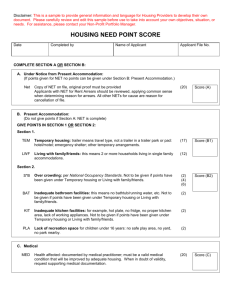

Admissions and Continued Occupancy Policy

advertisement