ALBERTSON INC. ERP SOLUTION

advertisement

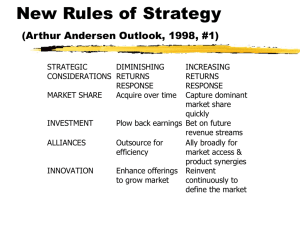

ALBERTSONS INC. ERP SOLUTION IT4 Consulting Team Reza Edalat (Financial Analyst) Mike Darmo (Operations Analyst) Arbi Torasian (ERP Specialist) Francisco Flores (CEO) Preview of Main Points Introduction Brief History of Albertsons Industrial Analysis Porter Five Model Implementing ERP SWOT Analysis Weighed Scoring Model Financial Considerations Conclusion Brief History of Albertsons Albertson was originated in Idaho, 1939 Family Run Joe Albertson by 1947 it operated six stores in Idaho Co-founder Albertson died in 1993 at age 86 In 2001 Larry Johnston, former CEO , took over as chairman Online Stores Today Albertson is one of the biggest food stores, bought Bristol Farms Industrial Analysis Albertson’s Company is starting as the food and drug retailer worldwide. Albertson’s need to analyze the growing markets and customer behaviors to be able to compete Albertson’s has the third rank on the Grocery markets in US Porter Model Porter model for Albertsons Rivalry among Competitive Industry: Costco and Wal-Mart, traders Joe’s and whole foods The Bargaining Power of Customer: regular American households Threat of New Entrance: unlikely Threat of Substitutes: Ralph, Vons, and long drugs The bargaining power of suppliers: fresh fruit and vegetable grower, food corporations; Johnson and Johnson Porter’s Five Forces Implementing ERP Functional Areas that would Benefit with ERP Accounting and Finance Human Resources Marketing and Sales Implementing ERP Cont. Connectivity requirements: Secured database that is stable and fast Integration with other systems Support multiple administrators, users, accounts, banks, and organizations Must be database independent (SQL, Oracle) Web/E-Commerce requirements: Client web browser support Must have easy configuration Support minimal technology requirements on clients end. Powerful software to perform manual processes SWOT Analysis STRENGTHS Second food-grocery Industry leader among its competitors. Growth of Albertson is based on its expansion and joint venture to similar industries. Numerous awards and recognition for product quality and great recycling process. Multiple services in one stop makes easier for customers to shop at Albertson. New software technologies such as hand held scanners and selfcheckout lanes. WEAKNESSES Drop of the company profit due strikes and company overall performance. Decline of the value of its stock price. Challenge to regain customers back after the firm went on strike. Lack of up to date information of shipping, purchases, and delivery orders. Lack of employee organizational skills. SWOT Analysis Cont. OPPORTUNITIES To be able to increase the demand of regular and no regular shoppers. To follow the trend of competitors in selling variety of product to be able to attract new customers. The challenge of attracting some of the Whole Food shoppers by implementing natural and organic food products, public relations, and employment education. The implementation of online shopping, order deliveries, and scanner devices. THREATHS The sell of Albertson stores in Idaho due to competition The economy downturn is affecting tremendously the flow of the business is some areas. The joint venture of other firms within the same industry. The location or relocation of firms in the same industry in a radius close-by to Albertson stores hurts the business. The growth competition of similar industries such as Wal-Mart Payback Analysis for ERP Project: Assume the project is completed the first year 0 Discount rate 10% Year 0 Year 1 Cost -$32,485,000 Discount factor Year 4 Total -$1,894,500 -$1,894,500 -$1,894,500 -$1,894,500 -40,063,000 0.91 0.83 0.62 Discounted costs -$29,561,350 -$1,572,435 -$1,420,875 -$1,288,260 -$1,174,590 -$35,017,510 Benefits $0 $70,000,000 $70,000,0 00 $70,000,000 $70,000,000 $280,000,000 Discount factor 0.91 0.83 0.62 Discounted benefits $0 $58,100,000 $52,500,000 $47,600,000 $43,400,000 $201,600,000 -$29,561,350 $56,527,565 $51,079,125 $46,311,740 $42,225,410 $166,582,490 -$29,561,350 $26,966,215 $78,045,340 $124,357,080 $166,582,490 Discounted benefits + costs Cumulative benefits + costs ROI Payback 475% Payback year 1 in Year 2 0.75 0.75 Year 3 0.68 0.68 WEIGHTED SCORING MODEL FOR ASP vs. ERP WEIGHTED SCORING MODEL FOR ASP vs. ERP WEIGHT ASP Option 1 ERP Option 2 Supports key business objectives 10% 95 95 Has strong internal sponsor 9% 79 91 Has strong customer support 6% 85 85 Can be implemented in one year or less 8% 90 80 Provides positive NPV 7% 90 92 Has low risk 6% 75 89 Introduces new technology 5% 85 95 Increased business productivity 10% 90 90 Provides greater quality assurance 14% 90 92 Meets budget constraints 8% 95 85 Increases shareholder wealth 9% 92 94 Increases business operations 8% 91 93 100% 88.72 90.3 CRITERIA WEIGHTED SCORES Conclusion We consider really important the fact buying the ERP system with the SAP R/3 software would help us accomplish our goals, such as: Organize our filing system by departments, branches and headquarter Maintain up to date information of shipping, purchases, and delivery orders Enable us new levels of business process and technology integration Allow us to upgrade to any of the full range of SAP Solutions, so management can: Conclusion Deploy the functionally for Customers Product life cycle Supply chain management Supplier relationship management