MODEL INVESTASI ISLAMI

advertisement

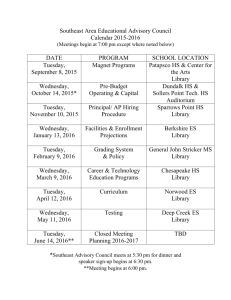

1 MODEL INVESTASI ISLAMI Tuesday, March 22, 2016 KULIAH 4 AGENDA 2 INVESTASI DALAM PERSPEKTIF KONVENSIONAL MODEL INVESTASI KONVENSIONAL INVESTASI DALAM PERSPEKTIF ISLAM MODEL INVESTASI ISLAM Tuesday, March 22, 2016 Pengertian Investasi 3 investasi diartikan sebagai penanaman uang atau modal dalam suatu perusahaan atau proyek untuk tujuan memperoleh keuntungan investasi diartikan sebagai komitmen atas sejumlah dana atau sumberdaya lainnya yang dilakukan pada saat ini, dengan tujuan memperoleh sejumlah keuntungan di masa datang Tuesday, March 22, 2016 PENGGOLONGAN INVESTASI (1) 1. Investasi pada financial asset dilakukan di pasar uang, misalnya berupa sertifikat deposito, commercial paper, Surat Berharga Pasar Uang (SBPU), dan lainnya. Investasi juga dapat dilakukan di pasar modal, misalnya berupa saham, obligasi, warrant, opsi, dan yang lainnya. 4 Tuesday, March 22, 2016 PENGGOLONGAN INVESTASI (2) 2. investasi pada real asset dapat dilakukan dengan pembelian aset produktif, pendirian pabrik, pembukaan pertambangan, perkebunan, dan yang lainnya. 5 Tuesday, March 22, 2016 Bentuk Investasi………….1 6 1. 2. Investasi tetap bisnis (business fixed investment), yaitu pengeluaran investasi untuk pembelian berbagai jenis barang modal yaitu mesin-mesin dan peralatan produksi lainnya untuk mendirikan berbagai jenis industri dan perusahaan Investasi residensial (residential investment), yaitu pengeluaran untuk mendirikan rumah tempat tinggal, bangunan kantor, bangunan pabrik dan bangunan lainnya Tuesday, March 22, 2016 Bentuk investasi ………….2 7 3. Investasi persediaan (Inventory investment) yaitu berupa pertambahan nilai stok barang-barang yang belum terjual , bahan mentah dan barang yang masih dalam proses produksi pada akhir tahun perhitungan pendapatan nasional. Tuesday, March 22, 2016 • Business fixed investment includes the equipment and structures that businesses buy to use in production. • Residential investment includes the new housing that people buy to live in and that landlords buy to rent out. • Inventory investment includes those goods that businesses put aside in storage, including materials and supplies, work in progress, and finished goods. The standard model of business fixed investment is called the neoclassical model of investment. It examines the benefits and costs of owning capital goods. Here are three variables that shift investment: 1) the marginal product of capital 2) the interest rate 3) tax rules To develop the model, imagine that there are two kinds of firms: production firms that produce goods and services using the capital that they rent and rental firms that make all the investments in the economy. To see what variables influence the equilibrium rental price, let’s consider the Cobb-Douglas production function as a good approximation of how the actual economy turns capital and labor into goods and services. The Cobb-Douglas production function is: Y = AKaL1-a , where Y is output, K capital, L labor, and a a parameter measuring the level of technology, and a a parameter between 0 and 1 that measures capital’s share of output. The real rental price of capital adjusts to equilibrate the demand for capital and the fixed supply. Capital supply Capital demand (MPK) K Capital stock, K The marginal product of capital for the Cobb-Douglas production function is MPK = aA(L/K)1-a. Because the real rental price equals the marginal product of capital in equilibrium, we can write R/P = aA(L/K)1-a . This expression identifies the variables that determine the real rental price. It shows the following: • the lower the stock of capital, the higher the real rental price of capital • the greater the amount of labor employed, the higher the real rental price of capitals • the better the technology, the higher the real rental price of capital. Events that reduce the capital stock, or raise employment, or improve the technology, raise the equilibrium real rental price of capital. Let’s consider the benefit and cost of owning capital. For each period of time that a firm rents out a unit of capital, the rental firm bears three costs: 1) Interest on their loans, which equals the purchase price of a unit of capital PK times the interest rate, i, so i PK. 2) The cost of the loss or gain on the price of capital denoted as -DPK . 3) Depreciation d defined as the fraction of value lost per period because of the wear and tear, so d PK . Therefore the total cost of capital = i PK - DPK + dPK or = PK (i - D PK/ PK + d) Finally, we want to express the cost of capital relative to other goods in the economy. The real cost of capital-- the cost of buying and renting out a unit of capital measured in terms of the economy’s output is: The Real Cost of Capital = (PK / P )(r + d), where r is the real interest rate and PK / P equals the relative price of capital. To derive this equation, we assume that the rate of increase of the price of goods in general is equal to the rate of inflation. Now consider a rental firm’s decision about whether to increase or decrease its capital stock. For each unit of capital, the firm earns real revenue R/P and bears the real cost (PK / P )(r + d). The real profit per unit of capital is Profit rate = Revenue - Cost = R/P - (PK / P )(r + d). Because the real rental price equals the marginal product of capital, we can write the profit rate as Profit rate = MPK - (PK / P )(r + d). The change in the capital stock, called net investment depends on the difference between the MPK and the cost of capital. If the MPK exceeds the cost of capital, firms will add to their capital stock. If the MPK falls short of the cost of capital, they let their capital stock shrink, thus: DK = In [MPK - (PK / P )(r + d)], where In ( ) is the function showing how much net investment responds to the incentive to invest. We can now derive the investment function in the neoclassical model of investment. Total spending on business fixed investment is the sum of net investment and the replacement of depreciated capital. The investment function is: I = In [MPK - (PK / P )(r + d)] + dK. the cost of capital depends on investment amount of depreciation marginal product of capital This model shows why investment depends on the real interest rate. interest rate lowers the cost of capital. A decrease in the real Notice that business fixed investment increases when the interest rate falls-- hence the downward slope of the investment function. Also, an outward shift in the investment function may be a result of an increase in the marginal product of capital. Investment, I Finally, we consider what happens as this adjustment of the capital stock continues over time. If the marginal product begins above the cost of capital, the capital stock will rise and the marginal product will fall. If the marginal product of capital begins below the cost of capital, the capital stock will fall and the marginal product will rise. Eventually, as the capital stock adjusts, the MPK approaches the cost of capital. When the capital stock reaches a steady state level, we can write: PK = (PK / P )(r + d). Thus, in the long run, the MPK equals the real cost of capital. The speed of adjustment toward the steady state depends on how quickly firms adjust their capital stock, which in turn depends on how costly it is to build, deliver and install new capital. The term stock refers to the shares in the ownership of corporations, and the stock market is the market in which these shares are traded. The Nobel-Prize-winning economist James Tobin proposed that firms base their investment decisions on the following ratio, which is now called Tobin’s q: q = Market Value of Installed Capital Replacement Cost of Installed Capital The numerator of Tobin’s q is the value of the economy’s capital as determined by the stock market. The denominator is the price of capital as if it were purchased today. Tobin conveyed that net investment should depend on whether q is greater or less than 1. If q >1, then firms can raise the value of their stock by increasing capital, and if q < 1, the stock market values capital at less than its replacement cost and thus, firms will not replace their capital stock as it wears out. Tobin’s q measures the expected future profitability as well as the current profitability. 1) Higher interest rates increase the cost of capital and reduce business fixed investment. 2) Improvements in technology and tax policies such as the corporate income tax and investment tax credit shift the business fixed investment function. 3) During booms higher employment increases the MPK and therefore, increases business fixed investment. We will now consider the determinants of residential investment by looking at a simple model of the housing market. Residential investment includes the purchase of new housing both by people who plan to live in it themselves and by landlords who plan to rent it to others. There are two parts to the model: 1) the market for the existing stock of houses determines the equilibrium housing price 2) the housing price determines the flow of residential investment. The relative price of housing adjusts to equilibrate supply and demand for the existing stock of housing capital. The relative price then determines residential investment, the flow of new housing that construction firms build. Demand Stock of housing capital, KH Flow of residential investment, IH When the demand for housing shifts, the equilibrium price of housing changes, and this change in turn affects residential investment. An increase in housing demand, perhaps due to a fall in the interest rate, raises housing prices and residential investment. Demand' Demand Stock of housing capital, KH Flow of residential investment, IH 1) An increase in the interest rate increases the cost of borrowing for home buyers and reduces residential housing investment. 2) An increase in population and tax policies shift the residential housing investment function. 3) In a boom, higher income raises the demand for housing and increases residential investment. Inventory investment, the goods that businesses put aside in storage, is at the same time negligible and of great significance. It is one of the smallest components of spending-- but its volatility makes it critical in the study of economic fluctuations. When sales are high, the firm produces less that it sells and it takes the goods out of inventory. This is called production smoothing. Holding inventory may allow firms to operate more efficiently. Thus, we can view inventories as a factor of production. Also, firms don’t want to run out of goods when sales are unexpectedly high. This is called stock-out avoidance. Lastly, if a product is only partially completed, the components are still counted in inventory, and are called, work in process. The accelerator model assumes that firms hold a stock of inventories that is proportional to the firm’s level of output. Thus, if N is the economy’s stock of inventories and Y is output, then N=bY where b is a parameter reflecting how much inventory firms wish to hold as a proportion of output. Inventory investment I is the change in the stock of inventories DN. Therefore, I = DN = b DY. Persamaan Investasi …………….1 27 investasi bersifat autonomos atau tidak dipengaruhi oleh variabel lain. Sehingga persamaan untuk investasi sbb _ I= I investasi yang dipengaruhi oleh variabel suku bunga atau interest (i) I = I - di Tuesday, March 22, 2016 C+I C + I2 C + I1 ∆I INVESTASI YANG DIPENGARUHI SUKU BUNGA C Y0 Y1 Y2 Y i1 i2 Investasi I1 28 I2 I = Investasi Tuesday, March 22, 2016 Persamaan Investasi …………….2 29 investasi bersifat autonomos atau tidak dipengaruhi oleh variabel lain. Sehingga persamaan untuk investasi sbb _ I= I investasi yang dipengaruhi oleh Tingkat Pendapatan Nasional atau GNP I = I + dY Tuesday, March 22, 2016 Autonomos dan Induced Investment 30 I I Induced Autonomos Y Y Tuesday, March 22, 2016 KESEIMBANGAN PEREKONOMIAN DUA SEKTOR 31 karena asumsi yang digunakan bahwa investasi bersifat autonomos ataupun dipengaruhi oleh tingkat suku bunga maka keseimbangan perekonomian dua sektor Y Y = a + bY + I - di _ = 1 ( a + I – di) . (1-b) Tuesday, March 22, 2016 32 INVESTASI DALAM PERSPEKTIF ISLAM Tuesday, March 22, 2016 KONSEP PENGETAHUAN 33 Islam sangat menjunjung tinggi ilmu pengetahuan yang memiliki gradasi (tadrij), dari tahapan diskursus (‘ilmu al yaqin), implementasi (‘ain al yaqin), serta hakikat akan sebuah ilmu (haqq al yaqin). Scheller dalam trichotomy pengetahuan menjelaskan bahwa ada 3 (tiga) jenis pengetahuan, yaitu pengetahuan instrumental (herrschafswissen), pengetahuan intelektual (beldungswissen), dan pengetahuan spiritual (erlosungswissen) sebagaimana dituangkan oleh Rich dalam bukunya the knowledge cycle Tuesday, March 22, 2016 KONSEP INVESTASI 34 Investasi merupakan salah satu ajaran dan konsep Islam yang memenuhi proses tadrij dan trichotomy pengetahuan tersebut. Hal tersebut dapat dibuktikan bahwa konsep investasi selain sebagai pengetahuan juga bernuansa spiritual karena menggunakan norma syariah, sekaligus merupakan hakekat dari sebuah ilmu dan amal, oleh karenanya investasi sangat dianjurkan bagi setiap muslim Tuesday, March 22, 2016 DASAR HUKUM INVESTASI……1 35 Qur’an Surat Al Hasyr : 18 Tuesday, March 22, 2016 DASAR HUKUM INVESTASI……2 36 Lafadz ولتنظر نفس ما قـدّمت لغـدditafsirkan dengan: ‘’hitung dan instropeksilah diri kalian sebelum diinstropeksi, dan lihatlah apa yang telah kalian simpan (invest) untuk diri kalian dari amal shalih (after here investment) sebagai bekal kalian menuju hari perhitungan amal pada hari kiamat untuk keselamatan diri di depan Allah SWT’’ (Katsir (2000) Tuesday, March 22, 2016 DASAR HUKUM INVESTASI……3 37 QS : LUQMAN : 34 Tuesday, March 22, 2016 DASAR HUKUM INVESTASI……4 38 Dalam Qur’an Surat Lukman ayat 34 secara tegas Allah SWT menyatakan bahwa tiada seorang pun di alam semesta ini yang dapat mengetahui apa yang akan diperbuat, diusahakan, serta kejadian apa yang akan terjadi pada hari esok. Sehingga dengan ajaran tersebut seluruh manusia diperintahkan untuk melakukan investasi sebagai bekal dunia dan akhirat: Tuesday, March 22, 2016 DASAR HUKUM INVESTASI……5 39 Dalam kitab Zubdatu Tafsir karya Al Asyqar lafadz ماذا تكسب غـداditafsirkan dengan من كسب دين أو كسب دنيا, yang dalam Bahasa Indonesia diterjemahkan ‘’Dari usaha untuk bekal akhirat ataupun usaha untuk bekal dunia’’ (Al Asyqar, (2000) Tuesday, March 22, 2016 RAMBU POKOK INVESTASI Terbebas dari unsur riba Terhindar dari unsur gharar Terhindar dari unsur judi (maisir) Terhindar dari unsur haram Terhindar dari unsur syubhat 40 Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…1 41 Fungsi investasi dengan pendekatan ekonomi islam tentu berbeda dengan fungsi investasi dengan pendekatan ekonomi konvensional. Perbedaannya karena fungsi investasi dalam ekonomi konvesional dipengarhi tingkat suku bunga, hal ini tentunya tidak berlaku dalam pendekatan ekonomi Islam. Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…2 42 Menurut Metwally (1995), Investasi di negara penganut ekonomi Islam memiliki kriteria : 1. Hoarding Idle Assets, adanya sanksi untuk pemegang asset kurang/tidak produktif 2. Dilarang melakukan berbagai macam bentuk spekulasi dan segala macam judi 3. Tingkat bunga untuk berbagai macam pinjaman adalah nol dan sebagai gantinya dipakai sistem bagi hasil Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…3 43 Dari kriteria tersebut jelas bahwa investasi dalam ekonomi Islam adalah fungsi dari tingkat keuntungan yang diharapkan. Tingkat keuntungan yang diharapkan tergantung pada pangsa keuntungan relatif antara investor dan penyedia dana sebagai mitra usaha. Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…4 44 Menurut Metwally fungsi investasi dalam ekonomi Islam I r = f ( r,Za,Zp, m ) = SI/SF Dimana : I r SI SF Za Zp m = Permintaan akan investasi = Tingkat keuntungan yang diharapkan = Bagian/pangsa keuntungan/kerugian investor = Bagian/pangsa keuntungan/kerugian peminjam dana = Tingkat zakat atas aset yang tidak/kurang produktif = Tingkat zakat atas keuntungan dari Investasi = pengeluaran lain selain zakat atas aset yang tidak/kurang produktif Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…5 45 Akan tetapi karena tingkat zakat adalah tetap maka dianggap given sehingga I = f ( r,m) Sehingga permintaan investasi akan meningkat dalam ekonomi Islam jika : Meningkatnya tingkat keuntungan yang diharapkan Meningkatnya tingkat iuran terhadap aset yang tidak atau kurang produktif Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…6 46 Khan dalam sebuah makalahnya yang berjudul A simple model of income determination, growth and economic development in the perspective of an interest free economy (2004) menyatakan bahwa permintaan investasi (investment demand) ditentukan oleh tingkat keuntungan yang diharapkan (expected profits) tingkat keuntungan yang diharapkan tergantung pada : Total profit yang diharapkan dari kegiatan firm (entrepreneurial) Share in profit yang diklaim oleh pemilik dana Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…7 47 Tingkat Keuntungan Yang Diharapkan (r) r2 r1 I1 I2 I= Investasi Tuesday, March 22, 2016 FUNGSI INVESTASI DALAM ISLAM…8 48 Berdasarkan gambar tersebut terlihat terdapat hubungan positif antara tingkat investasi dengan tingkat keuntungan yang diharapkan maksudnya jikatingkat keuntungan yang diharapkan mengalami kenaikan maka akan meningkatkan tingkat investasi sebaliknya jika tingkat keuntungan yang diharapkan mengalami penurunan maka akan menyebabkan penurunan tingkat investasi. Tuesday, March 22, 2016