalent-to-cash resources was received from donors who designated the purposes for which they could be spent. At the end of December, $11,000 of these gifts were yet to be disbursed for their restricted purposes. $51,000 could be spent for any purpose authorized by the church itself since the original donations were unrestricted. Cash Basis Report of Receipts & Disbursements (General Fund) Sample Local Church Year Ended December 31, 20xx Receipts Contributions Investment Income, Gains & Losses Miscellaneous Total Revenues Disbursements Compensation Occupancy Mortgage Payments Capital Expenditures Office Miscellaneous Total Expenditures Increase (decrease) in Fund Balance General Fund Balance, January 1, 20xx General Fund Balance, December 31, 20xx $160,000 4,000 2,000 166,000 68,000 34,000 22,000 12,000 19,000 3,000 158,000 8,000 43,000 $51,000 Unrestricted contributions and other receipts exceeded disbursements of these funds by $8,000 during the year ended December 31. Payments on long-term debt and expenditures for long-lived assets (“Capital Expenditures”) are reported as disbursements. This reporting format (and the cash basis) is perhaps the easiest to understand among the three choices. Cash Basis Supplementary Information Sample Local Church Supplementary Information--Designated Funds Year Ended December 31, 20xx Designated Fund Balances, January 1, 20xx Receipts Disbursements Designated Fund Balances, December 31, 20xx Missions Other Total $4,000 18,000 -16,000 $3,000 3,000 -1,000 $7,000 21,000 -17,000 $6,000 $5,000 $11,000 Sample Local Church Supplementary Information--Mortgage Activity Year Ended December 31, 20xx Mortgage Balance, January 1, 20xx Principal Payments Interest Payments $100,000 $7,000 -7,000 $5,000 n/a Mortgage Balance, December 31, 20xx Accounts Payable Balance, December 31, 20xx $93,000 $1,000 While cash basis reports are easy to understand, supplementary information should be provided. Modified Cash Basis Balance Sheet Sample Local Church December 31, 20xx Assets Current Assets Cash $17,000 Marketable Securities, at market value $45,000 Accounts Receivable 2,000 Total Assets $64,000 Liabilities & Fund Balances Accounts Payable $1,000 Fund Balances General Fund $51,000 Designated Funds 11,000 Endowment Funds 1,000 Total Fund Balances 63,000 $64,000 The modified cash basis omits long-lived assets and long-term debt from the balance sheet, but includes short-term receivables and payables. This approach avoids budgeting challenges and other shortcomings sometimes experienced when a strict cash basis is used. Modified Cash Basis Report of Receipts & Disbursements (General Fund) Sample Local Church Year Ended December 31, 20xx Receipts Contributions Investment Income Miscellaneous Total Revenues Disbursements Compensation Occupancy Mortgage Payments Capital Expenditures Office Miscellaneous Total Expenditures Increase (decrease) in Fund Balance General Fund Balance, January 1, 20xx General Fund Balance, December 31, 20xx Favorable (Unfavorable) Variances Actual Budget $160,000 4,000 2,000 $155,000 5,000 1,000 $5,000 -1,000 1,000 166,000 161,000 5,000 68,000 34,000 22,000 12,000 19,000 3,000 67,000 36,000 22,000 12,000 20,000 2,000 -1,000 2,000 0 0 1,000 -1,000 158,000 159,000 1,000 8,000 $2,000 $6,000 43,000 $51,000 Budgeted revenues are “projected” while most budgeted disbursements are “authorized.” Variance analysis can also be made based on percentage of actual to budget. Modified Cash Basis Chart of Accounts Cash Petty Cash Cash in Bank Checking Cash in Bank Savings Cash in Bank CDs Marketable Securities Mutual Fund Public Company Stock Accounts Receivable Accounts Payable Credit Card Payable Endowment Funds None Revenues Contributions Miscellaneous Youth Compensation Office Expenses Investment Gains & Losses Capital Expenditures Investment Income Miscellaneous Auxiliary—Camp Occupancy Miscellaneous Utilities Expenditures Repairs & Maintenance Ministry Auxiliary—Camp Teaching & Preaching Compensation Short-term Bank Note Payable Compensation Office Expenses Fund Balances Office Expenses Capital Expenditures General Fund Capital Expenditures Miscellaneous Designated Funds Miscellaneous Interest "Faith Promise" Missions Music Miscellaneous Vehicle Replacement Compensation Fixed Assets Camp Scholarships Office Expenses Long-term Debt Benevolence Capital Expenditures Depreciation Financial Audits Independent Certified Public Accountant audit Internal inspection—purposes: To provide accountability for church leaders and staff as stewards of the resources God has committed to the church To secure the confidence of the members in the reliability of the church financial reports To maintain credibility of the church as a self-policing organization The “Audit” Committee Organization Reporting Report of Audit Committee For Year Ended December 31, 20xx We have inspected the financial reports and related supporting records of the church for the year ended December 31, 20xx. The following procedures were completed: … In the course of our inspection we identified several recommendations that have been communicated to the church leadership. Inspection Procedures—Illustrated Compared budget amounts adopted by the church to actual receipts and disbursements for the year. Investigated major discrepancies and received satisfactory explanations. Traced all significant Balance Sheet amounts to appropriate supporting documents. Reconciled Fund Balances reported on the previous year’s Balance Sheet with current year increases and decreases in Fund Balances and current end-of-year Fund Balances. Traced a sample of receipts and disbursements reported on the Statement of Receipts and Disbursements to bookkeeping records. Evaluated adequacy of documentation. Accounting Software for Churches and Christian Ministries QuickBooks—Online or Pro (or Peachtree Complete) Advantages: well-known (likely to find members who are familiar with its use); easy to use; relatively inexpensive Disadvantages: not a substitute for formal accounting training; poor internal controls; Not-for-profit version adds little value Shelby (or other church-specific softwares) (http://www.shelbyinc.com/) Advantages: specifically designed for church and ministry applications; valuable supplementary products available in donor and church management, etc. Disadvantages: more expensive & complex Giving Records Ministries must carefully follow IRS guidelines when receiving cash and property gifts. IRS Publication 526 can be helpful. Software can be very helpful in recording and reporting donor activity. Annual reports to donors $250+ contributions must be specifically acknowledged (date and amount); otherwise, total contributions can be reported on annual statements to donors. Quid Pro Quo Disclosure: “The only benefit provided to the donor in return for his or her donation was an intangible religious benefit.” Records Retention Most financial and employment records should be retained for up to seven years. A copy of each year’s annual report should be kept indefinitely. Minutes of official meetings should be kept indefinitely. Employment Records and Reporting Churches and Christian organizations must meet virtually all of the records and reporting requirements stipulated for businesses. W-2 / W-3 W-4 / I-9 1099-MISC 941 / 944 FUTA / SUTA Tax-exempt Status The most recognized Internal Revenue Code section in the not-for-profit organization world: IRC 501 (c)(3) Benefits of tax-exempt status Ability to receive contributions that are tax-deductible to donors Elimination of taxes 1) on profits, 2) on real estate, 3) on purchases normally subject to sales taxes, and 4) on salaries and wages that normally require employer-paid unemployment taxes Application Form 1023 Annual information return Form 990 Internal Controls Cash receipts—“At no time is uncounted money to be in the possession of only one person.” Cash disbursements—Before a payment is made, a ministry must assure that the product or service was 1. purchased by an authorized individual following an authorized procedure, 2. received in a useable condition, 3. priced as previously agreed. Other controls