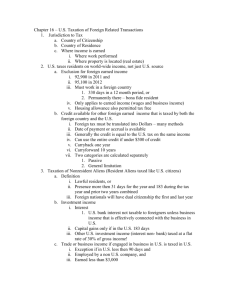

Capital Gains Tax- Introduction

advertisement

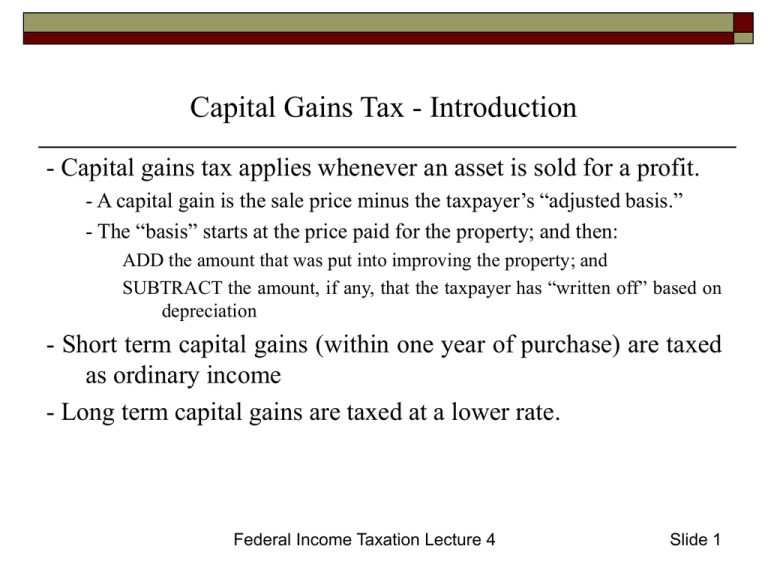

Capital Gains Tax - Introduction - Capital gains tax applies whenever an asset is sold for a profit. - A capital gain is the sale price minus the taxpayer’s “adjusted basis.” - The “basis” starts at the price paid for the property; and then: ADD the amount that was put into improving the property; and SUBTRACT the amount, if any, that the taxpayer has “written off” based on depreciation - Short term capital gains (within one year of purchase) are taxed as ordinary income - Long term capital gains are taxed at a lower rate. Federal Income Taxation Lecture 4 Slide 1 Capital Gains Tax on Partial Sales If a person sells part of a property, the basis for that portion of the property is generally the percentage of the whole basis that is proportional to its value relative to the whole property. In numbers, you use this simple formula to determine the basis of the portion sold: the total basis of the property x value of the sold portion total value of the property Federal Income Taxation Lecture 4 Slide 2 Capital Gains Tax on Partial Sales - Example Jenny buys 500 shares of Big Co, Inc. for $20,000 in 2003. In 2008, Jenny sells 200 shares for $50,000. What is her basis for the 200 shares? What is her capital gain? Federal Income Taxation Lecture 4 Slide 3 Capital Gains Tax on Partial Sales - Solution The total basis for the property was $20,000 and she sold 2/5 of her shares. Therefore, her basis for the shares that she sold is $8,000. Since her basis for the shares that she sold is $8,000 and her sales price is $50,000, Jenny’s capital gain is $42,000. Federal Income Taxation Lecture 4 Slide 4 Annuities An annuity is an arrangement whereby the annuitant pays a sum in exchange for fixed payments over the next years. The number of years can be fixed or it can be for the rest of his or her life. In the latter case, the payment will be based on the life expectancy of the annuitant. Income Tax Treatment: Each repayment is considered part return of principal (not taxed) and part income (taxed). The amount that’s considered income is the amount over and above the pro rated share of the principal that is scheduled to be paid back as part of the annuity payment each year. (For “lifetime” annuities, use the life expectancy.) Federal Income Taxation Lecture 4 Slide 5 Annuities - Example Carla pays $300,000 in exchange for an annuity that will pay her $30,000 per year for the next 15 years. How much of the $30,000 annual payment is income? Answer: Over the course of the annuity, it will pay Carla a total of $450,000 (15 years x $30,000). Therefore, 2/3 of the total amount will be return of principal and 1/3 income. Therefore, each year $10,000 of the annuity payment will be taxed as income. Note that if Carla were 70 years old and had a life expectancy of 15 years under the IRS tables and the annuity were for the rest of her life, the same result would apply. Federal Income Taxation Lecture 4 Slide 6 Life Insurance Proceeds - Life insurance payouts that are made because the insured died are NOT taxable as income to the recipient UNLESS The recipient is someone without an insurable interest in the decedent. In such a case, the recipient is considered an investor and his “profit” is taxed as ordinary income. - For whole life policies, if one withdraws cash value of the policies, it is not considered income unless and until the amount withdrawn from the policy exceeds the total amount of premiums paid. Federal Income Taxation Lecture 4 Slide 7 Other Miscellaneous Rules Gambling winnings are taxable as income. Gambling losses may not offset gambling wins. Therefore, if someone goes to the horse track and wins one bet and wins $500 but loses 10 more bets for $1,000 total, s/he is taxed on the $500 as income and cannot offset it with the $1,000 loss! If an income interest is split from a remainder interest (such as one person being entitled to trust income and the other to trust principal at some point later on), the income earned is taxed as income and the remainder is principal and not subject to income tax! Federal Income Taxation Lecture 4 Slide 8 Personal Injury Recoveries 1 To be exempt from income tax under the personal injury exemption rule, the injury must be: Personal (not a breach of contract or property matter) A physical injury or sickness Only compensatory damages are excludable, not punitive The following injuries are not taxed as income under this rule: Damages on account of physical injury to one’s spouse Wrongful death Emotional distress if it is a byproduct of a physical injury Damages for pain and suffering, medical expenses and lost wages Federal Income Taxation Lecture 4 Slide 9 Personal Injury Recoveries 2 The following are not excludable (and are income) under this rule: Interest earned on damages before they are paid Recoveries for medical expenses already deductible under the medical expenses rules Punitive Damages Federal Income Taxation Lecture 4 Slide 10 Repayment and Discharge of Loans A repayment of a loan is, of course, not taxable, but the interest on the loan is taxable. If a loan is discharged for less than the amount of indebtedness, the difference is considered income. Exceptions: The taxpayer is bankrupt or insolvent The debt is a purchase money mortgage (or a non-recourse debt) and the property is repossessed - if the creditor just takes the value of the repossessed property, that’s not income to the debtor The discharged amount would have been deductible if paid Discharge of student loans Where the debt is disputed Federal Income Taxation Lecture 4 Slide 11 Some Other Tax Exemptions Some state or municipal bonds are exempt from tax (although they usually pay a lower interest rate) Exemption for sale of personal residence (§121) If the taxpayer sells a personal residence in which s/he has lived for at least 2 of the last 5 years, the first $250,000 ($500,000 for married couples) is exempt from capital gains tax. If the taxpayer was forced by certain unforeseen circumstances to move and thus didn’t live there for 2 years, s/he gets a partial exemption based on the amount of time actually lived in the residence. Federal Income Taxation Lecture 4 Slide 12